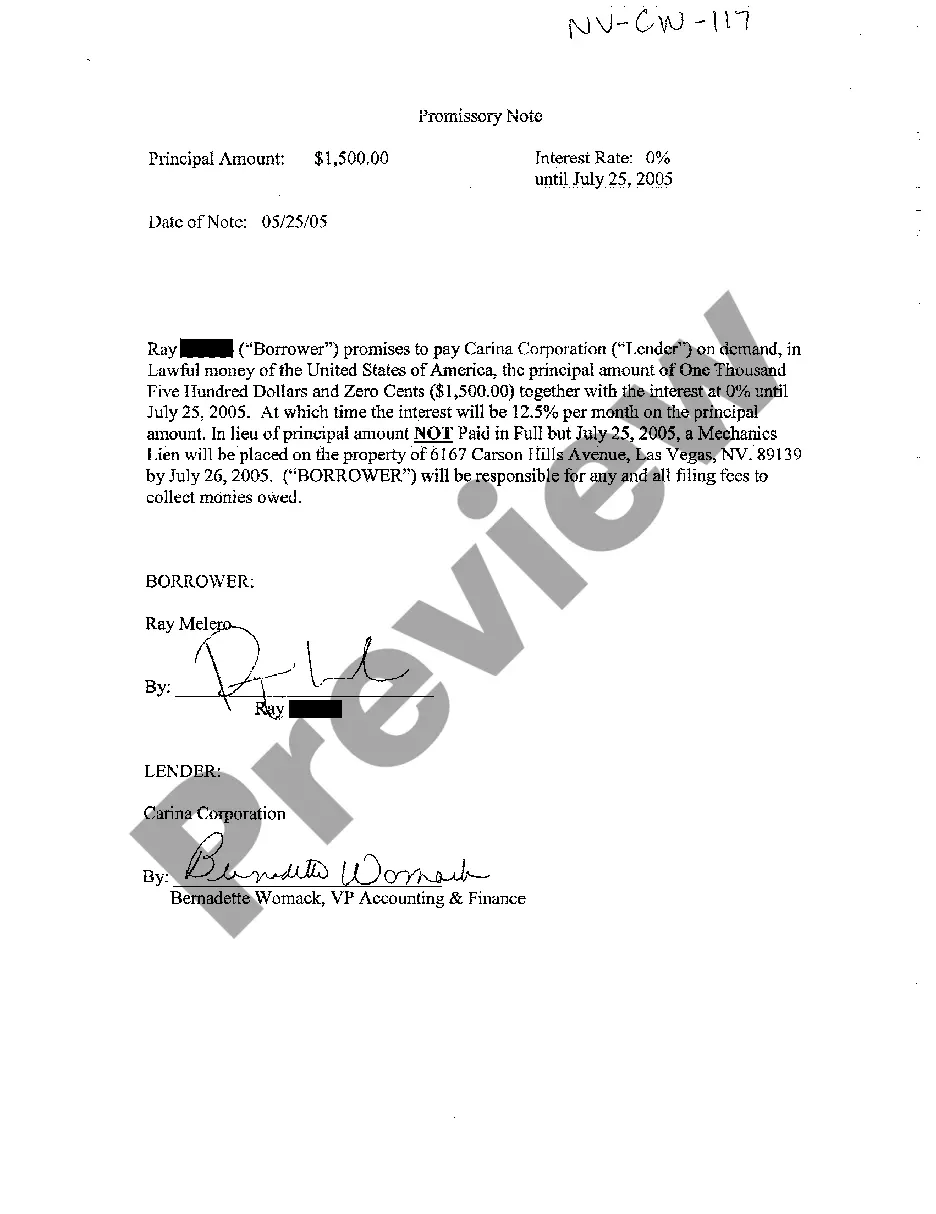

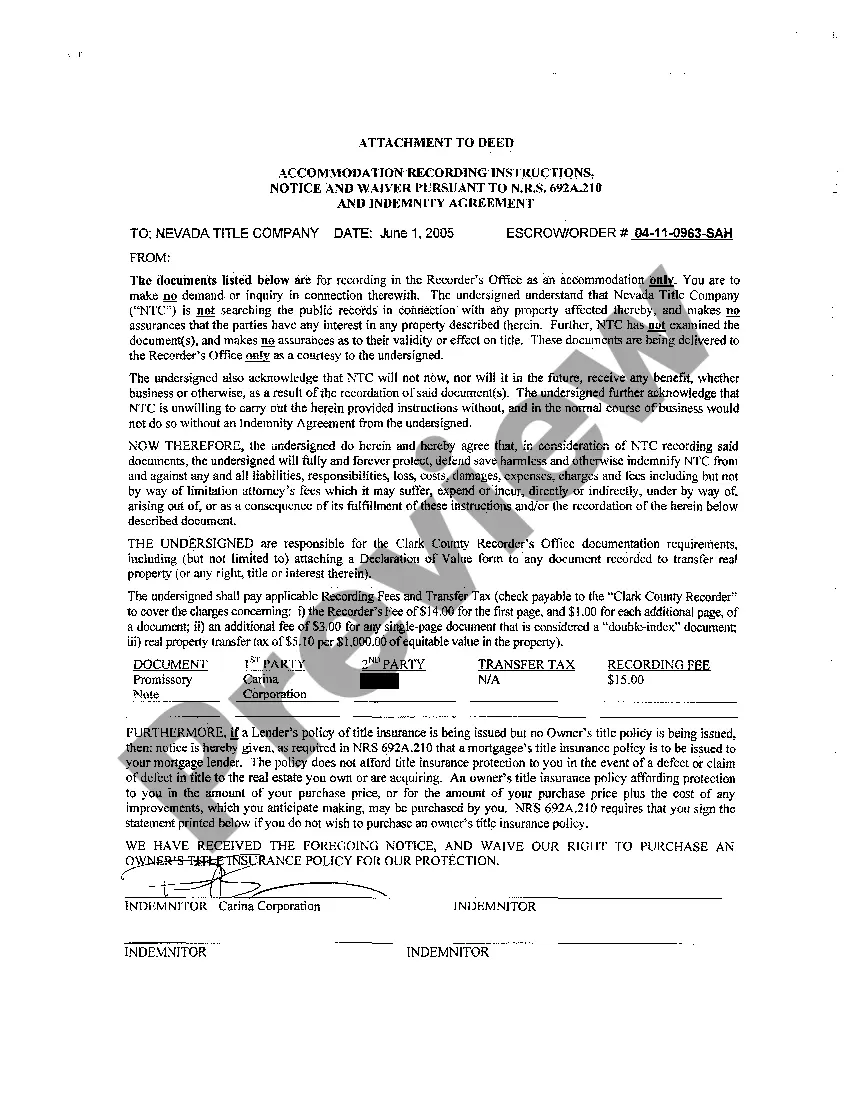

A Sparks Nevada Promissory Note for small loan with no interest is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in Sparks, Nevada. This type of promissory note is commonly utilized when lending a small sum of money with no interest charged. By drafting and signing a Sparks Nevada Promissory Note, both parties establish a mutual agreement and protect their respective rights. The Sparks Nevada Promissory Note for small loan — No Interest typically contains essential information such as the names and contact details of the lender and borrower, the loan amount, the repayment terms, and any additional clauses or conditions both parties agree upon. However, it's important to note that there aren't specifically named different types of Sparks Nevada Promissory Notes for small loans with no interest. Nonetheless, different variations may exist depending on the specific requirements or preferences of the lender and borrower. In order to ensure the validity and enforceability of the Promissory Note, it is crucial to include the following keywords: Sparks Nevada, Promissory Note, small loan, no interest, legal document, terms and conditions, lender, borrower, agreement, repayment terms. When considering the content of a Sparks Nevada Promissory Note for small loan — No Interest, it is essential to include the following details: 1. Loan Details: Clearly state the loan amount being borrowed in both numerical and written forms. Specify if any additional fees are involved (e.g., origination fees or late payment charges) or if any collateral is required. 2. Parties Involved: Provide the full legal names, addresses, and contact information of both the lender and borrower. 3. Repayment Schedule: Clearly outline the repayment terms, including the frequency of payments (e.g., monthly, quarterly), the due date of each payment, and the total number of payments required. Also, specify the preferred payment method and any penalties for late payments. 4. Interest Terms: In the case of a Sparks Nevada Promissory Note for small loan — No Interest, explicitly state that no interest will be charged on the loan amount. 5. Default and Remedies: Address the consequences of defaulting on the loan, including the rights and remedies available to the lender in such a situation. 6. Governing Law: Mention that the Promissory Note is governed by the laws of the State of Nevada and specify any relevant jurisdiction. Remember, it is crucial to consult a legal professional to ensure compliance with local laws and regulations when drafting or executing a Sparks Nevada Promissory Note for a small loan with no interest.

Sparks Nevada Promissory Note for small loan - No Interest

Description

How to fill out Sparks Nevada Promissory Note For Small Loan - No Interest?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney solutions that, usually, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Sparks Nevada Promissory Note for small loan - No Interest or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Sparks Nevada Promissory Note for small loan - No Interest adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Sparks Nevada Promissory Note for small loan - No Interest is proper for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!