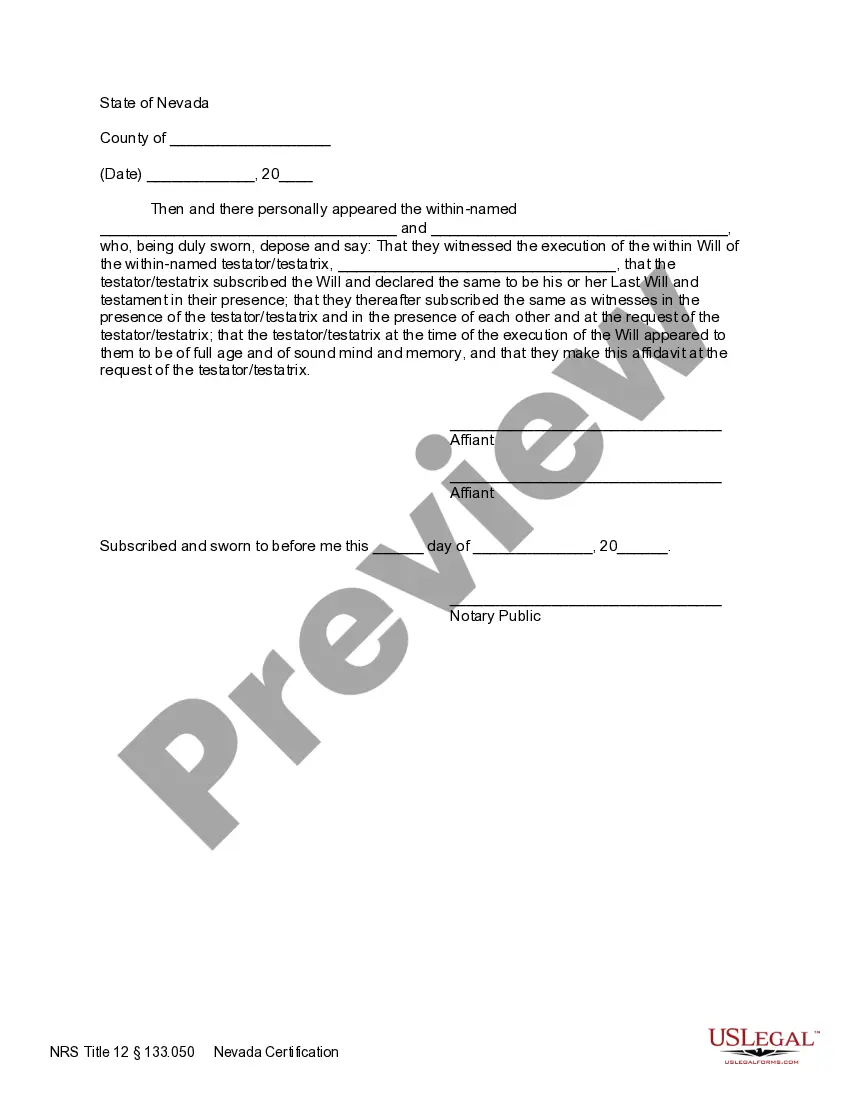

Clark Nevada Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a legal document that outlines the distribution of an individual's assets and property upon their death. A Pour Over Will allows the creator (testator) to transfer all of their assets to a revocable living trust, ensuring a smooth and streamlined transfer of assets to designated beneficiaries. This type of will is particularly useful for individuals who have established a revocable living trust and want to ensure that any assets not transferred directly to the trust during their lifetime are still included in the trust and distributed according to their wishes. By designating the trust as the ultimate recipient of all their assets, the testator can avoid probate and streamline the administration process. A Pour Over Will typically includes sections that name the testator, identify the trust, name an executor to manage the probate process, appoint a guardian for minor children if applicable, and specify the distribution of assets to the trust. It should also include provisions for alternate beneficiaries and contingencies in case the primary beneficiaries are unable to receive the assets. Different variations or subtypes of Clark Nevada Legal Last Will and Testament Form with All Property to Trust known as Pour Over Wills may exist based on specific situational requirements or preferences. Some possible variations may include Pour Over Wills with special provisions for specific assets, such as real estate, business interests, or valuable personal possessions. Other variations may involve Pour Over Wills that designate multiple co-trustees or include clauses for charitable donations. It is important to consult with an attorney experienced in estate planning to ensure that the Pour Over Will accurately reflects the testator's intentions, complies with Nevada state laws, and aligns with the overall estate planning strategy. Creating a comprehensive Pour Over Will, can provide peace of mind that all property will be transferred to the trust and distributed as desired, avoiding potential disputes or complications in the future.

Clark Nevada Legal Last Will and Testament Form with All Property to Trust, commonly known as a Pour Over Will, is a legal document that outlines the distribution of an individual's assets and property upon their death. A Pour Over Will allows the creator (testator) to transfer all of their assets to a revocable living trust, ensuring a smooth and streamlined transfer of assets to designated beneficiaries. This type of will is particularly useful for individuals who have established a revocable living trust and want to ensure that any assets not transferred directly to the trust during their lifetime are still included in the trust and distributed according to their wishes. By designating the trust as the ultimate recipient of all their assets, the testator can avoid probate and streamline the administration process. A Pour Over Will typically includes sections that name the testator, identify the trust, name an executor to manage the probate process, appoint a guardian for minor children if applicable, and specify the distribution of assets to the trust. It should also include provisions for alternate beneficiaries and contingencies in case the primary beneficiaries are unable to receive the assets. Different variations or subtypes of Clark Nevada Legal Last Will and Testament Form with All Property to Trust known as Pour Over Wills may exist based on specific situational requirements or preferences. Some possible variations may include Pour Over Wills with special provisions for specific assets, such as real estate, business interests, or valuable personal possessions. Other variations may involve Pour Over Wills that designate multiple co-trustees or include clauses for charitable donations. It is important to consult with an attorney experienced in estate planning to ensure that the Pour Over Will accurately reflects the testator's intentions, complies with Nevada state laws, and aligns with the overall estate planning strategy. Creating a comprehensive Pour Over Will, can provide peace of mind that all property will be transferred to the trust and distributed as desired, avoiding potential disputes or complications in the future.