Sparks Nevada Amendment to Living Trust

Description

How to fill out Nevada Amendment To Living Trust?

Are you searching for a reliable and cost-effective legal forms provider to purchase the Sparks Nevada Amendment to Living Trust? US Legal Forms is your ideal option.

Whether you require a simple agreement to establish guidelines for living together with your partner or a collection of documents to process your separation or divorce through the court system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use. All templates available are not generic and are created in accordance with the standards of specific state and county requirements.

To obtain the document, you must Log In to your account, find the desired form, and click the Download button next to it. Please note that you can redownload your previously purchased document templates at any time from the My documents section.

Are you unfamiliar with our website? No problem. You can easily create an account, but before that, ensure to do the following: Check if the Sparks Nevada Amendment to Living Trust adheres to the regulations of your state and local jurisdiction. Review the form's description (if available) to understand who and what the document is meant for. Restart your search if the form is not suitable for your legal needs.

Try US Legal Forms today, and say goodbye to spending hours researching legal documents online.

- Now you can set up your account.

- Then choose the subscription plan and proceed to payment.

- Once the payment is processed, download the Sparks Nevada Amendment to Living Trust in any available format.

- You can revisit the website whenever necessary and redownload the document at no extra cost.

- Obtaining current legal documents has never been simpler.

Form popularity

FAQ

A significant mistake parents make when setting up a trust fund is failing to keep it updated. As circumstances change, so should the terms of the trust, including beneficiaries or asset allocations. Additionally, overlooking tax implications can lead to unintended consequences. Ensuring the trust reflects contemporary wishes requires attention, especially through instruments like the Sparks Nevada Amendment to Living Trust.

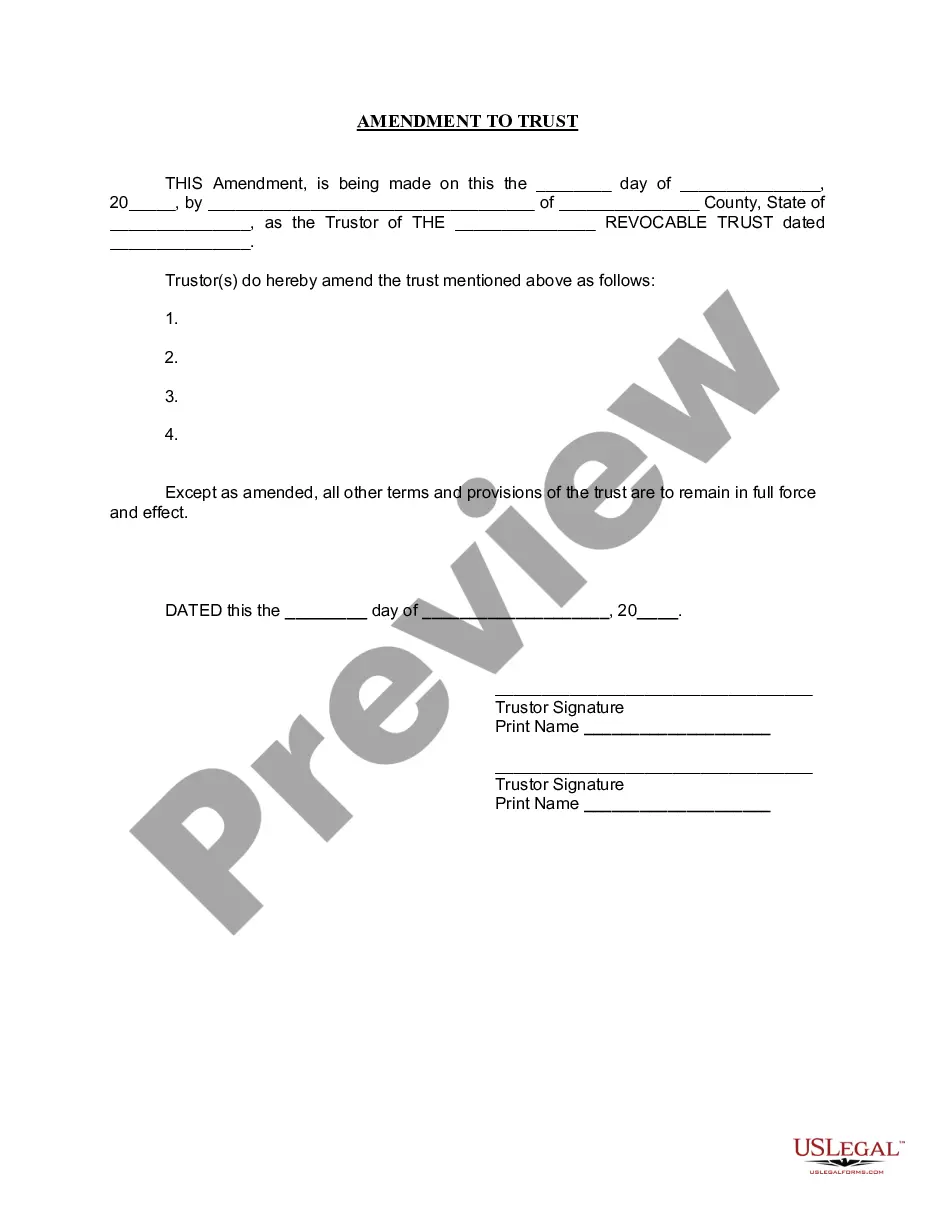

Amending a living trust requires clear language that specifies the changes you wish to make. First, identify the sections of the trust document that are affected, and then outline the new instructions. It’s important to ensure that your adjustments are legally binding by signing the amendment in the presence of witnesses. For detailed templates, consider consulting US Legal Forms to implement a Sparks Nevada Amendment to Living Trust.

Writing a codicil to a trust involves adding, altering, or revoking specific provisions. It must clearly articulate the intended changes and reference the original trust document. For clarity and legal soundness, it’s advisable to follow established forms or guidelines. Utilizing tools from US Legal Forms can streamline the process of creating a Sparks Nevada Amendment to Living Trust that's both effective and compliant.

While putting assets in a trust has several benefits, there are also downsides. For instance, trusts can incur setup and ongoing administrative costs. They may also limit access to assets during the grantor's lifetime. It's wise to evaluate these factors, especially through mechanisms like the Sparks Nevada Amendment to Living Trust, to ensure they align with your goals.

Creating a trust can indeed be beneficial for your parents. It not only helps in managing their assets but also offers protection from probate. However, each situation is unique, and it’s vital to consider your family's specific needs. Consulting a resource like US Legal Forms can assist in understanding how a Sparks Nevada Amendment to Living Trust might fit into their estate planning.

One disadvantage of a family trust is the potential complexity it introduces. Establishing a family trust can require significant time and legal expertise. Furthermore, if not properly managed, the trust may lead to disputes among beneficiaries or unintended tax consequences. Understanding how the Sparks Nevada Amendment to Living Trust can affect your family trust is essential for effective planning.

Amending a trust is usually a straightforward process. The Sparks Nevada Amendment to Living Trust can be completed with proper documentation, allowing you to make changes as needed. With effective tools and resources available, including platforms like uslegalforms, you can navigate the amendment process smoothly, ensuring your trust accurately reflects your current wishes.

A codicil is typically associated with wills, whereas an amendment to a trust modifies the terms of an existing living trust. With a Sparks Nevada Amendment to Living Trust, you can specify changes in beneficiaries, asset distributions, or trustee powers. This ensures your intentions remain clear and updated without the need to create an entirely new document.

Amending a trust in Nevada is straightforward. You must create an amendment document that details any changes while referencing the original trust. This process, known as a Sparks Nevada Amendment to Living Trust, helps ensure that your wishes are respected and your estate is effectively managed. Once you have drafted the amendment, obtaining notarization helps solidify its legal standing.

To amend a living trust in Nevada, you typically need to draft a new amendment document that specifies the changes you want. It should reference the original trust and include the date of the amendment for clarity, facilitating a Sparks Nevada Amendment to Living Trust. After completing the document, sign it in front of a notary. Finally, distribute copies of the amended trust to relevant parties.