Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

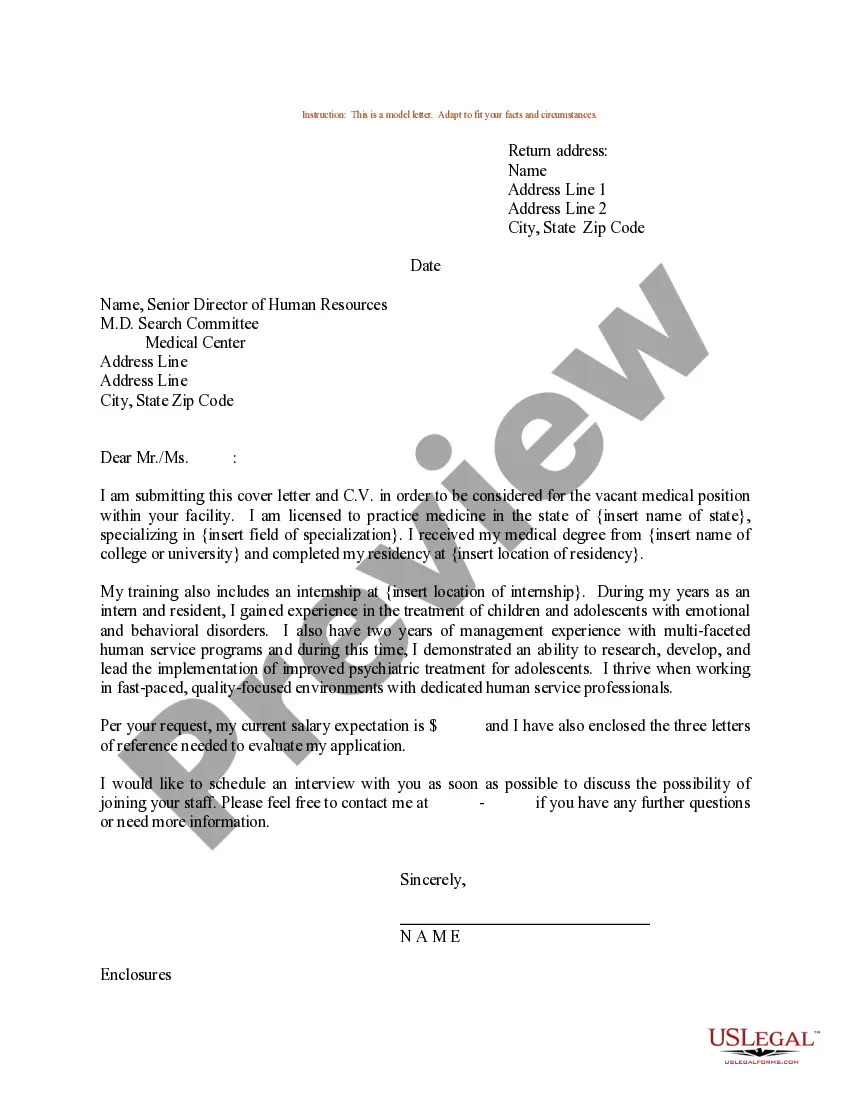

How to fill out Nevada Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We consistently aim to lessen or evade legal harm when navigating intricate legal or financial issues.

To achieve this, we seek out legal representation that is often very expensive.

Nonetheless, not every legal concern is as complicated.

Many can be handled independently.

Take advantage of US Legal Forms whenever you need to locate and download the Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other form rapidly and safely.

- US Legal Forms is a digital compilation of contemporary DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs independently without requiring a lawyer's assistance.

- We offer access to legal form templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which significantly streamlines the search process.

Form popularity

FAQ

Filling out a promissory demand note involves several clear steps. First, state the amount borrowed and the terms of repayment, including interest rate details. Ensure that all parties involved, such as lenders and borrowers, sign the document. You may find templates for a Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate on platforms like uslegalforms to simplify this process.

An on demand promissory note is a type of financial agreement where the borrower must repay the lender upon request. For instance, a lender may use a Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate. This note allows the lender to require immediate repayment if needed, providing flexibility and security.

The document that secures a promissory note to real property is typically called a mortgage or a deed of trust. This legally binding document outlines the rights and responsibilities of both the borrower and the lender. In the case of a Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is essential to have these documents in place to ensure clarity and legal enforcement.

Generally, a promissory note itself does not appear on your credit report unless there is a default or specific legal action taken. However, if the note is secured by real property, any default may impact your credit. By carefully leveraging a Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you can maintain good credit standing while fulfilling your obligations.

Yes, promissory notes can be backed by collateral, which provides additional security for the lender. In the context of real estate, this collateral is often the property itself. The Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate employs this strategy to ensure the lender's investment is well-protected.

To secure a promissory note with real property, you'll need to create a deed of trust or mortgage that ties the note to the specified property. This legal document details the conditions, including terms of repayment and penalties for default. By using a Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you can clearly define these terms and protect both parties involved.

You can record a promissory note at the county recorder's office in the area where the property is located. In Sparks, Nevada, this is crucial to ensure that your secured interests are legally recognized and enforceable. Recording a Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate provides clarity in ownership and financial obligations.

When it comes to reporting a promissory note on your taxes, you must include any income generated from it as taxable income. Track your earnings from interest payments, as the IRS requires this information. Using the Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate can also simplify your records for tax purposes.

To properly file a promissory note in Sparks, Nevada, you typically need to record it at your local county recorder's office. This process helps establish the note's enforceability as a secured document. Filing ensures that your interests are protected and can aid in future transactions related to the Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

While notarization is not always a legal requirement for a secured promissory note, having it notarized adds an extra layer of authenticity. This process helps verify the identity of the parties involved and can be helpful in case of disputes. To effectively create a Sparks Nevada Installments Fixed Rate Promissory Note Secured by Residential Real Estate, consider using uslegalforms, which can provide resources related to notarization.