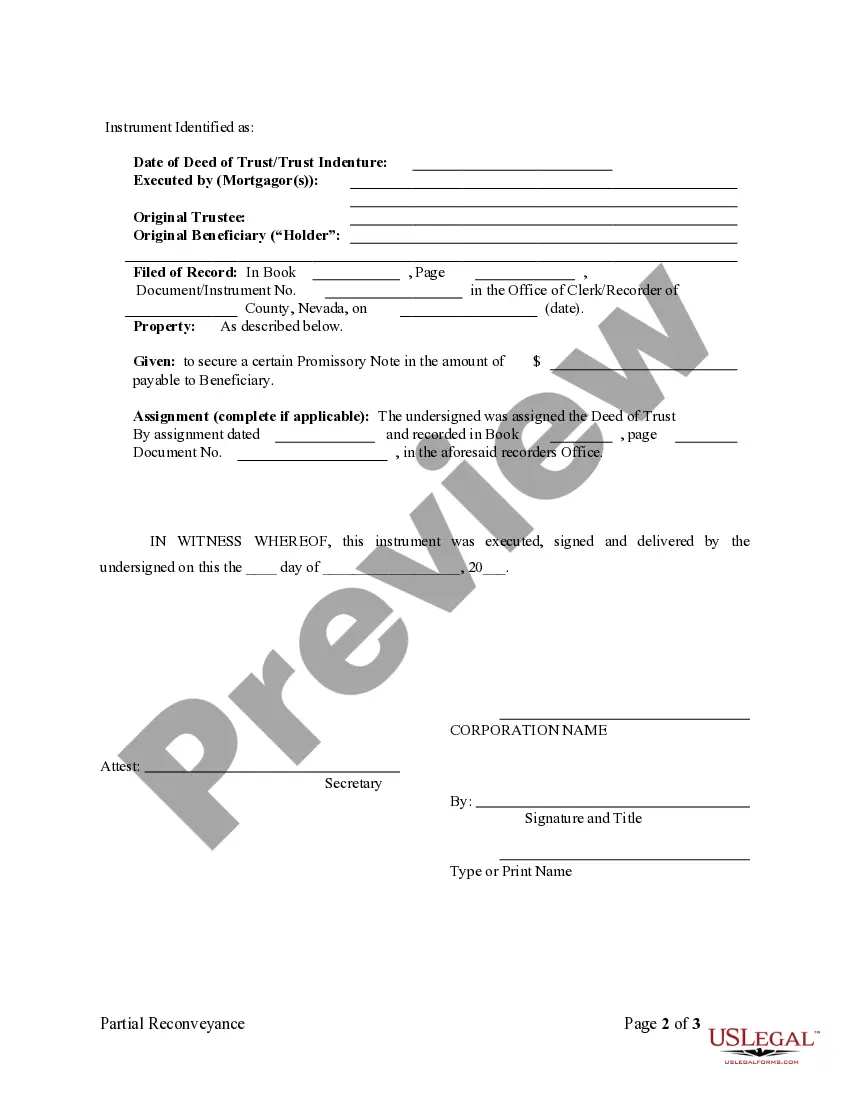

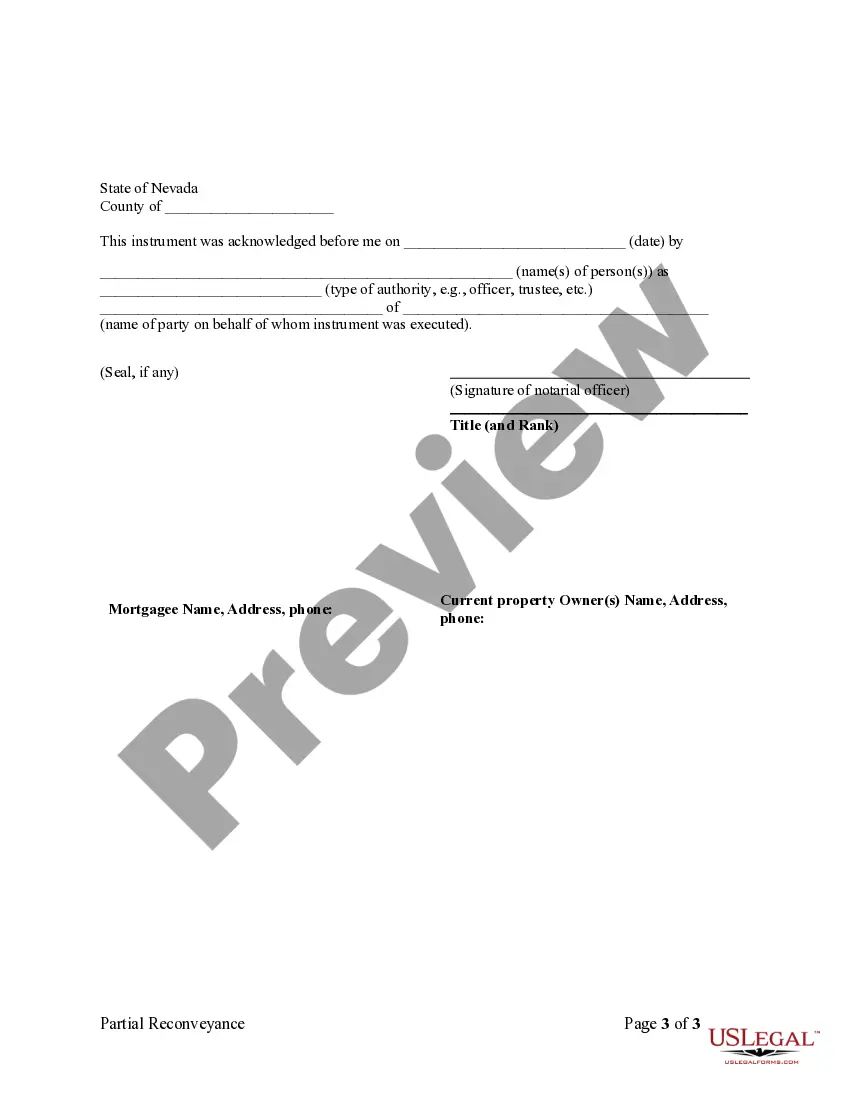

North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation is a legal document that provides a detailed description of the process and implications of releasing a portion of the property from a previously established trust deed for a corporation in North Las Vegas, Nevada. This release allows the corporation to retain ownership of a specific portion of the property while releasing the remaining portion from the encumbrances of the trust deed. The North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation serves as a safeguard for both the corporation and the lending institution involved. It ensures that the portion of the property being released is clearly defined and does not affect the corporation's ability to meet its obligations towards the remaining encumbered portion. Keywords related to this topic may include: 1. North Las Vegas, Nevada: Refers to the specific geographical location where the property subject to the deed of trust is situated. 2. Partial Release: Indicates that only a specific section or portion of the property is being released from the deed of trust, while the remainder remains encumbered. 3. Property: Refers to the real estate or land owned by the corporation that is subject to the deed of trust. 4. Deed of Trust: Represents the legal document that records the encumbrance on the property, typically in favor of a lending institution, to secure debt or financial obligation. 5. Corporation: Denotes the legal entity that owns the property and is seeking a partial release from the deed of trust. Types of North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation might include: 1. Commercial Property Partial Release: When a corporation owns commercial real estate, such as office buildings, stores, or warehouses, and seeks to release a specific section from the deed of trust to refinance or modify the existing loan terms. 2. Residential Property Partial Release: In cases where a corporation owns residential properties, such as apartment complexes or rental homes, this type of release is commonly used when the corporation wants to sell or transfer ownership of a particular unit or set of units. 3. Land Parcel Partial Release: If the corporation holds large tracts of land, it may opt for a partial release to segregate a specific portion for a different purpose or to develop separately from the rest of the property. It is essential for corporations in North Las Vegas, Nevada, to understand the specific requirements and legal implications surrounding a partial release of property from a deed of trust. Professional assistance from attorneys or real estate professionals is highly recommended ensuring compliance with local laws and regulations.

North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation

State:

Nevada

City:

North Las Vegas

Control #:

NV-S124

Format:

Word;

Rich Text

Instant download

Description

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation is a legal document that provides a detailed description of the process and implications of releasing a portion of the property from a previously established trust deed for a corporation in North Las Vegas, Nevada. This release allows the corporation to retain ownership of a specific portion of the property while releasing the remaining portion from the encumbrances of the trust deed. The North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation serves as a safeguard for both the corporation and the lending institution involved. It ensures that the portion of the property being released is clearly defined and does not affect the corporation's ability to meet its obligations towards the remaining encumbered portion. Keywords related to this topic may include: 1. North Las Vegas, Nevada: Refers to the specific geographical location where the property subject to the deed of trust is situated. 2. Partial Release: Indicates that only a specific section or portion of the property is being released from the deed of trust, while the remainder remains encumbered. 3. Property: Refers to the real estate or land owned by the corporation that is subject to the deed of trust. 4. Deed of Trust: Represents the legal document that records the encumbrance on the property, typically in favor of a lending institution, to secure debt or financial obligation. 5. Corporation: Denotes the legal entity that owns the property and is seeking a partial release from the deed of trust. Types of North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation might include: 1. Commercial Property Partial Release: When a corporation owns commercial real estate, such as office buildings, stores, or warehouses, and seeks to release a specific section from the deed of trust to refinance or modify the existing loan terms. 2. Residential Property Partial Release: In cases where a corporation owns residential properties, such as apartment complexes or rental homes, this type of release is commonly used when the corporation wants to sell or transfer ownership of a particular unit or set of units. 3. Land Parcel Partial Release: If the corporation holds large tracts of land, it may opt for a partial release to segregate a specific portion for a different purpose or to develop separately from the rest of the property. It is essential for corporations in North Las Vegas, Nevada, to understand the specific requirements and legal implications surrounding a partial release of property from a deed of trust. Professional assistance from attorneys or real estate professionals is highly recommended ensuring compliance with local laws and regulations.

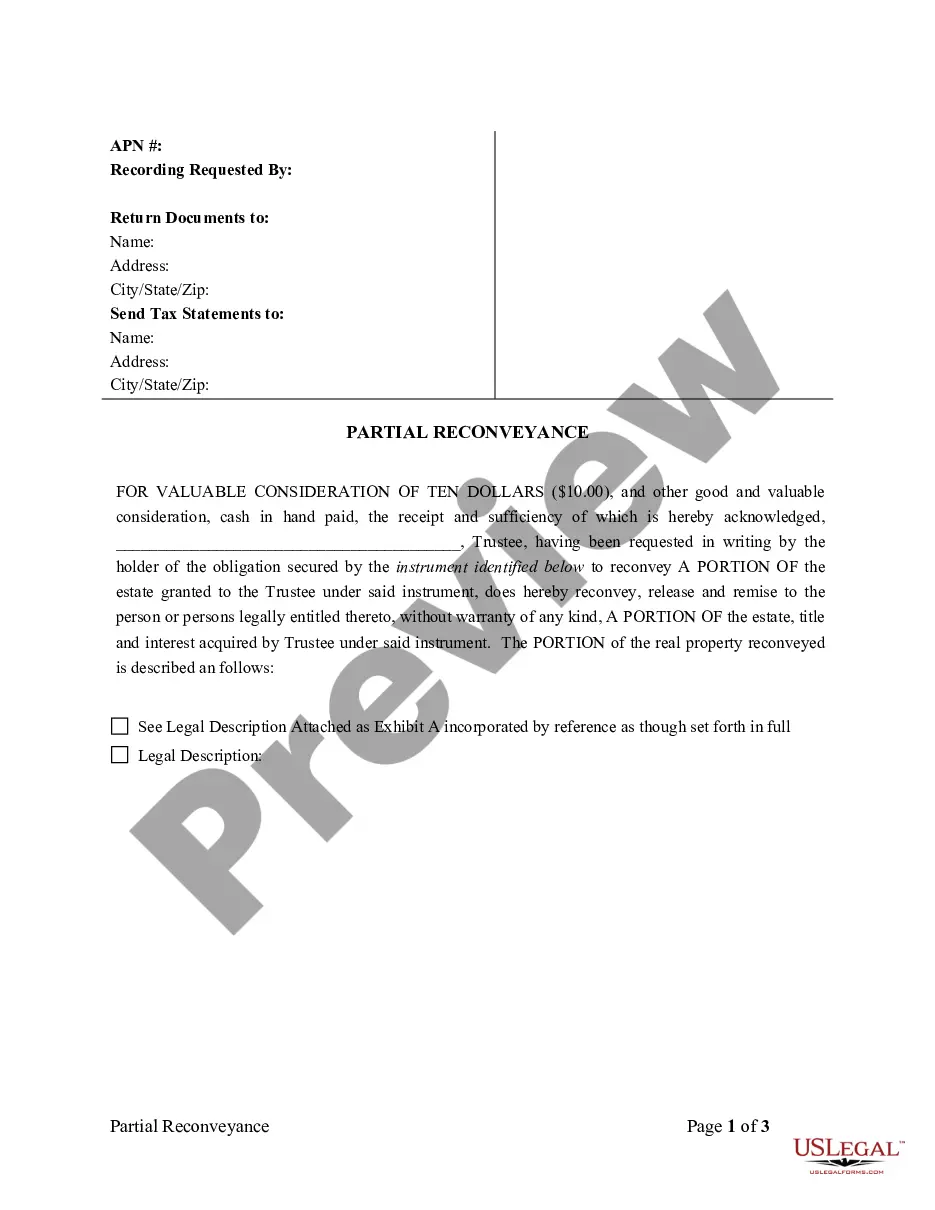

Free preview

How to fill out North Las Vegas Nevada Partial Release Of Property From Deed Of Trust For Corporation?

If you’ve already utilized our service before, log in to your account and save the North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your North Las Vegas Nevada Partial Release of Property From Deed of Trust for Corporation. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!