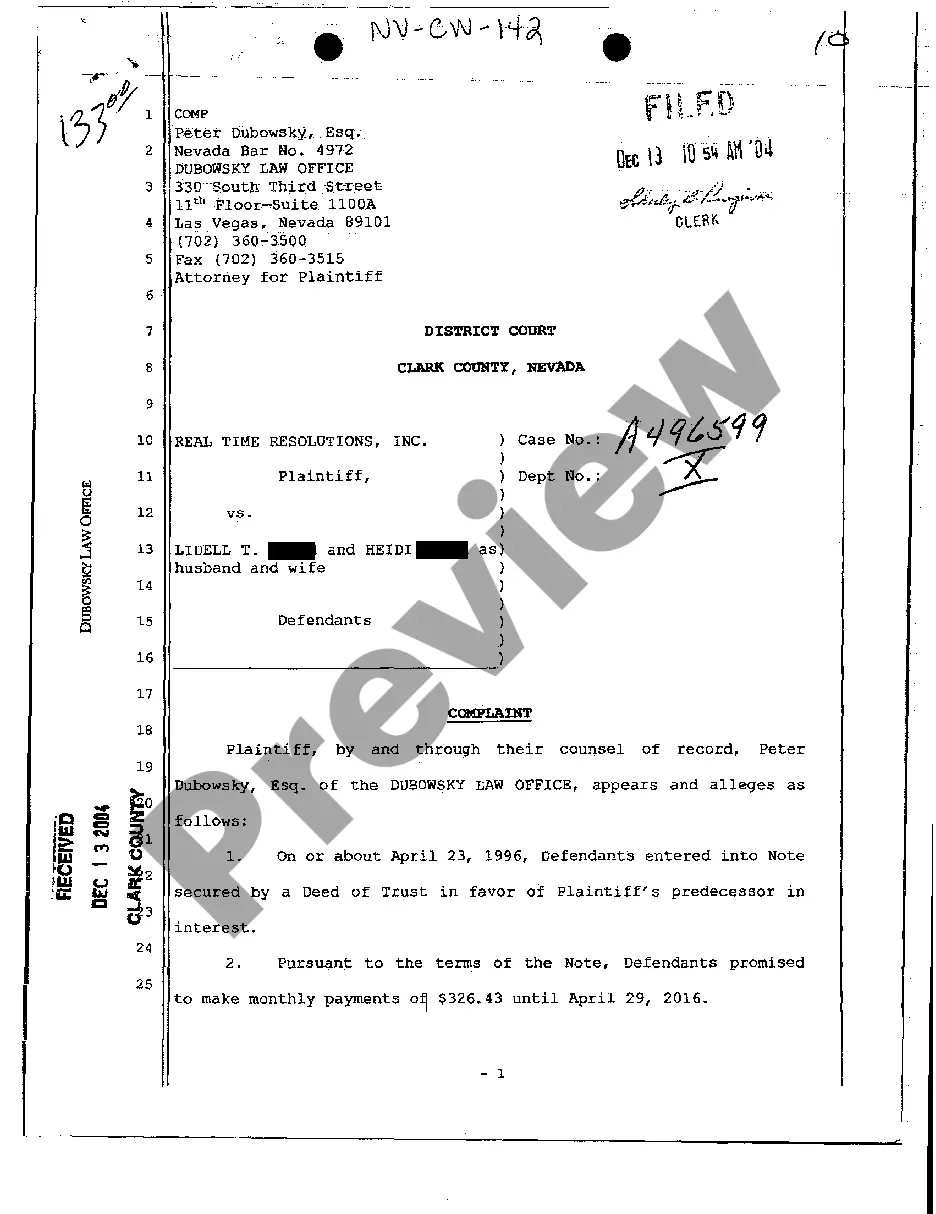

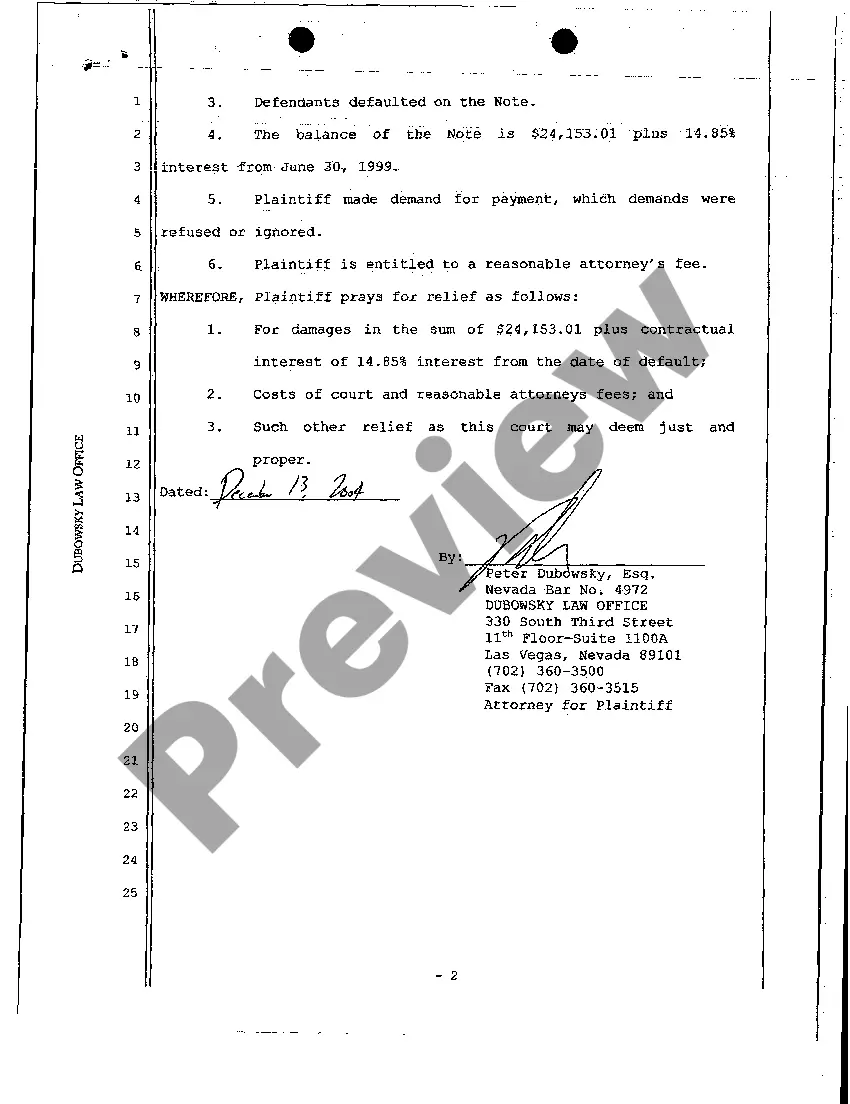

Clark Nevada Complaint — Debt Collection Due to Default on Promissory Note is a legal procedure initiated by a creditor against a debtor who has failed to fulfill their repayment obligations as agreed upon in a promissory note. This type of complaint typically arises when the debtor defaults on loan payments, resulting in the creditor pursuing legal action to recover the outstanding debt. In a Clark Nevada Complaint — Debt Collection Due to Default on Promissory Note, the creditor, often referred to as the plaintiff, files a formal complaint in the appropriate court in Clark County, Nevada. This complaint outlines the details of the promissory note, including the amount of the debt, the terms of repayment, and the evidence of the debtor's default. The complaint may include specific details such as the date the promissory note was executed, the original amount borrowed, the interest rate, the repayment schedule, and any applicable penalties or late fees. It is crucial for the complaint to provide substantial evidence to prove the debtor's default, such as payment records, written communication regarding non-payment, or any other evidence establishing the terms of the promissory note and the debtor's failure to meet those terms. Once the complaint is filed, the debtor, known as the defendant, will be served with a copy of the complaint and a summons, notifying them of the legal action taken against them. The defendant has a specific period, typically 20-30 days, to respond to the complaint and present their defense. Possible defenses may include challenging the validity of the promissory note, disputing the amount owed, claiming breach of contract by the creditor, or asserting any other applicable legal defense. Different types of Clark Nevada Complaints related to Debt Collection Due to Default on Promissory Note may include: 1. Clark Nevada Complaint — Debt Collection due to Default on Residential Property Promissory Note 2. Clark Nevada Complaint — Debt Collection due to Default on Commercial Property Promissory Note 3. Clark Nevada Complaint — Debt Collection due to Default on Personal Loan Promissory Note 4. Clark Nevada Complaint — Debt Collection due to Default on Student Loan Promissory Note 5. Clark Nevada Complaint — Debt Collection due to Default on Business Loan Promissory Note It's important to note that the specific details and procedures may vary depending on the type of promissory note and the unique circumstances of the debt collection case. Legal representation and advice should be sought to ensure compliance with Clark Nevada laws and to navigate the complexities of the legal process.

Clark Nevada Complaint - Debt Collection Due to Default on Promissory Note

Description

How to fill out Clark Nevada Complaint - Debt Collection Due To Default On Promissory Note?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Clark Nevada Complaint - Debt Collection Due to Default on Promissory Note becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Clark Nevada Complaint - Debt Collection Due to Default on Promissory Note takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Clark Nevada Complaint - Debt Collection Due to Default on Promissory Note. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!