Title: Understanding North Las Vegas Nevada Complaint — Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit Introduction: In North Las Vegas, Nevada, individuals engage in real estate transactions involving the sale of properties. These transactions often require the buyer to provide an earnest money deposit to secure the deal. However, there are instances where banks' errors in clearing the earnest money deposit lead to breaches of contract. This article aims to provide a detailed description of the North Las Vegas Nevada Complaint — Breach of Contract for Sale of Property Due to the Error of Bank in Clearing Earnest Money Deposit, exploring different types of such complaints. 1. Definition of a Breach of Contract: A breach of contract refers to a legal situation where one party fails to fulfill their obligations as outlined in the agreement. In the context of a real estate transaction, this occurs when either the buyer or seller fails to comply with the terms agreed upon in the contract of sale. 2. Understanding the Significance of the Earnest Money Deposit: An earnest money deposit serves as a good faith gesture from the buyer to the seller, demonstrating their commitment to purchasing the property. The deposit is typically held in escrow until the completion of the sale. Its purpose is to protect the seller from frivolous offers and to compensate the seller in case the buyer fails to fulfill their contractual obligations. 3. Common Types of Complaints: a. Delayed or Incorrect Clearing of the Earnest Money Deposit: In some cases, when the buyer transfers the earnest money deposit to the bank designated in the contract, the bank may mistakenly delay or fail to clear the deposit. This situational error can lead to a breach of contract, causing significant inconvenience and financial loss for both parties involved. b. Improper Handling of the Earnest Money Deposit by the Bank: Another type of complaint arises when the bank mishandles the earnest money deposit, resulting in its loss, misplacement, or accidental dispersion. Such mistakes can jeopardize the transaction and may give rise to legal disputes and subsequent breaches of contract. c. Insufficient Funds or Account-Related Errors: Instances where the bank withdraws the earnest money deposit due to insufficient funds in the buyer's account, errors in account numbers, or incorrect transaction details also fall under this category. These errors can impede the successful completion of the sale and result in the breach of contract. Conclusion: In North Las Vegas, Nevada, complaints regarding breaches of contracts for the sale of property due to bank errors in clearing the earnest money deposit can occur in various forms. Delayed clearing, mishandling of the deposit, and insufficient funds are common issues that may lead to the breach of contract. It is crucial for all parties involved in real estate transactions to ensure proper oversight and diligence to minimize the occurrence of such complaints and to promptly address and resolve any potential errors to protect their rights and interests.

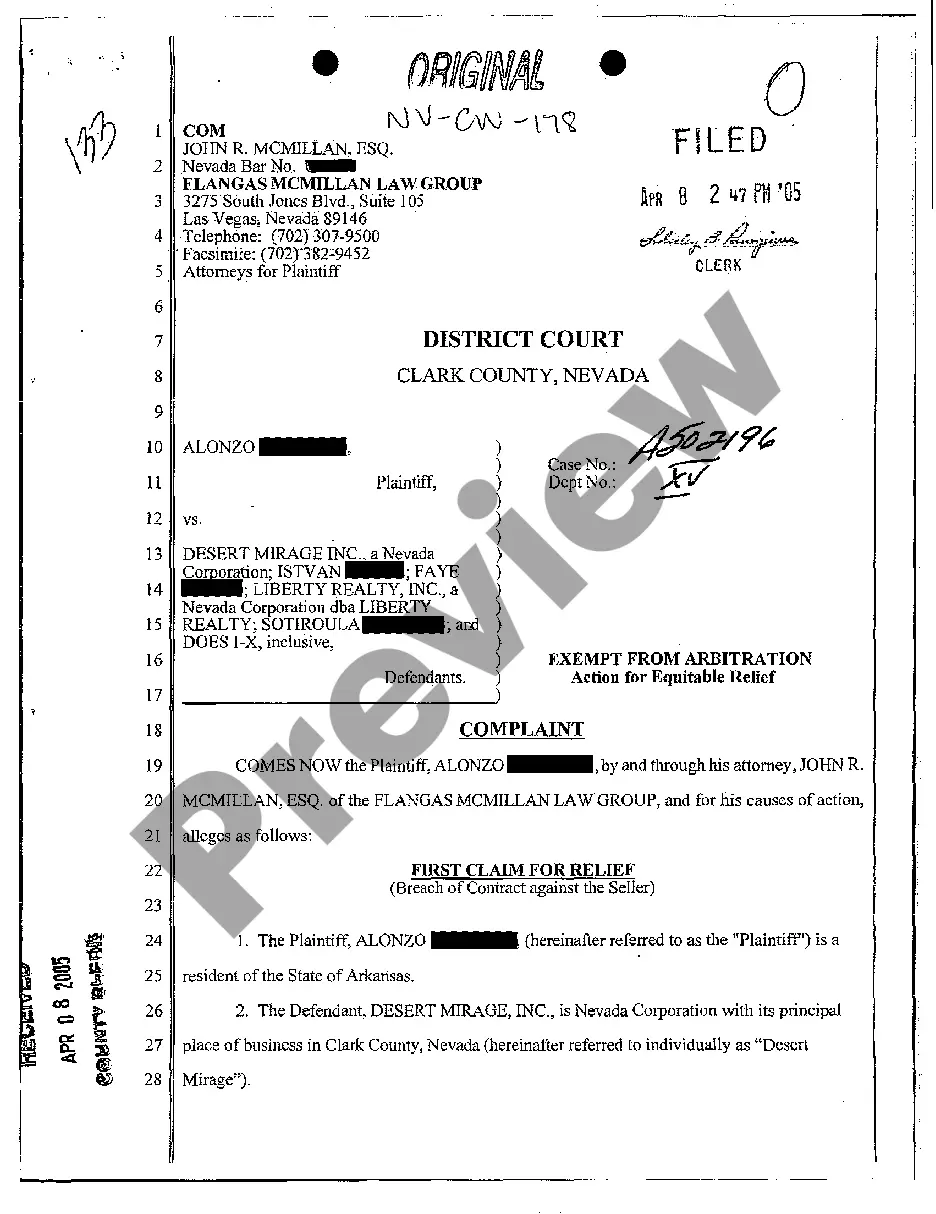

North Las Vegas Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit

Description

How to fill out North Las Vegas Nevada Complaint - Breach Of Contract For Sale Of Property Due To Error Of Bank In Clearing Earnest Money Deposit?

If you are searching for a relevant form, it’s impossible to choose a better service than the US Legal Forms site – one of the most extensive libraries on the web. With this library, you can find thousands of form samples for business and individual purposes by categories and regions, or keywords. Using our high-quality search function, getting the most up-to-date North Las Vegas Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit is as elementary as 1-2-3. Moreover, the relevance of each and every record is confirmed by a team of professional attorneys that on a regular basis review the templates on our platform and revise them based on the latest state and county demands.

If you already know about our platform and have an account, all you need to receive the North Las Vegas Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit is to log in to your user profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have chosen the sample you need. Look at its explanation and make use of the Preview option to explore its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to find the proper record.

- Affirm your selection. Select the Buy now option. Following that, pick your preferred pricing plan and provide credentials to register an account.

- Make the purchase. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the form. Indicate the file format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the received North Las Vegas Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit.

Each form you save in your user profile has no expiry date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you want to have an additional copy for editing or printing, you may return and download it once more whenever you want.

Take advantage of the US Legal Forms professional collection to get access to the North Las Vegas Nevada Complaint - Breach of Contract for Sale of Property Due to Error of Bank in Clearing Earnest Money Deposit you were seeking and thousands of other professional and state-specific templates on a single platform!