A Sparks Nevada Living Trust for Husband and Wife with Minor and/or Adult Children is a legal document designed to protect and manage the assets and property of a married couple during their lifetime and ensure a smooth transition of ownership to their beneficiaries after their passing. This type of living trust is especially essential for families with minor or adult children as it provides additional safeguards and guidelines for the effective distribution of assets. Here are some key features and benefits of a Sparks Nevada Living Trust for Husband and Wife with Minor and/or Adult Children: 1. Asset Protection: The trust helps shield the couple's assets from potential creditors, lawsuits, or divorce proceedings, preserving the wealth for the benefit of the intended beneficiaries. 2. Probate Avoidance: By transferring legal ownership of assets to the trust, they become non-probate assets, saving time and expenses associated with the probate process. This allows for a faster and more efficient transfer of assets to the heirs. 3. Flexibility and Control: The couple retains full control over the trust assets during their lifetime and can modify or revoke the trust as circumstances change. They can also select specific terms and conditions to dictate how and when their beneficiaries receive the assets. 4. Minor Children Protection: The trust enables parents to assign a trusted individual or institution as a successor trustee, responsible for managing and distributing assets to their minor children until they reach a specified age or milestone. This ensures the children's financial well-being and avoids the need for a court-appointed guardian or conservator. 5. Adult Children Planning: If the couple's children are already adults, the trust can still be highly advantageous. It can provide for the management of assets if any child has special needs, struggles with financial responsibility, or requires protection from potential creditors. Different types of Sparks Nevada Living Trusts for Husband and Wife with Minor and/or Adult Children might include: 1. Revocable Living Trust: This allows the couple to retain control and make changes or revoke the trust during their lifetime as circumstances dictate. 2. Irrevocable Living Trust: Once established, this type of trust cannot be modified or revoked, offering added protection against creditors and potential estate taxes. 3. Testamentary Trust: Sometimes referred to as a "trust under will," this trust takes effect upon the death of the couple and can incorporate provisions for minor and adult children, ensuring their financial security and providing guidance on asset distribution. In conclusion, a Sparks Nevada Living Trust for Husband and Wife with Minor and/or Adult Children is a comprehensive legal strategy that addresses the needs and concerns of families, allowing for the seamless management of assets, avoidance of probate, protection of beneficiaries, and customization based on individual family situations.

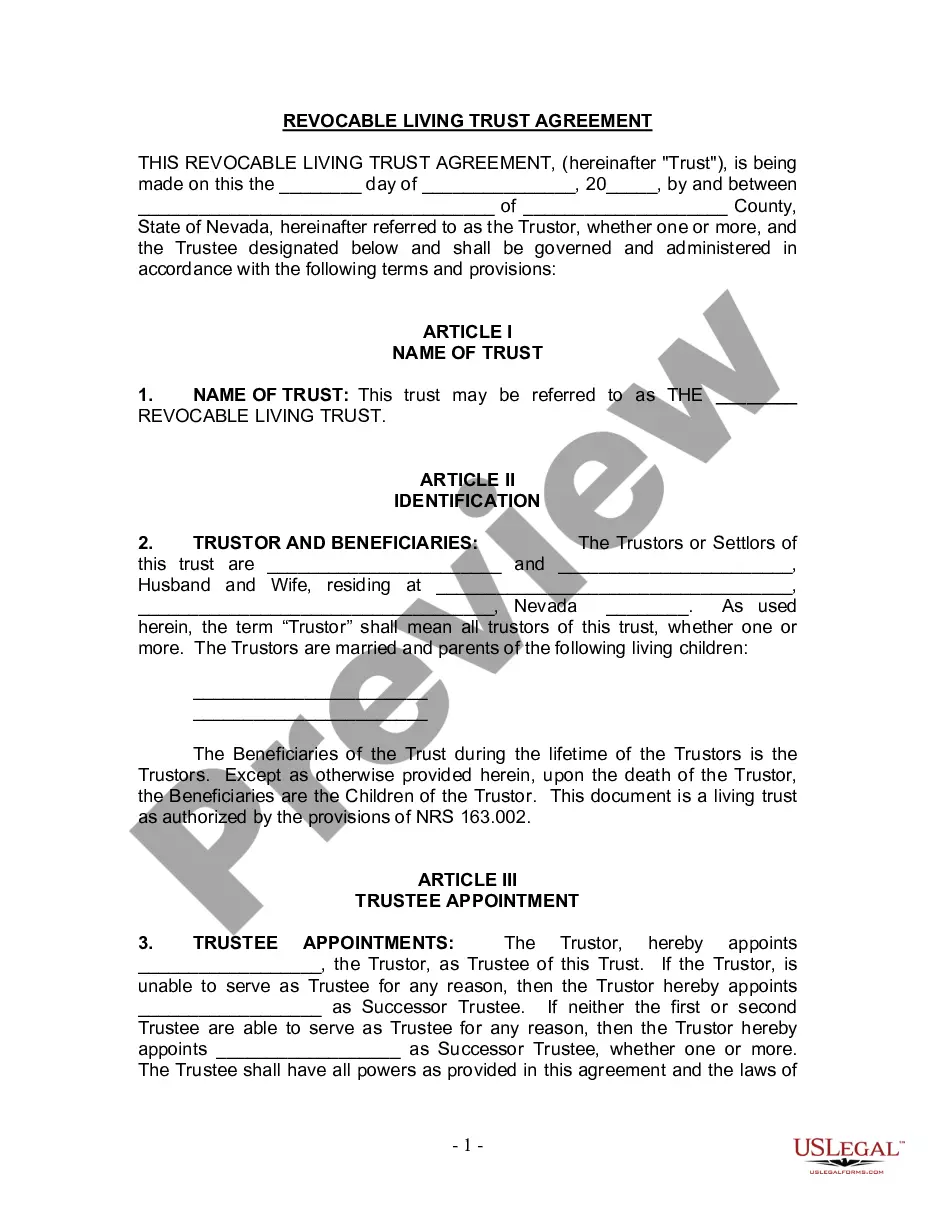

Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Sparks Nevada Living Trust For Husband And Wife With Minor And Or Adult Children?

Do you need a trustworthy and inexpensive legal forms provider to buy the Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children? US Legal Forms is your go-to option.

Whether you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of specific state and county.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is good for.

- Restart the search if the form isn’t suitable for your legal situation.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Sparks Nevada Living Trust for Husband and Wife with Minor and or Adult Children in any available file format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal paperwork online once and for all.