Included in your package are the following forms:

1. Satisfaction, Release or Cancellation of a Deed of Trust by a Corporation;

2. Satisfaction, Release or Cancellation of a Deed of Trust by an Individual;

3. Letter of Notice to Borrower of Status of Mortgage;

4. Letter to Recording Office for Recording Satisfaction of a Mortgage

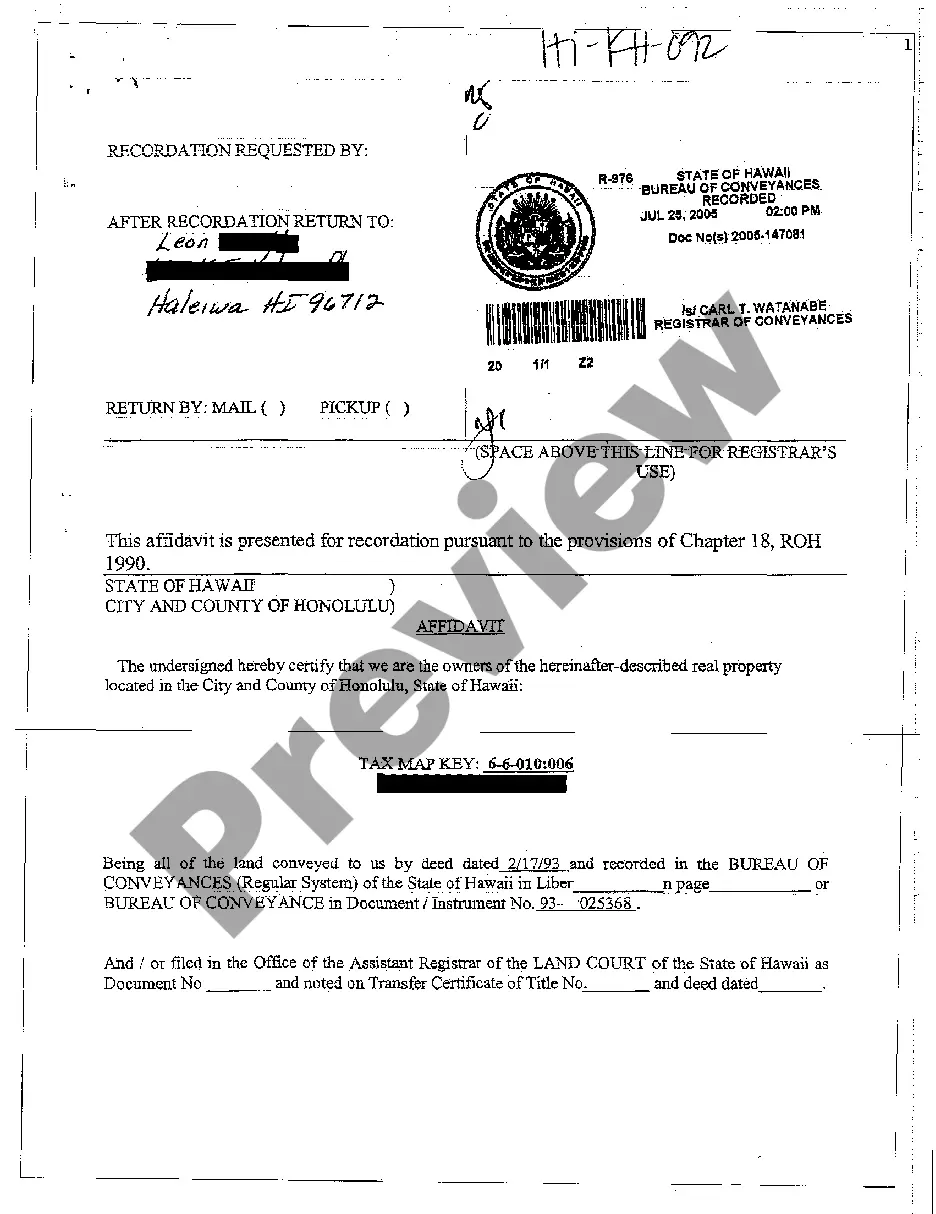

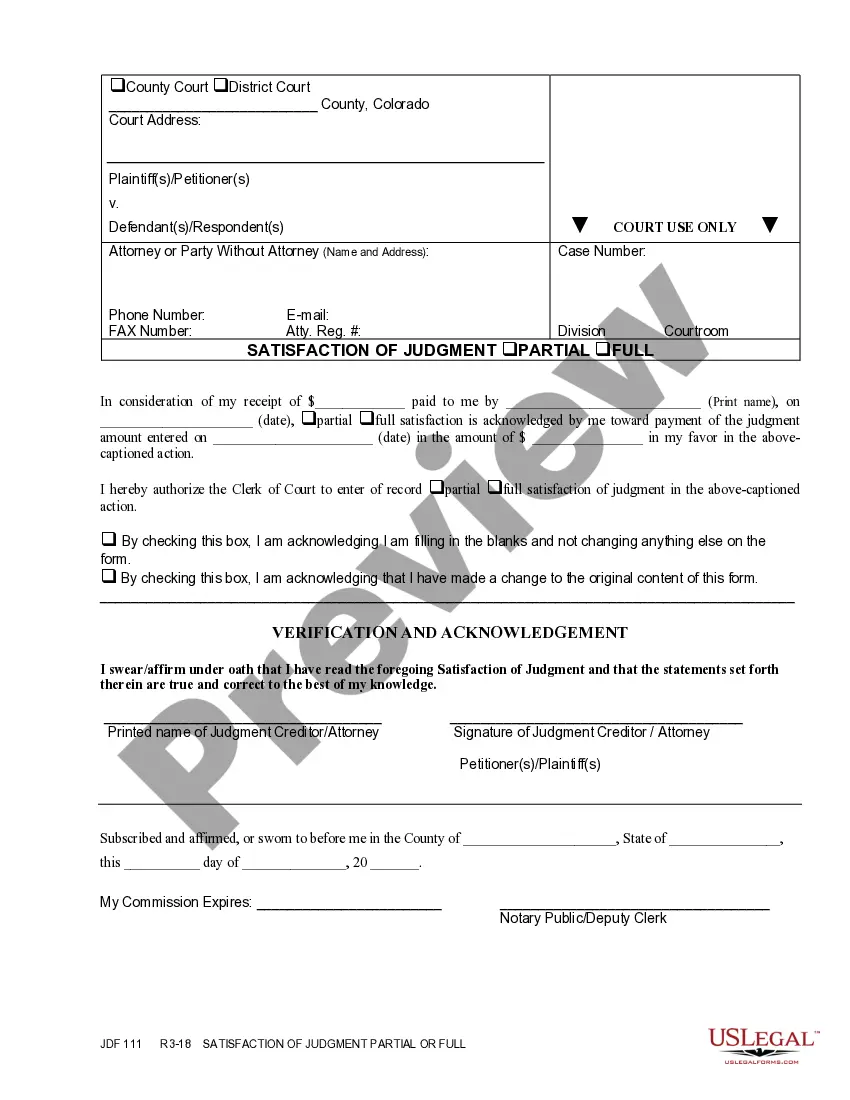

Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Package refers to a set of legal documents required to officially acknowledge the full repayment of a mortgage loan and release the mortgage lender's claims on the property. This package serves as evidence that the borrower has fulfilled their financial obligations and can enjoy unencumbered ownership of the property. It is an essential part of the mortgage closing process and provides protection and peace of mind to homeowners. The Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Package typically includes the following documents: 1. Satisfaction of Mortgage: This document, also known as a Mortgage Release or Certificate of Satisfaction, is the main component of the package. It states that the mortgage loan has been fully repaid, and the lender no longer has any rights or liens on the property. The Satisfaction of Mortgage serves as proof of the borrower's fulfillment of their mortgage obligations. 2. Affidavit of Satisfaction: This document is a sworn statement by the mortgage lender, confirming that the loan has been paid in full and there are no outstanding obligations. It is signed by an authorized representative of the lender and notarized to add legal significance to the statement. 3. Deed of Release: This document is executed by the mortgage lender, releasing the property from any claims or liens held against it due to the mortgage. It guarantees that the lender will not pursue any legal actions related to the mortgage or claim ownership rights on the property anymore. 4. Notice of Cancellation: In some cases, a Notice of Cancellation may be included, especially in situations where the mortgage is canceled before being recorded or filed. This document declares the mortgage null and void, ensuring that no record of the mortgage exists in public records. It is important to note that the specific requirements for Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Package may vary depending on the jurisdiction. Additional documents or forms may be required in certain situations, such as when the property has multiple mortgages or if the mortgage is being transferred to a new lender. In conclusion, the Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Package encompasses a set of documents that formally release the borrower from their mortgage obligations. These documents provide legal proof that the mortgage loan has been fully repaid and the property is free from any liens or claims by the lender. Homeowners must ensure that all necessary documents are properly executed and recorded to enjoy full ownership rights without any encumbrances on their property. Types of Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Packages: 1. Residential Mortgage Release Package 2. Commercial Mortgage Release Package 3. Second Mortgage Release Package 4. Mortgage Cancellation Package for Refinanced Loans 5. Inherited Property Mortgage Release Package.

Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Package refers to a set of legal documents required to officially acknowledge the full repayment of a mortgage loan and release the mortgage lender's claims on the property. This package serves as evidence that the borrower has fulfilled their financial obligations and can enjoy unencumbered ownership of the property. It is an essential part of the mortgage closing process and provides protection and peace of mind to homeowners. The Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Package typically includes the following documents: 1. Satisfaction of Mortgage: This document, also known as a Mortgage Release or Certificate of Satisfaction, is the main component of the package. It states that the mortgage loan has been fully repaid, and the lender no longer has any rights or liens on the property. The Satisfaction of Mortgage serves as proof of the borrower's fulfillment of their mortgage obligations. 2. Affidavit of Satisfaction: This document is a sworn statement by the mortgage lender, confirming that the loan has been paid in full and there are no outstanding obligations. It is signed by an authorized representative of the lender and notarized to add legal significance to the statement. 3. Deed of Release: This document is executed by the mortgage lender, releasing the property from any claims or liens held against it due to the mortgage. It guarantees that the lender will not pursue any legal actions related to the mortgage or claim ownership rights on the property anymore. 4. Notice of Cancellation: In some cases, a Notice of Cancellation may be included, especially in situations where the mortgage is canceled before being recorded or filed. This document declares the mortgage null and void, ensuring that no record of the mortgage exists in public records. It is important to note that the specific requirements for Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Package may vary depending on the jurisdiction. Additional documents or forms may be required in certain situations, such as when the property has multiple mortgages or if the mortgage is being transferred to a new lender. In conclusion, the Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Package encompasses a set of documents that formally release the borrower from their mortgage obligations. These documents provide legal proof that the mortgage loan has been fully repaid and the property is free from any liens or claims by the lender. Homeowners must ensure that all necessary documents are properly executed and recorded to enjoy full ownership rights without any encumbrances on their property. Types of Clark Nevada Satisfaction, Cancellation, or Release of Mortgage Packages: 1. Residential Mortgage Release Package 2. Commercial Mortgage Release Package 3. Second Mortgage Release Package 4. Mortgage Cancellation Package for Refinanced Loans 5. Inherited Property Mortgage Release Package.