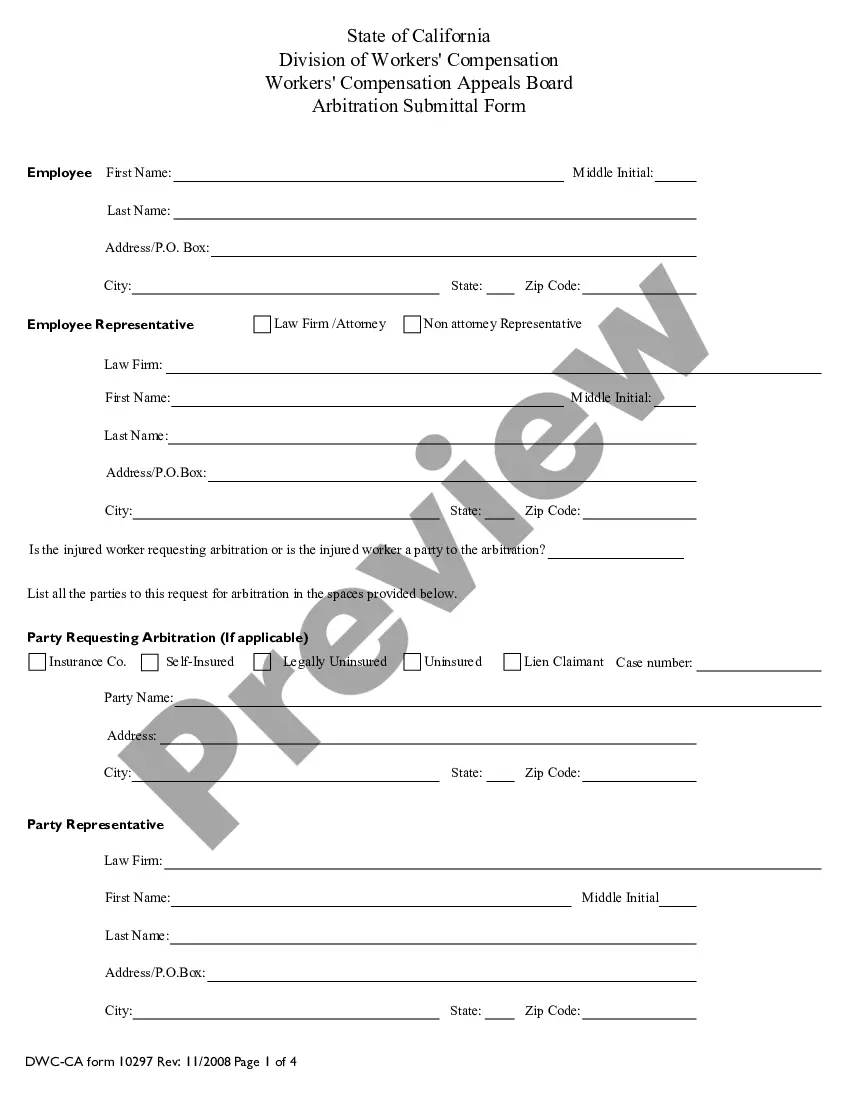

Las Vegas Nevada Proof of Coverage Notice is an important document that serves as evidence of insurance coverage in the state of Nevada. It is required to be provided by individuals or businesses who need to demonstrate that they have obtained the necessary insurance policies in compliance with Nevada's legal requirements. This notice is commonly used in various aspects such as automobile insurance, workers' compensation insurance, professional liability insurance, general liability insurance, and other forms of coverage that may be legally mandated. The Las Vegas Nevada Proof of Coverage Notice is crucial for verifying that a person or entity has secured sufficient insurance protection. It ensures that the insured party has met the minimum requirements set by Nevada law to safeguard against potential risks and liabilities. This notice is typically issued by insurance companies and must contain specific details, including the name and contact information of the insurance provider, the policyholder's name, policy number, effective date, and expiration date. It may also include additional information such as coverage limits, types of coverage included, and any applicable deductibles. Different types of Las Vegas Nevada Proof of Coverage Notice can be categorized based on the specific insurance policy they represent. Some common types include: 1. Automobile Insurance Proof of Coverage Notice: This notice is provided by individuals or businesses that own vehicles and need to demonstrate that they have obtained the legally required auto insurance coverage in Nevada. 2. Workers' Compensation Proof of Coverage Notice: This notice is issued by employers who have obtained workers' compensation insurance to provide coverage for any work-related injuries or illnesses sustained by their employees. 3. Professional Liability Proof of Coverage Notice: Professionals, such as doctors, lawyers, and architects, often need to provide proof of professional liability insurance coverage to safeguard against potential claims arising from their professional services. 4. General Liability Proof of Coverage Notice: This notice is commonly provided by businesses and organizations to demonstrate that they have obtained general liability insurance, which covers potential claims for bodily injury, property damage, or personal injury. It is important to note that the Las Vegas Nevada Proof of Coverage Notice may vary slightly depending on the type of insurance policy, but the overall purpose remains the same — to show evidence of insurance coverage as required by Nevada law. Businesses and individuals must ensure they possess an up-to-date and accurate proof of coverage notice to adhere to regulatory guidelines and protect themselves from potential legal consequences.

Las Vegas Nevada Proof of Coverage Notice

Description

How to fill out Las Vegas Nevada Proof Of Coverage Notice?

If you have previously taken advantage of our service, Log In to your account and store the Las Vegas Nevada Proof of Coverage Notice on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to quickly discover and save any template for your personal or professional needs!

- Ensure you have found the correct document. Review the description and utilize the Preview option, if available, to verify if it suits your requirements. If it doesn’t, use the Search tab above to locate the appropriate one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and make your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Las Vegas Nevada Proof of Coverage Notice. Select the file format for your document and store it on your device.

- Finalize your sample. Print it out or leverage professional online editors to complete it and sign it digitally.

Form popularity

FAQ

Complete the Notice of Injury or Occupational Disease, Form C-1. You must fill out this form and turn it in to your employer within one week of your injury. If your work-related injury requires medical treatment, you will need to fill out Form C-4, Employee's Compensation Report of Initial Treatment.

Form C-3 Employer's Report Of Industrial Injury or Occupational Disease. As soon as you have been notified of a work-related injury, please fill out this form and submit it to EMPLOYERS. This form must be completed within 10 days from notice of an accident. Fatalities must be reported within 24 hours.

Workers' compensation is a no-fault insurance program in the State of Nevada, which provides benefits to employees who are injured on the job and protection to employers who have provided coverage at the time of injury.

Filing A Workers' Compensation Claim Your workers' compensation claim does not start until the C-4 form is completed. The C-4 form is titled ?Employee's Claim for Compensation/Report of Initial Treatment?. The physician fills out their part of the form, and sends a copy to your employer and the insurer.

For each percent of impairment, you will receive 0.6% of your average monthly wage at the time of your injury.

EMPLOYEE'S CLAIM FOR COMPENSATION/REPORT OF INITIAL TREATMENT. FORM C-4.

The C-3 Employee Claim form allows workers to make a claim for compensation benefits with the New York Workers' Compensation Board. It gathers your personal information, your work position in the company, the type of injury or illness you received while on the job, and whether you obtained medical treatment.

Does Nevada allow Evidence of Insurance to be presented on a cell phone? Yes. Evidence of Insurance may be presented on a printed card or in an electronic format to be displayed on a mobile electronic device. Insurers are not required to provide electronic evidence.