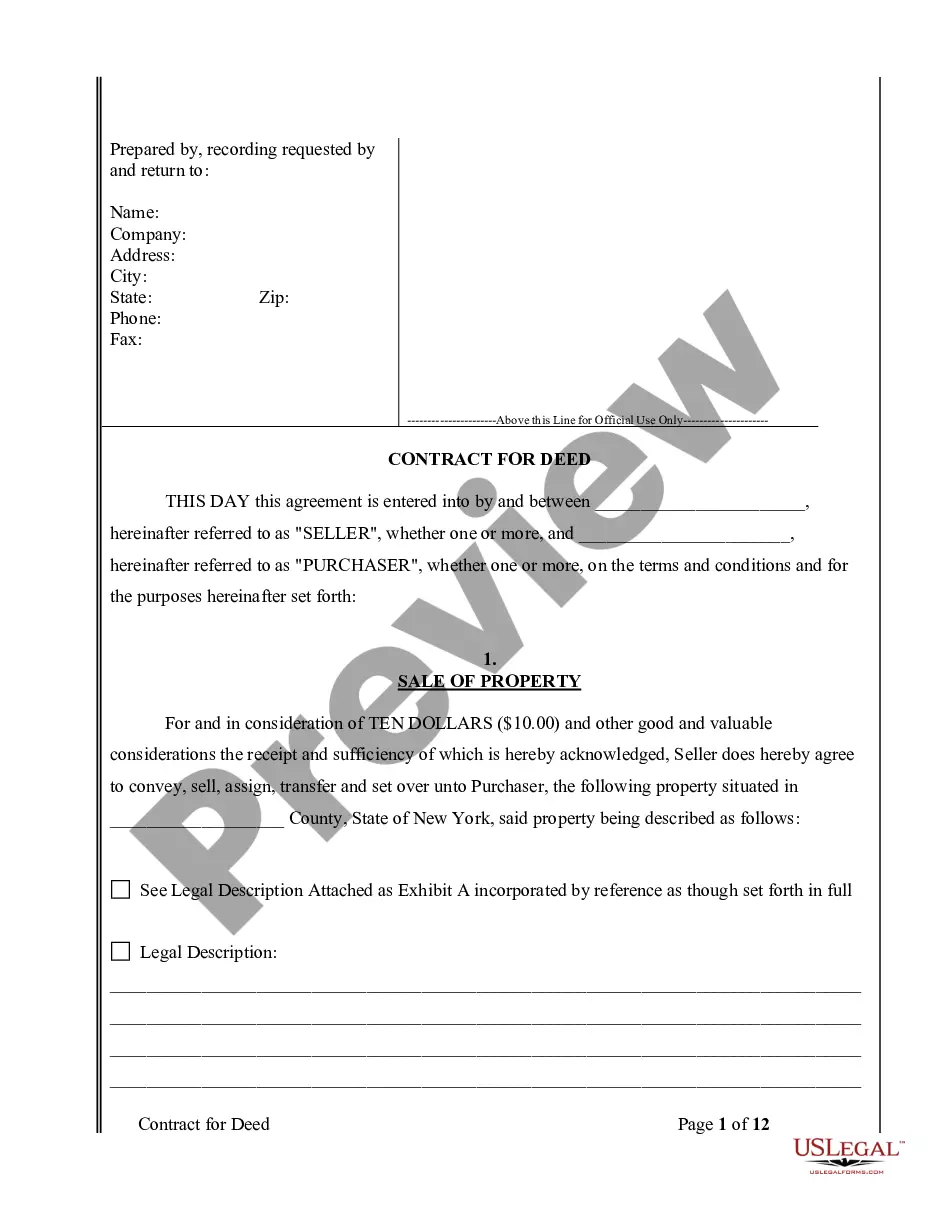

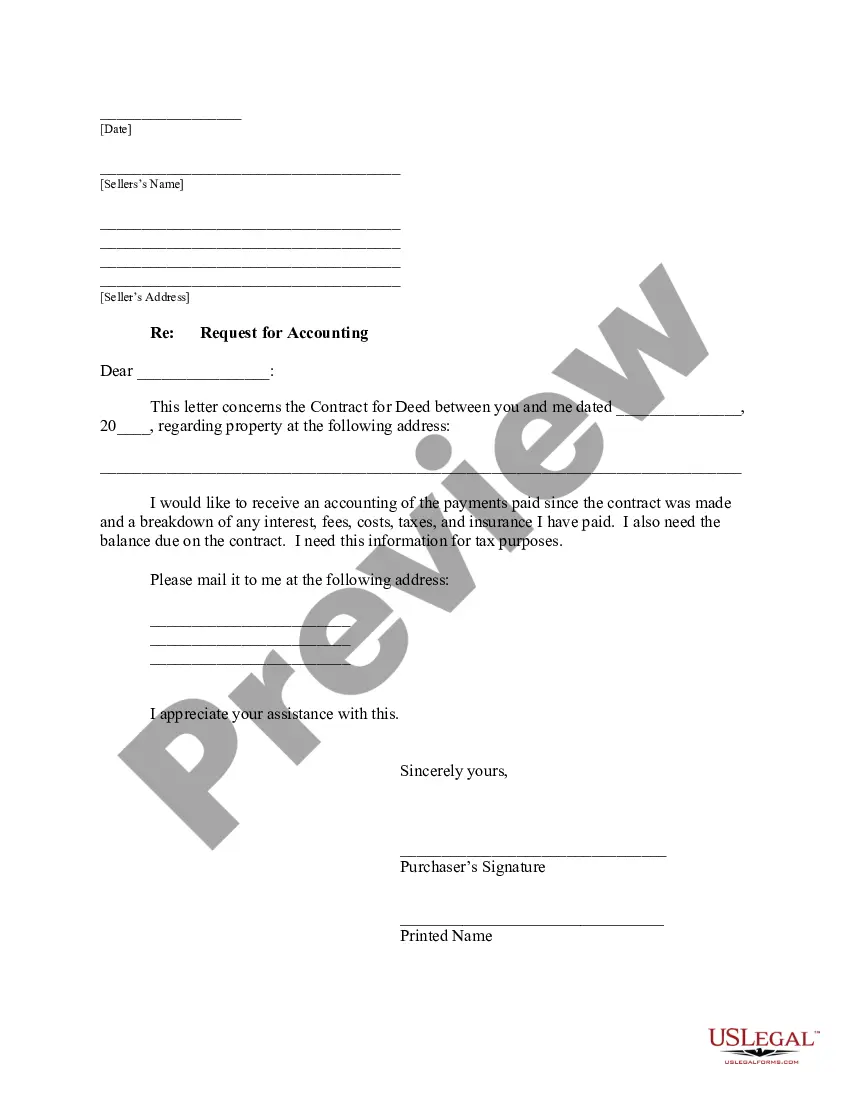

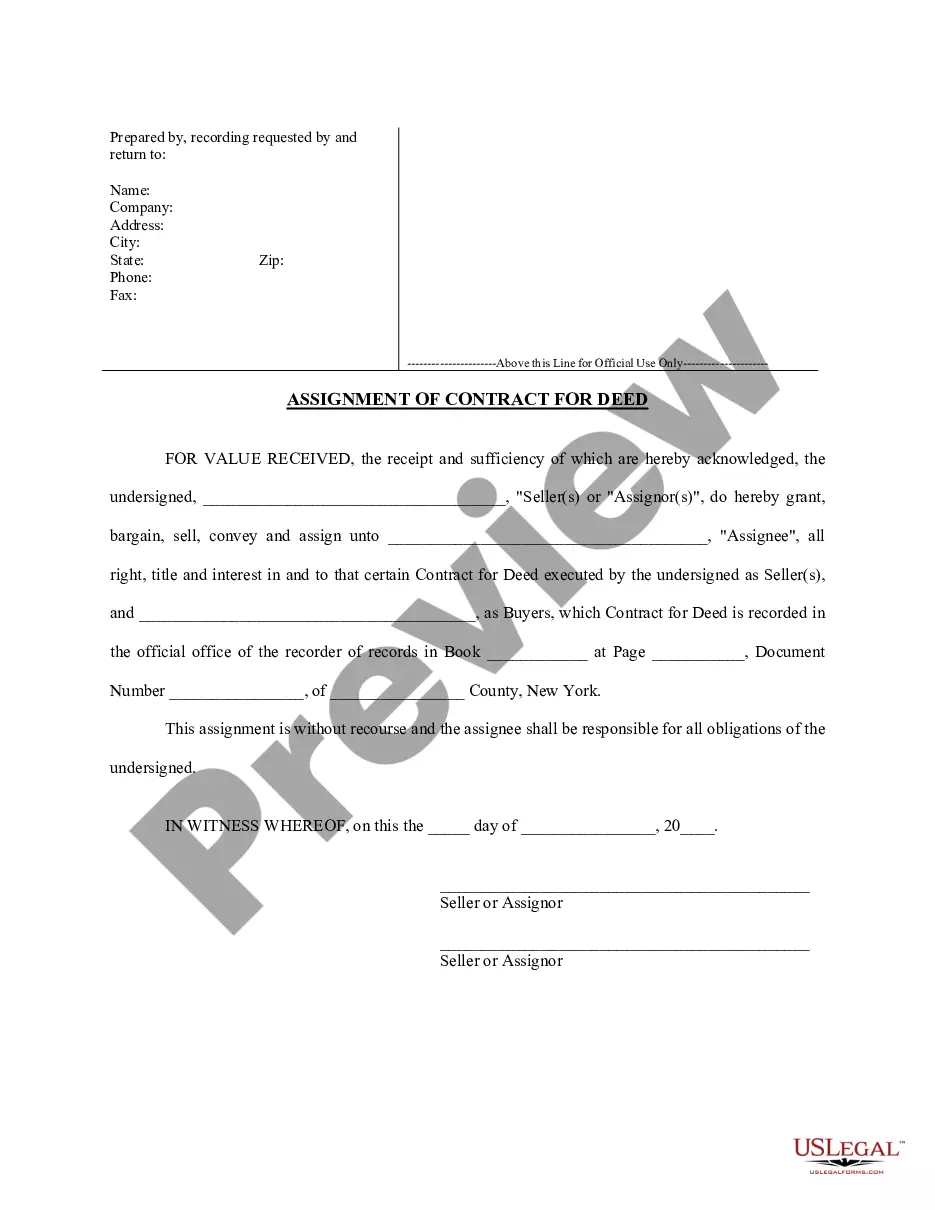

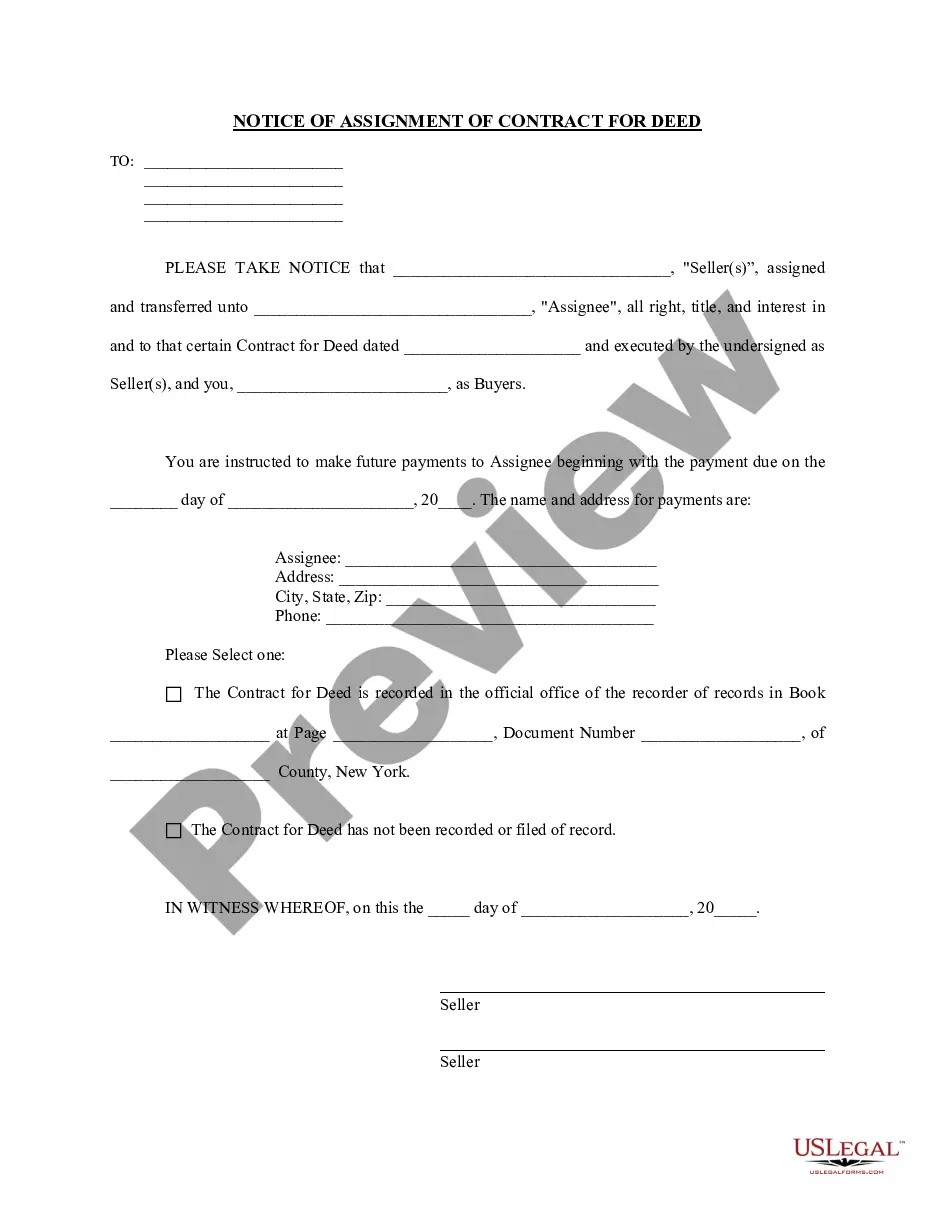

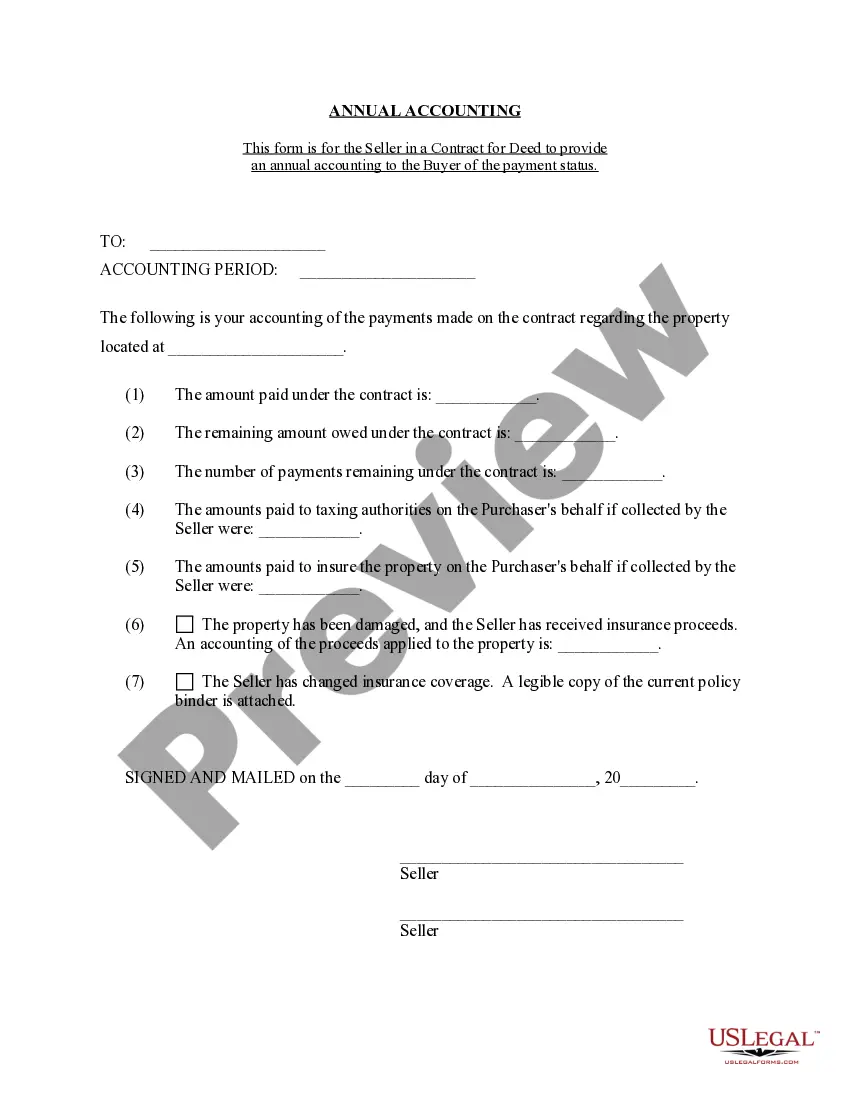

The Bronx New York Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial details and transactions related to a contract for deed arrangement in the Bronx, New York. This statement provides a comprehensive overview of the income and expenses associated with the contract, ensuring transparency and accountability between the seller and buyer. In the Bronx, New York, there are several types of Contract for Deed Seller's Annual Accounting Statements depending on the specific terms and conditions of the contract. Some common variations include: 1. Basic Accounting Statement: This type of statement includes essential financial information such as the total sales price, down payment received, principal amount remaining, and interest accrued during the accounting period. It also details any penalties or fees incurred by the buyer. 2. Detailed Income and Expense Statement: This type of statement provides a more comprehensive breakdown of income and expenses related to the contract for deed. It includes details about the monthly installments received, interest earned, property taxes paid by the seller, insurance costs, and maintenance expenses incurred. 3. Capital Gain or Loss Statement: If the seller decides to sell the property during the accounting period, this statement highlights the capital gain or loss realized. It includes information such as the purchase price, sales price, cost of improvements made by the seller, and any expenses associated with the property's sale. 4. Tax Deduction Statement: This type of accounting statement focuses on the tax-related aspects of the contract for deed. It includes information about deductible expenses such as mortgage interest, property taxes, and specific tax credits related to the property. 5. Depreciation Schedule: In cases where the seller claims depreciation on the property, this statement outlines the calculated depreciation amount for each accounting period. It helps track the value of the property over time and mitigate tax liability for the seller. Each Bronx New York Contract for Deed Seller's Annual Accounting Statement is personalized to reflect the specific terms and conditions agreed upon by the parties involved. It serves as a vital tool for monitoring financial progress, ensuring compliance, and maintaining a transparent relationship between the seller and the buyer throughout the tenure of the contract for deed.

Bronx New York Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Bronx New York Contract For Deed Seller's Annual Accounting Statement?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal services that, usually, are extremely expensive. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Bronx New York Contract for Deed Seller's Annual Accounting Statement or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Bronx New York Contract for Deed Seller's Annual Accounting Statement adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Bronx New York Contract for Deed Seller's Annual Accounting Statement is proper for you, you can select the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!