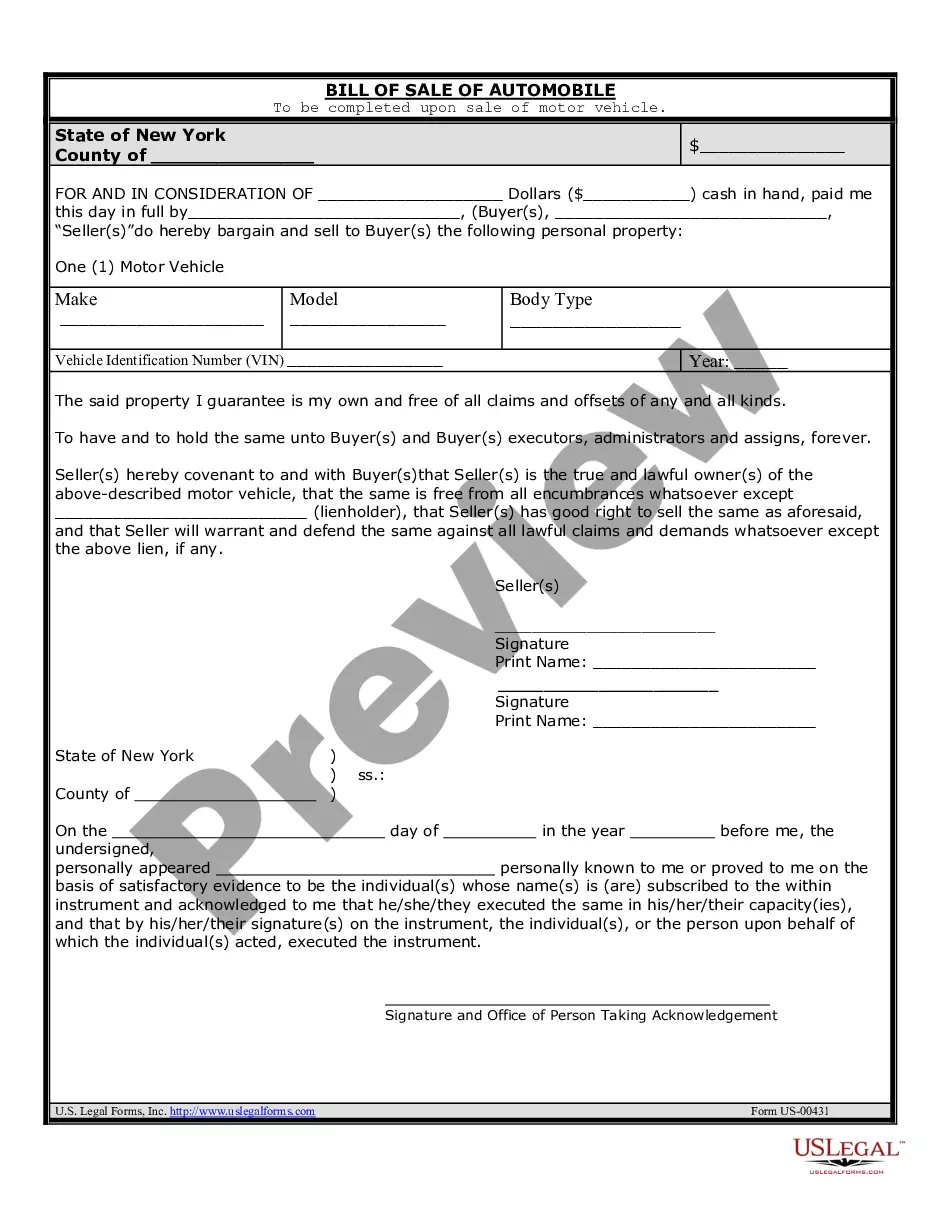

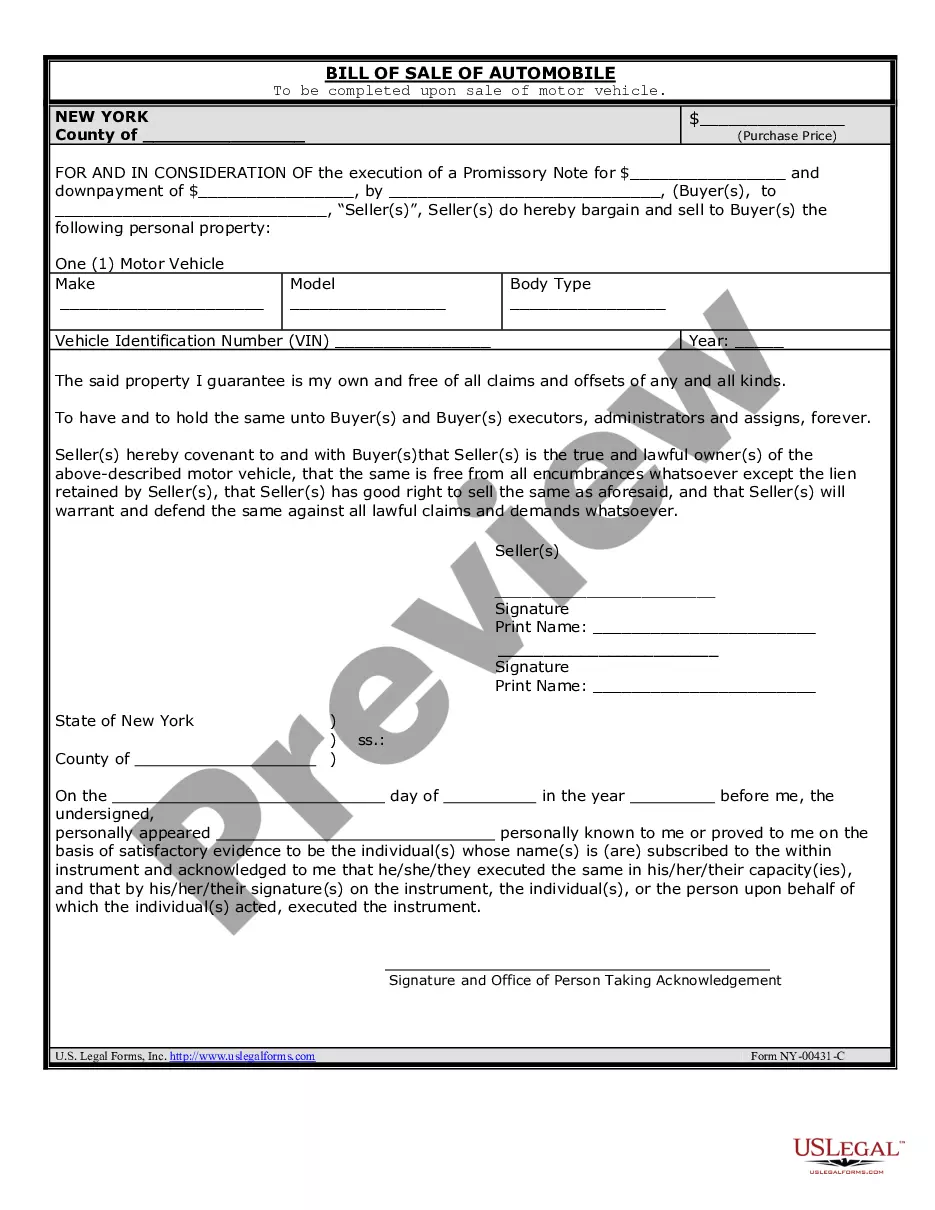

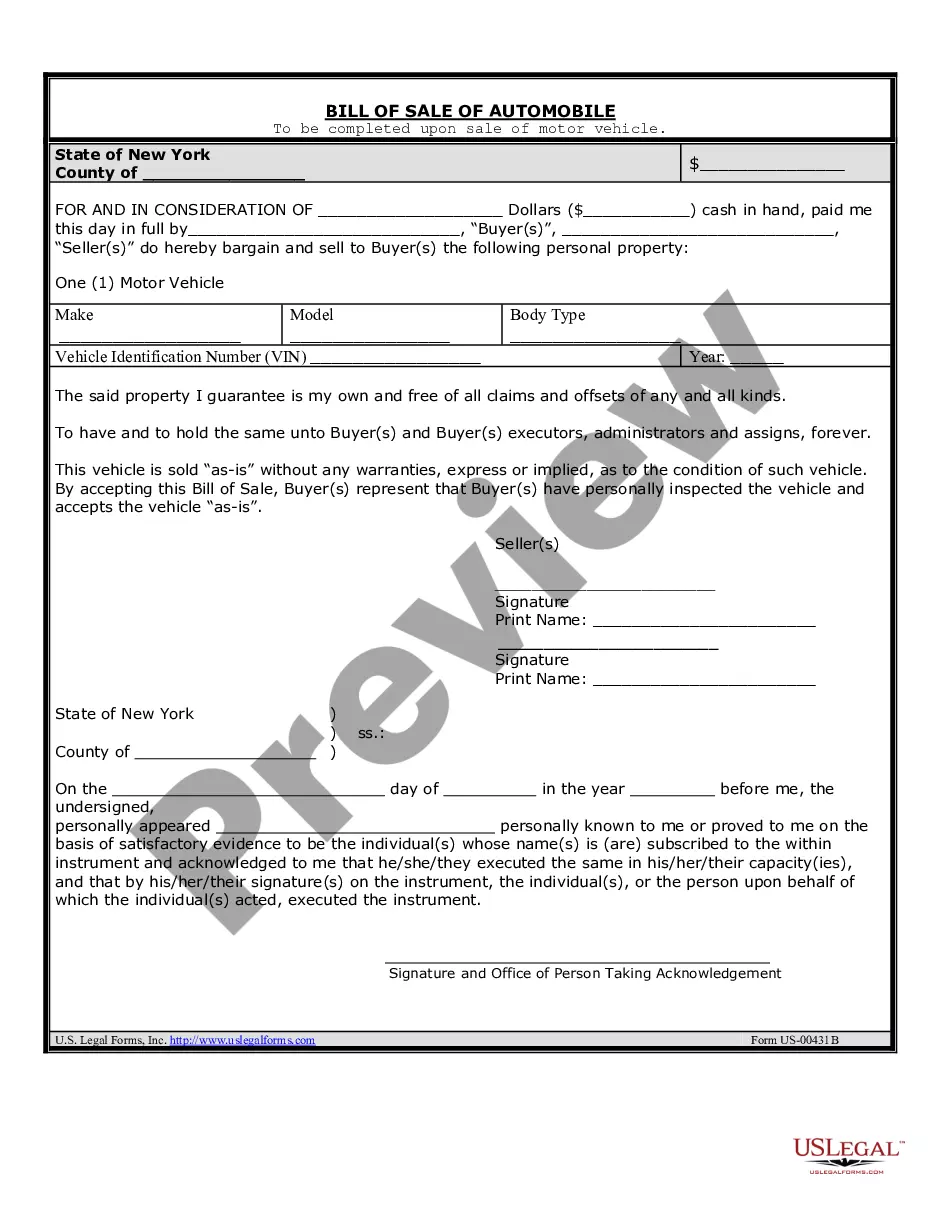

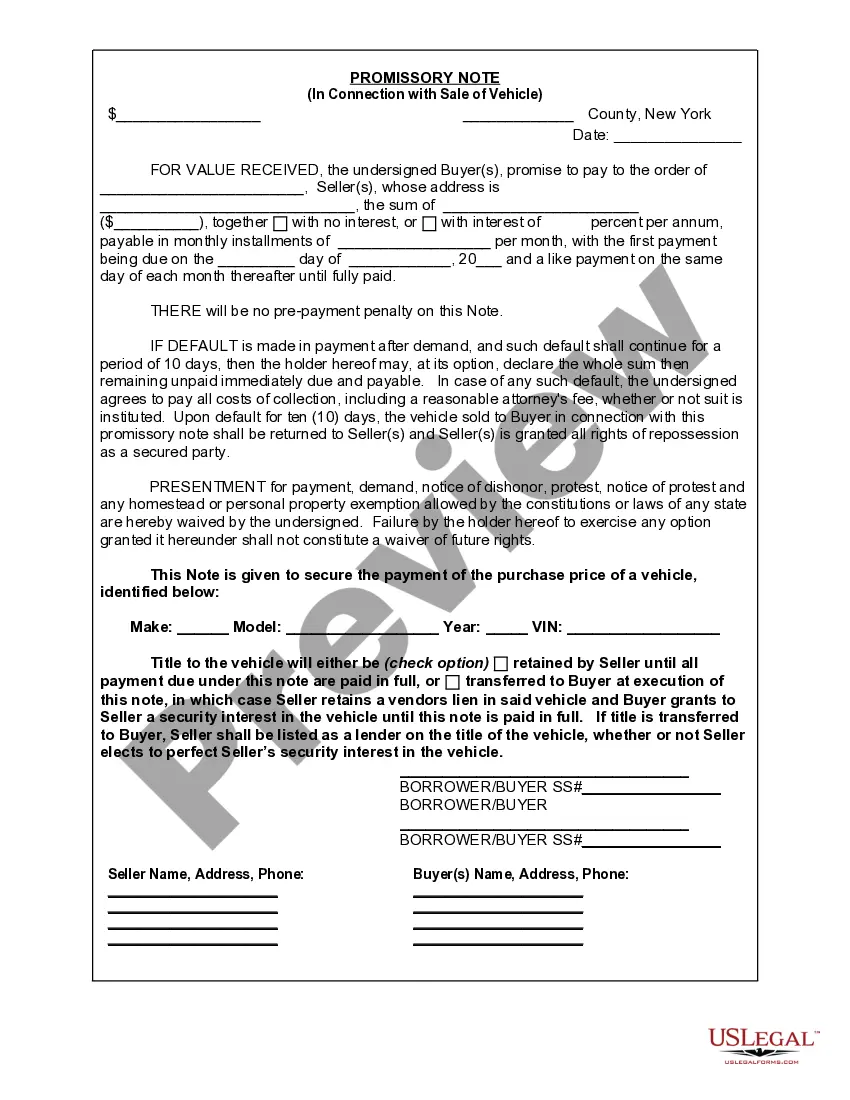

A promissory note is a legal document used in Queens, New York, to solidify an agreement between a vehicle seller and buyer. The note outlines the terms and conditions of payment for the purchased vehicle. It serves as evidence of the buyer's promise to repay the seller in agreed installments over a specific period. Keywords: Queens New York, promissory note, sale of vehicle, automobile. There are two main types of promissory notes commonly used in the sale of vehicles in Queens, New York: 1. Secured Promissory Note: This type of note is created when the buyer provides collateral, typically the vehicle being sold, to secure the loan. In the event of default, the seller has the right to repossess and sell the vehicle to recover the outstanding balance. This note ensures added security for the seller. 2. Unsecured Promissory Note: Unlike the secured note, an unsecured promissory note does not include any collateral. This type of note relies solely on the buyer's promise to repay the seller. In case of default, the seller's ability to recover the outstanding balance might be more challenging, as they do not have a specific asset to seize and sell. Regardless of the type, a Queens New York promissory note in connection with the sale of a vehicle typically includes the following details: 1. Identification of Parties: The note includes the names, addresses, and contact information of both the seller and the buyer. It may also include vehicle details, such as make, model, year, and identification number. 2. Payment Terms: The note specifies the total purchase price of the vehicle and outlines the agreed-upon installments, including the due dates, amounts, and any applicable interest or penalty charges. This section also defines the consequences for late or missed payments. 3. Interest Rate: If both parties agree, the promissory note may include an interest rate, which determines the additional cost the buyer bears for borrowing the money. The rate can be fixed or variable. 4. Default and Remedies: The note outlines the consequences of default, such as repossession and legal action. It also covers any additional fees, collection costs, or attorney fees that may be incurred in case of default. 5. Governing Law: The note specifies that the agreement is governed by the laws of Queens, New York, ensuring that any disputes or legal matters are resolved within the jurisdiction. 6. Signatures and Notarization: Both the buyer and the seller must sign the promissory note to make it legally binding. Notarization is not mandatory but adds an extra layer of authenticity and credibility. A Queens New York promissory note in connection with the sale of a vehicle ensures a comprehensive agreement between the seller and buyer, protecting the rights and obligations of both parties while providing a clear framework for payment terms and potential default scenarios.

Queens Note

Description

How to fill out Queens New York Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you are searching for a relevant form template, it’s extremely hard to find a more convenient platform than the US Legal Forms site – probably the most considerable online libraries. Here you can get thousands of templates for business and individual purposes by types and regions, or key phrases. Using our advanced search function, discovering the most recent Queens New York Promissory Note in Connection with Sale of Vehicle or Automobile is as easy as 1-2-3. In addition, the relevance of each and every document is proved by a team of professional attorneys that on a regular basis review the templates on our platform and revise them in accordance with the latest state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Queens New York Promissory Note in Connection with Sale of Vehicle or Automobile is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have found the form you need. Check its description and make use of the Preview function to see its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to discover the needed file.

- Affirm your choice. Click the Buy now option. Next, select your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the form. Pick the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the obtained Queens New York Promissory Note in Connection with Sale of Vehicle or Automobile.

Each form you save in your profile does not have an expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to receive an additional duplicate for enhancing or creating a hard copy, feel free to come back and download it once more at any time.

Make use of the US Legal Forms extensive collection to gain access to the Queens New York Promissory Note in Connection with Sale of Vehicle or Automobile you were seeking and thousands of other professional and state-specific samples on one platform!

Form popularity

FAQ

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

One such term is ?promissory note,? which will definitely come up if you are using lender money to finance your home purchase. Don't let this term confuse you ? a promissory note is essentially just a legal document where you, the borrower, formally agree in writing that you'll repay the loan.

When a loan changes hands, the promissory note is endorsed (signed over) to the loan's new owner. In some cases, the note is endorsed in blank, making it a bearer instrument under Article 3 of the Uniform Commercial Code. Whoever holds the note has the legal authority to enforce it and has standing to foreclose.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

Information contained in a basic vehicle promissory note should include: The amount of the loan. How payment will be made. What the interest rate will be. What the payment schedule will be. What the grace period on payments is, if any. What defaulting and missed payment penalties will be.

Yes, a promissory note is a legal, binding agreement, even if it's a handwritten note signed by both parties on a cocktail napkin. ?However, it would be foolish to sign a handwritten promissory note as it is easier to add language to a handwritten note after the fact as opposed to a typewritten one,? said Vincent J.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

Interesting Questions

More info

New York, 1995×, 8. “Bank of America and the American People.” 9.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.