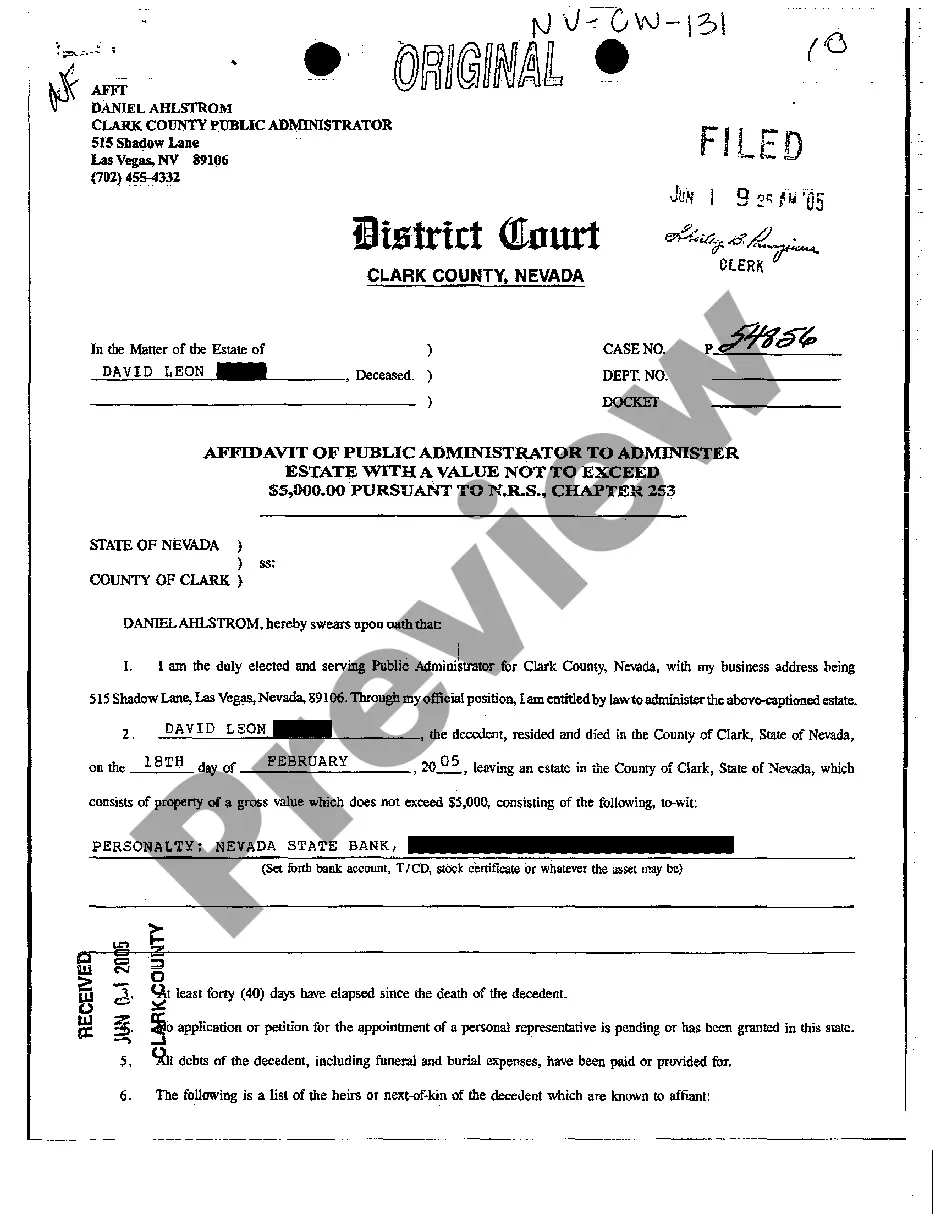

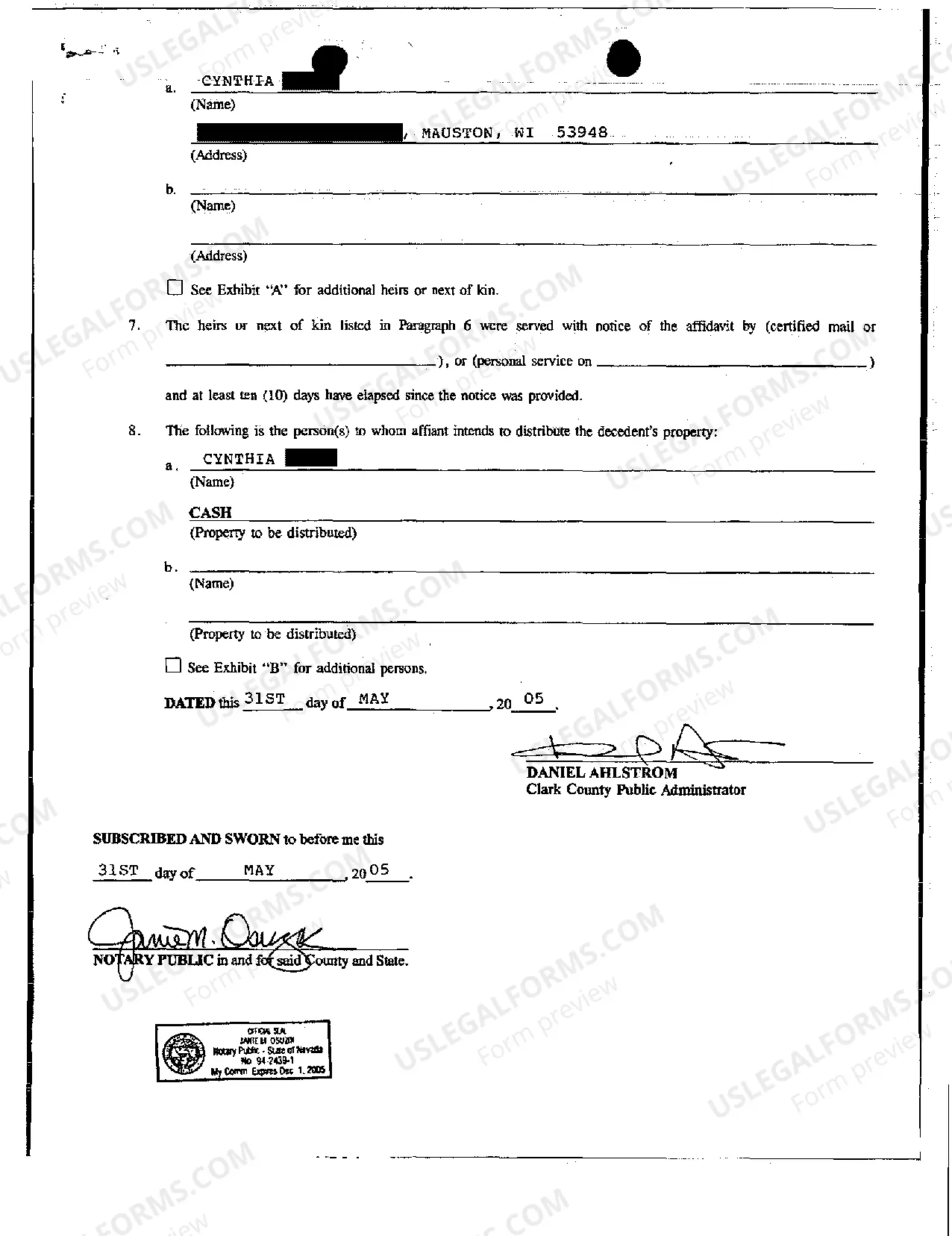

The Las Vegas Nevada Affidavit of Public Administrator to Administer Estate with a value not to Exceed $5000 is an important legal document used in cases where the value of an estate does not exceed $5000. This affidavit allows the Public Administrator to step in and administer the estate, ensuring that all assets are properly distributed according to state laws. There are several types of Las Vegas Nevada Affidavit of Public Administrator to Administer Estate with a value not to Exceed $5000: 1. General Affidavit of Public Administrator: This type of affidavit is used when the deceased individual did not leave behind a will or any other legal instructions regarding the distribution of their assets. The Public Administrator acts as the legal representative and oversees the administration of the estate. 2. Small Estate Affidavit: In cases where the total value of the estate is less than $5000, this type of affidavit is used to simplify the probate process. It allows for a quicker and less expensive administration, reducing the burden on the court system. 3. Affidavit for Personal Property: This specific type of affidavit is used when the estate consists solely of personal property, such as jewelry, furniture, or vehicles. It provides a streamlined process for transferring these assets to the rightful beneficiaries. 4. Affidavit for Real Property: In cases where the estate includes real estate properties, this type of affidavit is utilized. It ensures that the transfer of ownership of the property is done in compliance with state laws and regulations. 5. Affidavit for Financial Accounts: If the estate consists of financial accounts, such as bank accounts, stocks, or retirement funds, this type of affidavit is used to facilitate the transfer of these assets to the designated beneficiaries. Regardless of the specific type of Las Vegas Nevada Affidavit of Public Administrator to Administer Estate with a value not to Exceed $5000, it is crucial to follow all the legal requirements and procedures to ensure a smooth and fair distribution of the estate's assets. It is advised to consult with a qualified attorney specializing in estate administration to navigate through the complexities of this process.

Las Vegas Nevada Affidavit of Public Administrator to Administer Estate with a value not to Exceed $5000

Description

How to fill out Las Vegas Nevada Affidavit Of Public Administrator To Administer Estate With A Value Not To Exceed $5000?

If you have previously utilized our service, sign in to your account and acquire the Las Vegas Nevada Affidavit of Public Administrator to Manage Estate with a maximum value of $5000 on your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Take advantage of the US Legal Forms service to effortlessly locate and save any template for your personal or professional requirements!

- Ensure you’ve found the correct document. Review the description and utilize the Preview feature, if accessible, to verify it fits your requirements. If it doesn’t suit you, use the Search feature above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Las Vegas Nevada Affidavit of Public Administrator to Manage Estate with a maximum value of $5000. Select the file format for your document and store it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

Simple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

What is Summary Administration? ?Summary Administration? is a type of probate proceeding in Nevada that exists as an alternative to the full probate proceeding known as a ?General Administration.? It's intended to help modest sized estates avoid some of the cost and delay of general administration.

The estate must also be worth less than the state-established maximum. Small estate affidavits may be used regardless of whether the decedent had a will.... Step 1 ? Notify Other Claimants.Step 2 ? Wait Forty Days.Step 3 ? Fill Out the Form.Step 4 ? Collect the Property.

In a routine probate proceeding, you can expect a minimum probate period of from 120 to 180 days.

Letters Testamentary are issued when the decedent had a will, and Letters of Administration are issued when there was no will. Some financial institutions might request to see a certified copy of the Letters. You can get certified copies from the court clerk's office at the Regional Justice Center.

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

To apply for the letters of administration: download the correct paper form. fill in all sections that apply. print the form. sign and date the application. include a cheque with your application (see How to pay) send your completed form and supporting documents to:

If the will does not say anything about compensation, or if there is no will, Nevada law allows the executor or personal representative to receive payment based on the size of the estate. The fee (as of 2018) is 4% of the first $15,000 of the estate; 3% of the next $85,000; and 2% of any amount over $100,000.

What's the difference between letters of administration and grant of probate? The main difference is that a grant of probate is issued to the executor named in the will, whereas a grant of letters of administration is issued to the next of kin, who is called the administrator.

As an Executor, you should ideally wait 10 months from the date of the Grant of Probate before distributing the estate. The Grant of Probate is the document obtained from the court which gives the legal authority for you to deal with the estate.