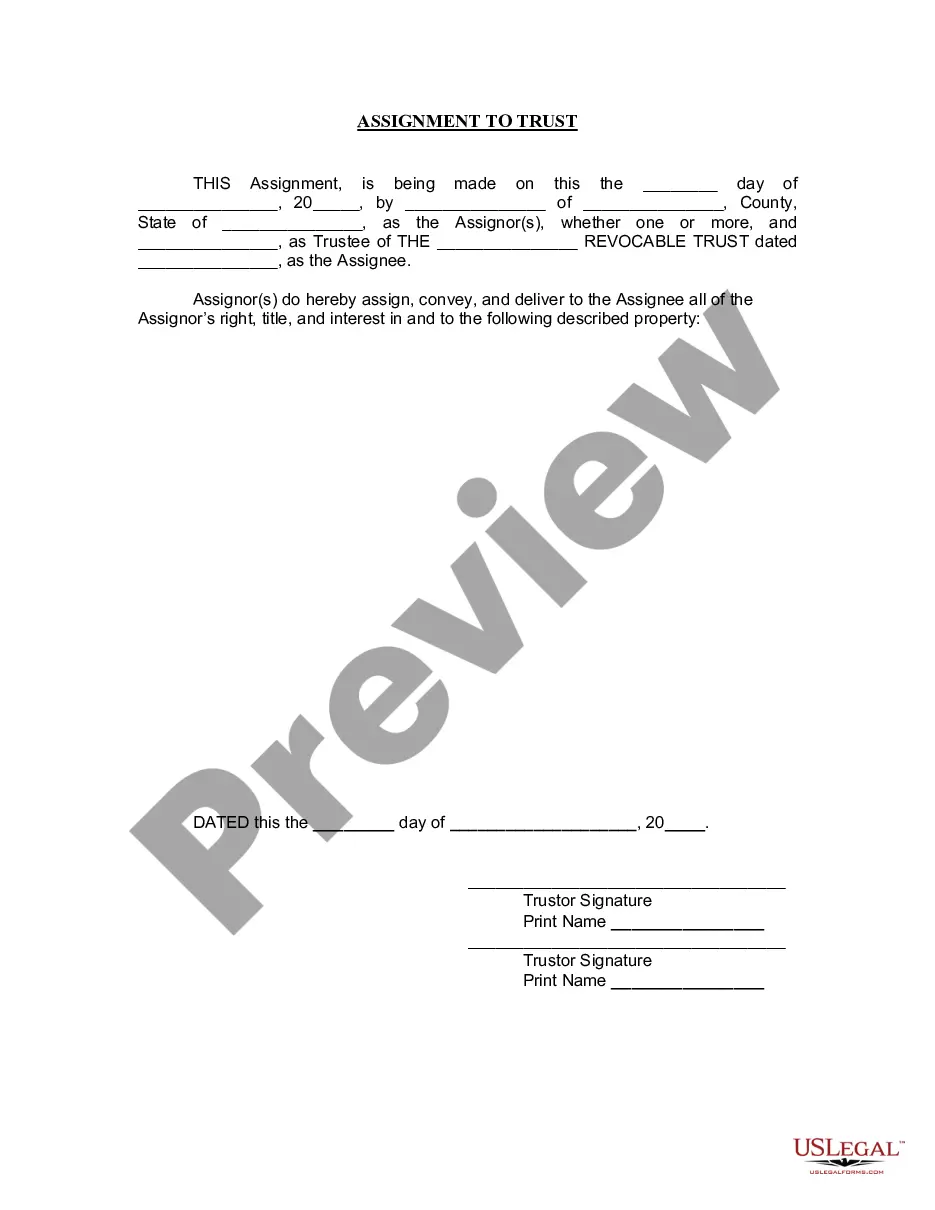

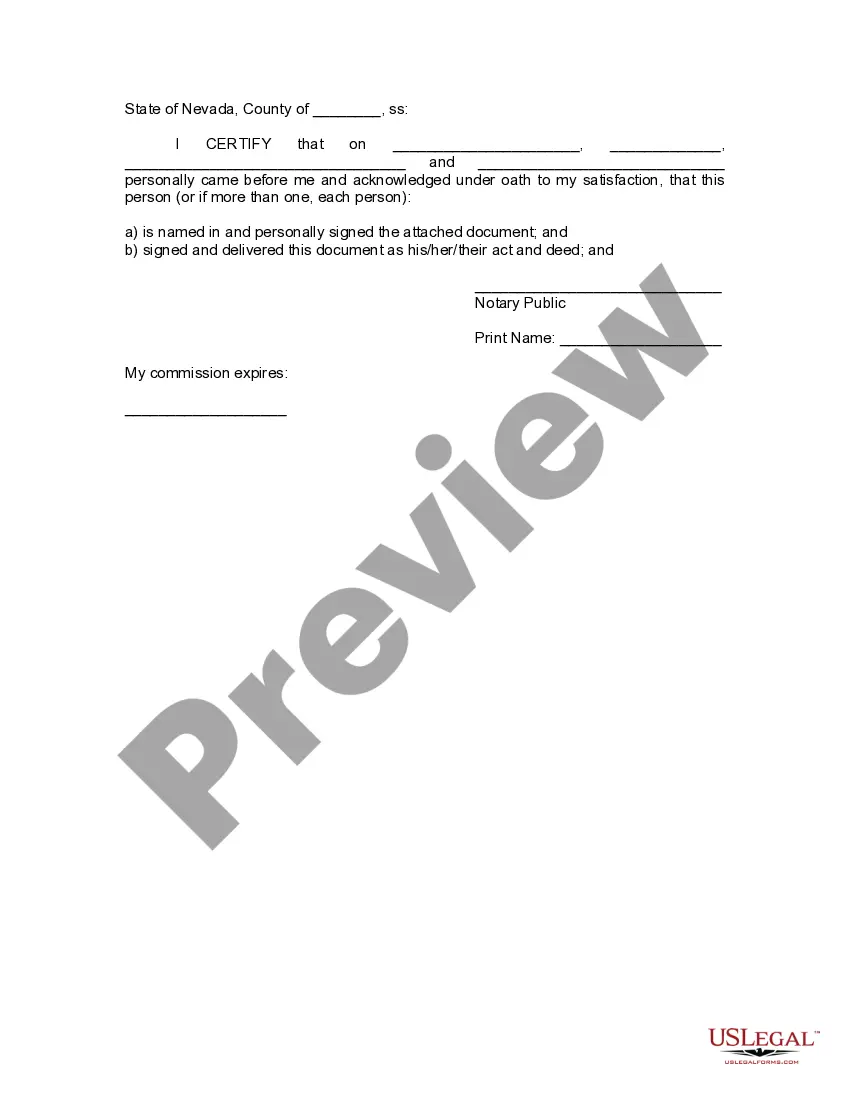

Sparks Nevada Assignment to Living Trust is a legal document that outlines the transfer of assets, property, and wealth to an individual or trust after the death of the assignor. This assignment ensures a smooth transition of assets and prevents them from being subjected to the probate process. Living trusts provide numerous benefits, including avoiding probate, maintaining privacy, reducing estate taxes, and offering flexibility in managing assets. Sparks Nevada, being known for its robust legal framework, offers a dedicated Assignment to Living Trust process that allows residents to secure their assets and ensure their distribution according to their wishes. There are various types of Sparks Nevada Assignment to Living Trust, catering to different circumstances and preferences. These include: 1. Revocable Living Trust: This type of trust allows the assignor to maintain control over the assets during their lifetime and modify or revoke the trust terms whenever desired. It provides flexibility in managing assets and enables easy transfer to beneficiaries upon the assignor's death. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be modified or revoked once established. It serves as an effective tool for minimizing estate taxes and protecting assets from potential creditors. 3. Testamentary Living Trust: This type of trust is created within a will and becomes effective only upon the assignor's death. It allows for the management and distribution of assets as per the assignor's wishes while avoiding probate. 4. Special Needs Trust: This trust is designed for individuals with special needs or disabilities. It safeguards their eligibility for government benefits by placing assets in the trust, ensuring that these resources do not affect their access to essential programs and services. 5. Qualified Personnel Residence Trust (PRT): PRT allows individuals to transfer their primary residence or vacation home to a trust while retaining the right to live in it for a specified period. It offers potential estate tax benefits while still allowing the assignor to continue residing in the property. Assigning assets to a living trust in Sparks Nevada involves a comprehensive process, including drafting a trust agreement, identifying beneficiaries, and properly titling assets in the trust's name. Seeking the assistance of an experienced estate planning attorney familiar with Sparks Nevada Assignment to Living Trust laws is crucial to ensure the assignment is legally valid and aligns with the assignor's objectives.

Sparks Nevada Assignment to Living Trust

Description

How to fill out Sparks Nevada Assignment To Living Trust?

If you are looking for a valid form template, it’s difficult to choose a more convenient service than the US Legal Forms site – one of the most extensive online libraries. With this library, you can find a huge number of form samples for business and individual purposes by categories and states, or key phrases. With our advanced search option, discovering the most recent Sparks Nevada Assignment to Living Trust is as easy as 1-2-3. Furthermore, the relevance of each and every file is verified by a group of skilled lawyers that on a regular basis check the templates on our website and update them in accordance with the newest state and county requirements.

If you already know about our platform and have a registered account, all you need to get the Sparks Nevada Assignment to Living Trust is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the sample you need. Check its description and use the Preview feature to explore its content. If it doesn’t suit your needs, use the Search option at the top of the screen to get the appropriate document.

- Affirm your decision. Click the Buy now option. Next, choose the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Receive the template. Choose the file format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the received Sparks Nevada Assignment to Living Trust.

Every template you add to your account has no expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to get an extra duplicate for editing or printing, you can return and export it again whenever you want.

Take advantage of the US Legal Forms professional collection to get access to the Sparks Nevada Assignment to Living Trust you were seeking and a huge number of other professional and state-specific templates on a single platform!