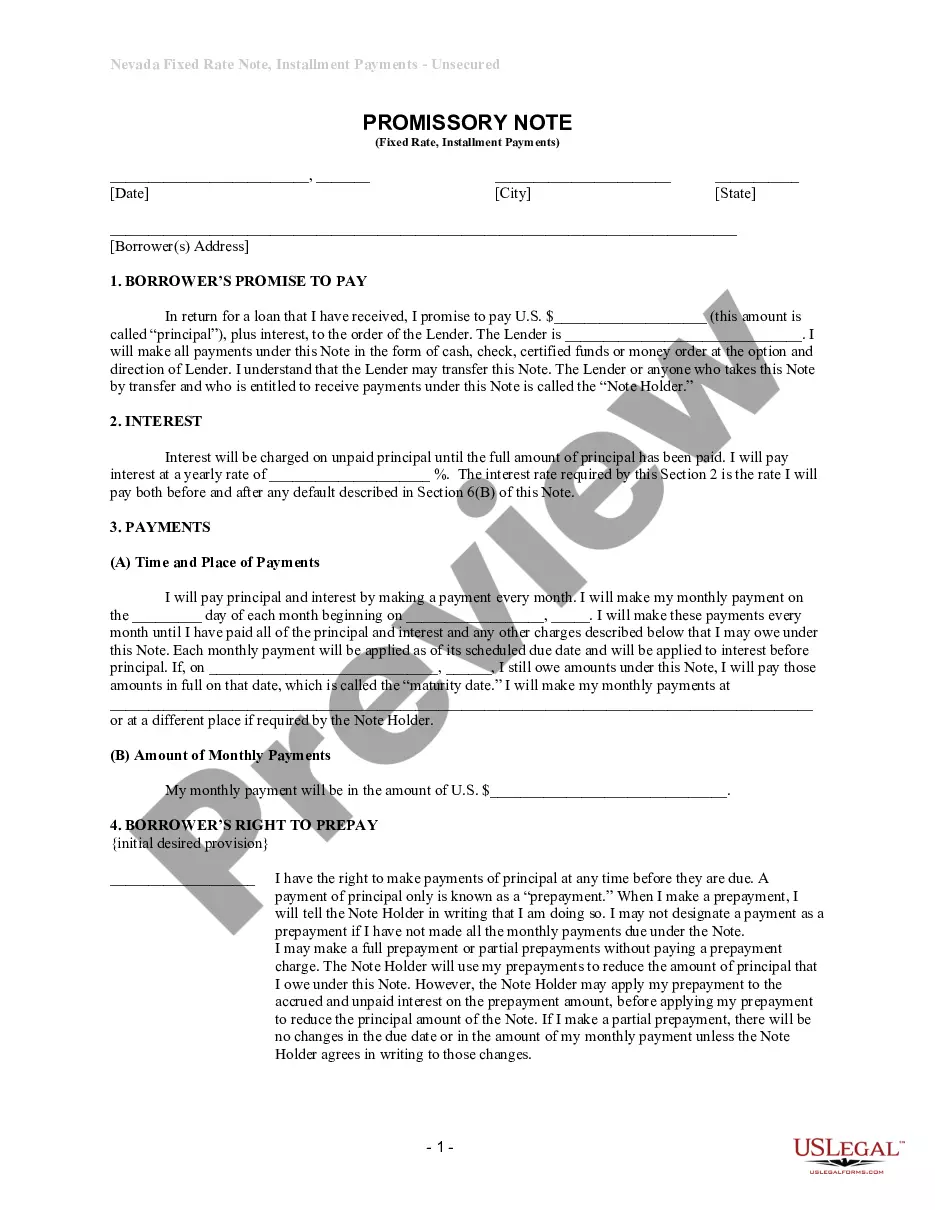

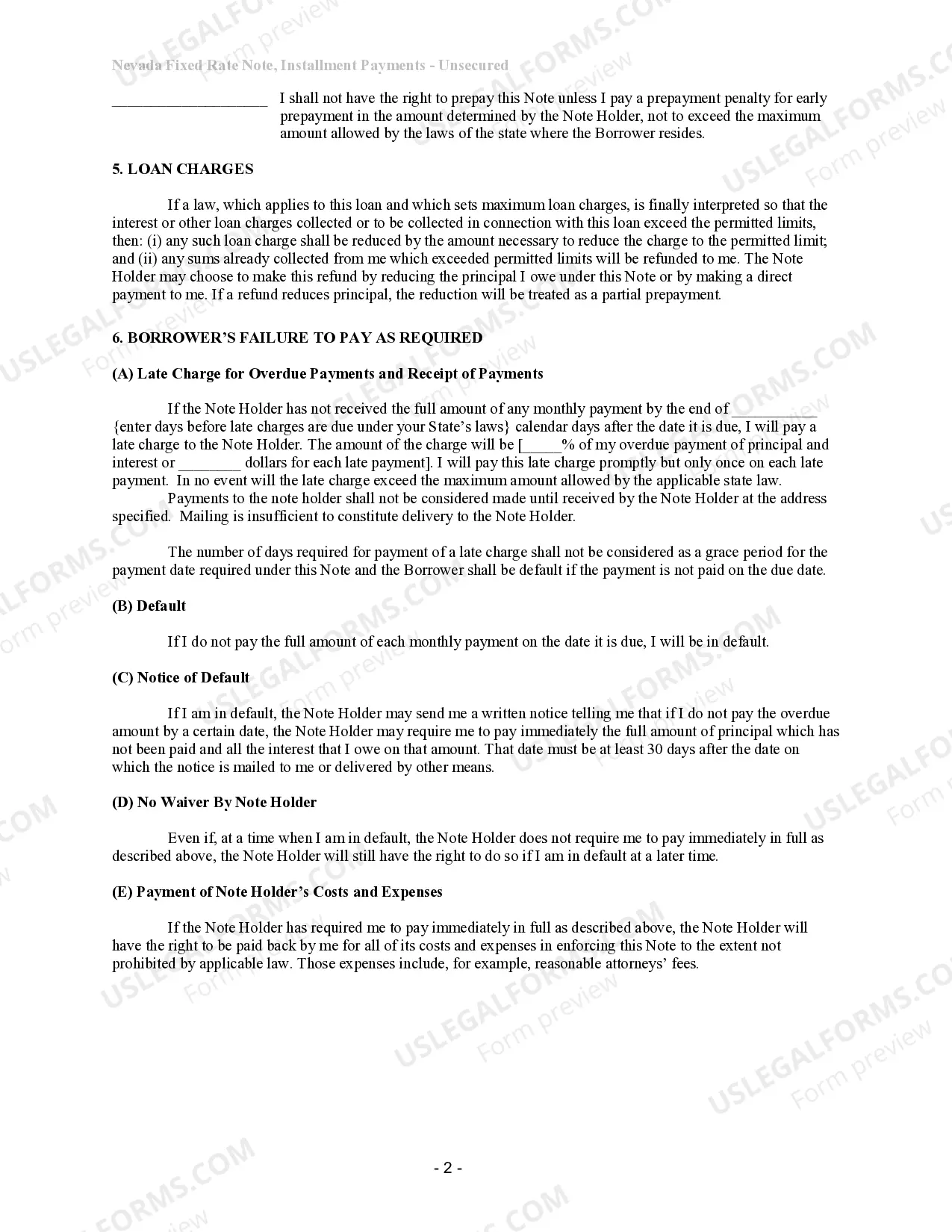

Las Vegas, Nevada Unsecured Installment Payment Promissory Note for Fixed Rate — Detailed Description In Las Vegas, Nevada, an Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan between a lender and borrower. This particular type of promissory note is unsecured, meaning that it does not require any collateral or security from the borrower. The purpose of this promissory note is to establish a repayment agreement for a fixed-rate loan. The fixed rate ensures that the interest rate remains constant throughout the loan term, providing stability to both parties involved. This type of promissory note is commonly used in Las Vegas, Nevada, for personal loans, small business financing, or any other situation where a borrower requires funds and a lender is willing to provide them without requiring collateral. The Las Vegas, Nevada Unsecured Installment Payment Promissory Note for Fixed Rate includes essential information that protects the rights and interests of both the lender and the borrower. It typically includes the following details: 1. Loan Amount: The total amount of money borrowed by the borrower from the lender. 2. Interest Rate: The fixed rate at which interest will be charged on the loan amount throughout the repayment period. 3. Repayment Schedule: The agreed-upon schedule for the borrower to repay the loan, which includes the number of installments and the due dates. 4. Installment Amount: The specific amount the borrower must repay in each installment. 5. Late Payment Charges: The fees or penalties imposed if the borrower fails to make a payment on time. 6. Prepayment Terms: Whether the borrower is allowed to make early repayments without penalties. 7. Default and Remedies: The consequences the borrower will face in the event of default, along with the available remedies for the lender. Some variations of Las Vegas, Nevada Unsecured Installment Payment Promissory Note for Fixed Rate include: 1. Personal Loan Promissory Note: Specifically designed for individuals seeking financial assistance, often for personal expenses such as debt consolidation, medical bills, or education financing. 2. Small Business Loan Promissory Note: Geared towards entrepreneurs or owners of small businesses who need funds to support their operations, purchase equipment, or expand their enterprises. 3. Student Loan Promissory Note: Tailored for students pursuing higher education, covering tuition fees, textbooks, and other educational expenses during their studies. When entering into this agreement, it is crucial for both parties to fully understand the terms and conditions outlined in the Las Vegas, Nevada Unsecured Installment Payment Promissory Note for Fixed Rate. Seeking legal advice or consulting a professional can help ensure that all parties involved are well-informed and protected throughout the loan process.

Las Vegas Nevada Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Nevada Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are looking for an authentic document, it’s impossible to discover a superior service than the US Legal Forms website – one of the most extensive online repositories.

With this repository, you can acquire a vast array of templates for business and personal uses categorized by types and areas, or keywords.

Using our top-notch search option, obtaining the latest Las Vegas Nevada Unsecured Installment Payment Promissory Note for Fixed Rate is as simple as 1-2-3.

Complete the purchase. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the form. Specify the format and download it to your device. Edit the document. Fill in, alter, print, and sign the obtained Las Vegas Nevada Unsecured Installment Payment Promissory Note for Fixed Rate.

- Furthermore, the accuracy of each document is confirmed by a team of experienced attorneys who consistently evaluate the templates on our platform and refresh them according to the latest state and county regulations.

- If you are already acquainted with our platform and possess an account, all you need to do to acquire the Las Vegas Nevada Unsecured Installment Payment Promissory Note for Fixed Rate is to Log In to your user account and select the Download option.

- If you utilize US Legal Forms for the first time, simply adhere to the guidelines stated below.

- Ensure you have accessed the sample you require. Review its description and use the Preview option to inspect its contents. If it doesn’t fulfill your needs, employ the Search feature near the top of the page to locate the desired document.

- Verify your selection. Choose the Buy now option. Then, select your chosen subscription plan and provide details to create an account.

Form popularity

FAQ

Anyone lending money can issue a promissory note (like home sellers, credit unions, FinTech solutions, and nonmortgage-related banks, for instance) but specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

Based on discussions with professionals who buy and sell notes, the market rate of return for a privately held note typically ranges from 12% for a well collateralized note with a strong payment history to 25% for an uncollateralized note.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A good personal loan interest rate depends on your credit score: 740 and above: Below 8% (look for loans for excellent credit) 670 to 739: Around 14% (look for loans for good credit) 580 to 669: Around 18% (look for loans for fair credit)

A promissory note is a written promise to pay a specified amount of money with, or without, interest at a stated time or on demand. The main purpose of a promissory note is to serve as written evidence of the amount loaned, the interest rate, if any, and the terms under which the loan is to be repaid.

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

If you are borrowing money from a lending institution, they will have someone on staff who creates a promissory note. However, if you need a promissory note for a personal loan or a loan between friends and family, you can contact a lawyer or financial professional to help you create a promissory note.

According to Bankrate, people with a good credit score of 720?850 get an average loan interest rate of 10.3?12.5% from banks or online lenders. Meanwhile, people with credit scores of 630?689 pay an average of 17.8?19.9%.

interest loan is one with an annual percentage rate above 36%, the highest APR that most consumer advocates consider affordable. Highinterest loans are offered by online and storefront lenders that promise fast funding and easy applications, sometimes without checking your credit.

Interesting Questions

More info

Our loan program is an affordable way for students to pay back their debt in a way that will enable them to achieve their goals and reach their goals. We work hard to help students get off of debt to achieve their career and personal accomplishments, and we are so pleased that you are interested in learning more about our program. Las Vegas' premier residential and office loan lender. We will do our best to serve our clients. This is not a consumer loan program. Our loan service provider, loan officers and loan professionals are dedicated to working with you to provide you with excellent personalized service every step of the process. Las Vegas, NV 89130. We are a licensed and bonded New Deal lending institution. Our New Deal banking institution offers a unique experience in terms of pricing and service.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.