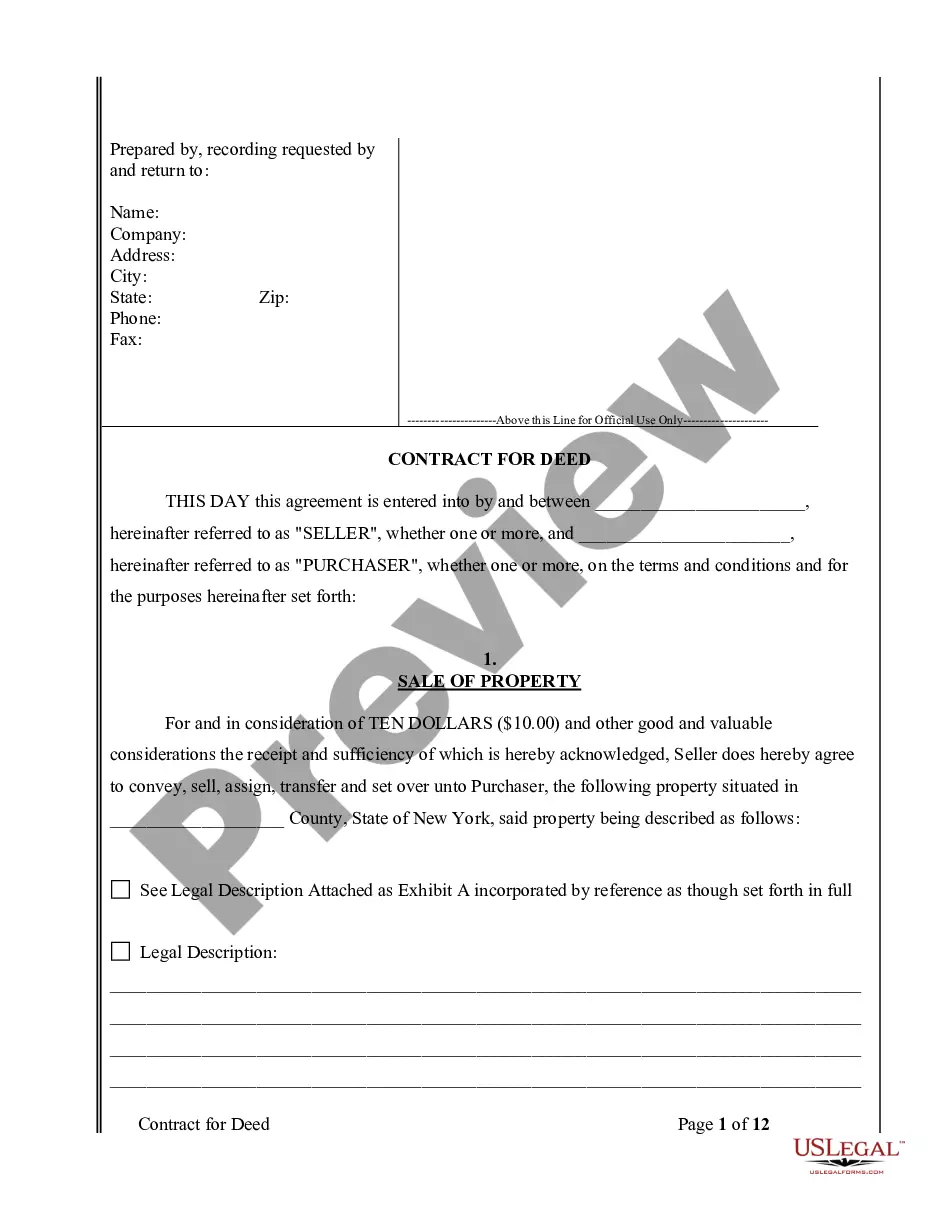

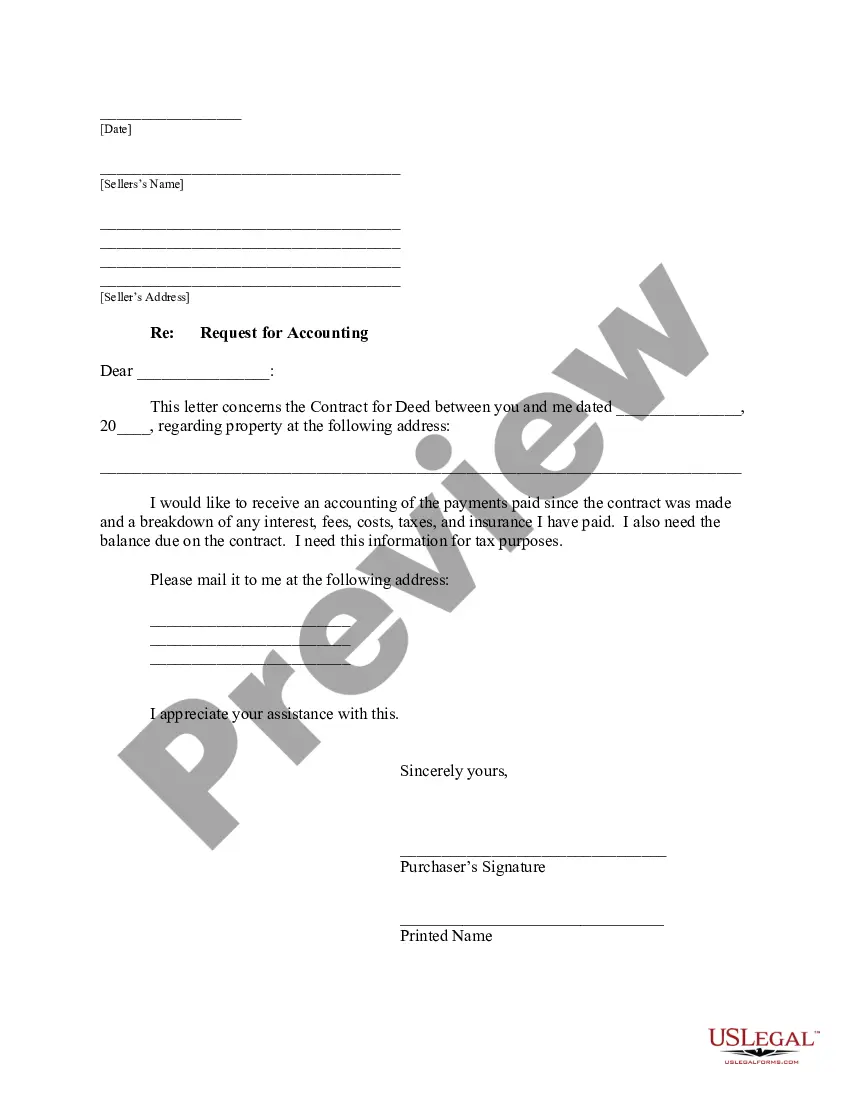

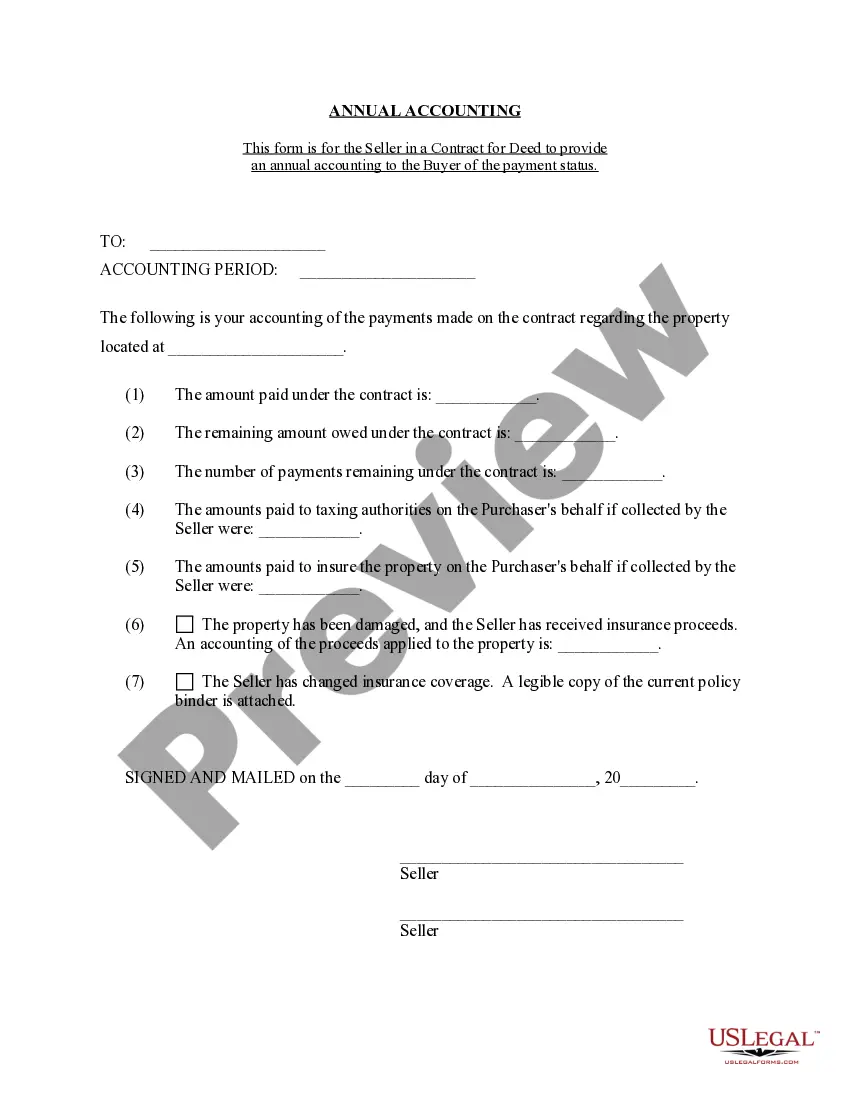

Bronx New York Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out New York Contract For Deed Seller's Annual Accounting Statement?

We consistently work to reduce or avert legal harm when handling intricate law-related or financial matters.

To achieve this, we request legal services that are often exceedingly costly.

Nevertheless, not all legal issues are equally intricate.

A majority of them can be managed independently.

Utilize US Legal Forms whenever you need to obtain and download the Bronx New York Contract for Deed Seller's Annual Accounting Statement or any other document quickly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to take control of your affairs without relying on legal counsel.

- We provide access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, significantly easing the search process.

Form popularity

FAQ

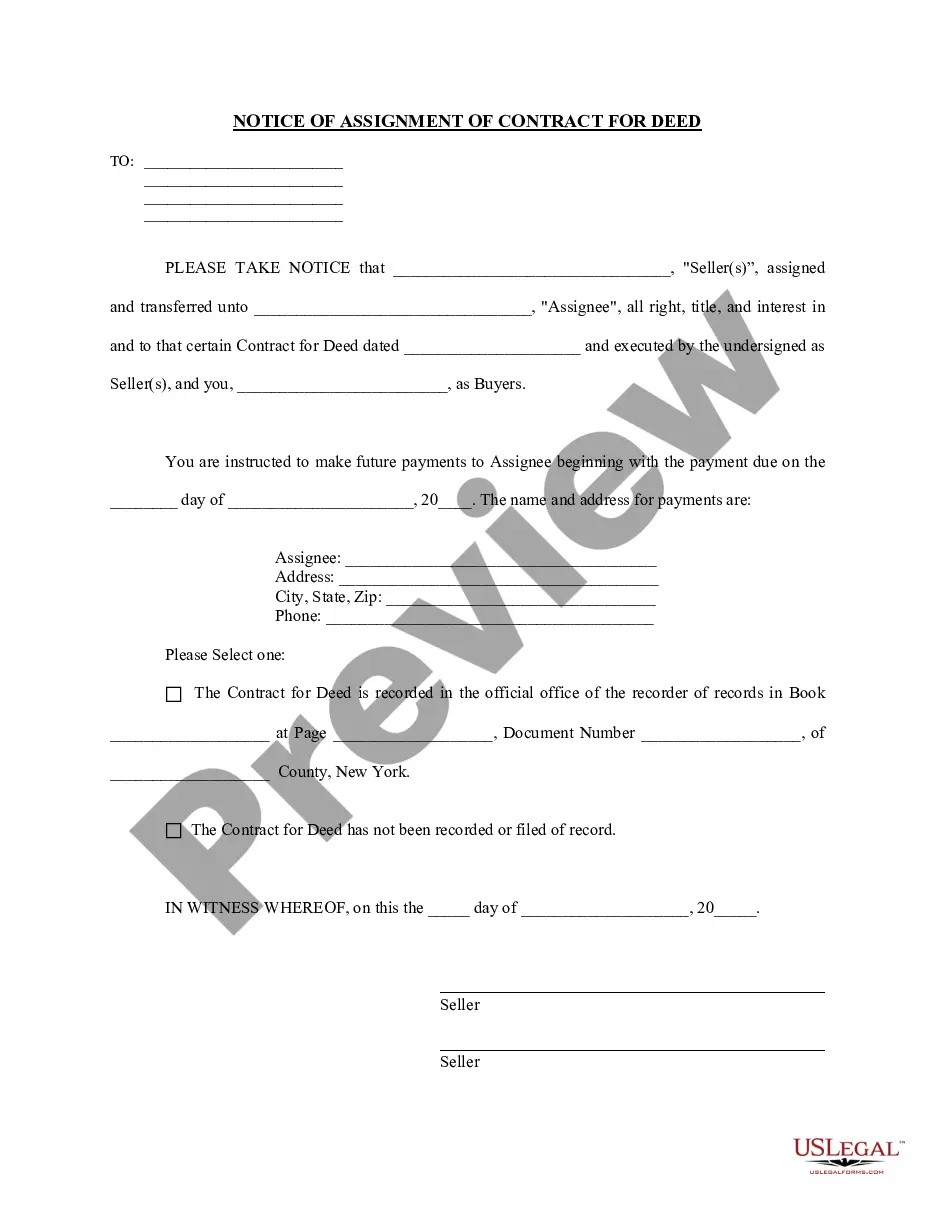

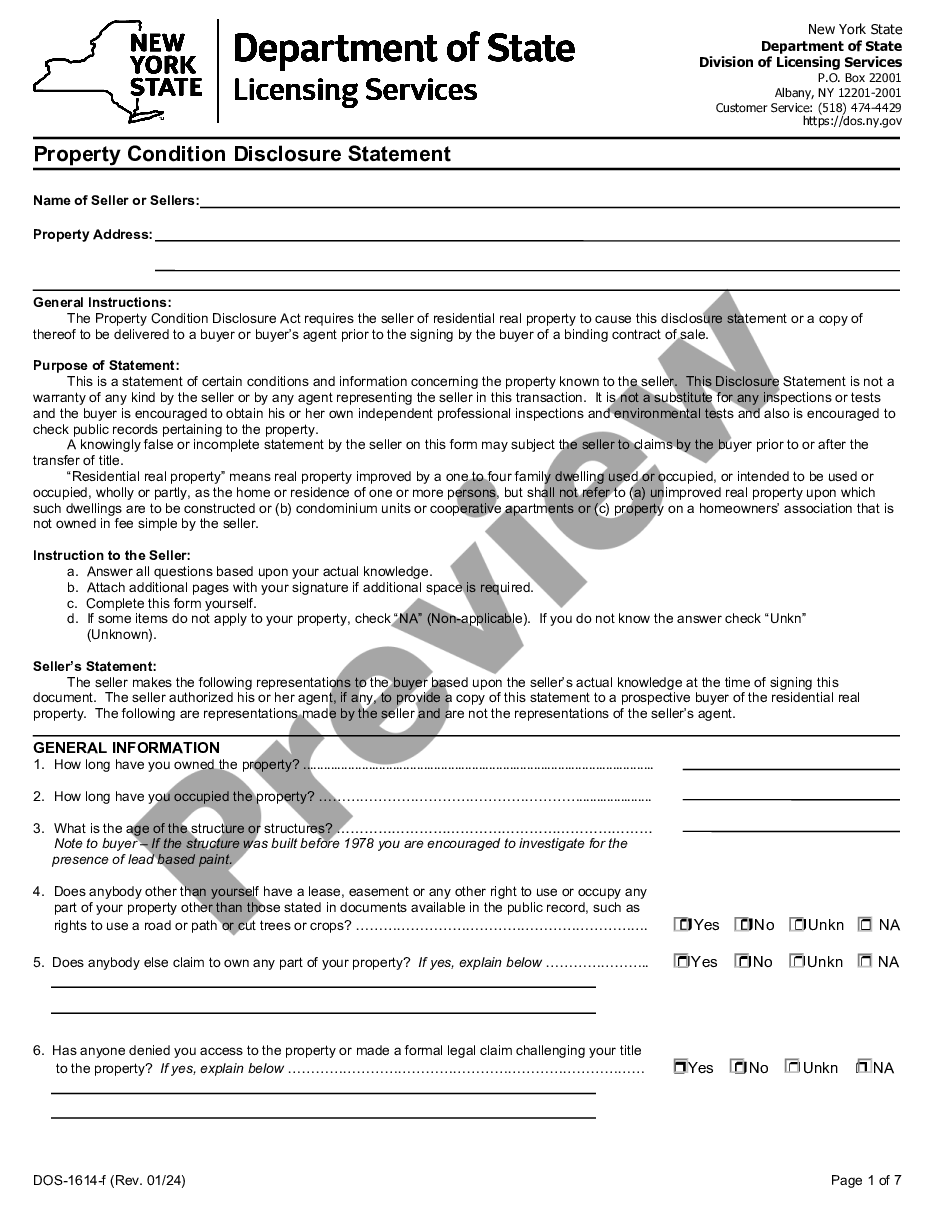

NY residents can usually find property records at their local county recorder's office. However, a county might sometimes store property deeds with the county clerk. The researcher must identify which office is responsible for managing and disseminating property records and then visit the office to request the records.

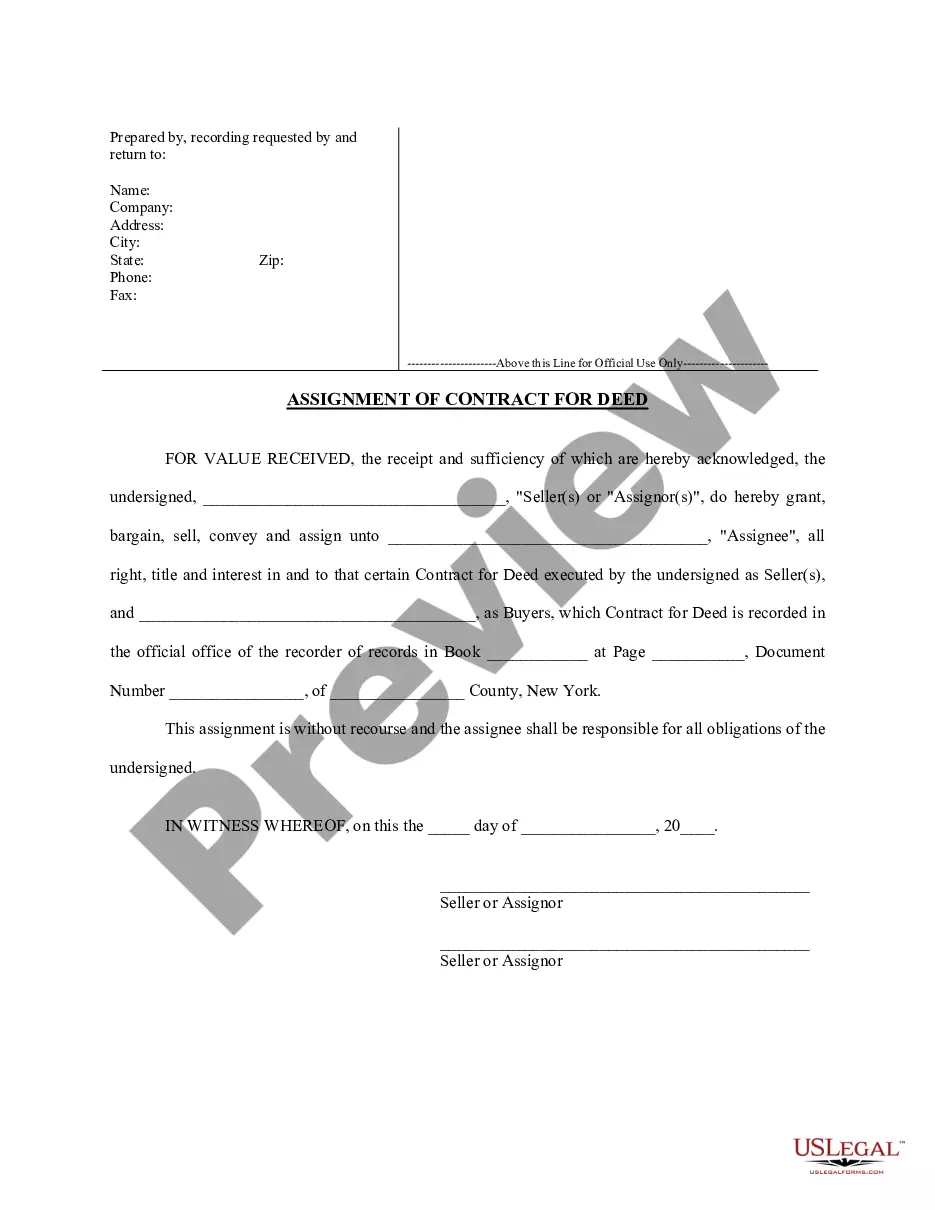

In order to fully protect the buyer's interest, the deed must be recorded at the office of the clerk of the county where the land is located. Recording the deed puts everyone on notice of the deed.

In order to fully protect the buyer's interest, the deed must be recorded at the office of the clerk of the county where the land is located. Recording the deed puts everyone on notice of the deed.

Land conveyances (deeds and mortgages) are recorded in the county clerks' offices or in the New York City Register's Office. Recording of deeds became mandatory statewide in 1823.

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

You can record property-related documents in person or online. To register a document, you must create a cover page in ACRIS, and submit document, supporting documents, and pay fees and taxes (if necessary). Learn more about recording documents, including required documentation and fees online.

The recorder is an official appointed to the county and serves the role of preparing, recording, and submitting documents. There is one recorder per county, and the buyer must record the deed at the recorder's office in the county in which the purchased property is situated.

The Office of the City Register records and maintains all property-related documents including deeds, mortgages and leases for every borough except for Staten Island.

A good attorney will typically file paperwork a day or two after the closing. The city will usually record the sale one to two weeks later. However, this can sometimes take longer, and in some cases can take several months.