North Las Vegas Nevada Complaint — Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property Keywords: North Las Vegas Nevada, complaint, breach, home purchase agreement, refusal, close escrow, transfer property Description: In North Las Vegas Nevada, a complaint can arise when a breach of a home purchase agreement occurs due to the refusal of one party to close escrow and transfer the property. This type of situation can lead to legal action as it involves a violation of contractual obligations and can have serious consequences for both the buyer and seller involved. There are different types of North Las Vegas Nevada complaints that can arise in relation to a breach of a home purchase agreement due to refusal to close escrow and transfer the property. Some common types of complaints in this regard can include: 1. Failure to Meet Closing Date: One party may refuse to close escrow and transfer the property on the agreed-upon closing date. This can lead to financial losses for the other party, such as additional rent or mortgage payments, storage fees, or lost opportunities for alternative housing. 2. Non-Disclosure of Property Issues: If one party discovers undisclosed property issues during the escrow period and the other party refuses to address or disclose these issues, it can constitute a breach of the agreement. This can include undisclosed mold, structural damage, or any other significant defects affecting the value and livability of the property. 3. Financing Issues and Refusal to Close: Sometimes, a party may encounter unexpected difficulties in securing financing for the purchase. If the buyer or seller refuses to cooperate in finding alternative solutions or refuses to close escrow due to these issues, it can lead to a breach of the home purchase agreement. 4. Title Disputes: If a title dispute arises during the escrow period and one party refuses to resolve it, it can jeopardize the transfer of the property. This can include issues related to liens, encumbrances, or unresolved ownership claims that can hinder the rightful transfer of the property. 5. Failure to Deliver Marketable Title: In some cases, the seller may fail to deliver a marketable title to the property, such as missing necessary legal documentation or unresolved title defects. If the seller refuses to address these issues and transfer the property with a marketable title, it can result in a breach of the home purchase agreement. In any of these scenarios, it is essential to seek legal advice promptly to understand your rights and options regarding a North Las Vegas Nevada complaint for breach of a home purchase agreement due to refusal to close escrow and transfer the property. Legal remedies can include seeking specific performance of the contract, financial compensation for damages, or cancellation of the agreement with the return of any funds invested in the transaction.

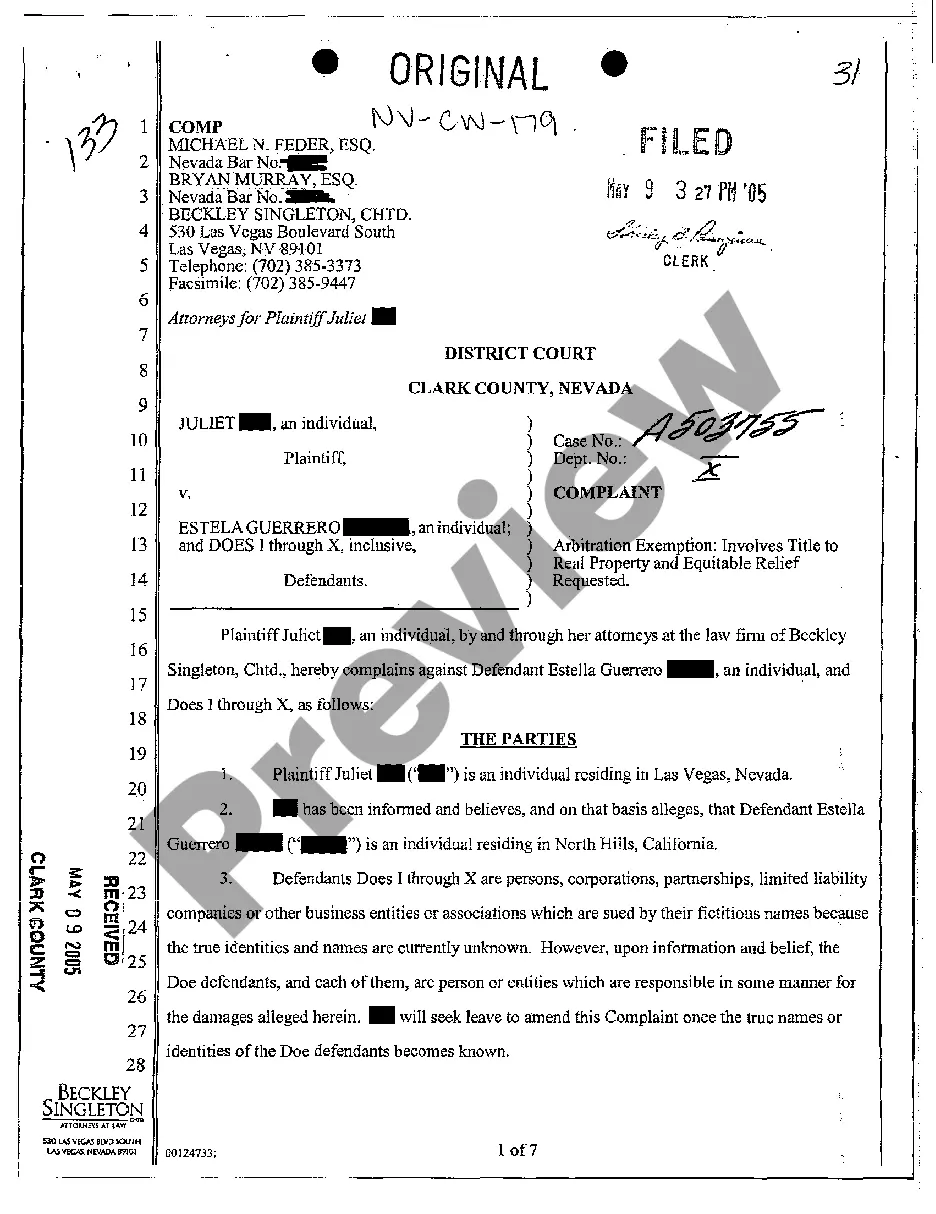

North Las Vegas Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property

Description

How to fill out North Las Vegas Nevada Complaint - Breach Of Home Purchase Agreement Due To Refusal To Close Escrow And Transfer The Property?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the North Las Vegas Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the North Las Vegas Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the North Las Vegas Nevada Complaint - Breach of Home Purchase Agreement Due to Refusal to Close Escrow and Transfer the Property. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!