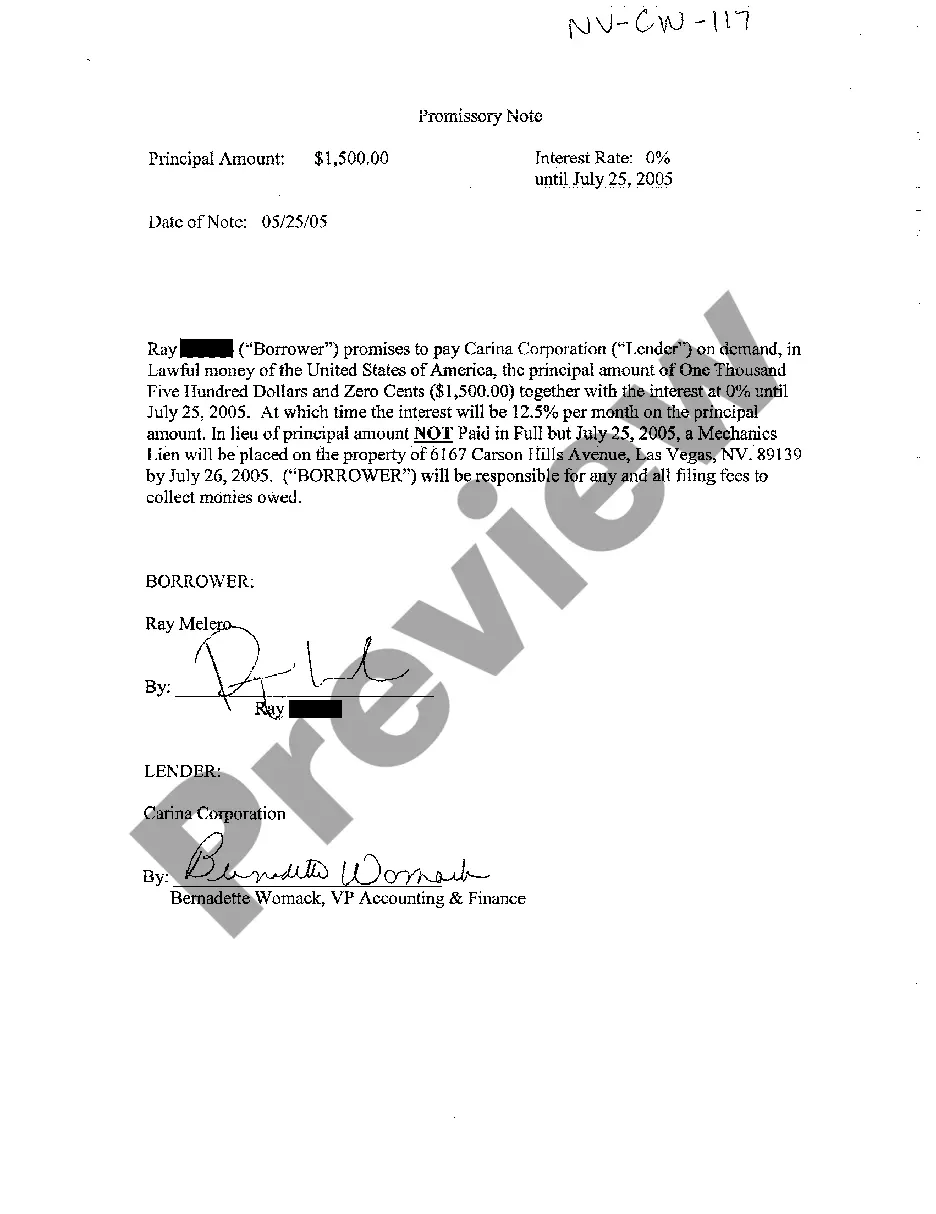

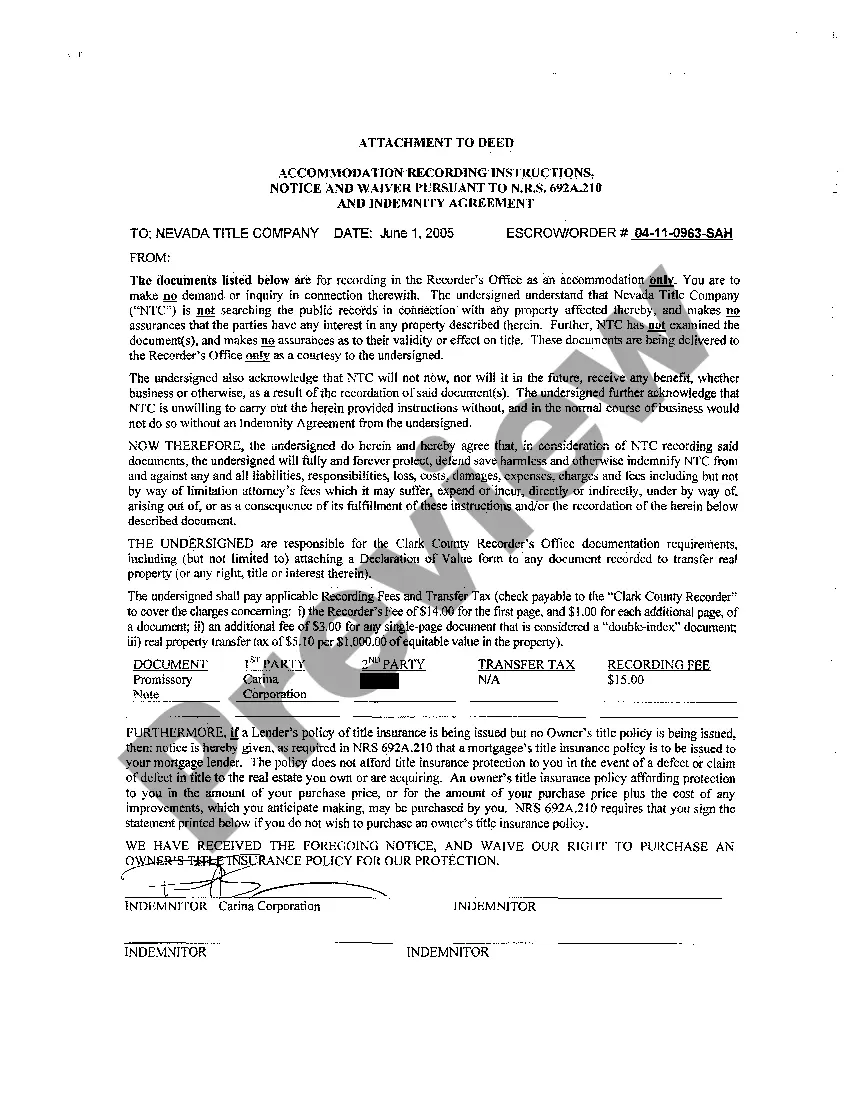

A North Las Vegas Nevada Promissory Note for small loan — No Interest is a legal document that outlines the terms and conditions of a financial agreement between a lender and a borrower in North Las Vegas, Nevada, where no interest is charged on the loan amount. It serves as a written evidence of the loan and provides a clear understanding of the obligations and responsibilities of both parties involved. The North Las Vegas Nevada Promissory Note for small loan — No Interest typically includes essential details such as the names, addresses, and contact information of the lender and the borrower. It specifies the loan amount, stating the exact sum borrowed by the borrower. The terms of repayment are also outlined, including the agreed-upon duration of the loan and the schedule of payments. This type of promissory note is extremely beneficial for borrowers seeking small loans in North Las Vegas, Nevada, as it offers them the opportunity to borrow funds without incurring any interest charges. It could be used for various purposes like covering personal expenses, emergency needs, educational expenses, or business investments. In addition to the standard North Las Vegas Nevada Promissory Note for small loan — No Interest, there may be some specific variations of this type of promissory note. These variations could include: 1. Student Loan Promissory Note — No Interest: This type of promissory note is designed explicitly for students in North Las Vegas, Nevada, who need financial assistance for their education. It enables them to borrow funds without being burdened by high-interest rates typically associated with student loans. 2. Small Business Loan Promissory Note — No Interest: This promissory note variation caters to entrepreneurs and small business owners in North Las Vegas, Nevada. It provides them with an interest-free loan option to support their business operations, expansion plans, or capital investments. This type of promissory note empowers small businesses by reducing the financial strain associated with paying interest. 3. Emergency Loan Promissory Note — No Interest: This variation addresses the immediate financial needs of individuals in North Las Vegas, Nevada, who require funds in times of unexpected crises or emergencies. By eliminating interest charges, borrowers can obtain the financial assistance they need quickly without accumulating additional debt. It is important to note that while a North Las Vegas Nevada Promissory Note for small loan — No Interest may seem advantageous for borrowers, lenders might choose this option for various reasons as well. It can serve as a philanthropic gesture, an act of goodwill, or even as an investment strategy to support the local community. In conclusion, a North Las Vegas Nevada Promissory Note for small loan — No Interest is a legally binding document that outlines the terms and conditions of a loan agreement without the inclusion of any interest charges. It provides clarity and protection for both lenders and borrowers while facilitating financial transactions in a fair and mutually beneficial manner.

Simple Promissory Note

Description

How to fill out North Las Vegas Nevada Promissory Note For Small Loan - No Interest?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the North Las Vegas Nevada Promissory Note for small loan - No Interest becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the North Las Vegas Nevada Promissory Note for small loan - No Interest takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the North Las Vegas Nevada Promissory Note for small loan - No Interest. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!