A North Las Vegas Nevada Living Trust for Husband and Wife with Minor and/or Adult Children is a legal document that plays a crucial role in estate planning. It provides individuals with the ability to have control over their assets and how they will be distributed during and after their lifetime. This type of trust is specifically designed for married couples residing in North Las Vegas who have minor children, adult children, or both. Here are the different types of North Las Vegas Nevada Living Trusts that cater to the unique needs of couples with children: 1. Revocable Living Trust: A revocable living trust is the most common type, allowing individuals to have complete control over their assets during their lifetime. Married couples can create a joint revocable living trust to ensure seamless asset management and distribution for their minor and adult children. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be modified or revoked after its creation, providing more protection. This type of trust may be advantageous in safeguarding assets from creditors or minimizing estate taxes. It can also include provisions for distribution to minor and adult children. 3. Testamentary Trust: A testamentary trust is not established during the lifetime of the granter(s) but is instead created within a will. This allows couples to specify how their assets will be managed and distributed after their passing. Testamentary trusts can include provisions for the care of minor children or financial support for adult children. 4. Special Needs Trust: If one or more of the couple's children have special needs or disabilities, a special needs trust can be established within a living trust. This ensures that, in the event of the parents' incapacity or death, the child's inheritance will not jeopardize their eligibility for government benefits and support services. 5. Educational Trust: With an educational trust, parents can designate funds specifically for their children's education. This type of trust can be useful for couples with children of any age, as it allows parents to set aside funds for college tuition, vocational training, or other educational expenses. Regardless of the specific type of North Las Vegas Nevada Living Trust, it is highly recommended that couples consult with an experienced estate planning attorney to ensure that their wishes are adequately documented and legally binding. An attorney can assist in tailoring the trust to address the specific needs and circumstances of the couple and their minor and adult children while complying with relevant state laws and regulations. Keywords: North Las Vegas Nevada, living trust, husband and wife, minor children, adult children, revocable living trust, irrevocable living trust, testamentary trust, special needs trust, educational trust, estate planning, estate taxes, asset management, distribution.

North Las Vegas Nevada Living Trust for Husband and Wife with Minor and or Adult Children

Description

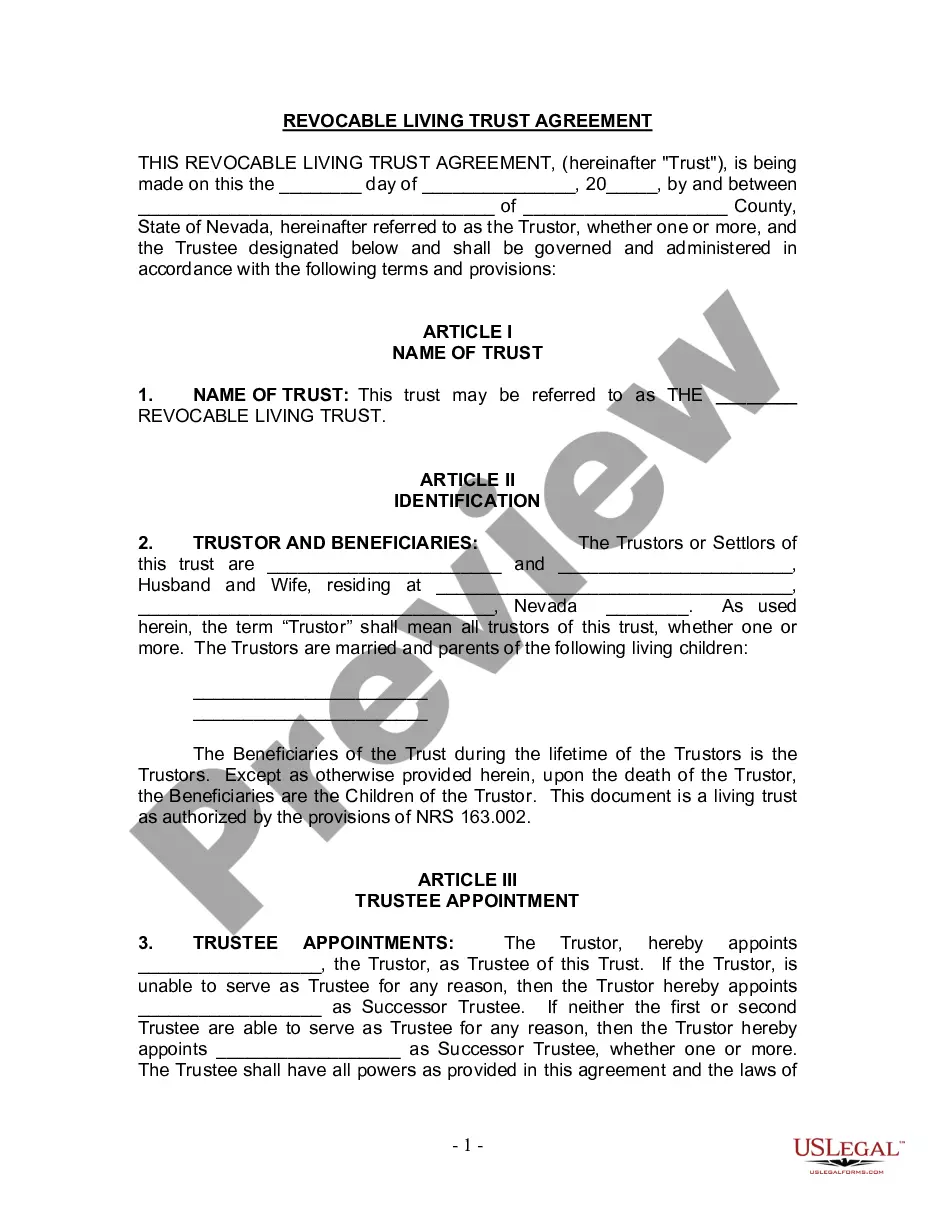

How to fill out North Las Vegas Nevada Living Trust For Husband And Wife With Minor And Or Adult Children?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal background to draft such paperwork from scratch, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform provides a huge catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you require the North Las Vegas Nevada Living Trust for Husband and Wife with Minor and or Adult Children or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the North Las Vegas Nevada Living Trust for Husband and Wife with Minor and or Adult Children in minutes employing our reliable platform. If you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

However, in case you are new to our platform, ensure that you follow these steps prior to obtaining the North Las Vegas Nevada Living Trust for Husband and Wife with Minor and or Adult Children:

- Be sure the form you have found is specific to your area considering that the rules of one state or county do not work for another state or county.

- Preview the document and go through a short outline (if available) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your needs, you can start over and search for the suitable document.

- Click Buy now and choose the subscription option you prefer the best.

- with your login information or register for one from scratch.

- Choose the payment method and proceed to download the North Las Vegas Nevada Living Trust for Husband and Wife with Minor and or Adult Children as soon as the payment is completed.

You’re good to go! Now you can go ahead and print out the document or fill it out online. If you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.