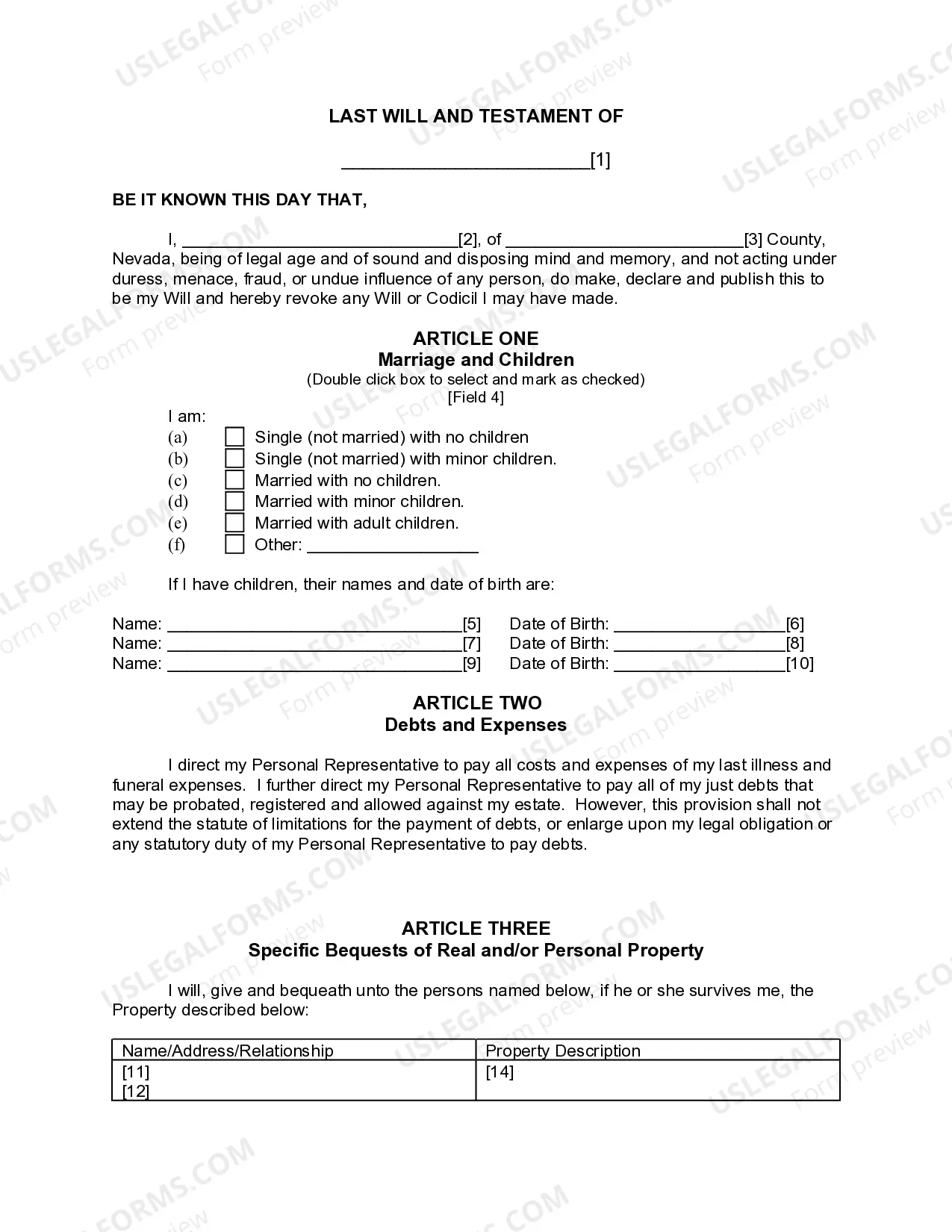

Sparks Nevada Last Will and Testament is a legal document that outlines a person's final wishes regarding the distribution of their assets and properties upon their passing. It is designed to ensure smooth and efficient transfer of one's estate while protecting their interests and loved ones. The Sparks Nevada Last Will and Testament can be categorized into two main types: 1. Simple Last Will and Testament: This type is suitable for individuals with uncomplicated estates and straightforward distribution plans. It covers essential aspects like appointing an executor, designating beneficiaries, and specifying how different assets should be distributed. The Simple Last Will and Testament is commonly used by people with moderate estates or those who have less complex family dynamics. 2. Complex Last Will and Testament: This type is suitable for individuals with more intricate estate planning needs. It includes provisions and clauses that account for specific circumstances, such as the creation of trusts, guardianship for minor children, charitable donations, and tax-saving strategies. The Complex Last Will and Testament is typically used by high-net-worth individuals, business owners, and those with intricate family structures. Regardless of the type, Sparks Nevada Last Will and Testament must adhere to specific legal requirements to be considered valid. It should clearly identify the testator (the person writing the will) and provide explicit instructions on the distribution of assets, including real estate, financial accounts, personal belongings, and investments. The document should also appoint an executor, who is responsible for carrying out the instructions outlined in the will and managing the estate's affairs. Additionally, Sparks Nevada Last Will and Testament may include provisions for alternate beneficiaries in case the primary beneficiaries are unable or unwilling to inherit the assets. It may also address the testator's desires concerning funeral arrangements, organ donation, and final wishes to ensure their voice is heard and respected even after their passing. Creating a Sparks Nevada Last Will and Testament is a crucial step in proper estate planning, regardless of the size of one's estate. It helps avoid conflicts among family members, ensures the desired distribution of assets, and provides peace of mind for both the testator and their loved ones. Consulting with an experienced estate planning attorney is highly recommended ensuring all legal requirements are met and the document accurately reflects the testator's wishes.

Sparks Nevada Last Will and Testament for other Persons

Description

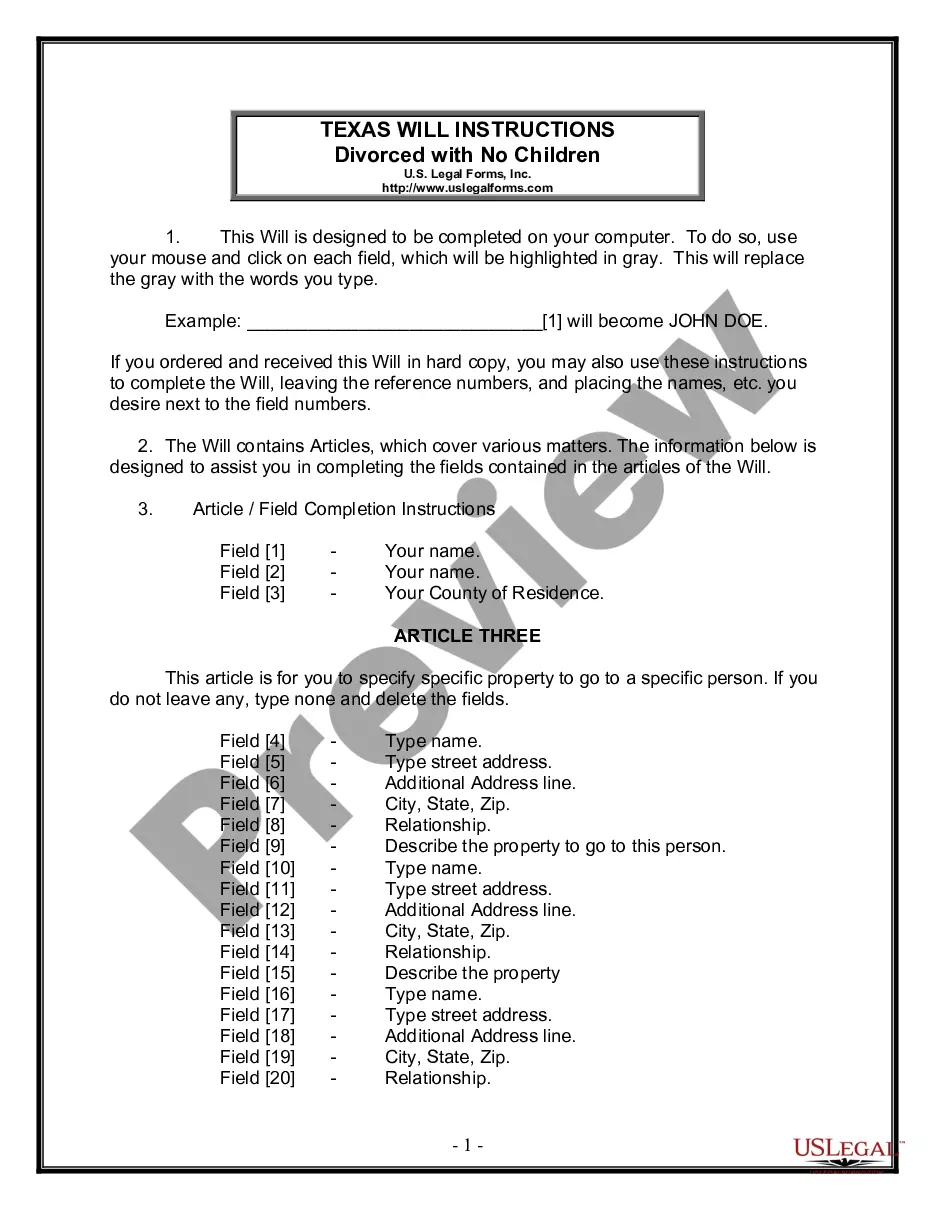

How to fill out Sparks Nevada Last Will And Testament For Other Persons?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Sparks Nevada Last Will and Testament for other Persons gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Sparks Nevada Last Will and Testament for other Persons takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Sparks Nevada Last Will and Testament for other Persons. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

In Nevada, All Wills Are Public Record Those who wish to see the contents of a will in Nevada may obtain a copy from the Clerk of the Court.

Nevada law requires a person in possession of the deceased person's will must ?deliver it to the clerk of the district court? within 30 days of the death.

You can file the will at the clerk's office for the Eighth Judicial District Court, which is located on the 3rd floor of the Regional Justice Center at 200 Lewis Avenue, Las Vegas, NV 89155 or at the Family Courts and Services Center at 601 N. Pecos Road, Las Vegas, NV 89101.

Filing a Will in Nevada is a Serious Responsibility. This rule is absolute. Any person in possession of an original will must deliver it to the Clerk of the Court within 30 days of knowledge of death.

GENERAL ADMINISTRATION PROBATE OF WILL AND APPOINTMENT OF PERSONAL REPRESENTATiVE FOR ESTATES OVER $200,000 (Cites in brackets are for estates administered without a will.) 136.050 The original will must be filed with the County Clerks office within 30 days of the death of the Testator.

Under Nevada law, a will must be filed with the court within 30 days after the death of the testator. N.R.S. 136.050. So, after you pass away, your will should be filed in your local probate court by the person named to be your personal representative (also called an ?executor? or ?administrator?).

You can file the will at the clerk's office for the Eighth Judicial District Court, which is located on the 3rd floor of the Regional Justice Center at 200 Lewis Avenue, Las Vegas, NV 89155 or at the Family Courts and Services Center at 601 N. Pecos Road, Las Vegas, NV 89101.

Signature: The will must be signed by the testator or by an attending person at the testator's direction. Witnesses: A Nevada will must be signed by at least two witnesses who are not beneficiaries in the presence of the testator. Writing: A Nevada will must be in writing to be valid.