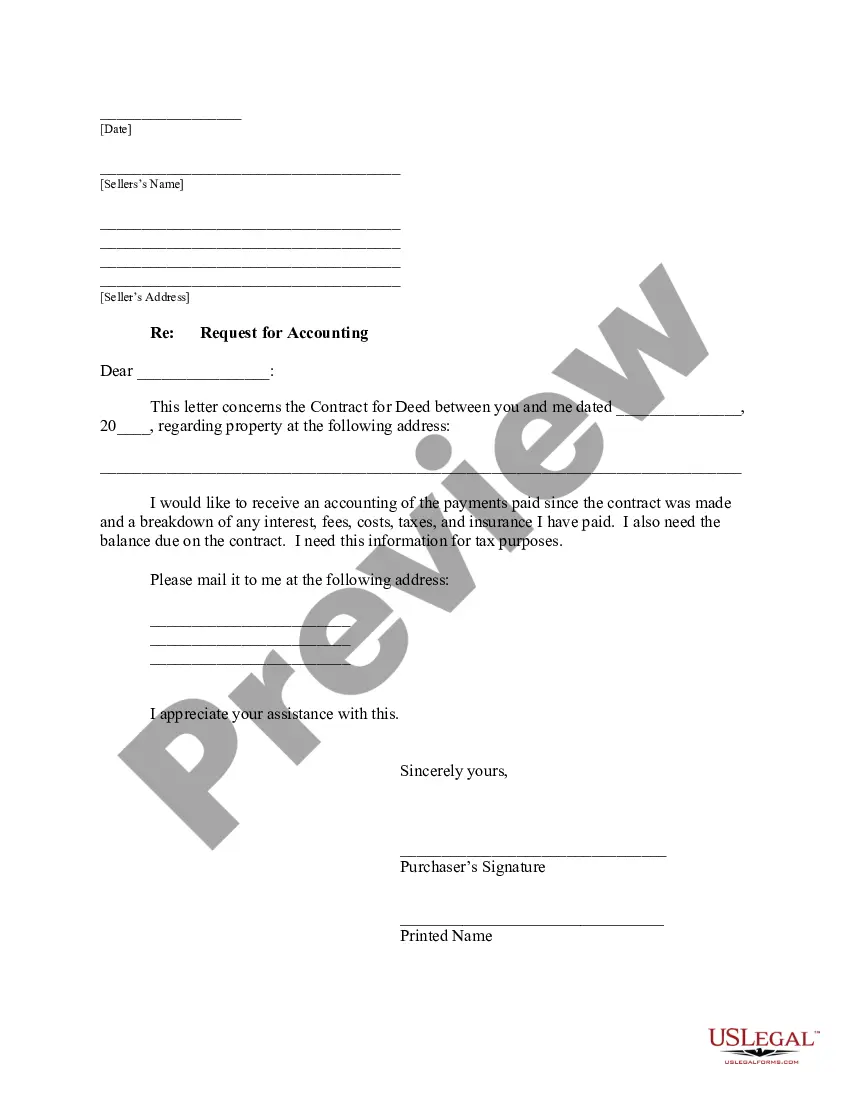

Kings New York Buyer's Request for Accounting from Seller under Contract for Deed is a legal document that allows the buyer to request detailed financial information from the seller regarding the property being purchased under a contract for deed arrangement. This request typically occurs when the buyer wants to ensure transparency in the financial aspects of the transaction before finalizing the purchase. This document helps protect the buyer's interests and ensures an informed decision-making process. Keywords: Kings New York, buyer's request, accounting, seller, contract for deed, detailed description, financial information, transparency, purchase, transaction, informed decision-making Different types of Kings New York Buyer's Request for Accounting from Seller under Contract for Deed: 1. Standard Request: This is the most common type of request where the buyer asks the seller to provide a complete breakdown of all financial matters related to the property. This includes existing mortgages, liens, taxes, insurance, and any other financial obligations the seller holds. 2. Expense Request: This type of request focuses on the specific expenses associated with the property. The buyer may ask for a breakdown of utility bills, maintenance costs, repair expenses, property management fees, and other relevant expenses incurred by the seller. 3. Income Request: In certain cases, the buyer may specifically request accounting information related to the property's income. This can include rental income, lease agreements, vacancy rates, and any other sources of income generated by the property. 4. Tax and Legal Obligation Request: This type of request concentrates on the tax and legal obligations associated with the property. The buyer might ask the seller to provide documents such as property tax records, zoning and permit information, compliance with building codes, and any pending legal actions or disputes affecting the property. 5. Financial Statement Request: In some instances, the buyer may request a comprehensive financial statement from the seller. This statement should disclose the seller's assets, liabilities, income, and expenses, providing a holistic view of the seller's financial situation. By using a Kings New York Buyer's Request for Accounting from Seller under Contract for Deed, buyers can ensure transparency and gain valuable insights into the financial aspects of a property before finalizing the purchase, avoiding any potential financial surprises.

Kings New York Buyer's Request for Accounting from Seller under Contract for Deed

Description

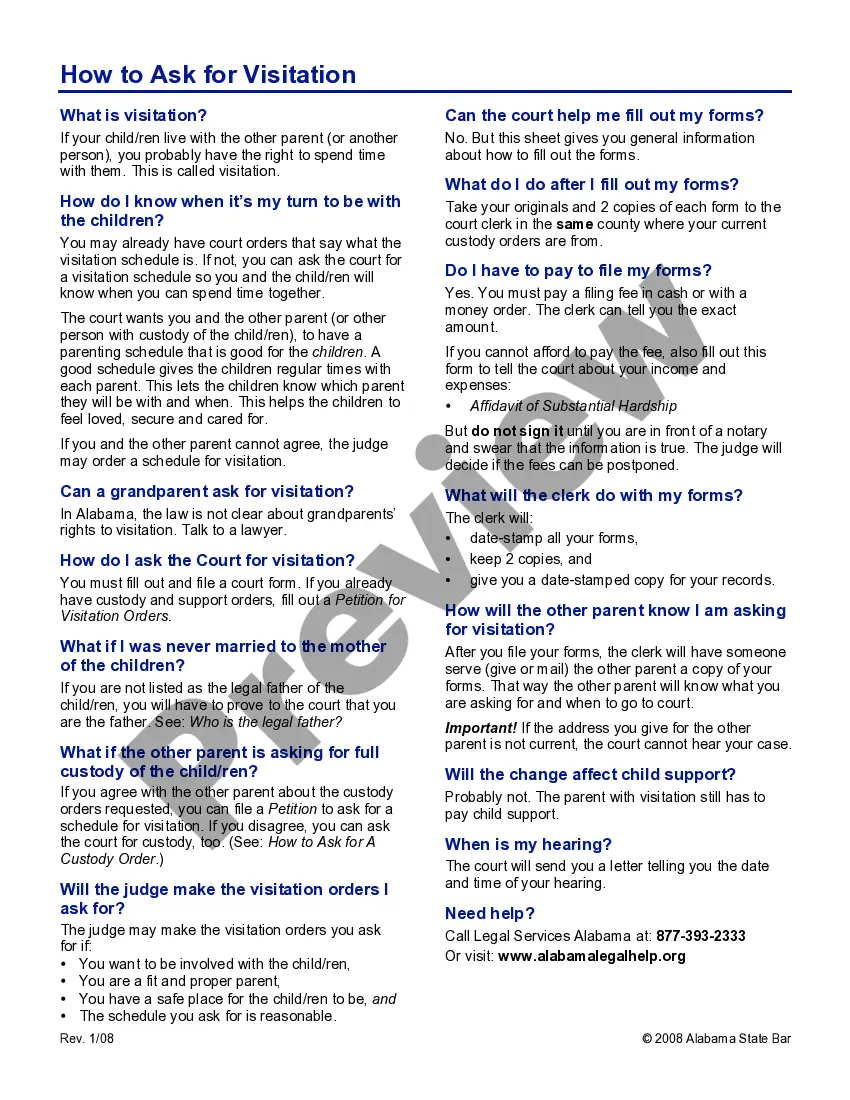

How to fill out New York Buyer's Request For Accounting From Seller Under Contract For Deed?

We consistently aim to mitigate or evade legal repercussions when managing intricate law-related or financial matters.

To accomplish this, we engage attorney services which are typically quite costly.

However, not all legal issues are exceedingly complicated. Most can be handled by ourselves.

US Legal Forms is a digital collection of current DIY legal templates covering everything from wills and power of attorney to incorporation articles and dissolution petitions.

If you accidentally misplaced the form, you can always re-download it in the My documents tab.

- Our platform empowers you to manage your affairs independently without seeking an attorney.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and areas, greatly easing the search process.

- Utilize US Legal Forms whenever you need to locate and download the Kings New York Buyer's Request for Accounting from Seller under Contract for Deed or any other document conveniently and securely.

Form popularity

FAQ

Form RP-5217-PDF, Real Property Transfer Report.

RPTT applies whenever the sale or transfer is more than $25,000. This includes state or federal government-owned property transferred to a non-government entity. The RPTT must also be paid when the land and building(s) that make up a cooperative dwelling(s) are transferred to a cooperative housing corporation.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

The RP-5217 Real Property Transfer Report is a form (RPL Article 9, Section 333) used to document the information associated with all real property transfers within New York State, except for New York City transfers prior to January 1, 2003.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

How do I write a Sales Agreement? Specify your location.Provide the buyer's and seller's information.Describe the goods and services.State the price and deposit details (if applicable)Outline payment details.Provide delivery terms.Include liability details.State if there's a warranty on the goods.

A real property transfer form?RP-5217, RP-5217-NYC, or RP-5217-PDF (pilot project)?is required for all real property transfers where a deed is filed. A filing fee is also required.

Property owners in New York state cannot add or change a name on a deed or title. Instead, they must file a new deed reflecting the change. However, if there is an error on the document, they can file a correction deed. A correction deed does not convey title ? it simply perfects the original deed.

A property deed is a formal, legal document that transfers one person or entity's rights of ownership to another individual or entity. The deed is the official ?proof of transfer? for real estate, which can include land on its own or land that has a house or other building on it.

Steps For A Legal Agreement Between Two Parties It should be in writing.It should be simple.Deal with the right person.Parties detail should be mention correctly.Specify each detail in a legal agreement.Payment obligations shall be clear.Termination Clause shall be mentioned.Dispute resolution.

More info

The payment portion of the installment contract is made by the buyer and the seller pays the balance on the house mortgage within the term of the contract. In fact, if the balance is more than the buyer is required to pay, the seller is allowed to take a cash advance, and if the buyer fails to make the payment at the end of the term, the buyer is still responsible for the entire balance. Is a mortgage recording fee legal? A 125 deposit is required by the Federal Home Loan Mortgage Corporation (FILM) for a mortgage recording, the money is used by the FILM to purchase real estate to record on government securities. However, to claim the benefit, the purchaser should have a current mortgage, an established credit history with no delinquency or default and a clean tax file number to support it. If the sale does happen, the buyer must give an official receipt and pay all fees or taxes. Does the FFMC charge any fees? The FILM charges a 125 fee as mentioned above.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.