Clark Nevada Dissolution Package to Dissolve Corporation

Description

How to fill out Nevada Dissolution Package To Dissolve Corporation?

Finding authenticated templates that align with your local statutes can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements and various real-life scenarios.

All the forms are appropriately categorized by area of application and jurisdictional regions, making the search for the Clark Nevada Dissolution Package for Dissolving Corporation as simple as ABC.

Click on the Buy Now button and select your preferred subscription plan. Registration is necessary to gain entry to the library’s resources.

- Verify the Preview mode and form description.

- Ensure you have selected the correct one that meets your criteria and fully matches your local jurisdiction standards.

- Search for another template, if required.

- If any discrepancy is found, utilize the Search tab above to locate the correct one. If it meets your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To cancel your Clark County business license, you must submit a cancellation request to the appropriate county agency. Typically, this request includes your business details and the reason for cancellation. It's essential to ensure that you fulfill any final obligations and resolve any outstanding fees. The Clark Nevada Dissolution Package to Dissolve Corporation can assist you by offering the necessary forms and expert advice for a streamlined cancellation process.

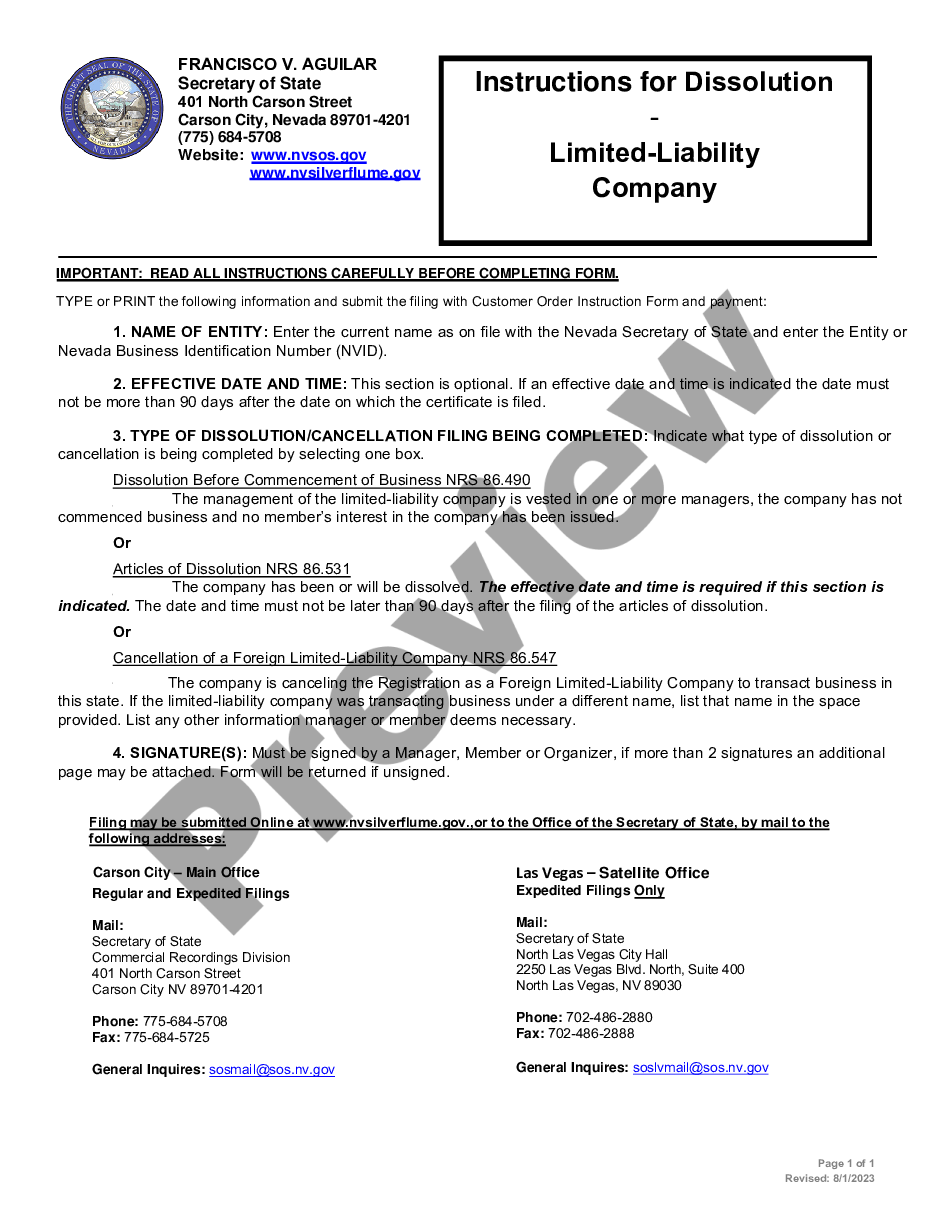

Dissolving a corporation in Nevada involves a few important steps. First, you need to obtain and complete the appropriate forms, including the Articles of Dissolution, through the Nevada Secretary of State's office. Additionally, you should settle any outstanding debts and obligations your corporation might have. Using the Clark Nevada Dissolution Package to Dissolve Corporation simplifies this process by providing you with all necessary forms and guidance for a smooth dissolution.

When you dissolve a corporation, any outstanding debts do not automatically disappear. You are still responsible for these debts, and creditors may pursue repayment through legal means. It is crucial to address any remaining obligations before finalizing the dissolution. Utilizing the Clark Nevada Dissolution Package to Dissolve Corporation can help you understand the best approach to manage corporate debts effectively.

After you dissolve a corporation, you typically cannot use the corporate bank account for business transactions. Any funds remaining in the account must be properly disbursed to shareholders or creditors, as per legal guidelines. It's essential to close the account to prevent unauthorized use. Consider the Clark Nevada Dissolution Package to Dissolve Corporation for a comprehensive guide on handling these matters correctly.

The timeline to dissolve an LLC in Nevada can vary, but typically, the process takes about 10 to 14 business days once you submit the necessary documents. Using the Clark Nevada Dissolution Package to Dissolve Corporation can streamline this process significantly, ensuring you have all required forms ready for submission. Additionally, if you opt for expedited services, you may receive approval in as little as 24 hours. Engaging with uslegalforms can provide clarity and support, making your dissolution process smoother and more efficient.

Dissolving a corporation does not automatically trigger an audit, but it can raise red flags if there are unresolved tax issues or discrepancies. Staying compliant during the dissolution process is essential to avoid complications. With the Clark Nevada Dissolution Package to Dissolve Corporation, you can manage your dissolution carefully and minimize the risk of an audit.

The dissolution of a corporation involves legally ending its existence. This requires filing Articles of Dissolution, canceling permits and licenses, notifying relevant parties, and settling debts. The Clark Nevada Dissolution Package to Dissolve Corporation offers a clear roadmap for completing this process efficiently and legally.

You must file the final tax return and indicate that it is the final return for your corporation. Ensure to report any assets sold or distributed before closing the business. To make this process easier, the Clark Nevada Dissolution Package to Dissolve Corporation includes instructions on notifying the IRS and managing tax implications.

The steps involved in dissolving a corporation generally include obtaining board approval, filing Articles of Dissolution, notifying creditors, settling obligations, and distributing remaining assets to shareholders. Each step is crucial for ensuring legal compliance. The Clark Nevada Dissolution Package to Dissolve Corporation provides a comprehensive approach to guide you through each phase seamlessly.

The process of dissolving a company typically involves several key steps, such as filing the Articles of Dissolution, settling all debts, and distributing remaining assets to shareholders. It's essential to follow legal procedures to avoid complications. With the Clark Nevada Dissolution Package to Dissolve Corporation, you can streamline this process and ensure compliance with state regulations.