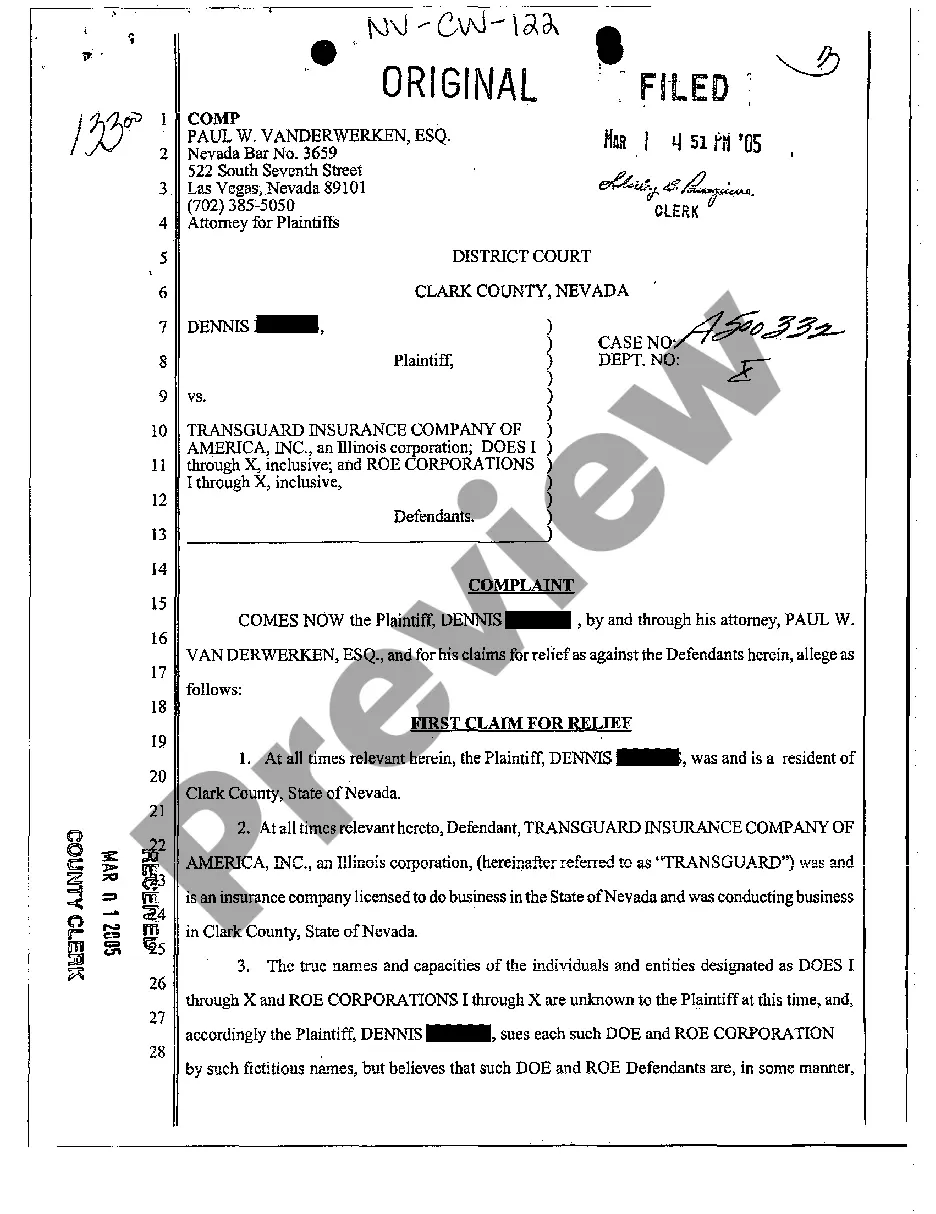

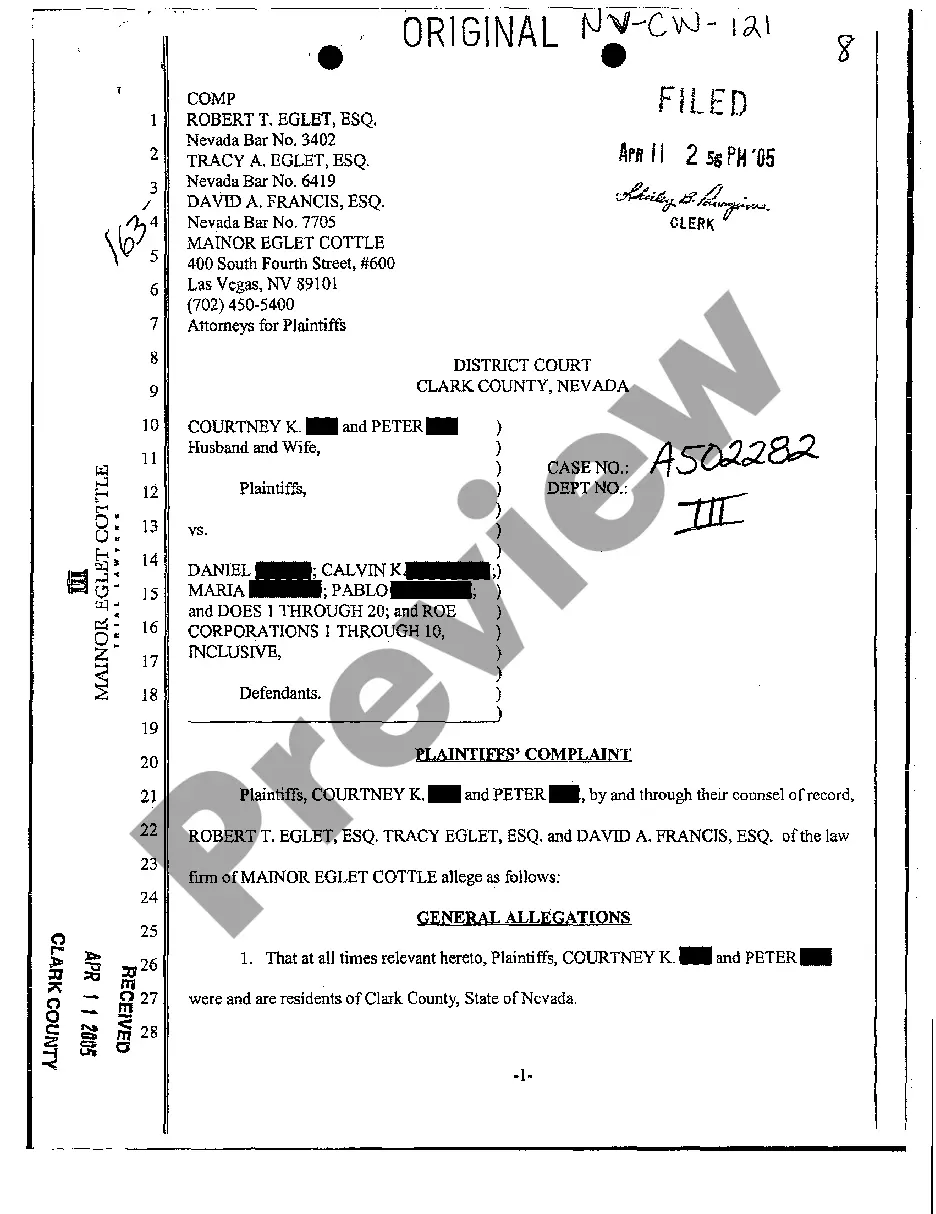

A Clark Nevada complaint for breach of automobile insurance policy refers to a legal claim filed in the state of Nevada by an individual or entity against an insurance provider for failing to fulfill their obligations as outlined in an automobile insurance policy. Such complaints typically involve various types of breaches that may arise in the context of an automobile insurance policy. Therefore, it is essential to understand the different types that may occur: 1. Coverage denial: This refers to instances where the insurance company refuses to provide coverage for an automobile insurance claim, despite it being legitimate and falling within the policy's terms and conditions. 2. Late or delayed claim processing: In this case, the insurance provider fails to process a claim within a reasonable time frame, causing inconvenience and potential financial strain to the policyholder. 3. Unreasonably low settlement offers: When an insured individual or entity files a claim, the insurance company may make an unreasonably low settlement offer, failing to adequately compensate for the damages or losses incurred. 4. Unfair policy cancellation: If an insurance company unjustly cancels an insured party's policy without a valid reason or proper notification, it may constitute a breach of the automobile insurance policy. 5. Failure to defend: If the insurance provider refuses to defend an insured individual or entity in a lawsuit arising from an automobile accident, despite the policy stating such obligations, it may be seen as a violation. 6. Failure to pay claims promptly: This refers to situations where an insurance company unreasonably delays the payment of valid automobile insurance claims, causing financial hardship and frustration for the policyholder. 7. Misrepresentation or fraud: If an insurance company provides false information or engages in fraudulent activities concerning the coverage or terms of an automobile insurance policy, it constitutes a breach. 8. Violation of duty to settle: When an insurance provider fails to reasonably settle a claim within policy limits, exposing the insured party to potential personal liability, it may be considered a breach of policy. When filing a Clark Nevada complaint for breach of an automobile insurance policy, it is crucial to gather evidence, such as policy documentation, claim correspondence, and any relevant communication with the insurance company. Seeking legal assistance can help navigate the complexities involved in pursuing such a complaint, ensuring adequate representation and protection of rights.

Clark Nevada Complaint - Breach of Automobile Insurance Policy

Description

How to fill out Clark Nevada Complaint - Breach Of Automobile Insurance Policy?

Are you looking for a reliable and inexpensive legal forms provider to buy the Clark Nevada Complaint - Breach of Automobile Insurance Policy? US Legal Forms is your go-to solution.

Whether you require a basic arrangement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Clark Nevada Complaint - Breach of Automobile Insurance Policy conforms to the laws of your state and local area.

- Read the form’s details (if available) to learn who and what the form is good for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Clark Nevada Complaint - Breach of Automobile Insurance Policy in any available format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal papers online once and for all.