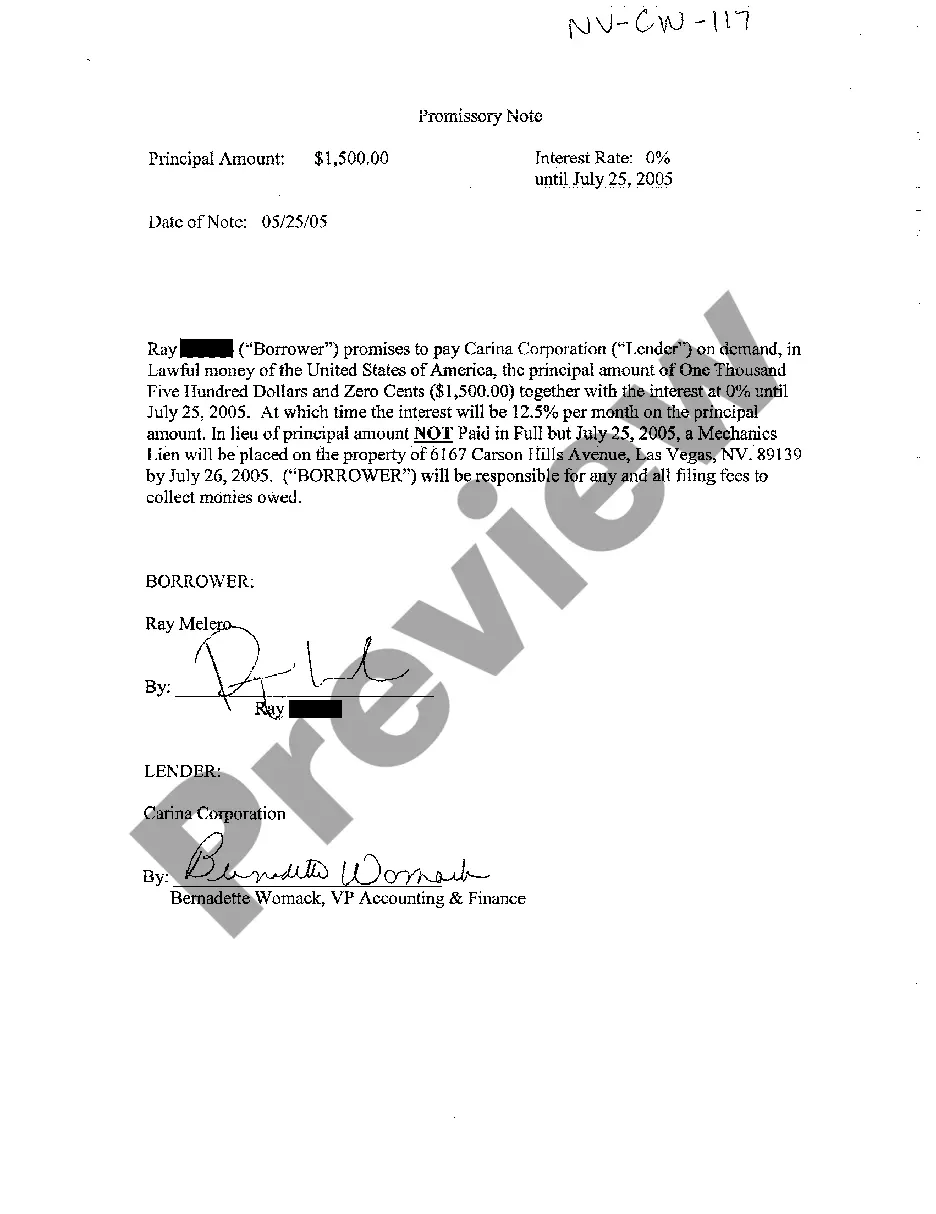

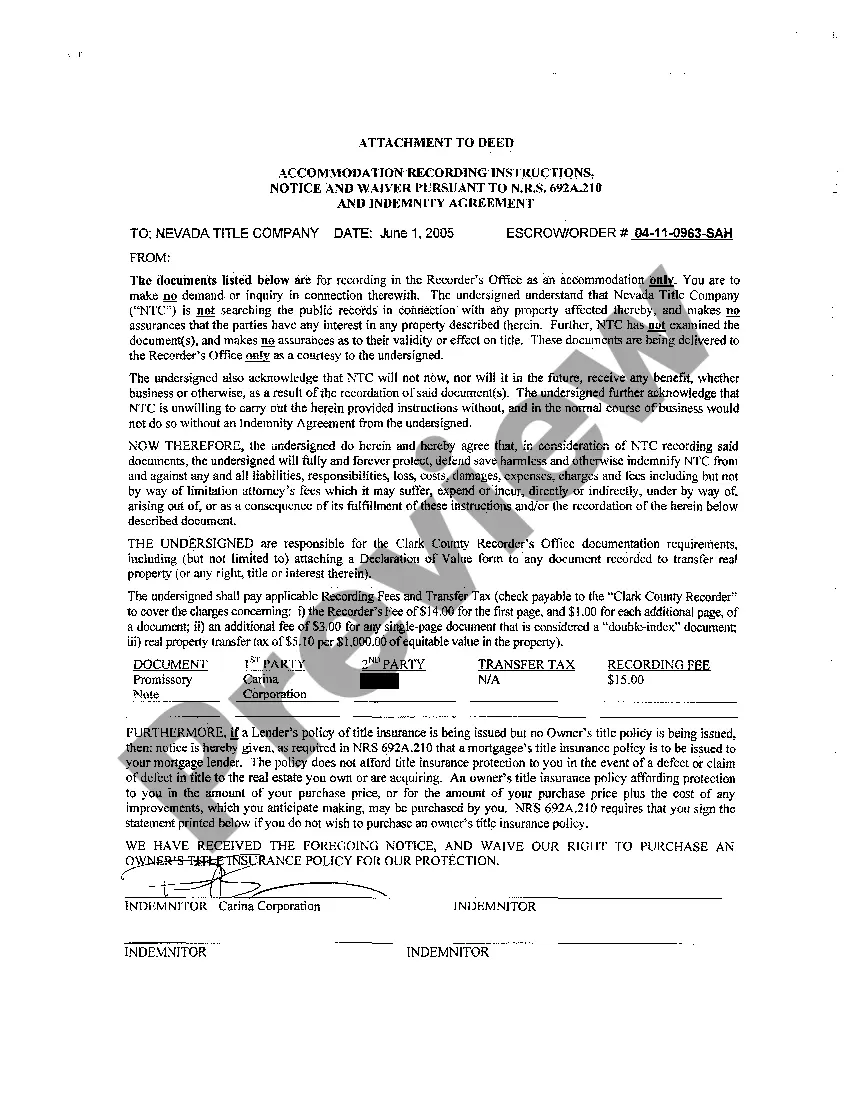

A Clark Nevada Promissory Note for a small loan with no interest is a legally binding document that outlines the specific terms and conditions of a loan agreement between a lender and a borrower. It serves as evidence of the borrower's promise to repay the borrowed amount within a specified time frame, without any additional interest charges. This type of promissory note is commonly used in situations where a lender wants to provide financial assistance to a borrower without expecting any monetary gain in return. The primary purpose of a Clark Nevada Promissory Note for a small loan with no interest is to document the agreement and protect the interests of both parties involved. The note typically includes important information such as the loan amount, repayment terms, and any additional provisions or conditions agreed upon by the lender and borrower. Although there might not be specific variations of Clark Nevada Promissory Note for small loan — No Interest, different versions may exist depending on the specific requirements of the lender or the nature of the transaction. Some key variations could include: 1. Personal Promissory Note: This is the most common type of promissory note used for small loans between individuals, friends, or family members. It outlines the loan details, repayment schedule, and any specific terms agreed upon. 2. Business Promissory Note: This type of note is specific to loans between businesses or when a business entity lends money to an individual. It may include additional provisions related to business transactions, such as repayment through profits or a percentage of future sales. 3. Installment Promissory Note: In cases where the borrowed amount is substantial or the repayment period is extended, an installment promissory note may be used. This note divides the loan amount into specific installments, making it easier for the borrower to repay over time. 4. Secured Promissory Note: If a lender wants additional security, they may opt for a secured promissory note. This note includes collateral details, such as property or assets that the borrower pledges to forfeit if they fail to repay the loan amount as agreed. It's important to note that while promissory notes are legal documents, it is advisable to consult with a legal professional to ensure compliance with local laws and regulations when drafting or signing such notes.

Clark Nevada Promissory Note for small loan - No Interest

State:

Nevada

County:

Clark

Control #:

NV-CW-117

Format:

PDF

Instant download

This form is available by subscription

Description

Promissory Note for small loan - No Interest

A Clark Nevada Promissory Note for a small loan with no interest is a legally binding document that outlines the specific terms and conditions of a loan agreement between a lender and a borrower. It serves as evidence of the borrower's promise to repay the borrowed amount within a specified time frame, without any additional interest charges. This type of promissory note is commonly used in situations where a lender wants to provide financial assistance to a borrower without expecting any monetary gain in return. The primary purpose of a Clark Nevada Promissory Note for a small loan with no interest is to document the agreement and protect the interests of both parties involved. The note typically includes important information such as the loan amount, repayment terms, and any additional provisions or conditions agreed upon by the lender and borrower. Although there might not be specific variations of Clark Nevada Promissory Note for small loan — No Interest, different versions may exist depending on the specific requirements of the lender or the nature of the transaction. Some key variations could include: 1. Personal Promissory Note: This is the most common type of promissory note used for small loans between individuals, friends, or family members. It outlines the loan details, repayment schedule, and any specific terms agreed upon. 2. Business Promissory Note: This type of note is specific to loans between businesses or when a business entity lends money to an individual. It may include additional provisions related to business transactions, such as repayment through profits or a percentage of future sales. 3. Installment Promissory Note: In cases where the borrowed amount is substantial or the repayment period is extended, an installment promissory note may be used. This note divides the loan amount into specific installments, making it easier for the borrower to repay over time. 4. Secured Promissory Note: If a lender wants additional security, they may opt for a secured promissory note. This note includes collateral details, such as property or assets that the borrower pledges to forfeit if they fail to repay the loan amount as agreed. It's important to note that while promissory notes are legal documents, it is advisable to consult with a legal professional to ensure compliance with local laws and regulations when drafting or signing such notes.

Free preview

How to fill out Clark Nevada Promissory Note For Small Loan - No Interest?

If you’ve already utilized our service before, log in to your account and save the Clark Nevada Promissory Note for small loan - No Interest on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Clark Nevada Promissory Note for small loan - No Interest. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!