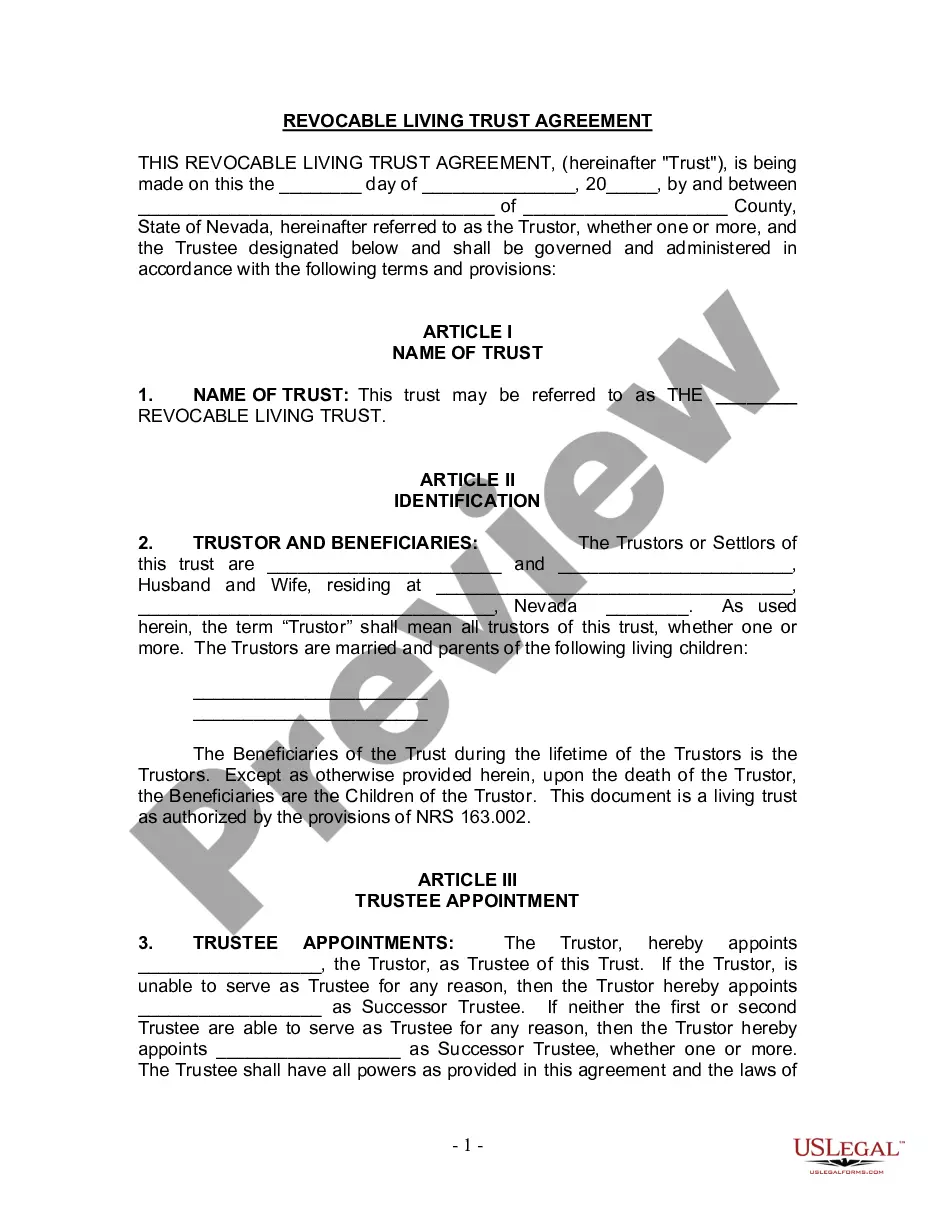

Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Nevada Living Trust For Husband And Wife With Minor And Or Adult Children?

Do you require a reliable and affordable legal document supplier to purchase the Sparks Nevada Living Trust for Spouses with Minor and/or Adult Children? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to advance your separation or divorce through the judiciary, we have you covered.

Our platform offers over 85,000 current legal form templates for personal and business use. All templates provided are tailored and designed to meet the demands of specific states and counties.

To obtain the form, you must Log In to your account, find the required form, and click the Download button adjacent to it.

If the form does not match your legal needs, restart the search.

You can now create your account. Next, choose the subscription option and complete the payment. Once the payment is made, download the Sparks Nevada Living Trust for Spouses with Minor and/or Adult Children in any available file format. You can return to the site anytime and redownload the form at no additional cost.

- Please remember that you can download your previously acquired form templates at any time from the My documents tab.

- Is this your first visit to our site? No problem.

- You can set up an account in just a few minutes, but first, ensure to do the following.

- Verify if the Sparks Nevada Living Trust for Spouses with Minor and/or Adult Children complies with your state and local laws.

- Review the specifics of the form (if provided) to determine who and what the form is appropriate for.

Form popularity

FAQ

A family trust, such as the Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children, may come with some disadvantages. One major concern is the complexity of managing the trust, especially if family dynamics are involved. Conflicts may arise if beneficiaries disagree on distributions or asset management. Furthermore, ongoing administrative duties can add to the burden of maintaining the trust.

One of the main downsides of placing assets in a Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children is the loss of control over those assets. Once assets are transferred, the trust, rather than the individuals, manages them. This can limit flexibility in financial decisions. It is essential to carefully consider this aspect and understanding how the trust operates is key.

Having your parents establish a Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children is often a wise decision. A trust can provide clear instructions for asset distribution, ensuring that their wishes are honored. Additionally, it can help avoid probate, saving time and costs for the family. This can be especially beneficial for minor children, as it allows for more controlled asset management.

To set up a joint living trust, first gather the necessary personal and financial information of both spouses. Then, draft the living trust agreement, detailing your wishes regarding asset distribution and guardianship for minor children. Utilizing a service like uslegalforms can guide you in creating a Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children, ensuring that you cover all essential aspects effectively.

One significant mistake parents make when establishing a trust fund is failing to clearly define the distribution terms for their children. This oversight can lead to confusion and conflict among heirs after the parents’ passing. With the Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children, you should ensure that you outline specific guidelines for how and when your children will receive assets.

While a joint trust can simplify management for spouses, it may have some disadvantages. One major concern is the potential lack of flexibility when it comes to changes in circumstances, such as divorce or death. Additionally, if both spouses pass away, the Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children may become more complex to administer for beneficiaries.

You don’t actually file a living trust in Nevada. Instead, you create and fund it with your assets. When setting up a Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children, you should focus on transferring ownership of your property and accounts to the trust to ensure proper management according to your wishes.

In Nevada, a living trust, including the Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children, does not need to be recorded. Instead, it's crucial to fund the trust by transferring ownership of assets into it. Keeping records of your trust is vital to ensure smooth management and avoid complications for your heirs.

To set up a Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children, start by gathering important documents, such as property deeds and financial statements. Next, you will need to create a trust document outlining terms, including beneficiaries and trustees. Using a reliable platform like uslegalforms can simplify this process, offering templates and guidance tailored for Nevada.

In most cases, a nursing home cannot take your house if it is held in a Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children, provided certain conditions are met. This trust structure can offer a layer of protection against Medicaid claims, but specific rules may vary. It is advisable to seek guidance on this matter to devise the best estate planning strategy for your family.