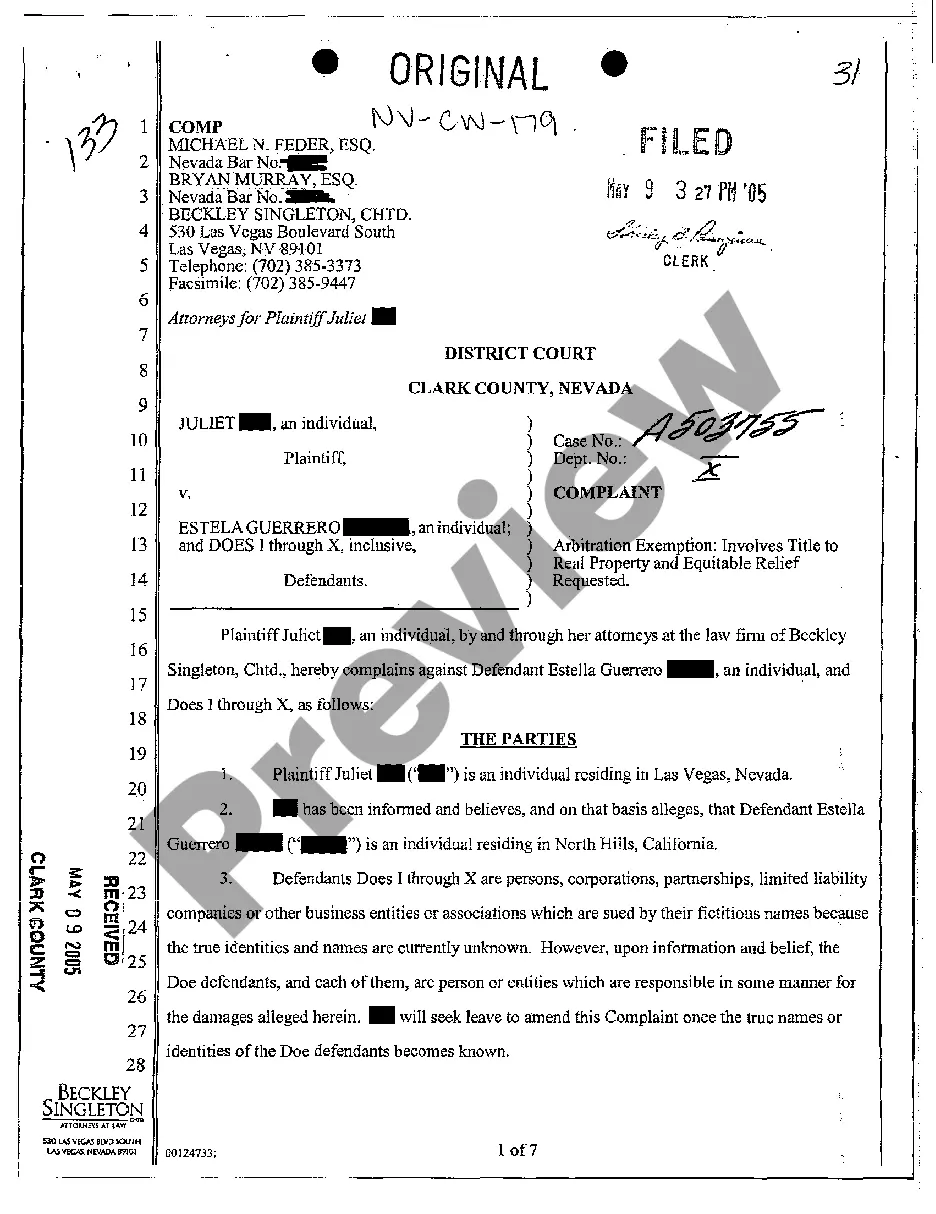

Clark Nevada Complaint — Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property Keywords: Clark Nevada, complaint, breach of home purchase agreement, refusal to close escrow, transfer the property Description: A Clark Nevada Complaint — Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property refers to a legal action taken against a party who has violated the terms and conditions outlined in a home purchase agreement in Clark County, Nevada. This complaint arises when the party involved refuses to complete the closing of an escrow and transfer the ownership of the property. There might be different types of Clark Nevada Complaints — Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property, including: 1. Non-payment: When the buyer fails to make the agreed-upon payment for the property within the specified time period, resulting in a breach of the home purchase agreement. 2. Failed inspections: If the buyer has requested certain inspections during the due diligence period, and the seller refuses to address or rectify any significant issues discovered, this will constitute a breach of the agreement. 3. Title issues: If the seller cannot provide clear title to the property or there are unforeseen liens or encumbrances that were not disclosed, leading to a refusal to close escrow, it can be considered a breach of the purchase agreement. 4. Failure to disclose material defects: If the seller intentionally conceals or fails to disclose material defects or issues that negatively impact the property's value or habitability, the buyer may refuse to close escrow, resulting in a breach of the agreement. 5. Failure to meet closing deadlines: If either party fails to meet the agreed-upon deadlines for completing the closing process, including finalizing financing, obtaining necessary documents, or fulfilling other contractual obligations, it can lead to a refusal to close escrow and a breach of the home purchase agreement. In cases where a breach of the home purchase agreement occurs due to refusal to close escrow and transfer the property, the aggrieved party can file a complaint in Clark County, Nevada. The complaint will outline the specific details of the alleged breach, including the facts surrounding the agreement, the refusal to close escrow, and the consequent damages suffered. The complaint will seek legal remedies, which may include specific performance of the agreement, monetary compensation, or the cancellation of the agreement altogether. It is essential to consult with an experienced real estate attorney in Clark County, Nevada, to handle such a complaint effectively and navigate the legal process.

Clark Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property

Description

How to fill out Clark Nevada Complaint - Breach Of Home Purchase Agreement Due To Refusal To Close Escrow And Transfer The Property?

Make use of the US Legal Forms and get instant access to any form template you need. Our beneficial website with a large number of document templates makes it simple to find and obtain almost any document sample you require. You are able to export, complete, and certify the Clark Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property in just a matter of minutes instead of browsing the web for hours attempting to find an appropriate template.

Using our catalog is a great way to improve the safety of your record submissions. Our professional attorneys on a regular basis review all the records to ensure that the forms are relevant for a particular state and compliant with new acts and polices.

How do you get the Clark Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Additionally, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Find the template you require. Ensure that it is the template you were looking for: check its title and description, and take take advantage of the Preview option if it is available. Otherwise, make use of the Search field to find the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Pick the format to obtain the Clark Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property and modify and complete, or sign it for your needs.

US Legal Forms is among the most considerable and reliable template libraries on the web. We are always ready to help you in any legal process, even if it is just downloading the Clark Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property.

Feel free to make the most of our platform and make your document experience as efficient as possible!