Clark Nevada Complaint — Breach of Life Insurance Coverage Policy Life insurance provides financial protection for an individual's family or loved ones in the event of their untimely demise. However, there are instances where the life insurance company fails to fulfill its obligations, breaching the life insurance coverage policy. This can lead to frustration, financial strain, and emotional distress for the policyholder or their beneficiaries. The Clark Nevada Complaint — Breach of Life Insurance Coverage Policy is a legal complaint filed against an insurance company operating in Clark County, Nevada, when they fail to meet their contractual obligations outlined in the life insurance coverage policy. This complaint can arise due to various reasons, such as denied claims, delayed payouts, insufficient coverage, wrongful policy cancellation, or misleading policy terms. There may be different types of Clark Nevada Complaint — Breach of Life Insurance Coverage Policy, depending on the specific issues faced by the policyholder. Some examples include: 1. Denied Claims: When an insurance company denies a claim despite it meeting all the requirements and provisions stated in the policy. 2. Delayed Payouts: The insurance company unreasonably delays processing the life insurance claim, causing financial hardships and distress to the grieving family members or beneficiaries. 3. Insufficient Coverage: Policyholders may find out that the insurance company did not adequately explain the coverage limitations or downsides of the policy, leaving them with inadequate financial protection during a critical time. 4. Wrongful Policy Cancellation: The insurance company cancels the policy without valid reasons or fails to notify the policyholder, leading to a breach of the life insurance coverage policy. 5. Misleading Policy Terms: The policyholder discovers that the insurance company was deceptive in communicating the policy terms, resulting in misunderstandings about coverage, premiums, or exclusions. In these cases, the policyholder or their beneficiaries have the right to file a Clark Nevada Complaint — Breach of Life Insurance Coverage Policy against the insurance company. The complaint aims to hold the insurance company accountable for their actions, seek fair compensation for damages, and ensure that the policyholder's rights are protected. It's important to consult with an experienced attorney specializing in insurance law to navigate the complexities of a Clark Nevada Complaint — Breach of Life Insurance Coverage Policy. The attorney will gather evidence, review the policy's terms and conditions, negotiate with the insurance company, and represent the policyholder's best interests throughout the legal process. By launching a Clark Nevada Complaint — Breach of Life Insurance Coverage Policy, policyholders and their beneficiaries can seek justice and ensure that they receive the rightful benefits they deserve during a difficult time.

Clark Nevada Complaint - Breach of Life Insurance Coverage Policy

State:

Nevada

County:

Clark

Control #:

NV-CW-123

Format:

PDF

Instant download

This form is available by subscription

Description

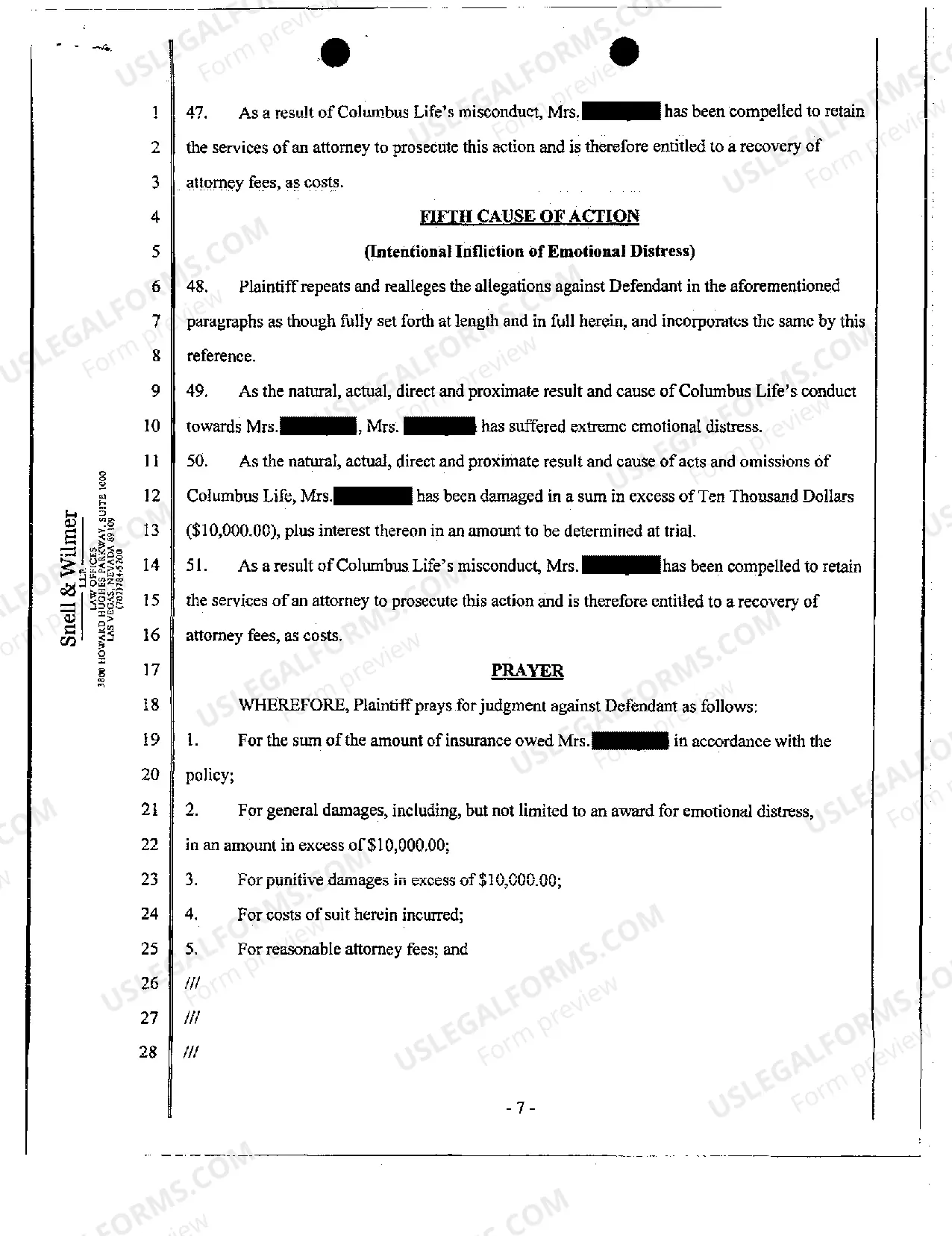

Complaint - Breach of Life Insurance Coverage Policy

Clark Nevada Complaint — Breach of Life Insurance Coverage Policy Life insurance provides financial protection for an individual's family or loved ones in the event of their untimely demise. However, there are instances where the life insurance company fails to fulfill its obligations, breaching the life insurance coverage policy. This can lead to frustration, financial strain, and emotional distress for the policyholder or their beneficiaries. The Clark Nevada Complaint — Breach of Life Insurance Coverage Policy is a legal complaint filed against an insurance company operating in Clark County, Nevada, when they fail to meet their contractual obligations outlined in the life insurance coverage policy. This complaint can arise due to various reasons, such as denied claims, delayed payouts, insufficient coverage, wrongful policy cancellation, or misleading policy terms. There may be different types of Clark Nevada Complaint — Breach of Life Insurance Coverage Policy, depending on the specific issues faced by the policyholder. Some examples include: 1. Denied Claims: When an insurance company denies a claim despite it meeting all the requirements and provisions stated in the policy. 2. Delayed Payouts: The insurance company unreasonably delays processing the life insurance claim, causing financial hardships and distress to the grieving family members or beneficiaries. 3. Insufficient Coverage: Policyholders may find out that the insurance company did not adequately explain the coverage limitations or downsides of the policy, leaving them with inadequate financial protection during a critical time. 4. Wrongful Policy Cancellation: The insurance company cancels the policy without valid reasons or fails to notify the policyholder, leading to a breach of the life insurance coverage policy. 5. Misleading Policy Terms: The policyholder discovers that the insurance company was deceptive in communicating the policy terms, resulting in misunderstandings about coverage, premiums, or exclusions. In these cases, the policyholder or their beneficiaries have the right to file a Clark Nevada Complaint — Breach of Life Insurance Coverage Policy against the insurance company. The complaint aims to hold the insurance company accountable for their actions, seek fair compensation for damages, and ensure that the policyholder's rights are protected. It's important to consult with an experienced attorney specializing in insurance law to navigate the complexities of a Clark Nevada Complaint — Breach of Life Insurance Coverage Policy. The attorney will gather evidence, review the policy's terms and conditions, negotiate with the insurance company, and represent the policyholder's best interests throughout the legal process. By launching a Clark Nevada Complaint — Breach of Life Insurance Coverage Policy, policyholders and their beneficiaries can seek justice and ensure that they receive the rightful benefits they deserve during a difficult time.

Free preview

How to fill out Clark Nevada Complaint - Breach Of Life Insurance Coverage Policy?

If you’ve already used our service before, log in to your account and download the Clark Nevada Complaint - Breach of Life Insurance Coverage Policy on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Clark Nevada Complaint - Breach of Life Insurance Coverage Policy. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!