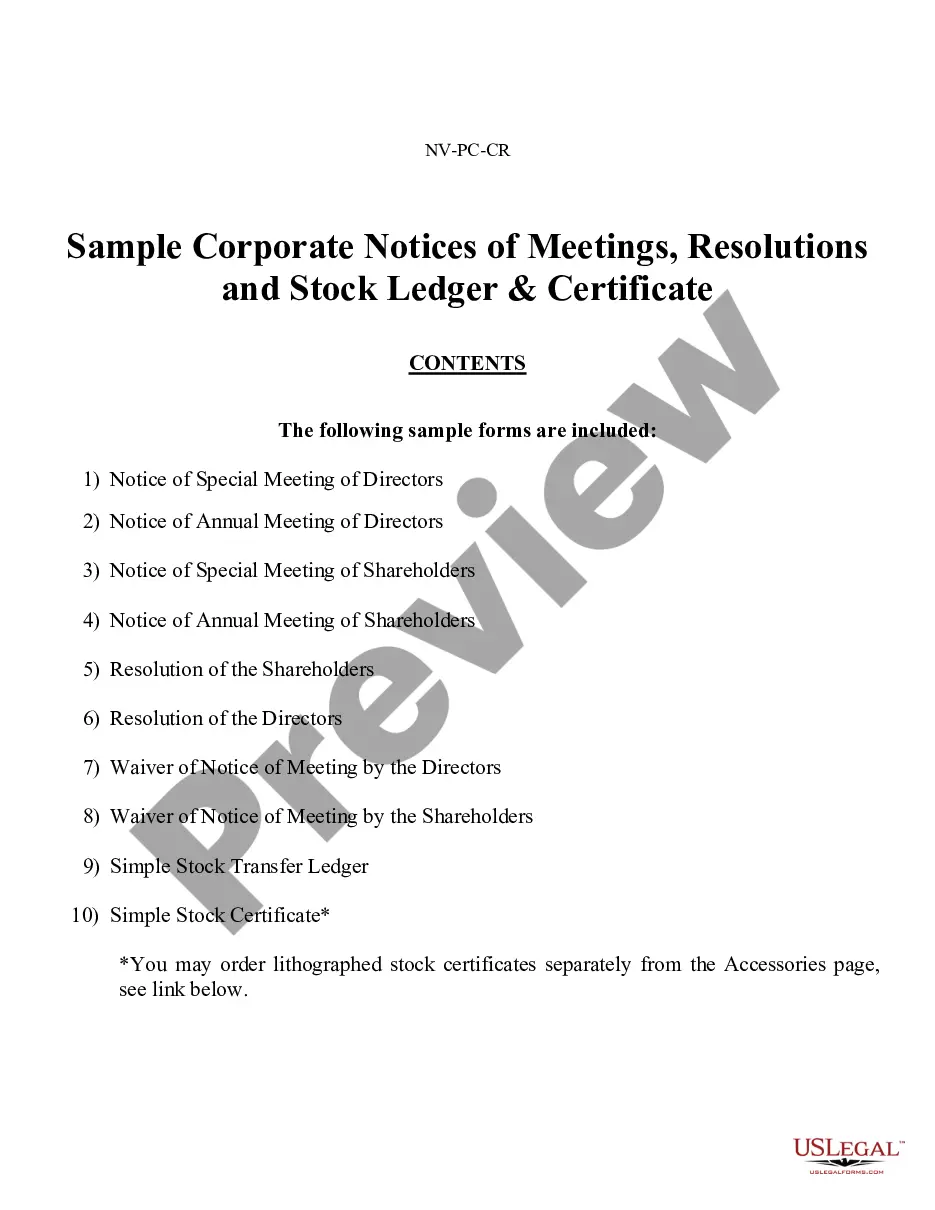

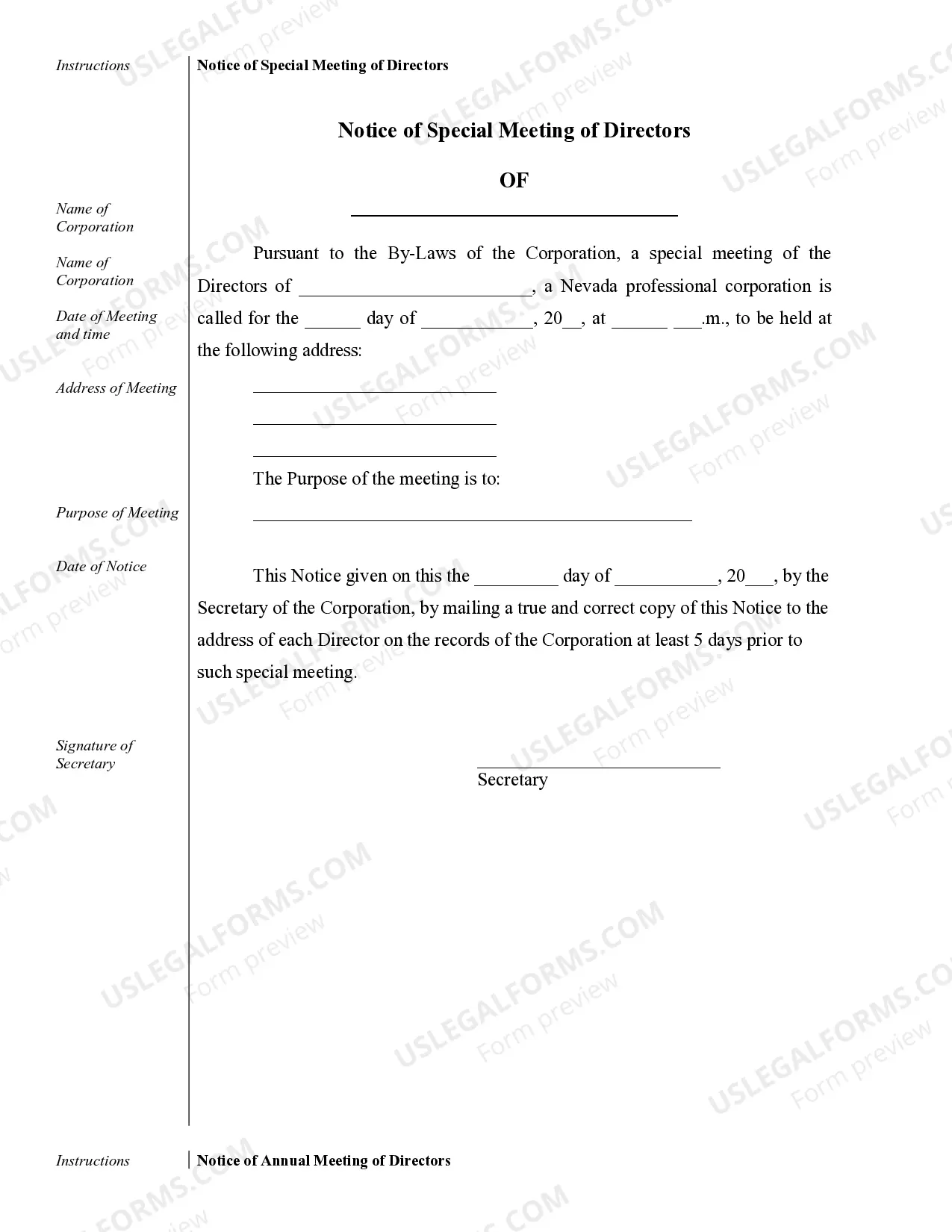

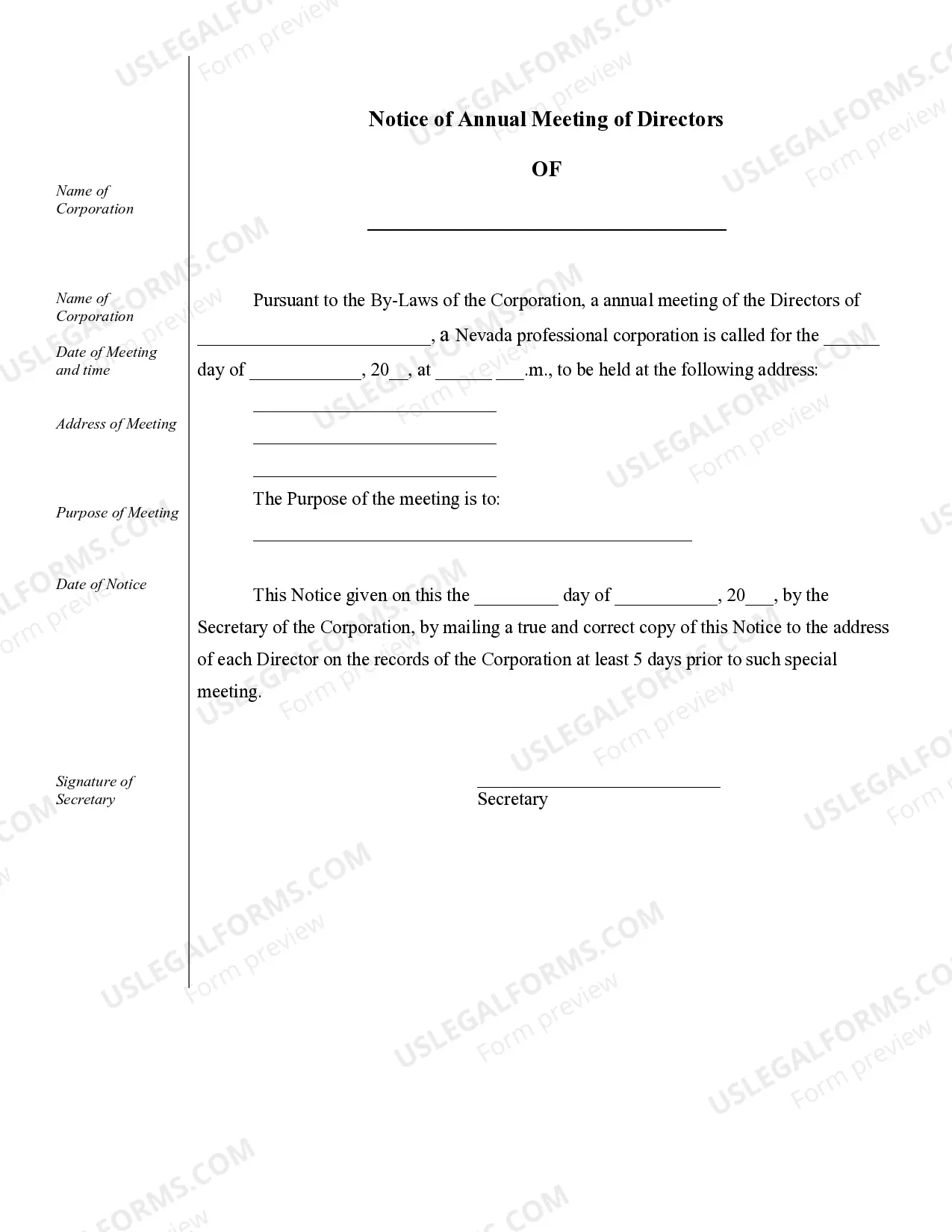

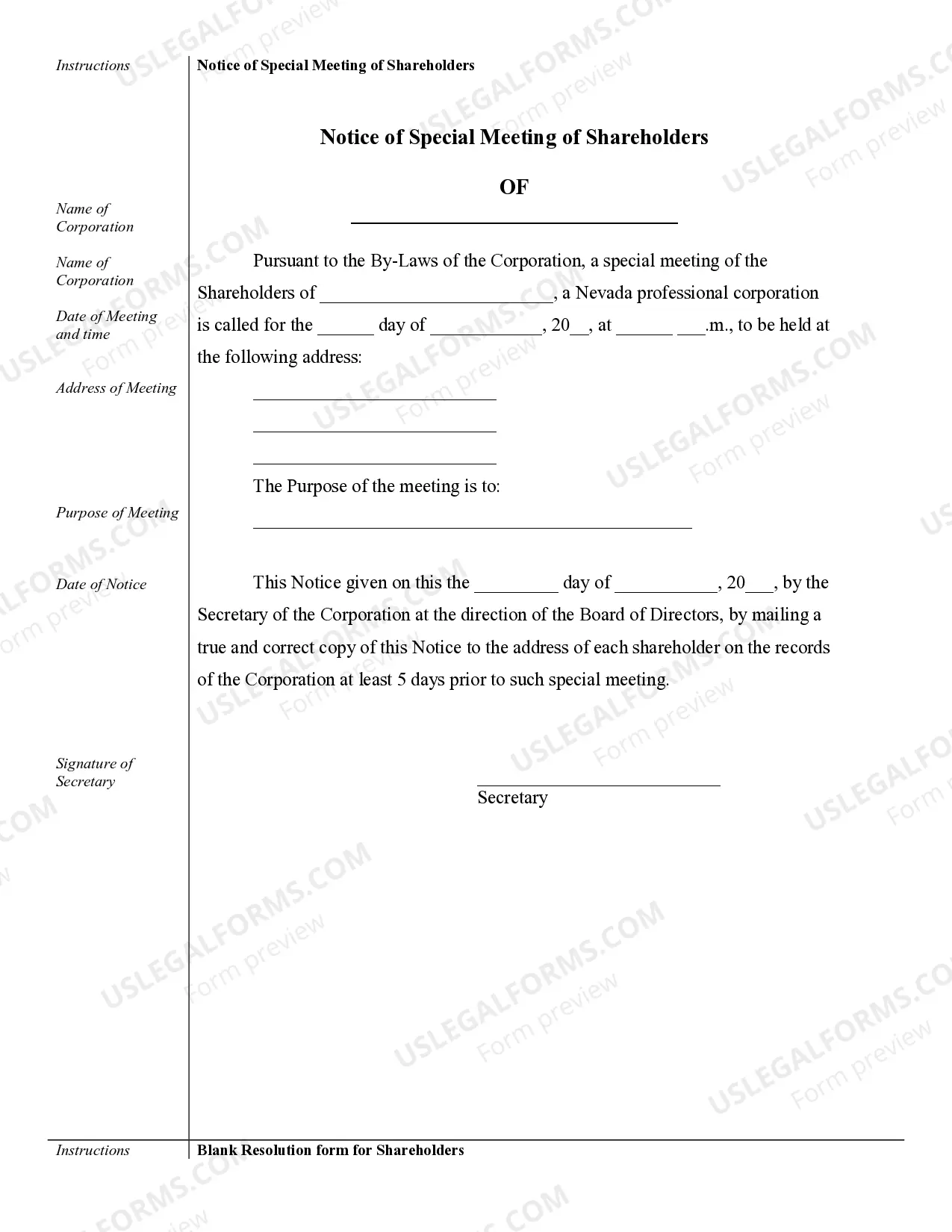

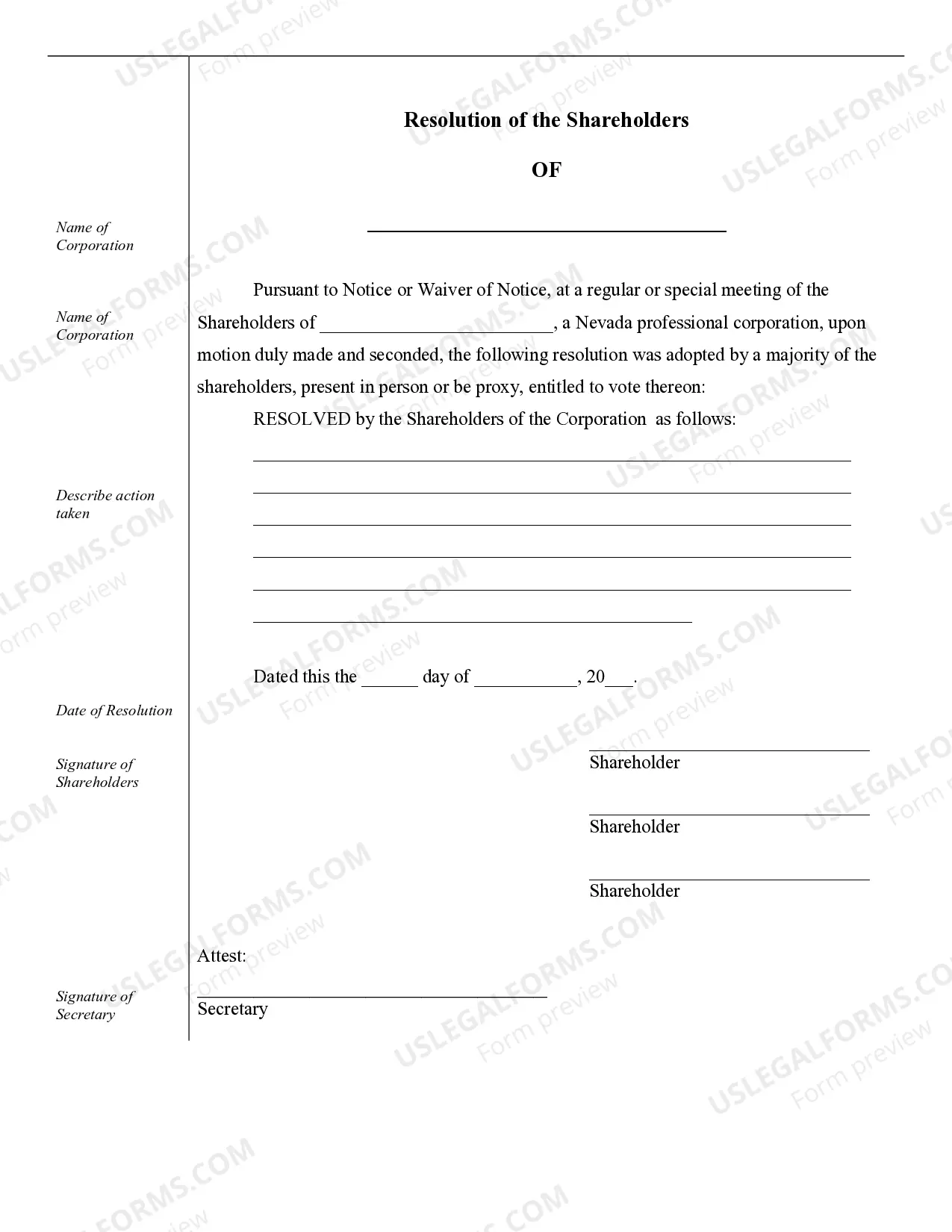

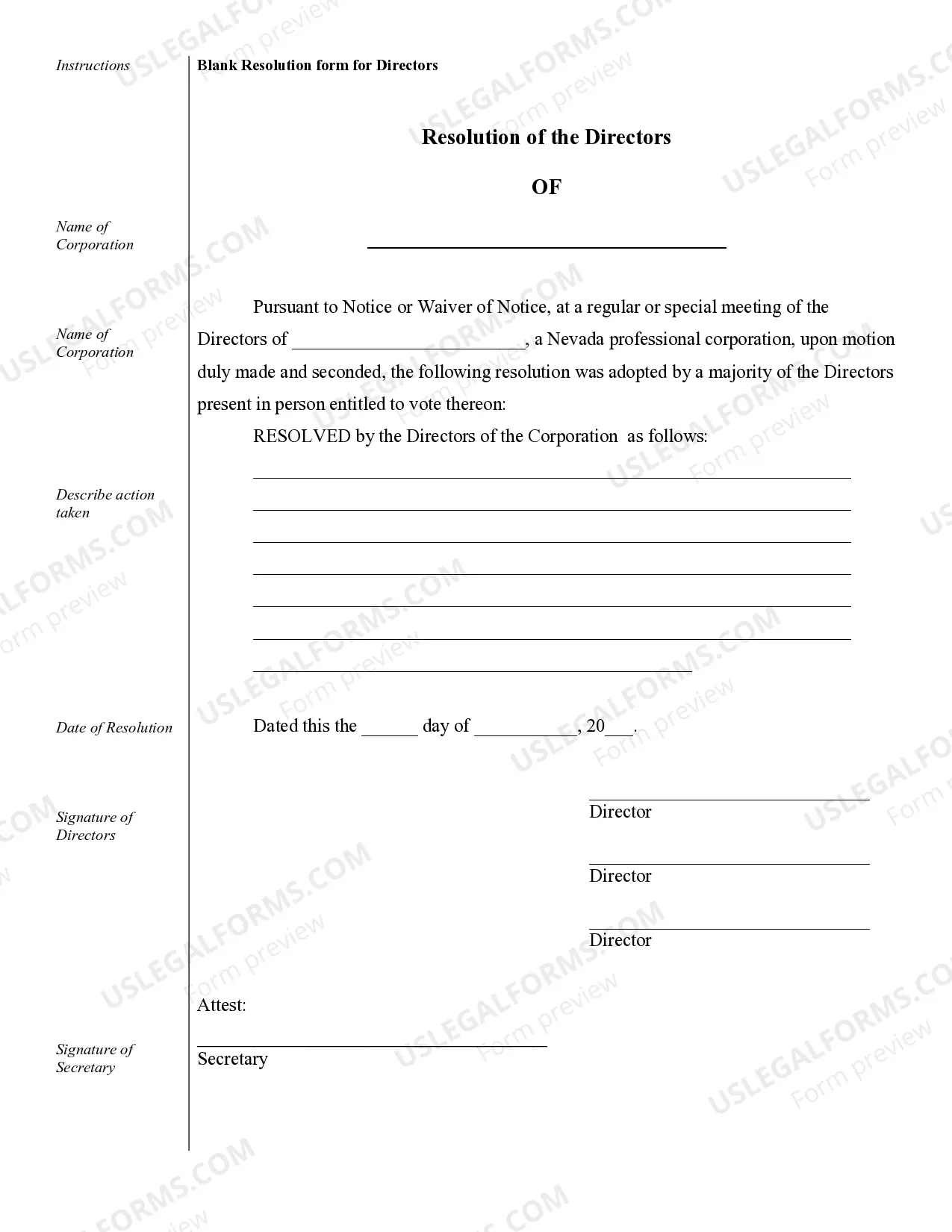

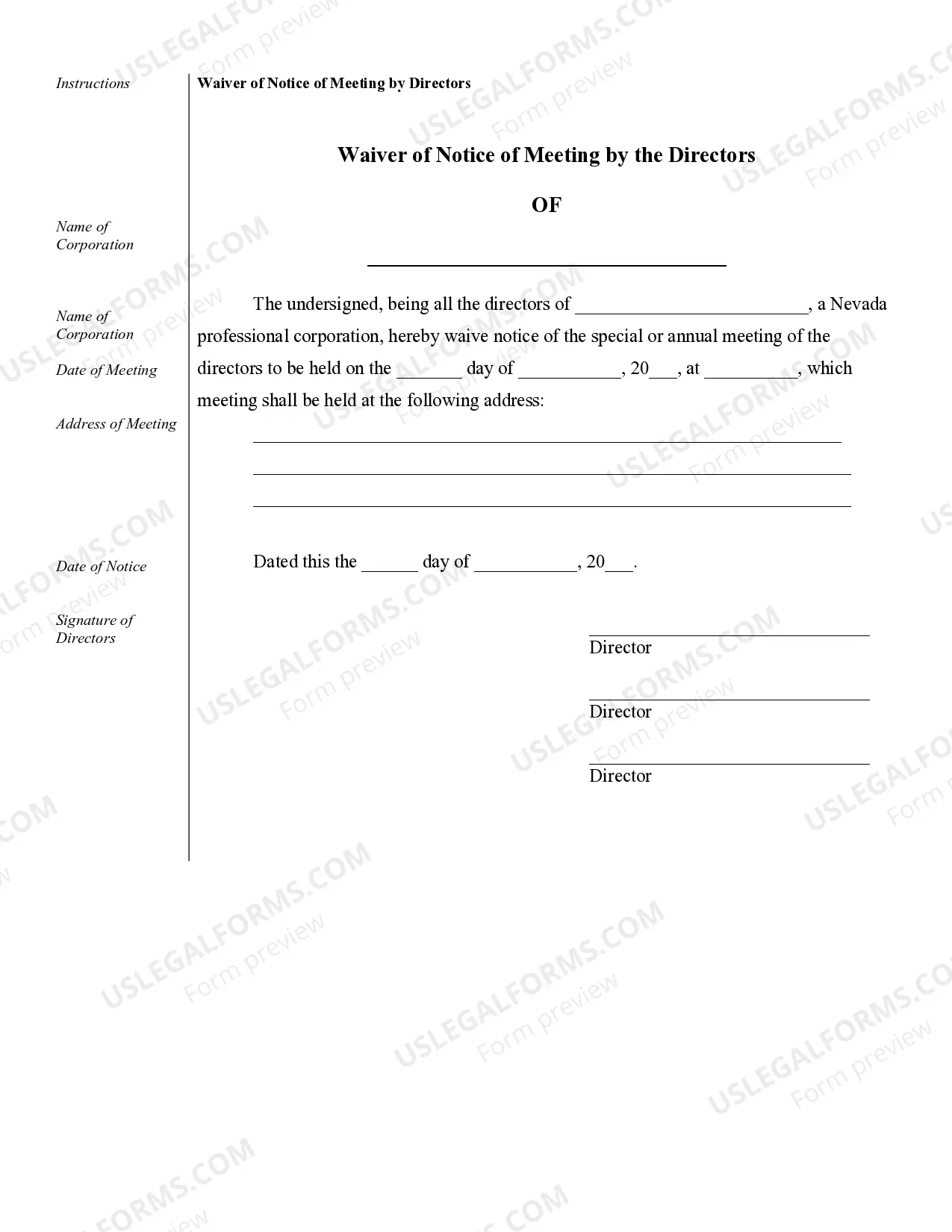

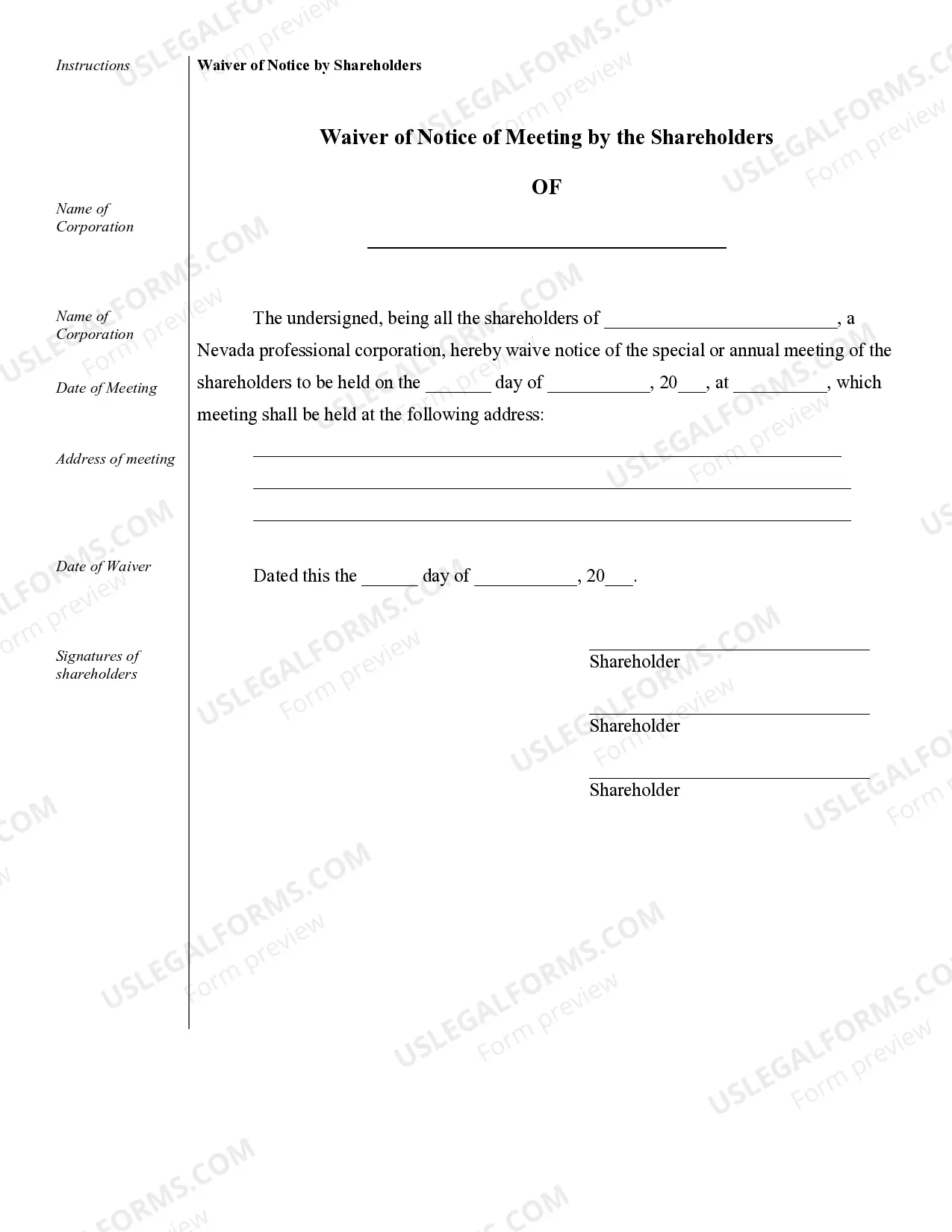

Sparks Sample Corporate Records for a Nevada Professional Corporation play a crucial role in maintaining proper documentation and legal compliance for businesses operating in the state of Nevada. These records serve as a comprehensive collection of the company's activities, financial transactions, and legal formalities. The primary purpose of Sparks Sample Corporate Records is to provide a transparent and organized overview of the corporation's activities. These records ensure that all legal obligations are met, including filing requirements, annual meetings, shareholder resolutions, and more. By maintaining accurate and up-to-date corporate records, companies can establish their credibility and ensure regulatory compliance. Sparks Sample Corporate Records for a Nevada Professional Corporation typically include: 1. Articles of Incorporation: This essential document outlines the corporation's fundamental information, such as its name, purpose, registered agent, and stock details. It serves as the foundation for the business's legal existence. 2. Bylaws: These are the rules and regulations that govern the internal operations of the corporation. Bylaws outline the roles and responsibilities of directors, officers, and shareholders, as well as procedures for meetings, voting, and decision-making processes. 3. Meeting Minutes: Detailed notes from corporate meetings, indicating the date, attendees, agenda, and discussions, are crucial to record decisions made by directors and shareholders. These minutes provide an audit trail of corporate activities and are often required by auditors and regulatory authorities. 4. Shareholder Register: This record contains information about shareholders, such as their names, addresses, and the number and class of shares held. It serves as a reference for communication, issuing dividends, and proxy voting. 5. Director and Officer Information: This section contains documentation related to the individuals appointed as directors and officers, including their names, addresses, and positions held within the corporation. These records help track changes in leadership and ensure compliance with state requirements. 6. Annual Reports: Nevada Professional Corporations must file annual reports with the Secretary of State. These reports provide updates on the corporation's directors, officers, and registered agent, as well as the number of authorized shares and outstanding shares. 7. Stock Certificate Ledger: A record of stock certificates issued, including the details of the recipient, the date of issuance, and the certificate numbers, is crucial to track ownership and transfers of shares. 8. Financial Statements: Financial records, including balance sheets, income statements, and cash flow statements, provide a clear snapshot of the corporation's financial health, allowing stakeholders and regulators to assess its performance. By keeping Sparks Sample Corporate Records for a Nevada Professional Corporation in order, businesses can demonstrate compliance with legal requirements, maintain transparency, facilitate financial audits, and protect the interests of shareholders and directors. These records are essential for establishing accountability, supporting corporate decision-making, and ensuring the smooth operation and growth of the corporation.

Sparks Sample Corporate Records for a Nevada Professional Corporation

Description

How to fill out Sparks Sample Corporate Records For A Nevada Professional Corporation?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person with no legal education to create such paperwork from scratch, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a massive library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you need the Sparks Sample Corporate Records for a Nevada Professional Corporation or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Sparks Sample Corporate Records for a Nevada Professional Corporation in minutes employing our trusted service. In case you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our platform, make sure to follow these steps prior to downloading the Sparks Sample Corporate Records for a Nevada Professional Corporation:

- Ensure the template you have found is specific to your location because the rules of one state or county do not work for another state or county.

- Review the document and go through a quick description (if available) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your requirements, you can start over and look for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the Sparks Sample Corporate Records for a Nevada Professional Corporation once the payment is through.

You’re good to go! Now you can go on and print out the document or complete it online. In case you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.