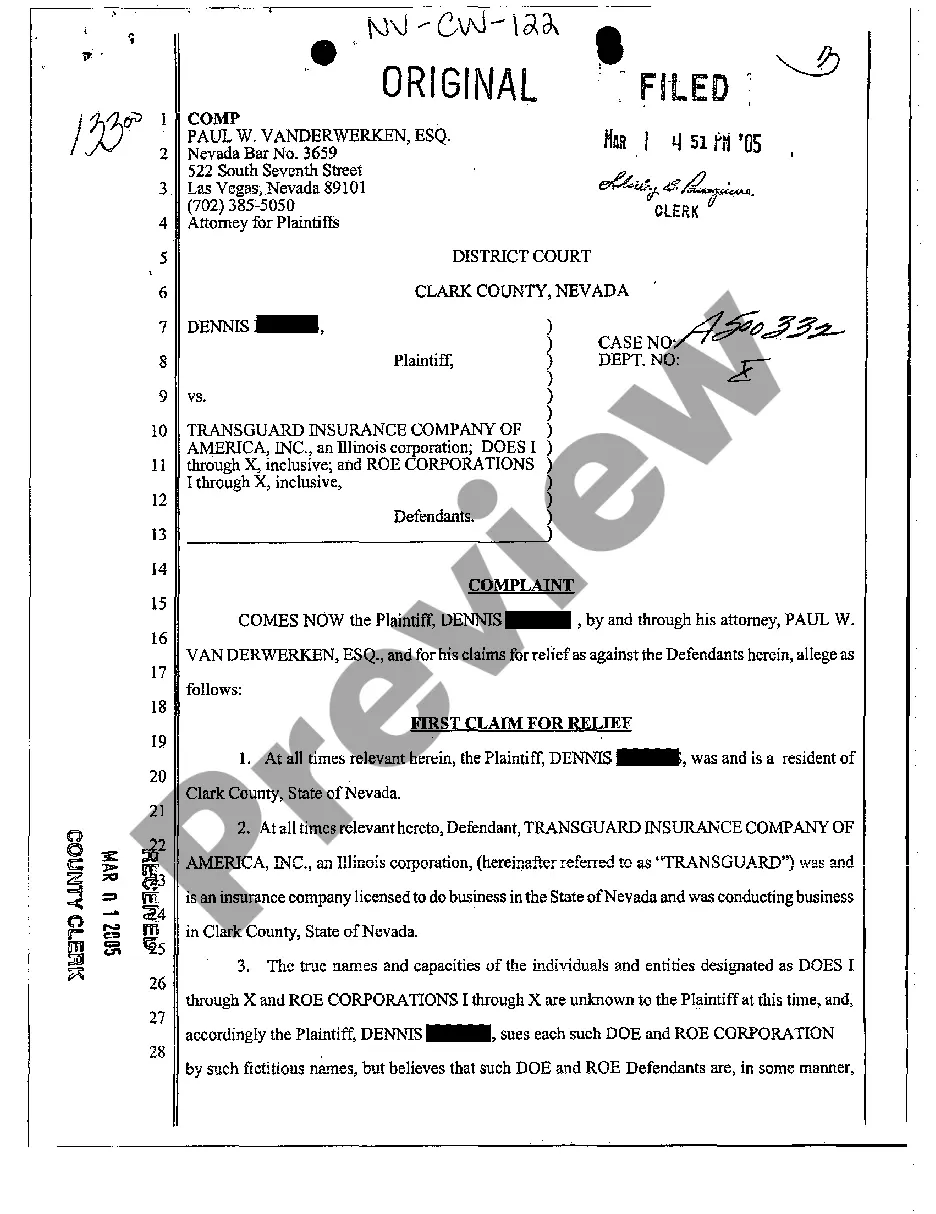

Las Vegas Nevada Complaint — Breach of Automobile Insurance Policy describes the legal action taken by individuals or companies against an insurance provider for failing to fulfill the terms and conditions stated in the automobile insurance policy. This breach can lead to various consequences for policyholders, such as denials of claims, delays in providing coverage, or unfair treatment when dealing with accident or damage claims. Keyword Variations: — Las Vegas Nevada Automobile Insurance Policy Breach Complaint — Breach of Auto Insurance Policy in Las Vegas Nevada — Las Vegas Complaint— - Automobile Insurance Policy Breach Types of Las Vegas Nevada Complaint — Breach of Automobile Insurance Policy: 1. Denied Claims: One type of complaint arises when an insurance company wrongfully denies a claim made by the policyholder, without valid reasons. Denial of claims can cause financial hardships and frustration for policyholders, as they might be left to cover the damages or repairs themselves. 2. Delayed Coverage: Policyholders may encounter situations where the insurance provider excessively delays the processing of their claim or the provision of coverage. This can often lead to additional financial burdens and inconveniences, especially if they need immediate repairs or medical treatments. 3. Unfair Settlements: Some complainants might argue that the insurance provider offered them an unfair settlement amount for their automobile damages, injuries, or medical expenses. Policyholders have the right to seek proper compensation as per the terms of their policy. 4. Violation of Contractual Obligations: In certain instances, policyholders may assert that the insurance company has breached specific contractual obligations outlined in the insurance policy. Such obligations can include timely communication, prompt investigation, and the provision of necessary documents. 5. Breach of Good Faith: Policyholders may argue that the insurance company failed to act in good faith when handling their claims. This can include improper investigation practices, failure to adequately communicate, or undue delay in claim processing. 6. Errors or Misrepresentation: Complaints may arise if a policyholder finds errors or misrepresentation made by the insurance provider during the policy application, renewal, or claims handling process. Instances such as policyholders being charged for coverage they did not request or were misinformed about can lead to complaints. Individuals filing a Las Vegas Nevada Complaint — Breach of Automobile Insurance Policy have the right to seek legal advice to protect their interests and pursue fair resolution. It is important to gather all necessary documentation and evidence to build a strong case against the insurance provider and to seek appropriate compensation or resolution for the damages suffered.

Las Vegas Nevada Complaint - Breach of Automobile Insurance Policy

State:

Nevada

City:

Las Vegas

Control #:

NV-CW-122

Format:

PDF

Instant download

This form is available by subscription

Description

Complaint - Breach of Automobile Insurance Policy

Las Vegas Nevada Complaint — Breach of Automobile Insurance Policy describes the legal action taken by individuals or companies against an insurance provider for failing to fulfill the terms and conditions stated in the automobile insurance policy. This breach can lead to various consequences for policyholders, such as denials of claims, delays in providing coverage, or unfair treatment when dealing with accident or damage claims. Keyword Variations: — Las Vegas Nevada Automobile Insurance Policy Breach Complaint — Breach of Auto Insurance Policy in Las Vegas Nevada — Las Vegas Complaint— - Automobile Insurance Policy Breach Types of Las Vegas Nevada Complaint — Breach of Automobile Insurance Policy: 1. Denied Claims: One type of complaint arises when an insurance company wrongfully denies a claim made by the policyholder, without valid reasons. Denial of claims can cause financial hardships and frustration for policyholders, as they might be left to cover the damages or repairs themselves. 2. Delayed Coverage: Policyholders may encounter situations where the insurance provider excessively delays the processing of their claim or the provision of coverage. This can often lead to additional financial burdens and inconveniences, especially if they need immediate repairs or medical treatments. 3. Unfair Settlements: Some complainants might argue that the insurance provider offered them an unfair settlement amount for their automobile damages, injuries, or medical expenses. Policyholders have the right to seek proper compensation as per the terms of their policy. 4. Violation of Contractual Obligations: In certain instances, policyholders may assert that the insurance company has breached specific contractual obligations outlined in the insurance policy. Such obligations can include timely communication, prompt investigation, and the provision of necessary documents. 5. Breach of Good Faith: Policyholders may argue that the insurance company failed to act in good faith when handling their claims. This can include improper investigation practices, failure to adequately communicate, or undue delay in claim processing. 6. Errors or Misrepresentation: Complaints may arise if a policyholder finds errors or misrepresentation made by the insurance provider during the policy application, renewal, or claims handling process. Instances such as policyholders being charged for coverage they did not request or were misinformed about can lead to complaints. Individuals filing a Las Vegas Nevada Complaint — Breach of Automobile Insurance Policy have the right to seek legal advice to protect their interests and pursue fair resolution. It is important to gather all necessary documentation and evidence to build a strong case against the insurance provider and to seek appropriate compensation or resolution for the damages suffered.

Free preview

How to fill out Las Vegas Nevada Complaint - Breach Of Automobile Insurance Policy?

If you’ve already used our service before, log in to your account and download the Las Vegas Nevada Complaint - Breach of Automobile Insurance Policy on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Las Vegas Nevada Complaint - Breach of Automobile Insurance Policy. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!