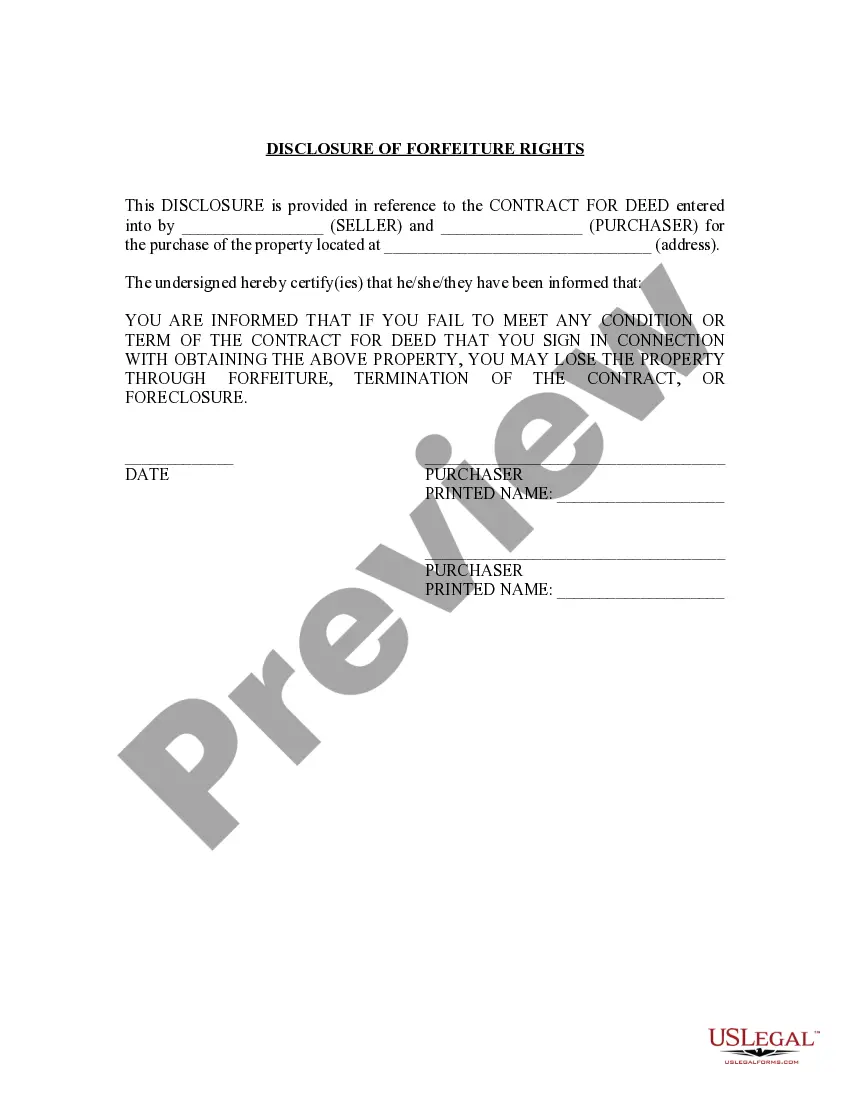

Queens New York Seller's Disclosure of Forfeiture Rights for Contract for Deed

Description

How to fill out New York Seller's Disclosure Of Forfeiture Rights For Contract For Deed?

If you seek a legitimate form template, it’s impossible to select a superior platform than the US Legal Forms site – arguably the most extensive libraries on the web.

With this collection, you can discover a vast array of templates for business and personal needs categorized by type and location, or keywords.

Utilizing our sophisticated search function, locating the most current Queens New York Seller's Disclosure of Forfeiture Rights for Contract for Deed is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Retrieve the template. Specify the file format and download it to your device.

- Moreover, the validity of each document is confirmed by a team of experienced attorneys who regularly review the templates on our platform and update them in accordance with the latest state and county laws.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Queens New York Seller's Disclosure of Forfeiture Rights for Contract for Deed is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, just follow the steps outlined below.

- Ensure you have accessed the form you need. Review its description and use the Preview option (if available) to view its contents. If it doesn’t satisfy your needs, make use of the Search field at the top of the page to find the required document.

- Confirm your choice. Select the Buy now button. Then, choose your preferred subscription plan and provide details to create an account.

Form popularity

FAQ

New York state law Section 462 requires all sellers to disclose known material defects to buyers, including: Material defects in electrical and other systems. Termite and asbestos conditions. Homeowners' association rules.

This is a statement of certain conditions and information concerning the property known to the seller. This Disclosure Statement is not a warranty of any kind by the seller or by any agent representing the seller in this transaction.

A NY Disclosure Form, more formally called the New York State Disclosure Form for Buyer and Seller, is an agency disclosure form that real estate agents are required to hand out to home buyers and sellers.

The Transfer Disclosure Statement (TDS) is required in the state of California unless the seller (or transferor) meets one of the following conditions: Court-ordered sales such as probate sales, foreclosure sales, sale by bankruptcy trustee, eminent domain.

New York law requires you to disclose known home defects to the buyer. Under today's law, you?as a New York home seller?could be found liable to a buyer for having failed to disclose certain property conditions, or defects, in the course of the sale.

Any ongoing problems with neighbours, including boundary disputes. Any neighbours known to have been served an Anti Social Behaviour Order (ASBO) Whether there have been any known burglaries in the neighbourhood recently. Whether any murders or suicides have occurred in the property recently.

If a property is transferred from one spouse to another during a divorce, no disclosure is required. Similarly, if the property is being transferred along close family lines (even without a divorce), then no disclosure is required. 4. Dwelling.

Transfers made by court order, default, divorce, and by government entities are exempt from the disclosure requirement. Sellers with exempt property should fill out an exemption certificate provided by the Delaware real estate commission.

This disclosure will help you to make informed choices about your relationship with the real estate broker and its sales agents. Throughout the transaction you may receive more than one disclosure form. The law may require each agent assisting in the transaction to present you with this disclosure form.