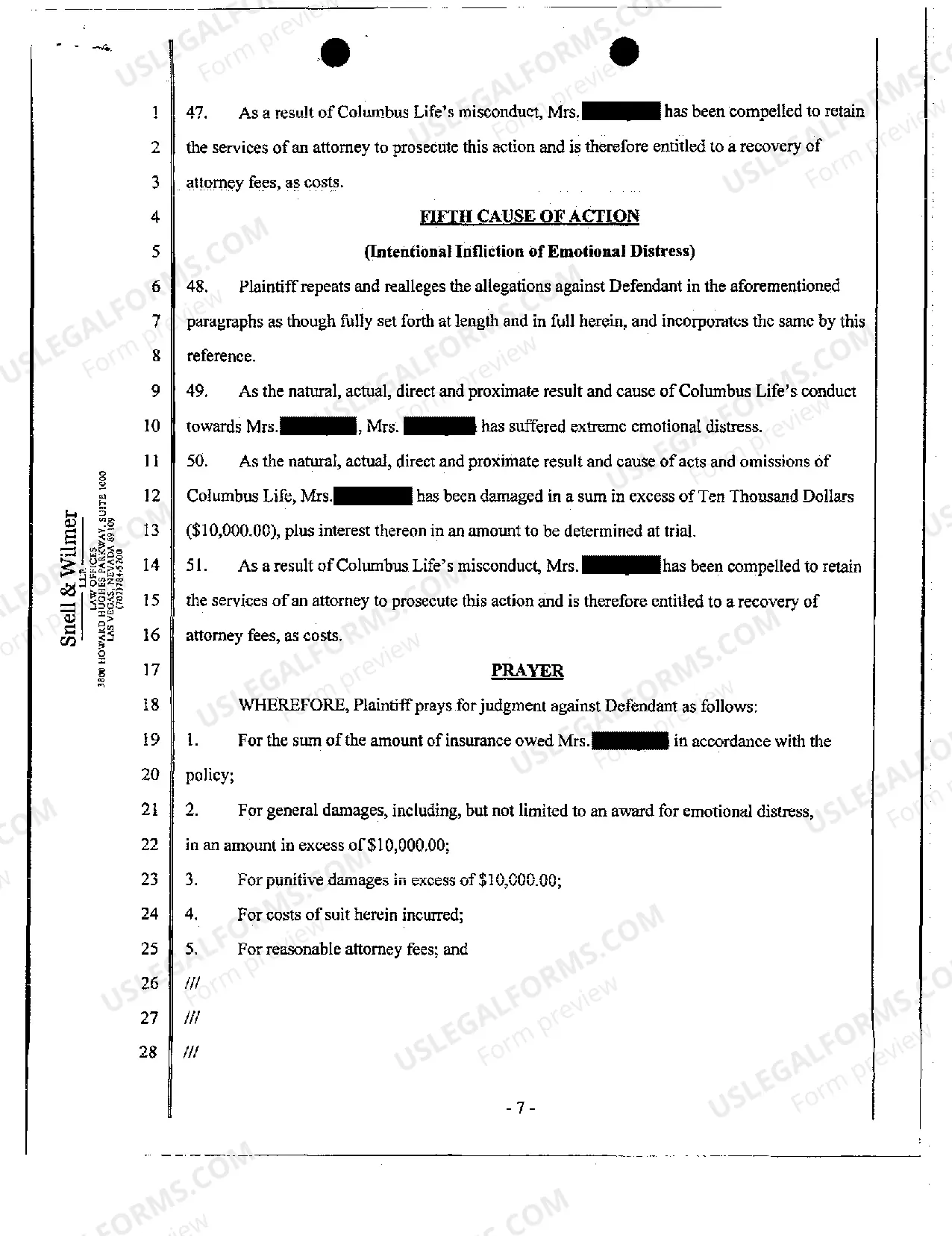

Las Vegas Nevada Complaint - Breach of Life Insurance Coverage Policy

Description

How to fill out Nevada Complaint - Breach Of Life Insurance Coverage Policy?

Finding authentic templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms archive.

It’s an online repository containing over 85,000 legal documents for personal and professional requirements and various real-world scenarios.

All the papers are effectively categorized by purpose and jurisdictional areas, making it as straightforward as ABC to search for the Las Vegas Nevada Complaint - Breach of Life Insurance Coverage Policy.

Maintaining documentation orderly and conforming to legal specifications is crucial. Take advantage of the US Legal Forms library to always have necessary document templates for any requirements right at your fingertips!

- Check the Preview mode and document description.

- Ensure you’ve chosen the appropriate one that addresses your needs and fully meets your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you spot any discrepancy, use the Search tab above to locate the correct one. If it meets your criteria, continue to the next step.

- Complete the purchase.

Form popularity

FAQ

If you're still getting nowhere, try calling the general claims department at your insurance company. They can help you contact your adjuster ? or tell you he or she is no longer with the company or on the case. If you still don't get any response, contact the adjuster's manager.

The commissioner of insurance is appointed by the director of the Nevada Department of Business and Industry, who is appointed by the governor.

In Nevada, there are insurance regulations on how to process claims. One of the regulations says that the insurer must establish procedures to begin investigating the claim within 20 working days.

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.

Call Toll Free Number 155255 (or) 1800 4254 732 or. Send an e-mail to complaints@irdai.gov.in. Make use of IRDAI's online portal - Integrated Grievance Management System (IGMS): Register and monitor your complaint at igms.irda.gov.in.

The insurance company should resolve your complaint within a reasonable time. In case if it is not resolved within 15 days or if you are unhappy with their resolution you can approach the Grievance Redressal Cell of the Consumer Affairs Department of IRDAI: Call Toll Free Number 155255 (or) 1800 4254 732 or.

Generally, the insurance company has about 30 days to investigate your auto insurance claim, though the number of days vary by state.

0300 123 9 123 ? Calls to this number cost no more than calls to 01 and 02 numbers. (18002) 020 7964 1000 ? Calls using next-generation text relay. +44 20 7964 0500 ? Call this number if you're calling from abroad. We'll also be happy to phone you back, if you're worried about the cost of calling us.

The Consumer Services Section of the Nevada Division of Insurance protects Nevada consumers through enforcement of Title 57 of the Nevada Revised Statutes pertaining to insurance.

Insurance companies in Nevada have 80 working days to settle a claim after it is filed. Nevada insurance companies also have specific timeframes in which they must acknowledge the claim and then decide whether or not to accept it, before paying out the final settlement.