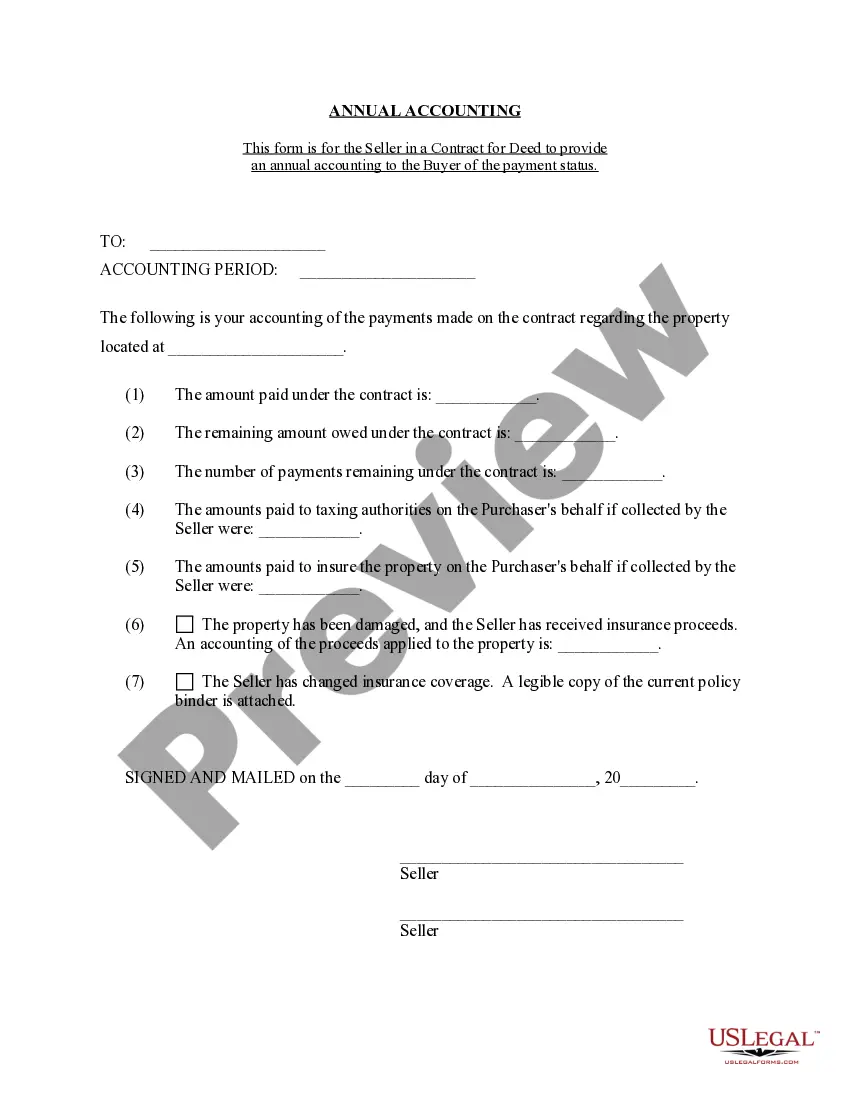

Nassau New York Contract for Deed Seller's Annual Accounting Statement

Category:

State:

New York

County:

Nassau

Control #:

NY-00470-4

Format:

Word;

Rich Text

Instant download

Description

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

How to fill out New York Contract For Deed Seller's Annual Accounting Statement?

If you are looking for a legitimate form template, it’s exceptionally challenging to find a more user-friendly service than the US Legal Forms website – arguably the most extensive online collections.

With this collection, you can obtain a multitude of document samples for business and personal purposes sorted by categories and areas, or keywords.

Thanks to the high-quality search feature, locating the most recent Nassau New York Contract for Deed Seller's Annual Accounting Statement is as simple as 1-2-3.

Execute the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the form. Choose the format and save it to your device.

- In addition, the accuracy of each document is validated by a team of professional attorneys who routinely review the templates on our site and update them in line with the latest state and county rules.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Nassau New York Contract for Deed Seller's Annual Accounting Statement is to Log In to your account and press the Download button.

- If this is your first time using US Legal Forms, simply adhere to the guidelines below.

- Ensure you have located the form you desire. Review its description and utilize the Preview option to view its contents. If it doesn’t fulfill your requirements, employ the Search function near the top of the page to find the necessary file.

- Verify your choice. Hit the Buy now button. Following that, choose your desired subscription plan and provide information to register for an account.