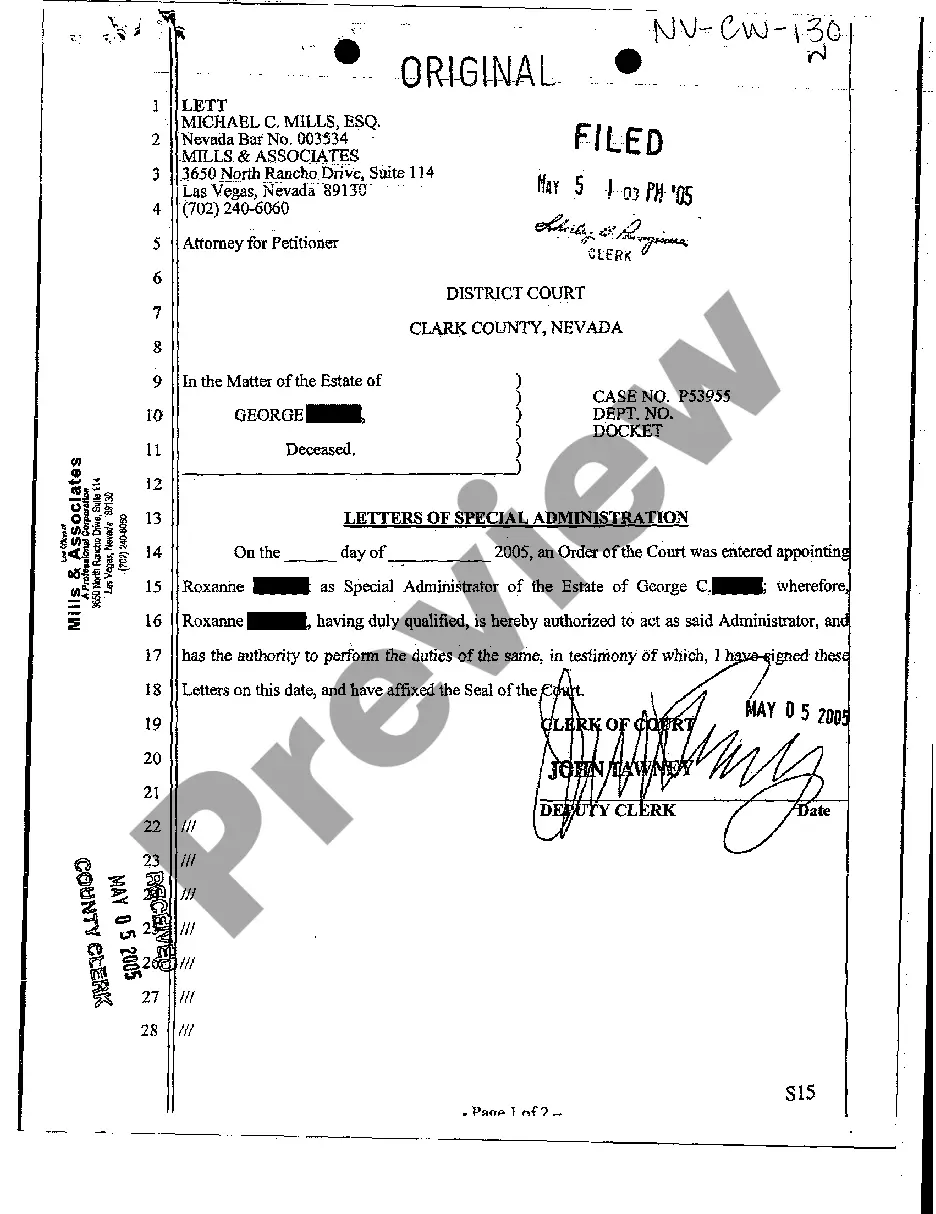

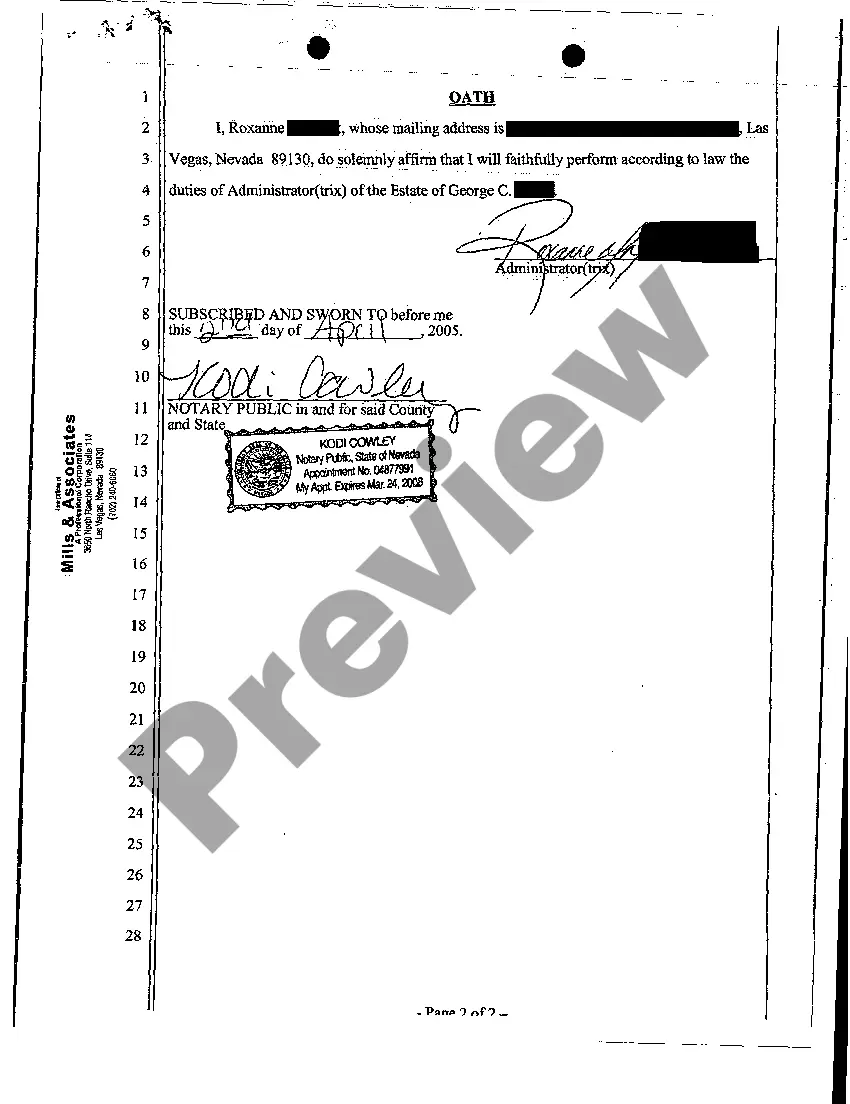

The Clark Nevada Letter of Special Administration is a legal document that grants authority to a designated individual to manage the affairs of an estate when there is no appointed personal representative or executor. This letter is typically issued by the Clark County, Nevada probate court and is applicable in situations where there is a need for immediate action, such as the sale of property or payment of debts, before a formal probate process can take place. The Clark Nevada Letter of Special Administration is commonly issued when the deceased person did not leave a will (intestate), or if the appointed executor is unable or unwilling to fulfill their duties. It is an essential legal instrument that enables the designated individual, known as the special administrator, to act on behalf of the estate and its beneficiaries. Typically, the Clark Nevada Letter of Special Administration grants limited powers to the special administrator. These powers may include collecting and safeguarding assets, paying outstanding debts and taxes, distributing property to beneficiaries according to state laws, and managing financial transactions related to the estate. The special administrator must fulfill their duties with utmost honesty, integrity, and in compliance with applicable laws and regulations. It is important to note that there are different types of Clark Nevada Letters of Special Administration, varying based on specific circumstances. For instance: 1. Letters of Special Administration with Full Authority: These letters grant broad powers to the special administrator, allowing them to handle all aspects of the estate's affairs, including selling property, managing investments, and distributing assets to beneficiaries. 2. Letters of Special Administration with Limited Authority: These letters grant the special administrator only specific powers or authority over certain aspects of the estate's administration. They may be limited to handling the immediate sale of property, for example, or paying specific debts. 3. Letters of Special Administration Pendent Lite: These letters are issued when there is a pending litigation regarding the estate. They grant temporary authority to a special administrator to manage the estate during the litigation period. 4. Letters of Special Administration C.T.A. (Come Testament Annex): These letters are issued when there is a will but no appointed executor or the appointed executor is unable to fulfill their duties. They enable the special administrator to administer the estate according to the terms of the will. In conclusion, the Clark Nevada Letter of Special Administration is a crucial legal document that allows a designated individual to handle the affairs of an estate in specific situations. It grants limited or full authority depending on the type of letter issued and empowers the special administrator to act in the best interest of the estate and its beneficiaries.

Clark Nevada Letter of Special Administration

Description

How to fill out Clark Nevada Letter Of Special Administration?

Take advantage of the US Legal Forms and obtain instant access to any form template you want. Our helpful website with thousands of templates allows you to find and get almost any document sample you require. You can download, complete, and certify the Clark Nevada Letter of Special Administration in just a matter of minutes instead of surfing the Net for many hours looking for the right template.

Using our collection is a wonderful strategy to increase the safety of your document filing. Our experienced attorneys regularly check all the records to make certain that the forms are relevant for a particular region and compliant with new laws and regulations.

How can you obtain the Clark Nevada Letter of Special Administration? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips below:

- Find the form you need. Make certain that it is the template you were seeking: verify its title and description, and use the Preview option if it is available. Otherwise, make use of the Search field to find the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Download the document. Choose the format to get the Clark Nevada Letter of Special Administration and edit and complete, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy document libraries on the internet. Our company is always ready to help you in any legal process, even if it is just downloading the Clark Nevada Letter of Special Administration.

Feel free to benefit from our platform and make your document experience as straightforward as possible!