A Clark Nevada Complaint — Breach of Contract for Sale of Property can arise if there is an error made by the bank while clearing an earnest money deposit. This type of complaint typically occurs when one party fails to fulfill their contractual obligations, resulting in a breach of contract. This article will provide a detailed description of this situation, including the consequences, legal considerations, and potential remedies. When a sale of property is agreed upon, the buyer is generally required to provide an earnest money deposit as a sign of good faith and commitment to purchase the property. This deposit is usually held in escrow until the closing of the sale. However, if there is an error made by the bank in clearing this deposit, it can lead to significant complications and a breach of contract. The breach of contract can occur in different ways depending on the specific circumstances. It could be due to the bank's failure to properly process the deposit, resulting in the funds not being available for the seller at the time of closing. Alternatively, it could be a result of the bank mistakenly releasing the funds to the wrong party or failing to deliver the funds altogether. Regardless of the exact nature of the error, it can have serious implications for both the buyer and the seller. In such instances, the seller may file a Clark Nevada Complaint — Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit. This complaint is aimed at seeking legal recourse for the damages suffered as a result of the breach of contract caused by the bank's error. The complaint will outline the specific details of the transaction, the terms of the contract, and the bank's role in clearing and handling the earnest money deposit. It is important to note that the consequences of a breach of contract can vary depending on the situation. The injured party may seek compensation for financial losses, including any additional expenses incurred due to delays in the sale or property value fluctuations. They may also request specific performance, which involves enforcing the completion of the contract as originally agreed upon. In some cases, the court may order the return of the earnest money deposit along with additional damages. When filing a Clark Nevada Complaint — Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit, it is critical to consult with an experienced attorney who specializes in real estate law. They can guide you through the legal process, evaluate the strength of your case, and determine the appropriate course of action. Additionally, they may help negotiate a settlement or litigate the matter in court if necessary. In summary, a Clark Nevada Complaint — Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit is a legal action taken when a breach of contract occurs due to a mistake made by the bank in handling the earnest money deposit. This type of complaint seeks remedies and compensation for the damages suffered by the injured party. Seeking legal advice is crucial to navigate through such a complicated situation and ensure the best possible outcome.

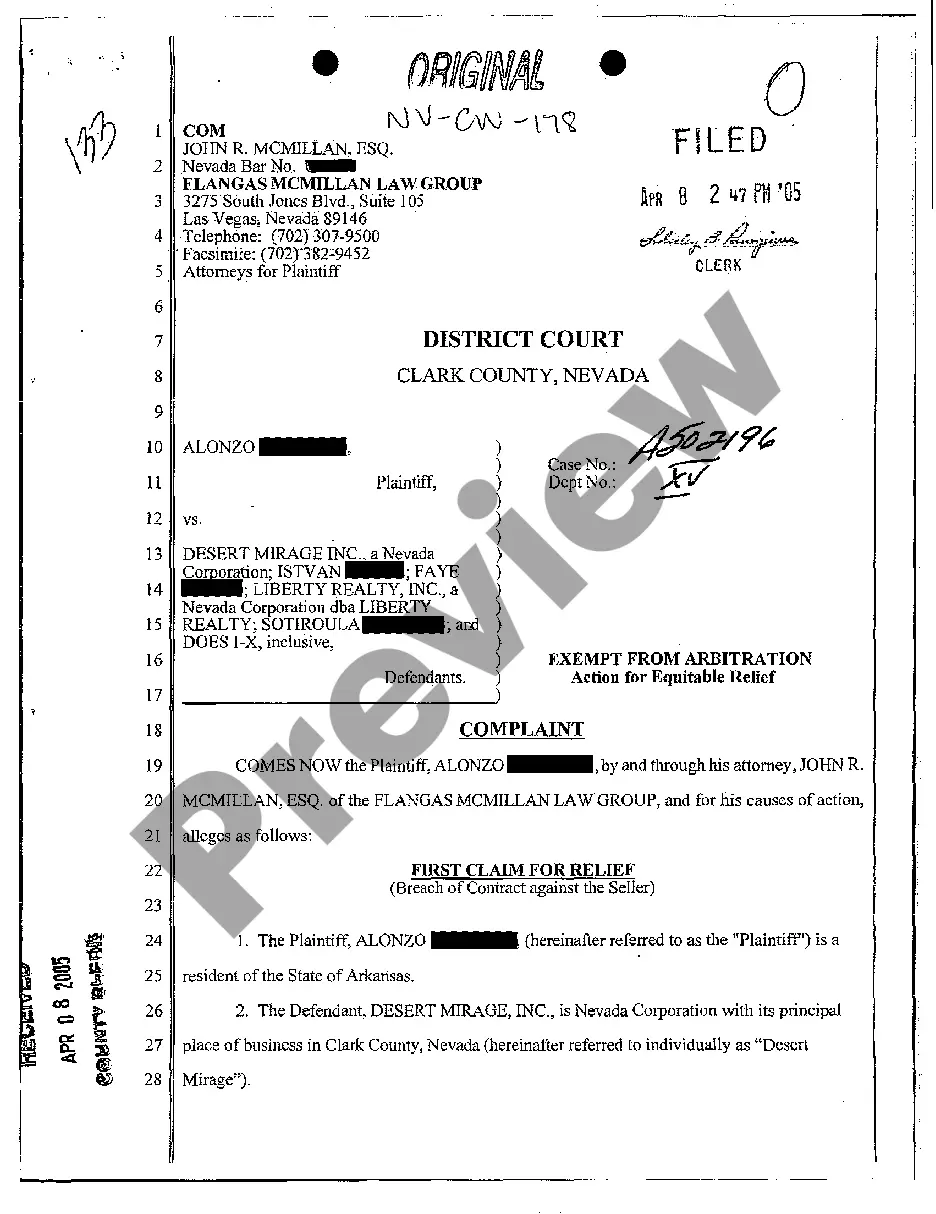

Clark Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit

Description

How to fill out Clark Nevada Complaint - Breach Of Contract For Sale Of Property Due To Error Of Bank In Clearing Earnest Money Deposit?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Clark Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Clark Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Clark Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!