Title: Sparks Nevada Election of Coverage by Employer; and Employer Withdrawal of Election of Coverage Explained Introduction: In Sparks Nevada, employers have the responsibility to provide health insurance coverage to their employees. The Sparks Nevada Election of Coverage by Employer refers to the process through which employers select and offer the type of health insurance coverage to their workers. On the other hand, Employer Withdrawal of Election of Coverage pertains to the option of an employer to revoke or cancel the health insurance coverage previously granted. Types of Sparks Nevada Election of Coverage by Employer: 1. Group Health Insurance Plans: Employers can opt for group health insurance plans to offer coverage to their employees collectively. These plans typically encompass a variety of benefits, including medical, dental, and vision coverage. Group plans often leverage the bargaining power of the employer, resulting in lower premium costs and increased affordability for employees. 2. Employer-Sponsored Health Maintenance Organizations (HMO's): are a type of managed care plan where employees are required to receive their healthcare services only from a network of providers. Employers may select HMO's as a coverage option due to their cost-effective nature and emphasis on preventive care. 3. Preferred Provider Organizations (PPO's): PPO's offer employees more flexibility in choosing healthcare providers compared to HMO's. Employees can generally receive care from both in-network and out-of-network providers, although utilizing in-network providers results in lower out-of-pocket expenses. The employer may offer PPO's to accommodate employees who prefer greater provider choice. Employer Withdrawal of Election of Coverage: Sometimes, employers may decide to withdraw or terminate the health insurance coverage they previously elected for their employees. Several circumstances can lead to this decision: 1. Financial Constraints: If an employer faces financial hardships or unexpected financial difficulties, they may consider withdrawing the election of coverage to reduce expenses. However, employers must comply with legal obligations and give employees sufficient notice to seek alternative coverage. 2. Changes in Business Structure: Mergers, acquisitions, or other significant changes within a company may prompt the withdrawal of the chosen coverage. Employers need to communicate such changes well in advance to allow employees enough time to secure new insurance options. 3. Compliance Challenges: Employers may discover that the selected coverage fails to meet certain regulatory requirements. In such cases, withdrawal becomes necessary to ensure the employer remains compliant with relevant laws and to protect employees' interests. Conclusion: The Sparks Nevada Election of Coverage by Employer and Employer Withdrawal of Election of Coverage are critical processes that heavily impact the health insurance options available to employees. Employers must carefully evaluate their employees' needs, financial capabilities, and the ever-changing healthcare landscape when making decisions regarding the election and potential withdrawal of coverage. Effective communication, transparency, and compliance with legal obligations remain essential throughout these processes to safeguard both the employer and employee interests.

Sparks Nevada Election of Coverage by Employer; and Employer Withdrawal of Election of Coverage

Description

How to fill out Sparks Nevada Election Of Coverage By Employer; And Employer Withdrawal Of Election Of Coverage?

If you are searching for a relevant form, it’s impossible to find a more convenient platform than the US Legal Forms site – probably the most comprehensive libraries on the web. Here you can get a huge number of templates for organization and individual purposes by categories and regions, or keywords. With our advanced search function, discovering the most recent Sparks Nevada Election of Coverage by Employer; and Employer Withdrawal of Election of Coverage is as easy as 1-2-3. Furthermore, the relevance of each file is verified by a group of professional lawyers that on a regular basis review the templates on our platform and update them according to the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to get the Sparks Nevada Election of Coverage by Employer; and Employer Withdrawal of Election of Coverage is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just refer to the instructions below:

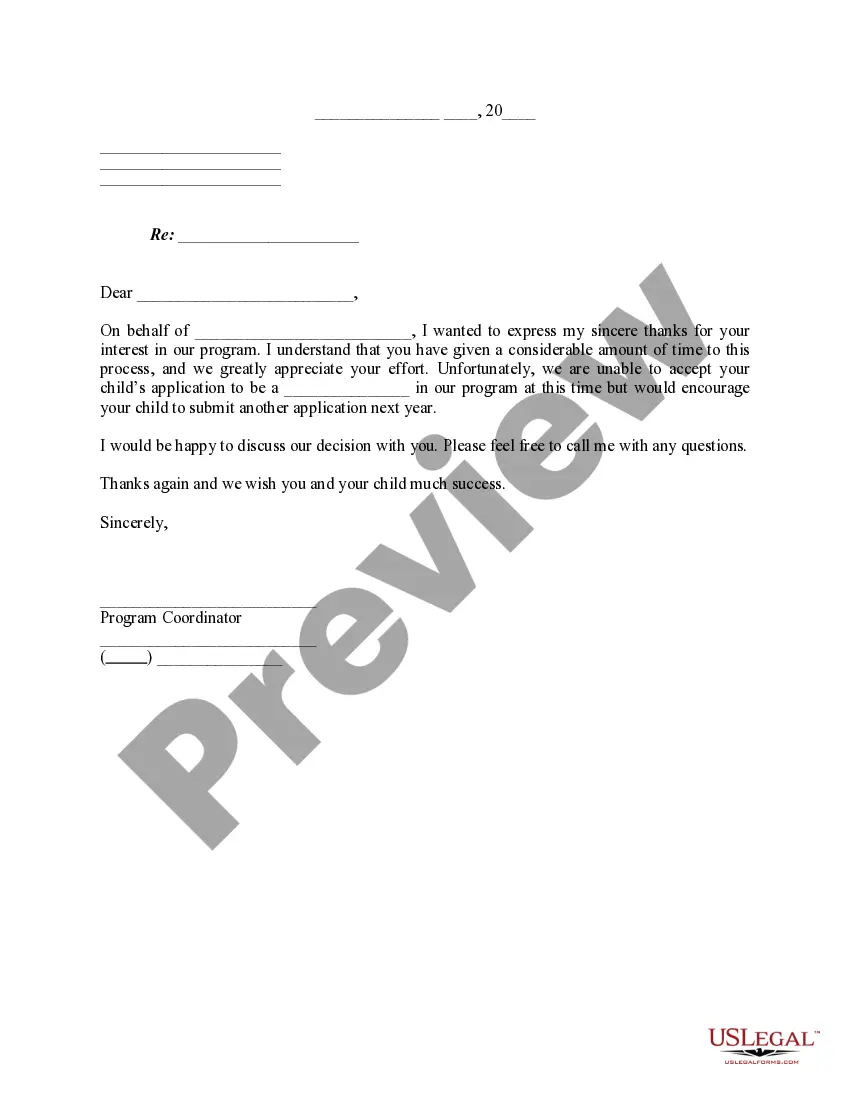

- Make sure you have chosen the form you need. Look at its information and utilize the Preview function to explore its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to get the appropriate file.

- Confirm your decision. Select the Buy now option. Following that, pick your preferred subscription plan and provide credentials to sign up for an account.

- Make the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the form. Select the format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the received Sparks Nevada Election of Coverage by Employer; and Employer Withdrawal of Election of Coverage.

Each and every form you add to your account does not have an expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to get an additional duplicate for editing or creating a hard copy, feel free to come back and export it once again whenever you want.

Take advantage of the US Legal Forms professional collection to get access to the Sparks Nevada Election of Coverage by Employer; and Employer Withdrawal of Election of Coverage you were seeking and a huge number of other professional and state-specific templates on a single website!