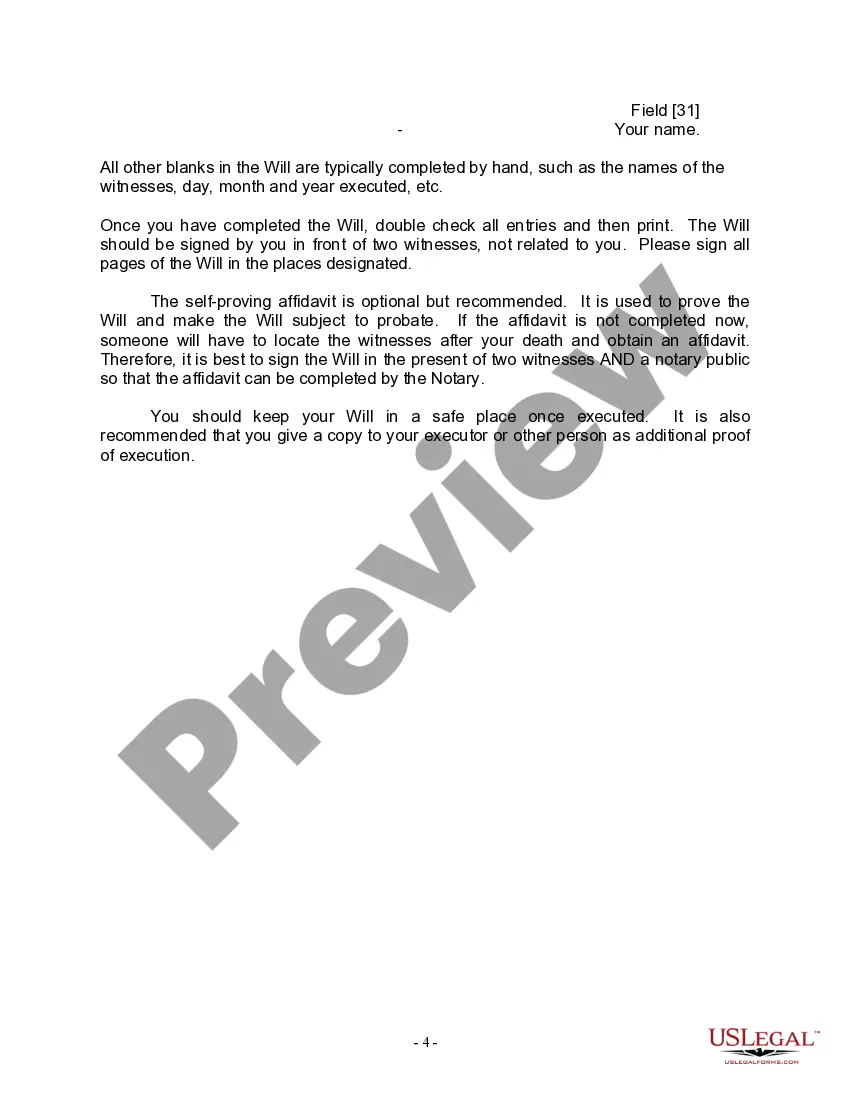

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

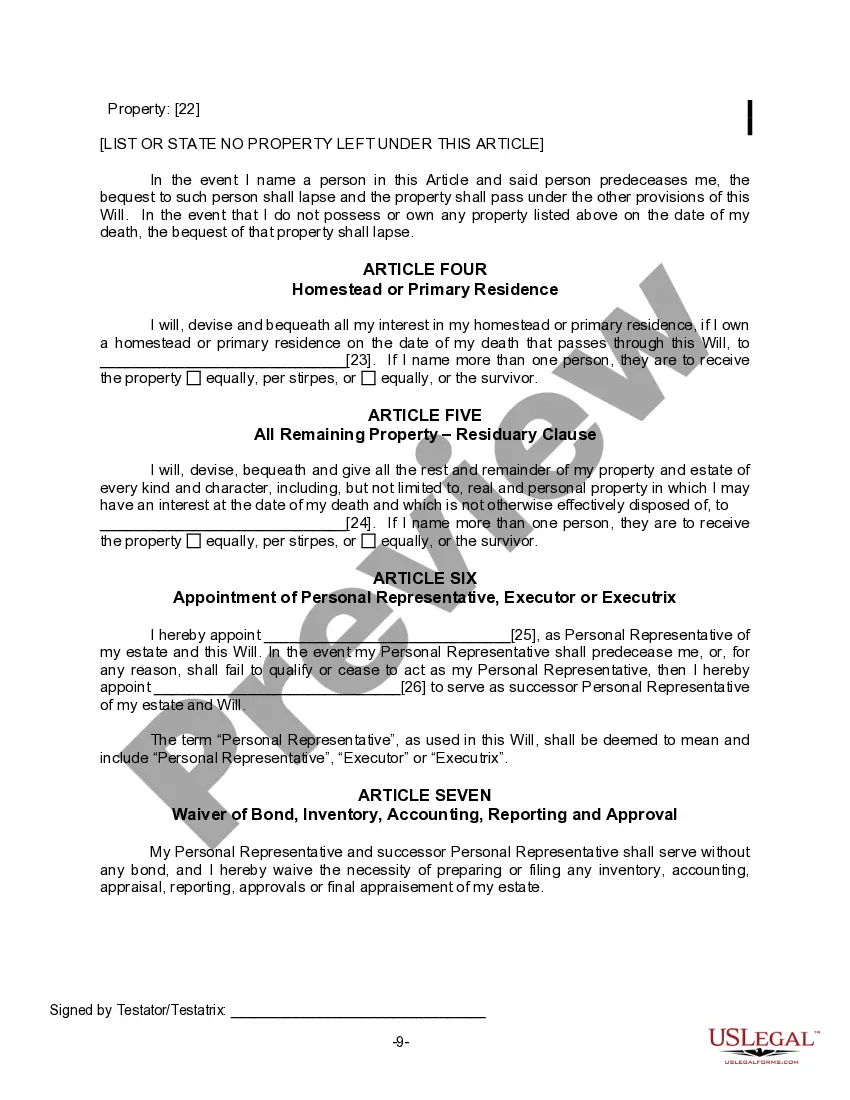

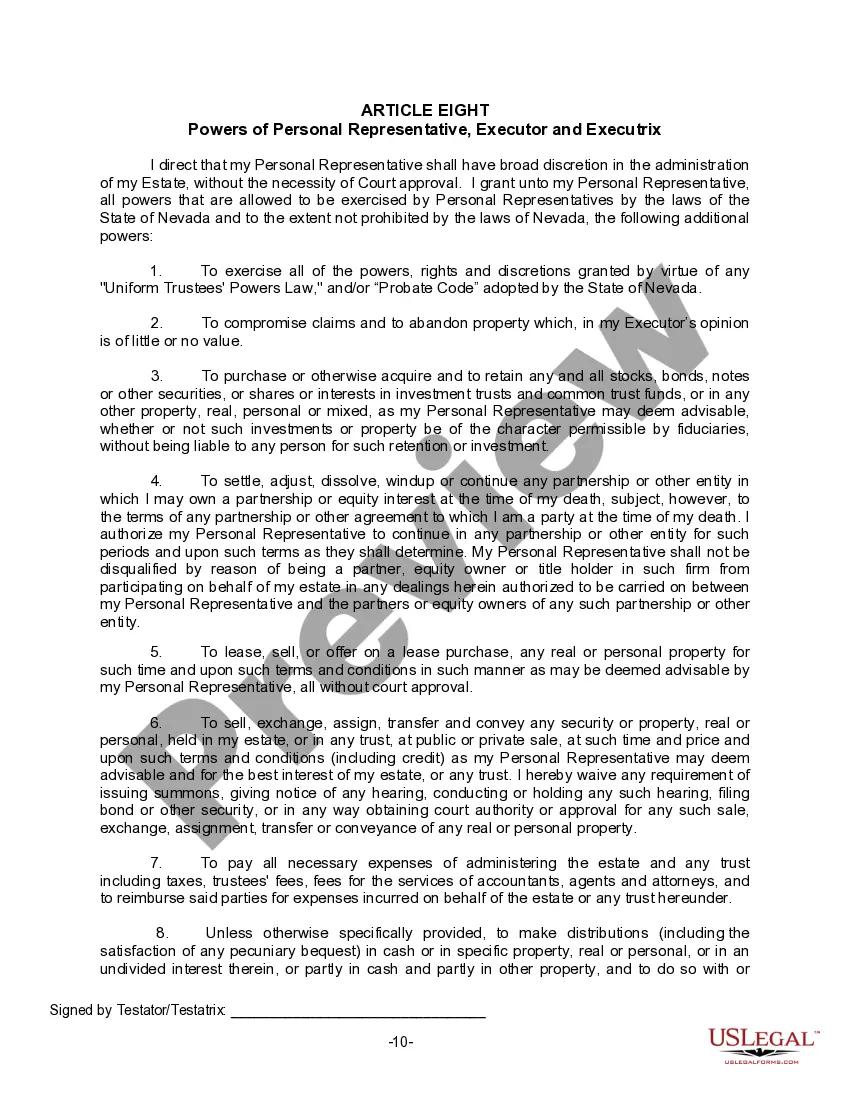

Las Vegas Nevada Last Will for a Widow or Widower with no Children

Description

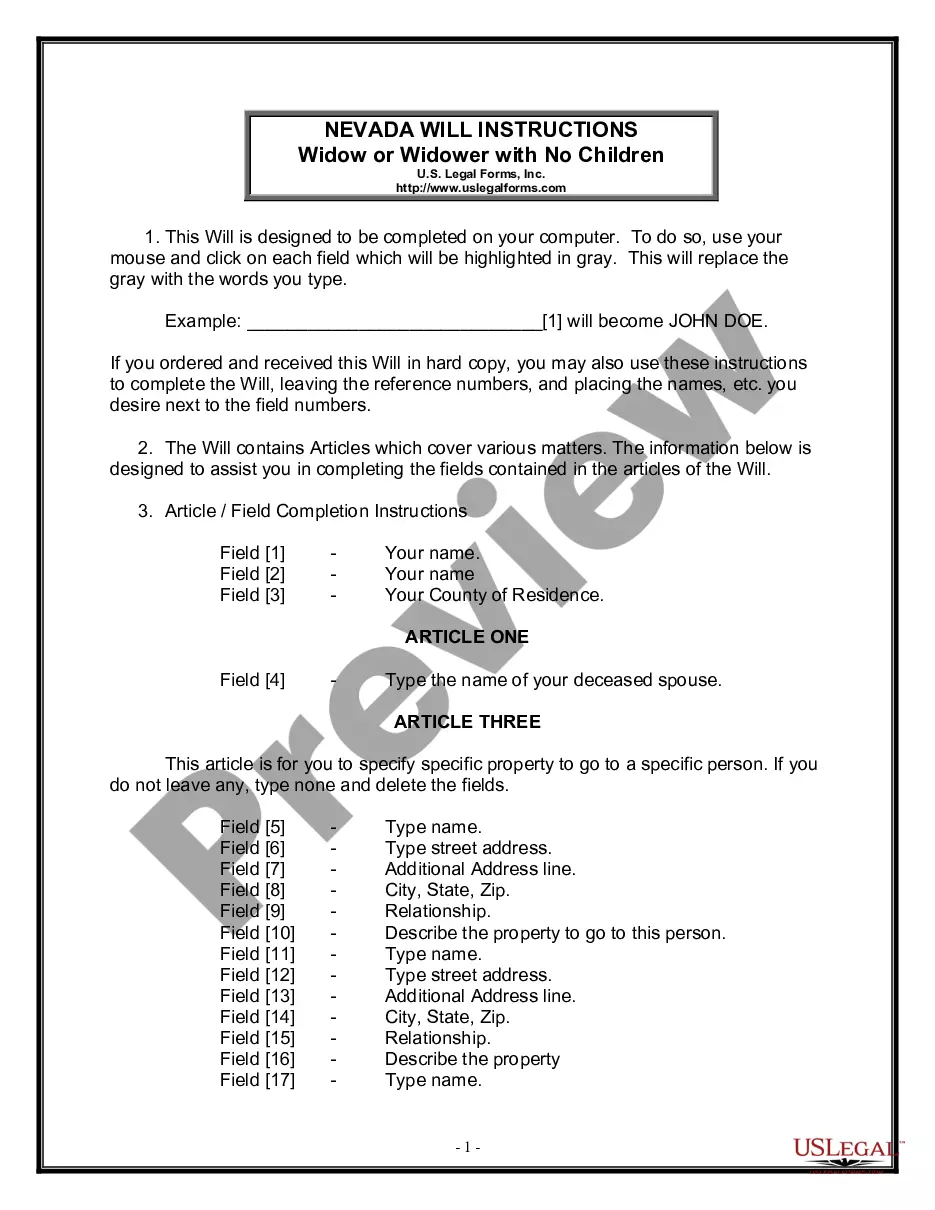

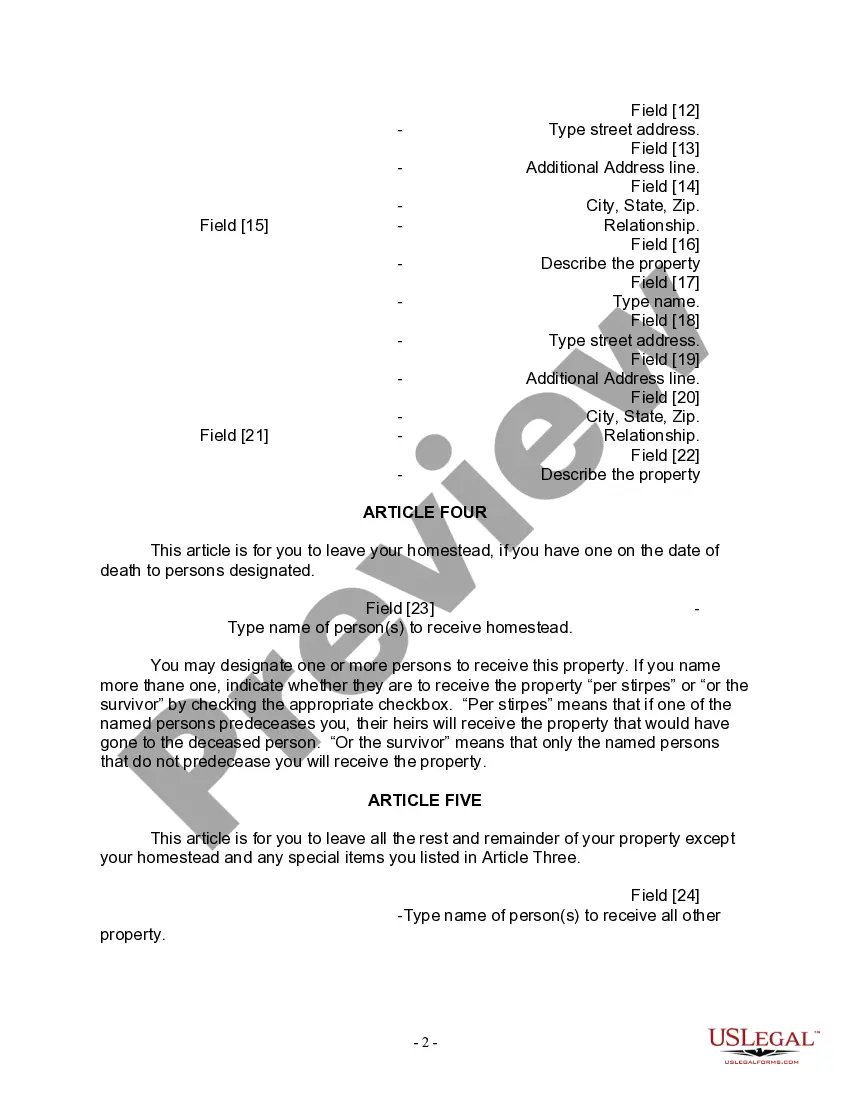

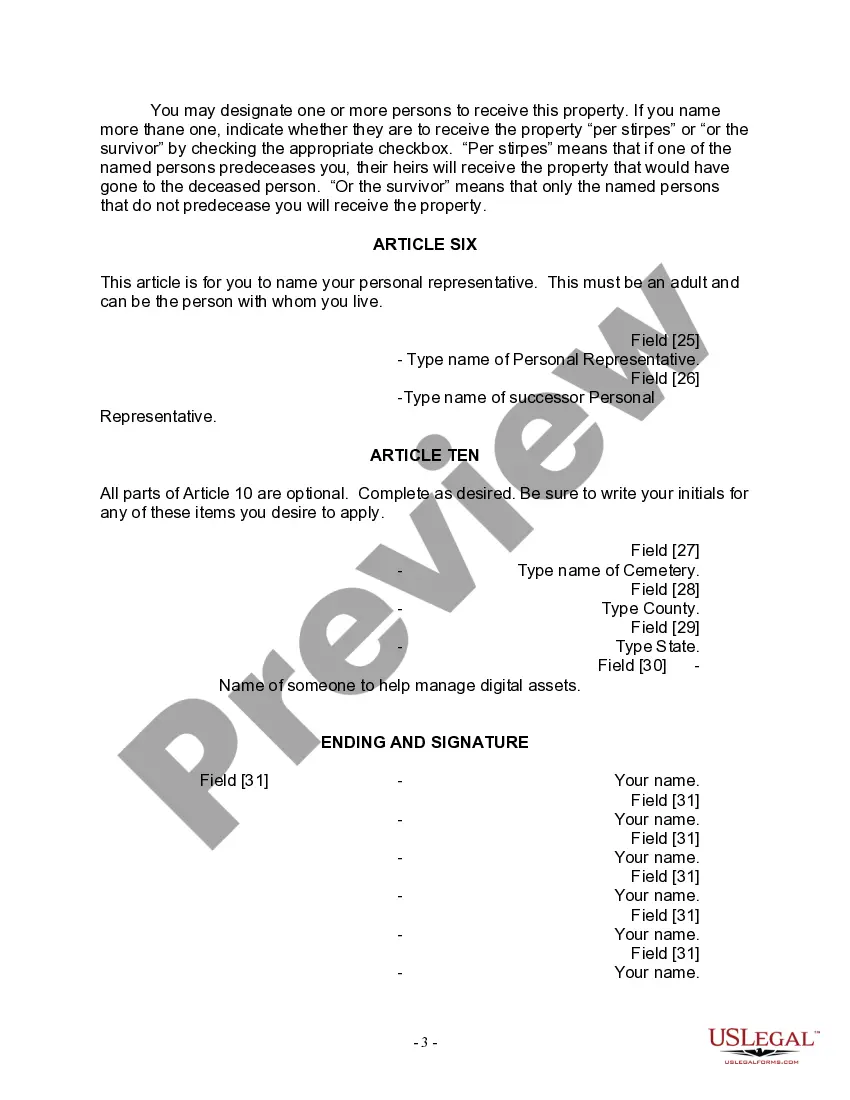

How to fill out Nevada Last Will For A Widow Or Widower With No Children?

Reap the advantages of US Legal Forms and gain immediate access to any form template you require.

Our practical website, featuring thousands of templates, simplifies the process of finding and acquiring nearly any document sample you might need.

You can export, complete, and sign the Las Vegas Nevada Legal Last Will Form for a Widow or Widower without Children in just a few minutes, rather than spending hours online searching for the correct template.

Leveraging our collection is an excellent method to enhance the security of your document filing.

Locate the template you need. Ensure it is the form you were seeking: confirm its title and description, and utilize the Preview option if accessible. If not, use the Search bar to identify the suitable one.

Initiate the saving procedure. Click Buy Now and select the pricing option you prefer. Then, register for an account and complete your purchase using a credit card or PayPal.

- Our skilled legal experts routinely evaluate all the documents to ensure that the forms are pertinent to a specific area and adhere to new laws and regulations.

- How can you obtain the Las Vegas Nevada Legal Last Will Form for a Widow or Widower without Children.

- If you already possess an account, simply sign in to your profile. The Download feature will be available on all the templates you review.

- Additionally, you can retrieve all previously saved documents in the My documents section.

- If you haven’t created an account yet, please follow the instructions below.

Form popularity

FAQ

Validity of Out-of-State Wills Yes, wills made in other states are valid in Nevada, as long as in writing, signed by the testator, and valid according to the laws of the state in which it was created or where the testator lived.

It may surprise you to know that the state of Nevada does recognize handwritten wills as valid. These documents are known as holographic wills and do not follow the same requirements for validation as formal wills do.

Requirements for a Will to Be Valid It must be in writing. Generally, of course, wills are composed on a computer and printed out.The person who made it must have signed and dated it. A will must be signed and dated by the person who made it.Two adult witnesses must have signed it. Witnesses are crucial.

Signature: The will must be signed by the testator or by an attending person at the testator's direction. Witnesses: A Nevada will must be signed by at least two witnesses who are not beneficiaries in the presence of the testator. Writing: A Nevada will must be in writing to be valid.

No will executed in this State, except such electronic wills or holographic wills as are mentioned in this chapter, is valid unless it is in writing and signed by the testator, or by an attending person at the testator's express direction, and attested by at least two competent witnesses who subscribe their names to

It may surprise you to know that the state of Nevada does recognize handwritten wills as valid. These documents are known as holographic wills and do not follow the same requirements for validation as formal wills do.

Under Nevada law, a will must be filed with the court within 30 days after the death of the testator. N.R.S. 136.050. So, after you pass away, your will should be filed in your local probate court by the person named to be your personal representative (also called an ?executor? or ?administrator?).