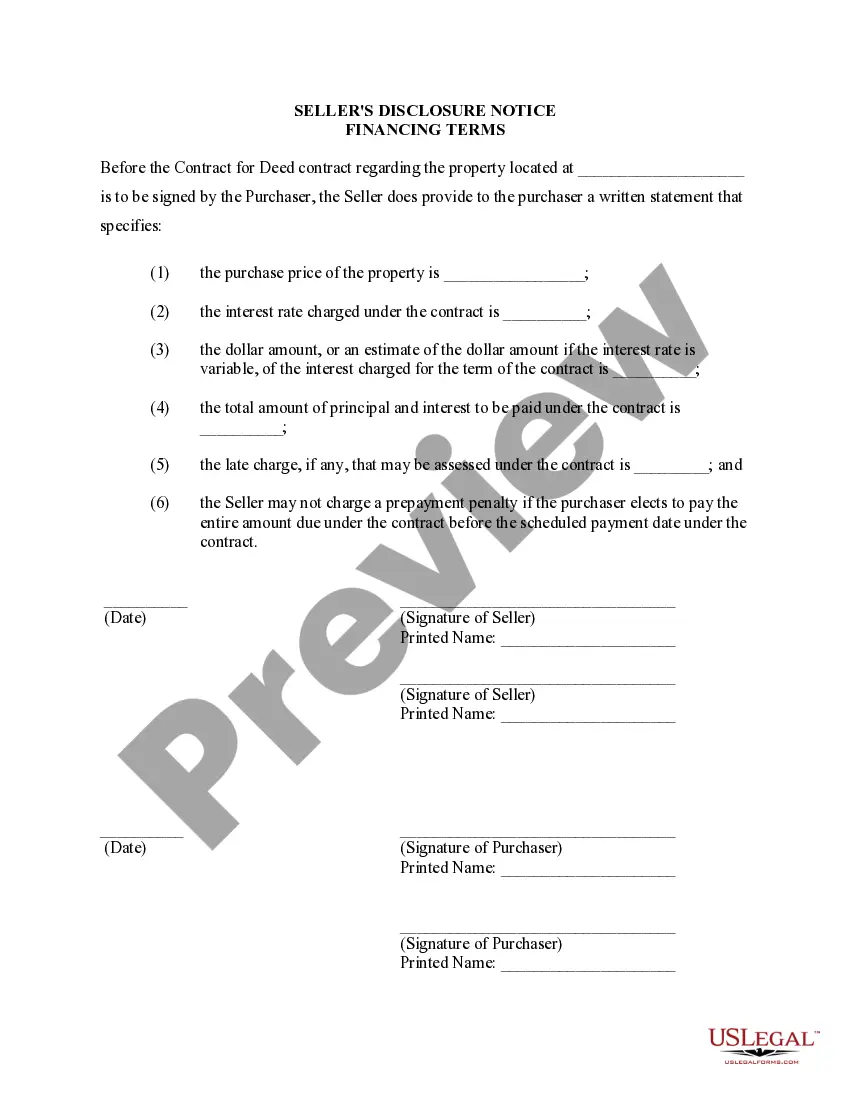

The Suffolk New York Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the financing terms and conditions agreed upon between the seller and buyer in relation to the purchase of a residential property. This disclosure serves to inform both parties about the financial aspects of the transaction and ensures transparency throughout the process. Here are some important details that may be included in the Suffolk New York Seller's Disclosure of Financing Terms for Residential Property: 1. Purchase Price: The disclosure will clearly state the agreed-upon purchase price for the residential property. This figure encompasses the total amount the buyer must pay to acquire ownership. 2. Down Payment: The down payment amount or percentage required by the seller will be outlined. It is important to mention if the down payment is refundable or non-refundable in case the buyer defaults on the agreement. 3. Interest Rate: The disclosure will specify the interest rate applicable to the financing arrangement. It will highlight whether it is a fixed rate or adjustable rate mortgage, and if there are any provisions for rate adjustments over time. 4. Loan Term: The length of the loan term will be stated, indicating the duration in which the buyer must repay the financing amount in full. 5. Financing Terms: All relevant terms and conditions regarding the financing arrangement will be disclosed. These may include, but are not limited to, late payment penalties, prepayment penalties, and any other financial obligations or restrictions imposed on the buyer. 6. Balloon Payments: If the financing agreement includes a balloon payment provision, it will be clearly stated in the disclosure. This indicates whether a significant final payment is required at the end of the loan term. 7. Default and Remedies: The document will outline the consequences and remedies in case of buyer defaults. This may include foreclosure proceedings, potential lawsuits, or any other legal action that the seller may take in the event of non-payment or breach of the agreement. 8. Property Condition: Some versions of the Suffolk New York Seller's Disclosure of Financing Terms for Residential Property may also include clauses related to the property's condition. This could involve disclosures regarding existing damages, repairs needed, or any other relevant information that affects the property's value. Different variations of the Suffolk New York Seller's Disclosure of Financing Terms for Residential Property may exist based on the specific contractual terms agreed upon by the parties involved. However, the common goal of this disclosure remains to ensure transparency, protect the interests of both the buyer and seller, and provide a comprehensive understanding of the financial aspects of the transaction.

Suffolk New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Suffolk New York Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Benefit from the US Legal Forms and have immediate access to any form template you need. Our useful platform with a huge number of document templates allows you to find and obtain almost any document sample you will need. You are able to save, complete, and sign the Suffolk New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract in a few minutes instead of surfing the Net for hours trying to find an appropriate template.

Utilizing our collection is a wonderful strategy to increase the safety of your document filing. Our professional legal professionals on a regular basis check all the documents to ensure that the forms are relevant for a particular region and compliant with new acts and regulations.

How can you get the Suffolk New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions below:

- Open the page with the form you require. Make sure that it is the template you were seeking: check its name and description, and take take advantage of the Preview function when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the downloading process. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Pick the format to get the Suffolk New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract and edit and complete, or sign it for your needs.

US Legal Forms is one of the most significant and reliable document libraries on the web. Our company is always happy to assist you in any legal procedure, even if it is just downloading the Suffolk New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract.

Feel free to benefit from our service and make your document experience as efficient as possible!

Form popularity

FAQ

General property defect disclosure Structural information such as roof condition as well as whether there is any fire, smoke, insect or water damage to the home. Information on the home's age and ownership history. Information on mechanical systems and services like drainage, water source and utilities.

This is a statement of certain conditions and information concerning the property known to the seller. This Disclosure Statement is not a warranty of any kind by the seller or by any agent representing the seller in this transaction.

In New York, sellers must complete and sign their disclosure statement deliver it to a home buyer before a purchase contract is official. In most cases, a buyer will hire an appraiser and inspector to ensure the property is free from other defects.

New York law requires you to disclose known home defects to the buyer. Under today's law, you?as a New York home seller?could be found liable to a buyer for having failed to disclose certain property conditions, or defects, in the course of the sale.

You are required to disclose any known defects on the house to the buyer during the sale process. Knowingly make false claims or omitting material facts about possible defects can result in liability for damages if such omission or misinformation influences the buyer's purchase decision.

Property sellers are usually required to disclose negative information about a property. It is usually wise to always disclose issues with your home, whether you are legally bound to or not. The seller must follow local, state, and federal laws regarding disclosures when selling their home.

What Do House Sellers Have to Disclose? The main point to bear in mind is that you need to be honest and disclose all known information about the property, both positive and negative. Secrecy and deceit are not permitted under any circumstances and may even lead to prosecution.

If a property is transferred from one spouse to another during a divorce, no disclosure is required. Similarly, if the property is being transferred along close family lines (even without a divorce), then no disclosure is required. 4. Dwelling.