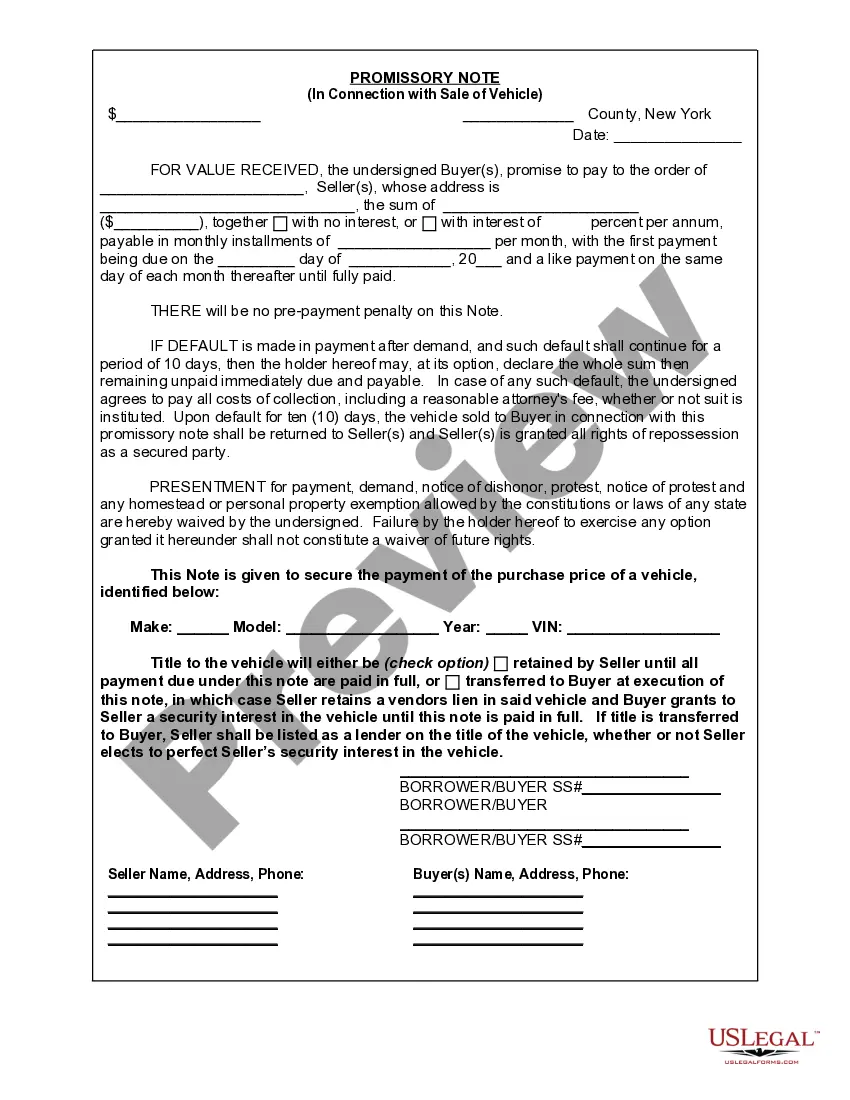

A Yonkers New York Promissory Note in Connection with Sale of Vehicle or Automobile is a legally-binding document that outlines the terms and conditions of a loan agreement between the buyer and seller in a vehicle sale transaction. It serves as a written promise by the buyer to repay the seller a specific amount of money, typically in installments, over a specified period of time. Keywords: Yonkers New York, promissory note, sale of vehicle, automobile, loan agreement, terms and conditions, written promise, repayment, installments, specified period of time. There are different types of Yonkers New York Promissory Notes in Connection with the Sale of Vehicle or Automobile, which are particularly designed to cater to various transaction situations. Some of these types include: 1. Simple Promissory Note: This type of promissory note details the basic terms of the loan agreement, including the loan amount, repayment schedule, interest rate (if any), and penalties for late payments or default. 2. Secured Promissory Note: In this type, the buyer pledges an asset, most commonly the vehicle being purchased, as collateral against the loan. This provides the seller with security in case the buyer fails to repay the loan, allowing the seller to seize the pledged asset to recover the outstanding debt. 3. Balloon Promissory Note: This variation allows the buyer to make low monthly payments over a specified period, followed by a larger final "balloon" payment to cover the remaining loan balance. This type may be suitable for buyers who anticipate a sudden increase in income or financial windfall. 4. Installment Promissory Note: With an installment promissory note, the buyer agrees to repay the loan amount in equal monthly or bi-weekly installments until the debt is fully cleared. This type helps to ensure a regular and consistent repayment schedule, benefitting both the buyer and seller. 5. Personal Promissory Note: When a vehicle is sold between family members, friends, or acquaintances without involving financial institutions, a personal promissory note is used. It outlines the terms of the loan, including the payment structure, interest (if any), and any applicable penalties. These types of Yonkers New York Promissory Notes provide the necessary legal protection and clarity for both parties involved in the sale of a vehicle or automobile. It is important to thoroughly review and understand the terms and conditions before entering into any promissory note agreement to ensure a smooth and secure transaction.

Yonkers New York Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Yonkers New York Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Are you looking for a reliable and affordable legal forms provider to buy the Yonkers New York Promissory Note in Connection with Sale of Vehicle or Automobile? US Legal Forms is your go-to option.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of particular state and county.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Yonkers New York Promissory Note in Connection with Sale of Vehicle or Automobile conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is good for.

- Start the search over if the template isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Yonkers New York Promissory Note in Connection with Sale of Vehicle or Automobile in any provided file format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online for good.