Las Vegas, Nevada Workers Compensation and Employers Liability Insurance Policies are designed to provide financial protection to both employees and employers in the event of work-related injuries, illnesses, or accidents. These insurance policies ensure that employees receive proper compensation for medical expenses, lost wages, and rehabilitation services, while protecting employers from potential lawsuits arising from workplace incidents. In Las Vegas, there are three main types of Workers Compensation and Employers Liability Insurance Policies: 1. Worker's Compensation Insurance: This type of policy is mandatory for most employers in Las Vegas, Nevada. It provides coverage for employees who suffer from work-related injuries or illnesses, regardless of fault. Worker's Compensation Insurance helps cover medical treatment costs, rehabilitation expenses, and a portion of lost wages for the injured employee. It also safeguards employers against costly legal claims resulting from such injuries. 2. Employers Liability Insurance: This policy protects employers against lawsuits filed by employees who believe their injuries were caused by the employer's negligence. While Worker's Compensation Insurance covers most occupational injuries, there are exceptional circumstances where employees are allowed to sue their employers for additional damages, such as instances of intentional harm or gross negligence. Employers Liability Insurance helps cover legal defense costs, settlements, or judgments if an employee files a lawsuit against the employer. 3. Voluntary Coverage: Employers in Las Vegas, Nevada also have the option to provide additional voluntary coverage to their employees. These added protections might include extended disability benefits, coverage for occupational diseases, and coverage for specific high-risk occupations such as construction or mining. Voluntary coverage allows employers to customize their insurance policies to suit their specific industry or employee needs beyond the minimum required coverage. Workers Compensation and Employers Liability Insurance Policies in Las Vegas, Nevada plays a vital role in maintaining a safe and secure work environment for employees while safeguarding employers from potential financial burdens. It is crucial for employers to understand and comply with the legal requirements surrounding these policies to ensure the well-being of their employees and the long-term viability of their businesses.

Las Vegas Nevada Workers Compensation and Employers Liability Insurance Policy

Description

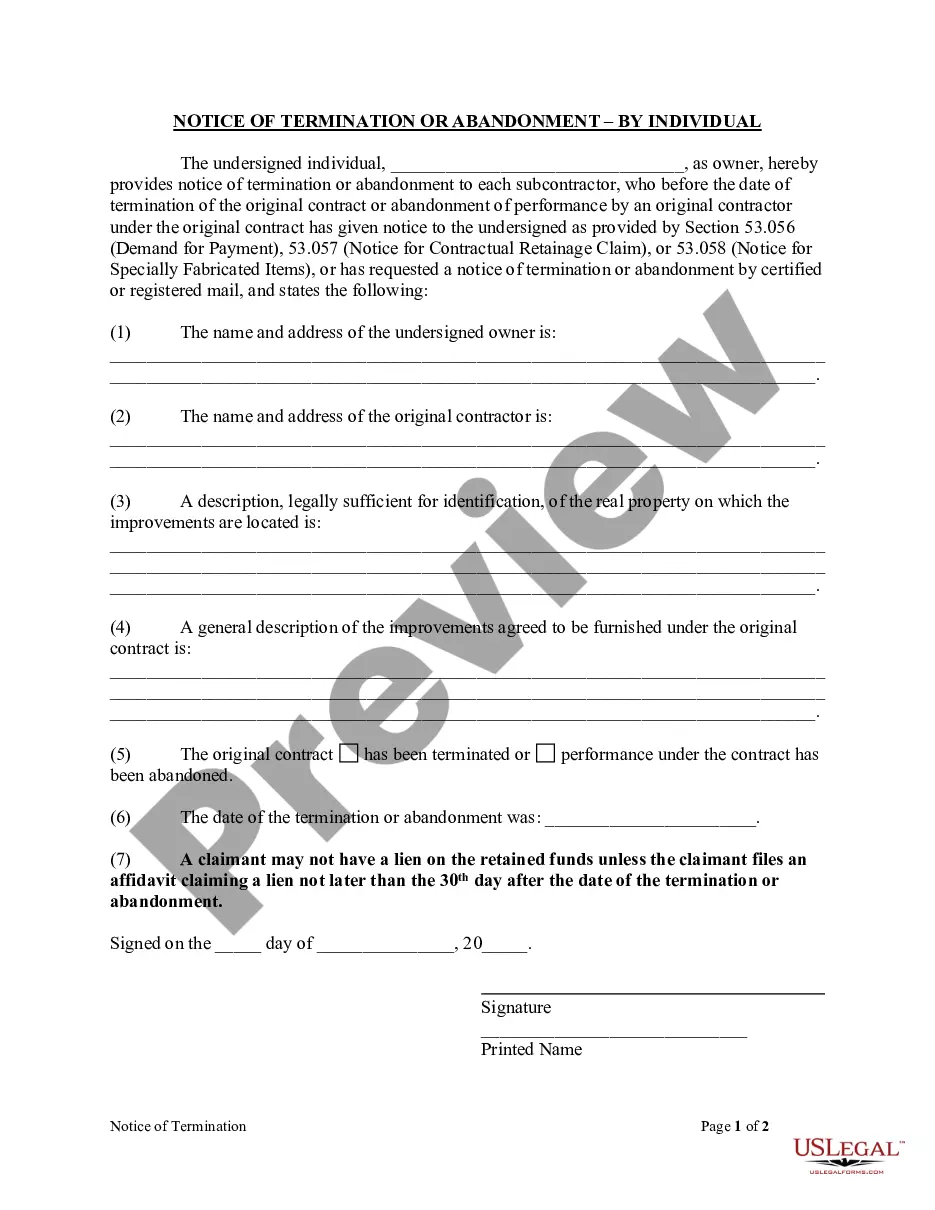

How to fill out Las Vegas Nevada Workers Compensation And Employers Liability Insurance Policy?

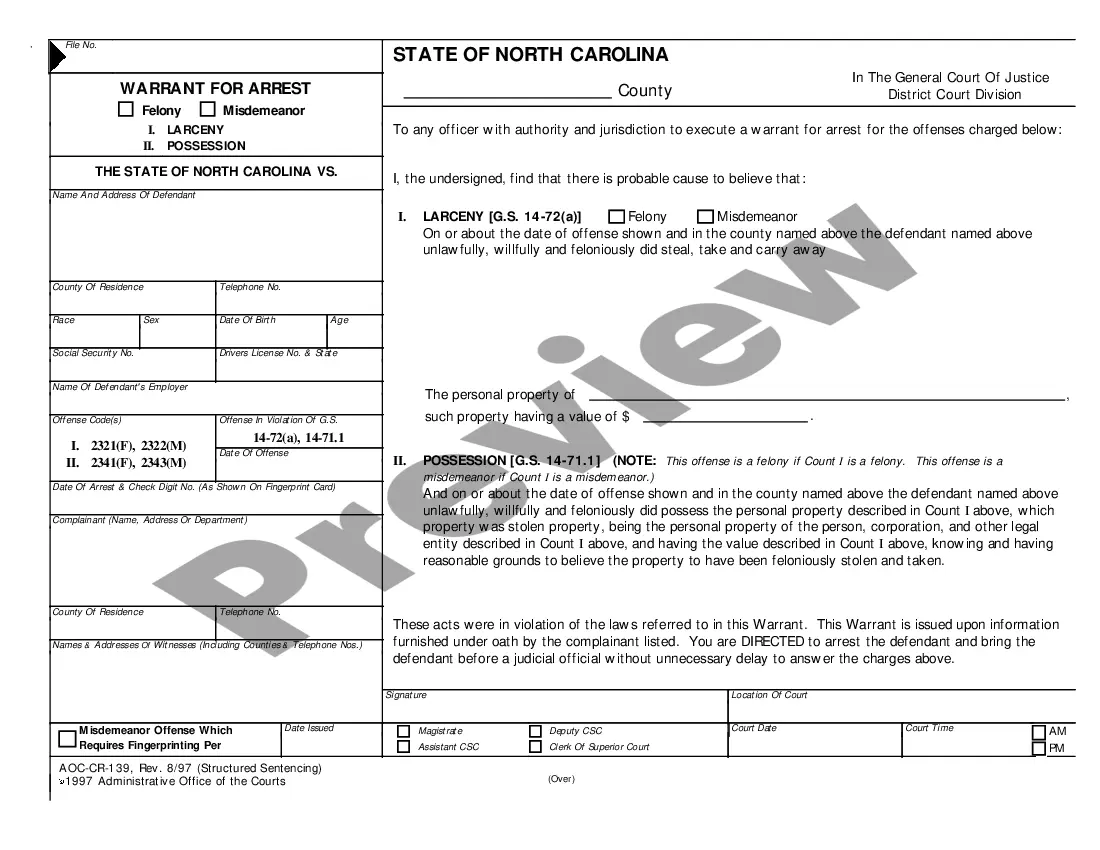

Finding validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an internet repository of over 85,000 legal documents for both personal and professional requirements and various real-world scenarios.

All the paperwork is well-organized by field of application and jurisdiction, making it as straightforward as ABC to find the Las Vegas Nevada Workers Compensation and Employers Liability Insurance Policy.

Organizing documents accurately and in compliance with legal stipulations is crucial. Utilize the US Legal Forms library to consistently have essential document templates for any requirements readily available!

- Examine the Preview mode and form details.

- Ensure you’ve selected the appropriate one that fulfills your needs and aligns with your local jurisdiction standards.

- Search for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the correct one. If it meets your criteria, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

Who needs workers' compensation in Nevada? Nevada businesses with one or more employees are required to carry workers' compensation insurance. Under Nevada statutes, any person, firm, voluntary association, private corporation, and public service corporation that hires employees needs to carry this coverage.

Yes. All employers in the state of Nevada are required to have workers' compensation insurance. Nevada law provides for benefit types and calculations to be the same regardless of the type of workers' compensation coverage.

Workers' compensation is a no-fault insurance program in the State of Nevada, which provides benefits to employees who are injured on the job and protection to employers who have provided coverage at the time of injury.

How much does workers' compensation insurance cost in Nevada? Estimated employer rates for workers' compensation in Nevada are $0.94 per $100 in covered payroll. Your cost is based on a number of factors, including: Payroll.

Nevada Revised Statutes (NRS) 616A. 065 requires the average monthly wage to be capped at 150 percent of the state Average Weekly Wage, multiplied by 4.33. Maximum disability compensation in Nevada is 66-2/3 percent of the Average Monthly Wage (NRS 616A.

Workers' compensation, a no-fault insurance plan, provides guaranteed financial payments for work related injuries and illnesses. Financial compensation includes lost wages (i.e. temporary disability payments), medical bills, and lump sum permanent disability payments.

In Nevada it is required by law to provide workers' compensation coverage if you have one or more employees. Sole Proprietors and Partners are excluded from coverage by default, but may elect to include themselves for coverage.

Workers' compensation is a no-fault insurance program in the State of Nevada, which provides benefits to employees who are injured on the job and protection to employers who have provided coverage at the time of injury.

Nevada requires all private employers with one or more employees to get and maintain workers' compensation insurance. Workers' compensation insurance provides benefits to employees who are injured on the job and protection to employers who have provided coverage at the time of injury.

With a few exceptions, the state of Nevada requires every business with an employee to have workers' compensation insurance coverage. This policy helps provide benefits to your employees if they get injured or ill while working.