North Las Vegas Nevada Complaint — Breach of Automobile Insurance Policy In North Las Vegas, Nevada, complaints regarding a breach of automobile insurance policies can arise due to various circumstances. It is crucial to understand the different types of complaints that can occur in order to address them properly. Here are some of the key aspects related to North Las Vegas Nevada Complaints — Breach of Automobile Insurance Policy: 1. Definitions: — Automobile Insurance Policy: A contract between an individual and an insurance company that provides coverage for financial loss in case of accidents, thefts, or damages related to the insured vehicle. — Breach of Insurance Policy: Failure to fulfill the terms and conditions of the automobile insurance policy by either the insurer or the insured party. 2. Types of Complaints: a. Non-payment or Delayed Payment: — When an insured party fails to pay their insurance premium on time, resulting in a policy cancellation or lapse in coverage. — When an insurer delays payment for a legitimate claim without a valid reason. b. Denied Claims: — When an insurance company denies a claim despite it meeting the required criteria, leaving the insured party responsible for the expenses. — When an insurer unreasonably delays the claim settlement process, causing financial hardship to the insured party. c. Unfair Settlement Practices: — When an insurance company undervalues the claim settlement, offering an amount that does not adequately cover the damages or losses suffered by the insured party. — When an insurance company unjustly denies specific coverage that should be included under the insured party's policy. d. Policy Cancellation or Non-Renewal: — When an insurance company cancels an insured party's policy without proper notice or a valid reason. — When an insurance company refuses to renew an insured party's policy based on unfair discriminatory practices or improper justifications. 3. Steps to Resolve Complaints: — Contact the Insurance Company: Report the complaint to the insurance company directly, providing detailed information about the breach of the automobile insurance policy. — Document Everything: Keep records of all communication, including dates, times, names, and any relevant documentation, such as policy documents, claim forms, and letters. — State Regulatory Authority: If the complaint remains unresolved, contact the Nevada Division of Insurance, which regulates insurance practices in the state of Nevada. — Legal Assistance: In more complex cases or when all other options fail, consult with an attorney specializing in insurance law to explore possible legal actions. 4. Importance of Seeking Legal Advice: — An attorney specializing in insurance law can assess the situation, determine the strength of the case, and guide the insured party through the legal process. — They can negotiate with the insurance company on behalf of the insured party and pursue legal action if necessary. In summary, complaints regarding a breach of automobile insurance policies in North Las Vegas, Nevada, can encompass various types of grievances related to non-payment/delayed payment, denied claims, unfair settlement practices, policy cancellation/non-renewal. It is crucial for individuals to follow the appropriate steps, document the complaints thoroughly, and seek legal advice when necessary to ensure fair resolution and protection of their rights as insured parties.

North Las Vegas Nevada Complaint - Breach of Automobile Insurance Policy

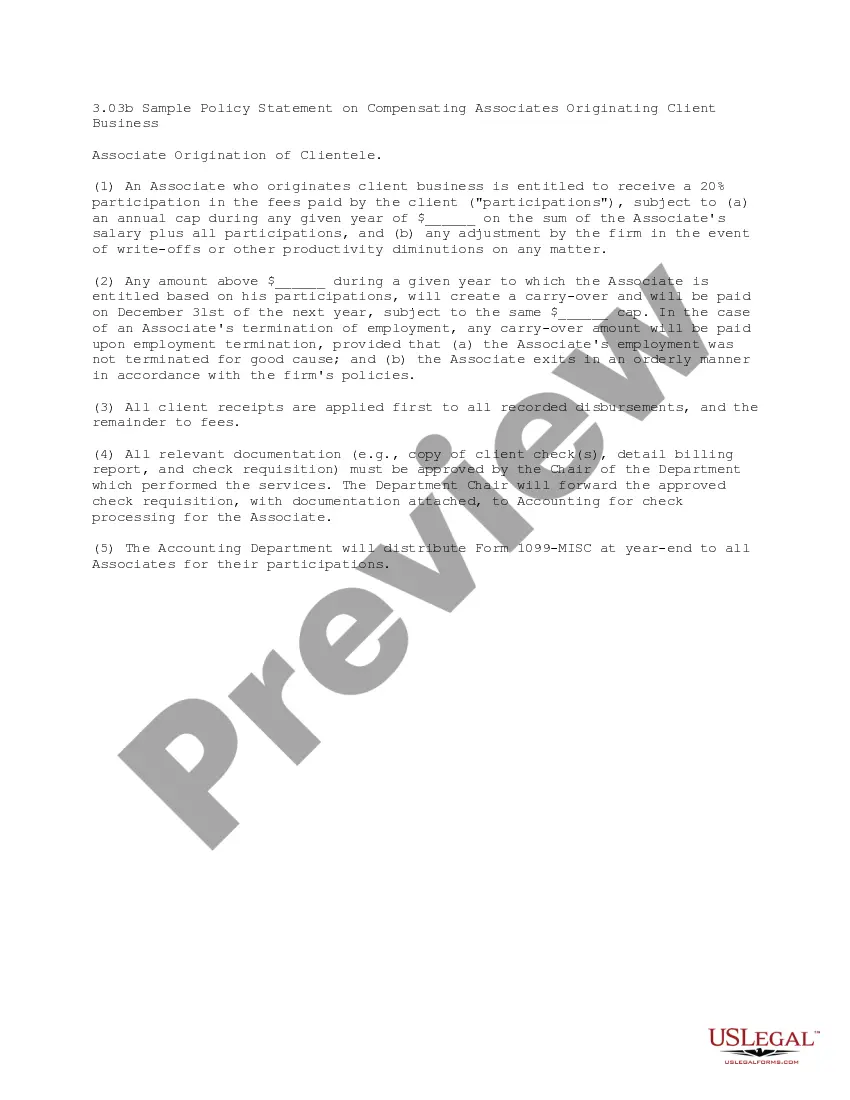

Description

How to fill out North Las Vegas Nevada Complaint - Breach Of Automobile Insurance Policy?

Do you need a reliable and inexpensive legal forms supplier to buy the North Las Vegas Nevada Complaint - Breach of Automobile Insurance Policy? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and county.

To download the document, you need to log in account, find the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the North Las Vegas Nevada Complaint - Breach of Automobile Insurance Policy conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is done, download the North Las Vegas Nevada Complaint - Breach of Automobile Insurance Policy in any available file format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal paperwork online for good.