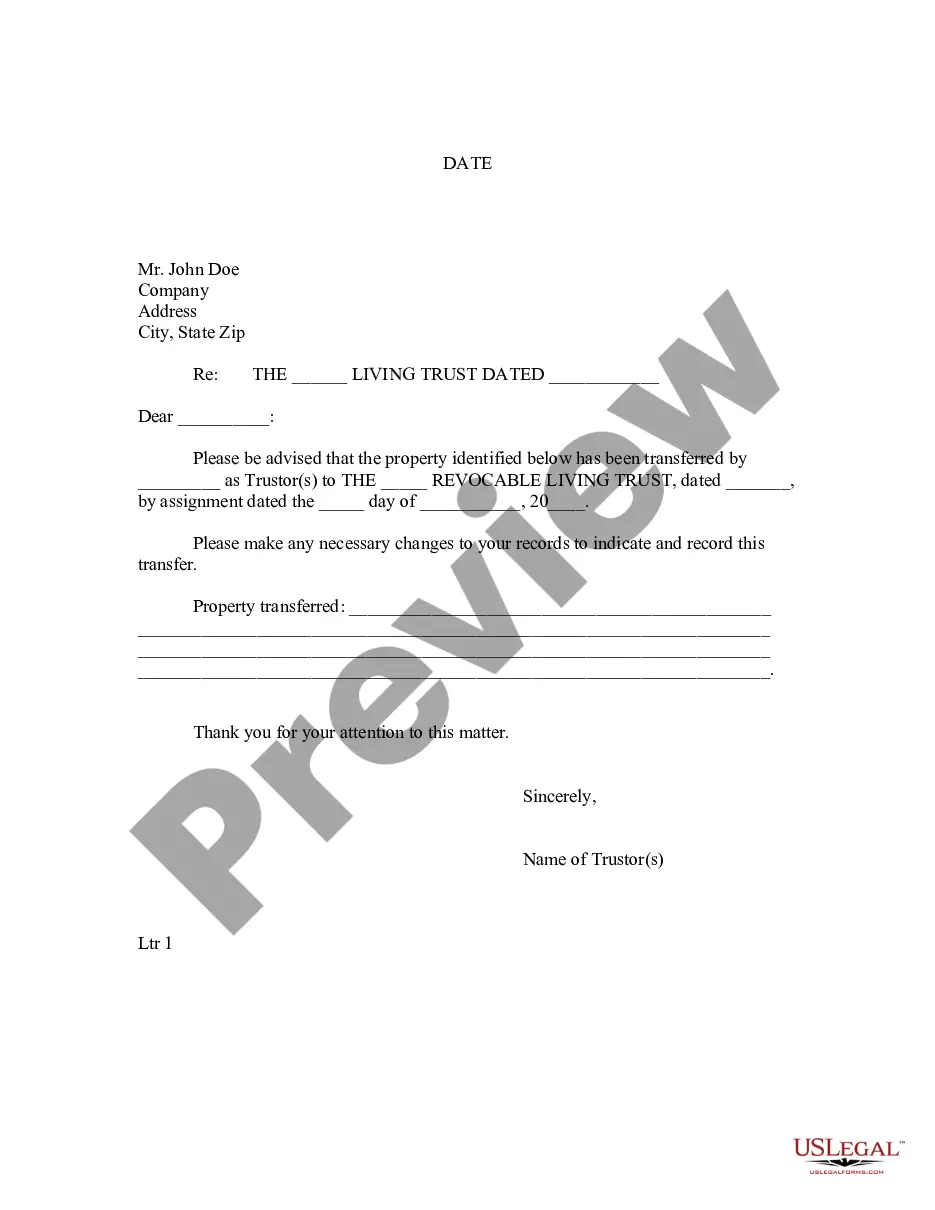

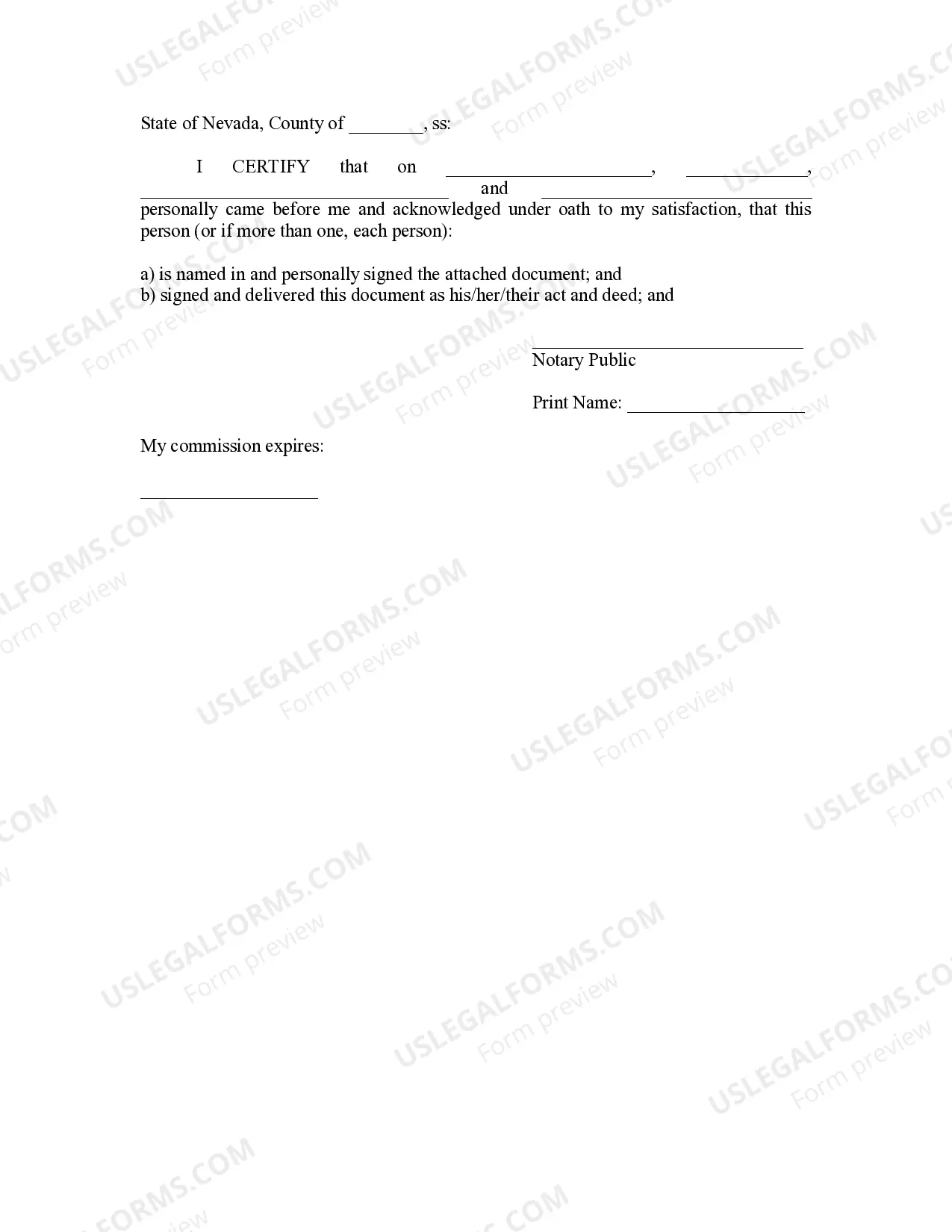

Sparks Nevada Letter to Lien holder to Notify of Trust is an important legal document that is used to inform the lien holder about the establishment of a trust. A trust is a legal arrangement where assets are transferred to a trustee who manages and holds them on behalf of the beneficiaries. In this context, the Sparks Nevada Letter serves as an official notification to the lien holder, ensuring that they are aware of the change in ownership and the transfer rights related to the property. By notifying the lien holder about the trust, the trustee aims to protect the beneficiaries' interests and avoid any unintentional violations of the lien holder's rights. The Sparks Nevada Letter to Lien holder to Notify of Trust contains several key elements. It typically begins with the date and includes the names and contact information of both the trust or and the lien holder. The letter should be addressed directly to the lien holder, ensuring that it reaches the relevant department or individual responsible for lien-related affairs. Furthermore, the Sparks Nevada Letter will specify the details of the trust, such as the name of the trust, the trustee appointed, and the beneficiaries involved. This information helps the lien holder to update their records accurately and ensures smooth communication with the trustee moving forward. Additionally, the letter should mention the property or assets covered by the trust, including any vehicles, real estate, or other valuable possessions. These details assist the lien holder in identifying the particular assets in question and to make the necessary adjustments on their records. It's crucial to emphasize the purpose of the Sparks Nevada Letter to Lien holder to Notify of Trust, which is to comply with legal requirements and provide transparency in financial matters. By notifying the lien holder, the trustee acts responsibly and ethically, ensuring all parties involved are aware of the trust's existence and their respective rights and obligations. Depending on the specific circumstances, there might be variations of the Sparks Nevada Letter to Lien holder to Notify of Trust. Some common types may include: 1. Sparks Nevada Letter to Mortgage Lien holder to Notify of Trust: This version is tailored specifically for mortgage lien holders, informing them about the establishment of a trust while addressing mortgage-related aspects, such as loan payments and any potential modifications in the agreement. 2. Sparks Nevada Letter to Vehicle Lien holder to Notify of Trust: This variant is designed for vehicle owners who have a lien on their vehicle titles. It notifies the lien holder of the trust's creation regarding the vehicle's ownership and updated contact information for any future lien-related communications. 3. Sparks Nevada Letter to Real Estate Lien holder to Notify of Trust: Real estate transactions often involve complex lien arrangements. This type of letter addresses real estate lien holders, informing them about the establishment of a trust and any alterations to the property's ownership. It ensures that lien holders are aware of the trust's presence when conducting future property-related transactions. In conclusion, the Sparks Nevada Letter to Lien holder to Notify of Trust plays a crucial role in ensuring transparency and compliance when establishing a trust. It enables the trustee to inform the lien holder about this legal arrangement while safeguarding the rights of all parties involved. Properly addressing the letter's contents, including specific details of the trust, is essential to facilitate efficient communication and maintain accurate records.

Sparks Nevada Letter to Lienholder to Notify of Trust

Description

How to fill out Sparks Nevada Letter To Lienholder To Notify Of Trust?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Sparks Nevada Letter to Lienholder to Notify of Trust? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Sparks Nevada Letter to Lienholder to Notify of Trust conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is intended for.

- Start the search over in case the template isn’t good for your legal scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Sparks Nevada Letter to Lienholder to Notify of Trust in any provided format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal paperwork online for good.

Form popularity

FAQ

To release a lien, the lien holder must sign and date two (2) release of lien forms. Mail one (1), signed and dated, copy of a lien release to the Oklahoma Tax Commission, P.O. Box 269061 Oklahoma City, Ok 73126, and one (1), signed and dated, copy of the lien release to the debtor.

You must attempt to contact the titled owner of the vehicle. The Petition requires that you explain how you have attempted to contact the titled Owner and proof must be provided regarding your attempts. For instance, by certified mail with a return receipt to the last known address of the titled owner.

When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

A mechanics lien in Nevada must be filed with the county recorder (in the county where the property is located) within 90 days of the date the lien claimant last provided labor and/or materials to the project or 90 days from the project's completion or termination ? whichever is later.

If you don't have the California Certificate of Title, you need to use an Application for Replacement or Transfer of Title (REG 227) to transfer ownership. The lienholder's release, if any, must be notarized. The buyer should then bring the completed form to a DMV office and we will issue a new registration and title.

Electronic Lien and Title. Nevada ELT is a distinguished certified provider of electronic lien and title (ELT) services in Nevada (and other states). As of October 2016, Nevada Statutes dictated that the Nevada ELT system be used by businesses that finance vehicles, vessels and mobile homes in the state of Nevada.

If your local DMV does not provide online access to titles, it is possible to visit their local office and request a title report. This report will provide lien information and in most cases will alert you to any accidents the car has been involved in.

O If the lienholder is an individual, a notice of release (lien release section of DOR-4809) must be completed, signed, and notarized. An estate executor may release the lien by submitting the above with an original or certified copy of the probate court order. information is legible.

What states are title-holding states? AlabamaIllinoisNevadaConnecticutMaineNorth DakotaDelawareMassachusettsOhioFloridaMississippiOregonGeorgiaMissouriPennsylvania6 more rows ?