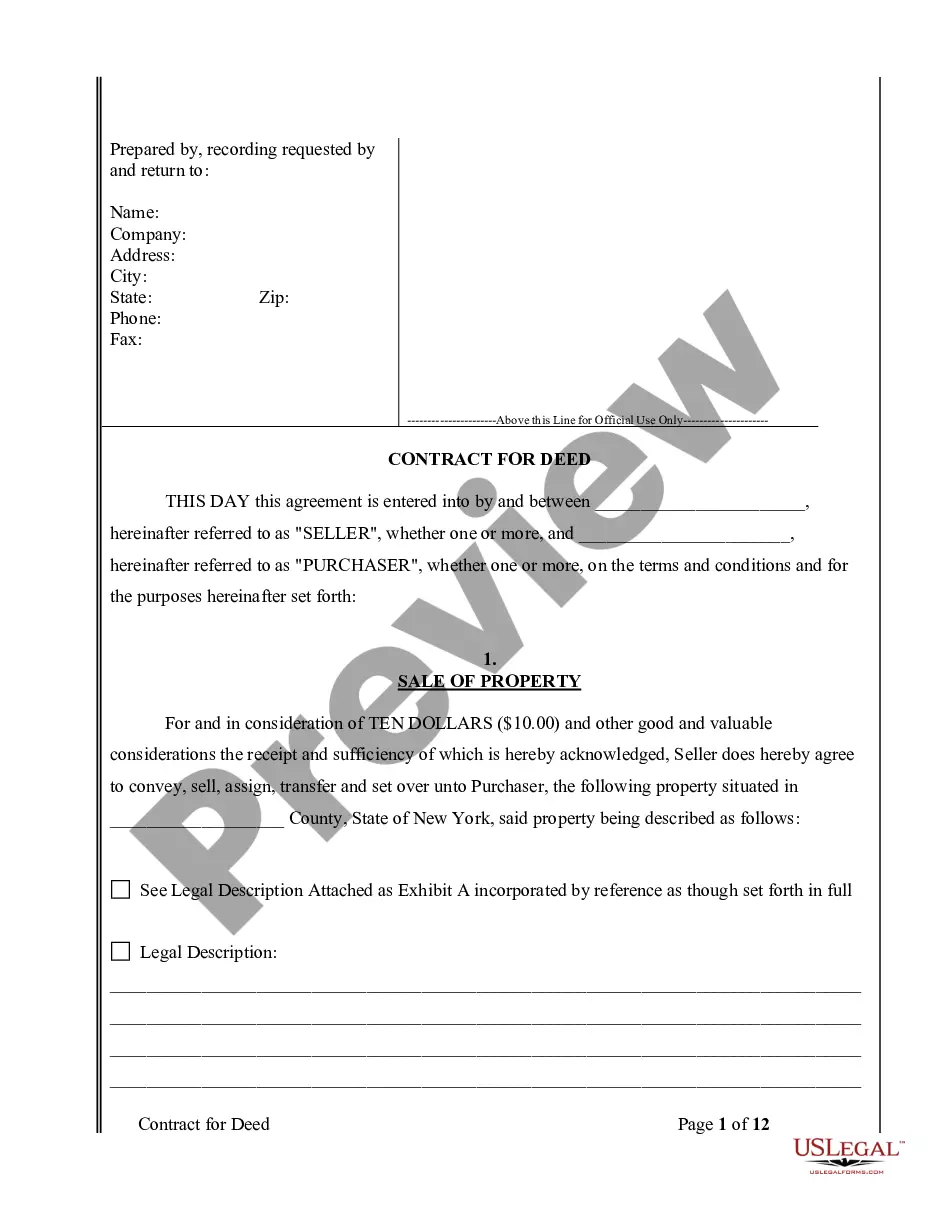

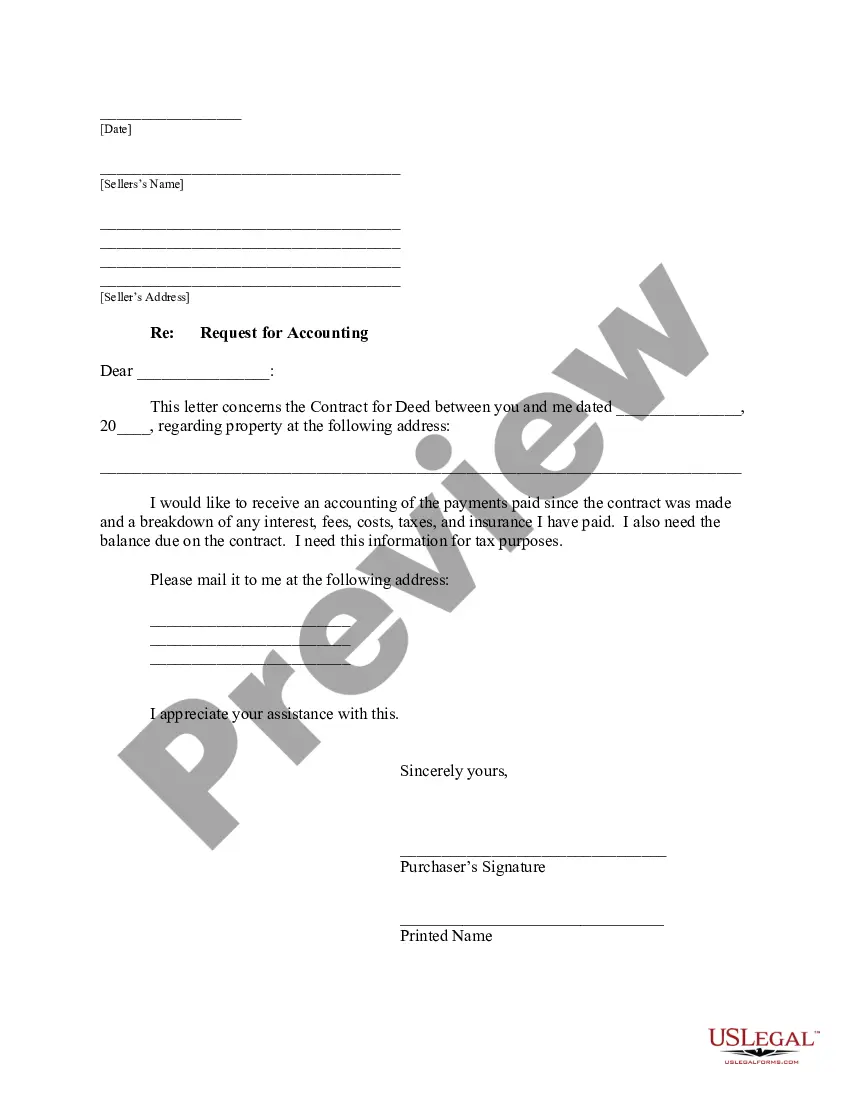

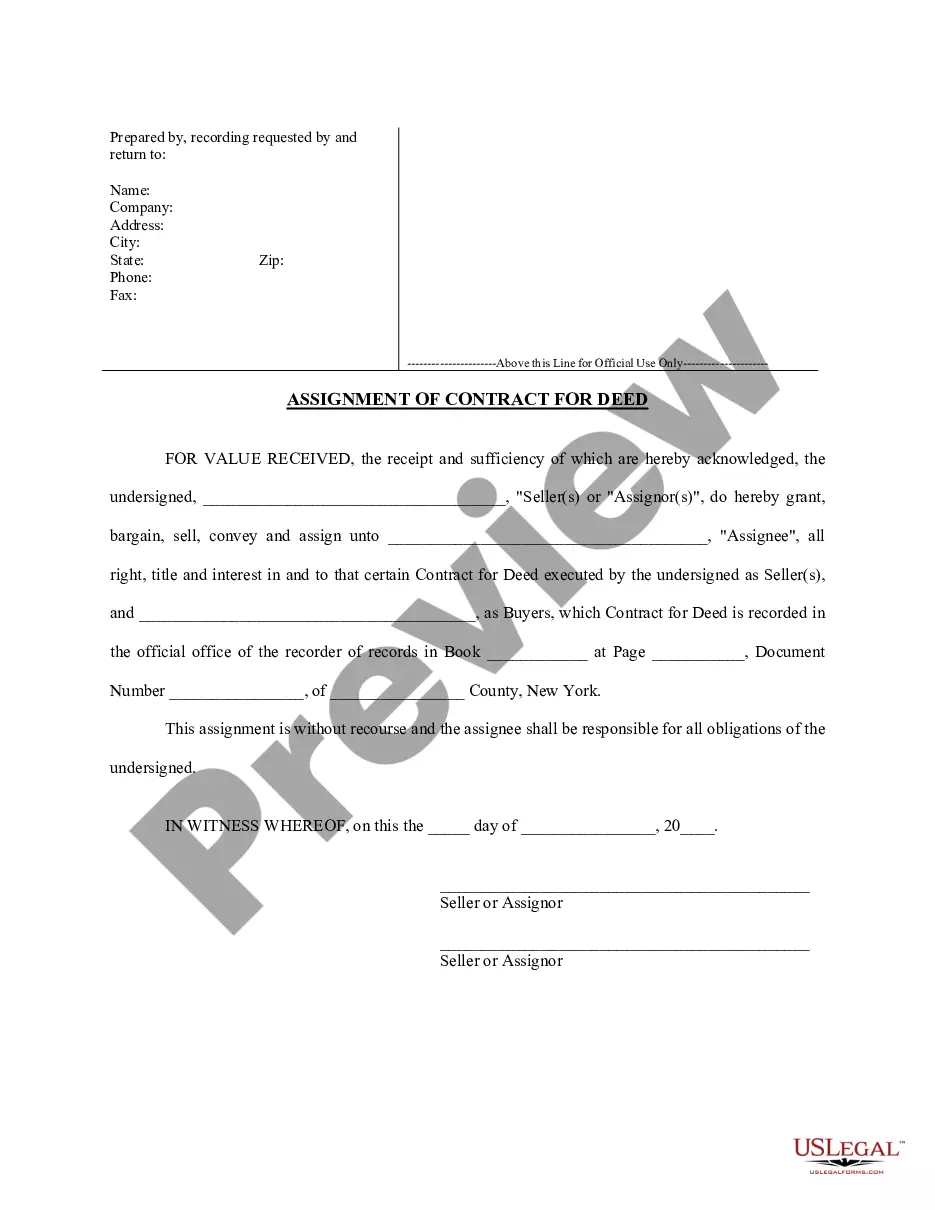

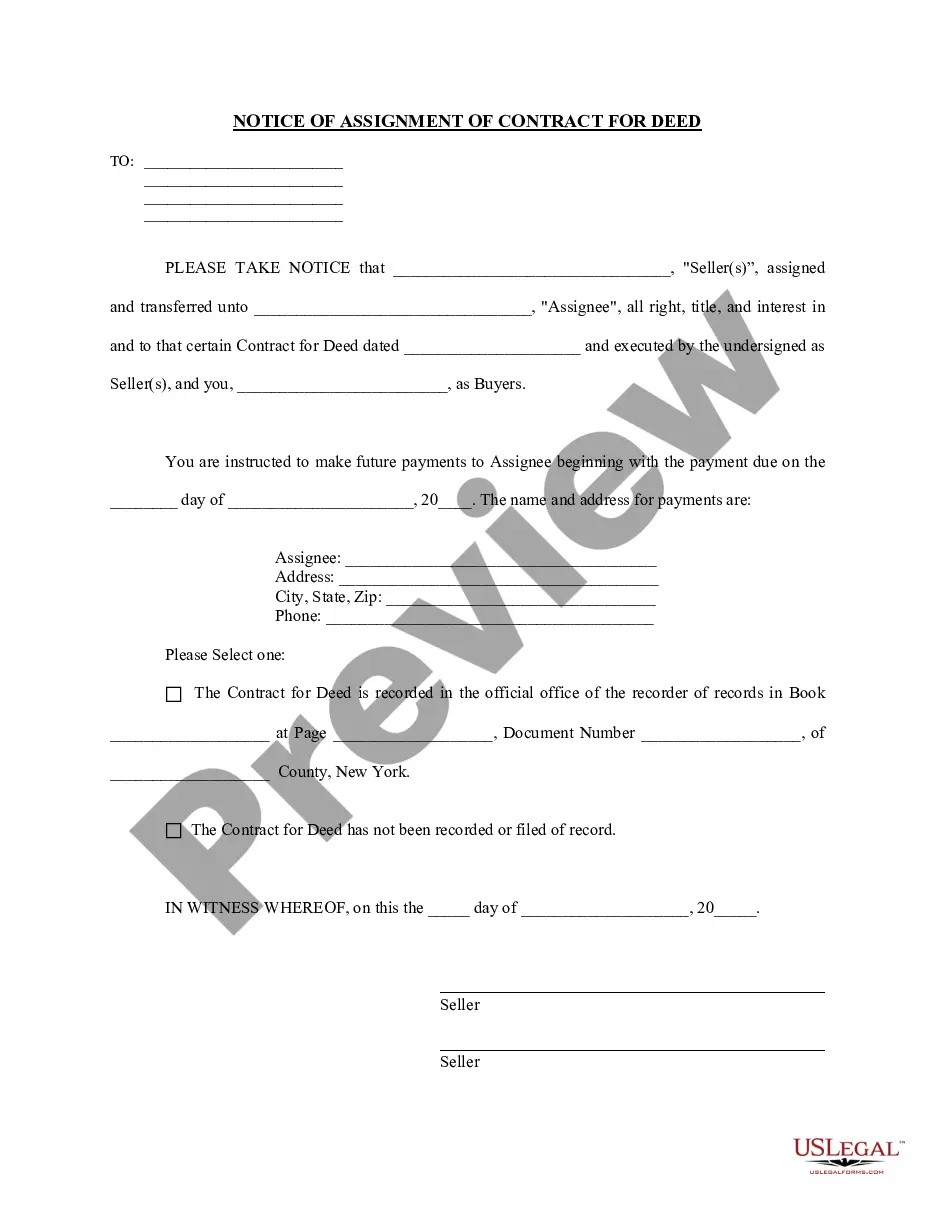

Queens New York Contract for Deed Seller's Annual Accounting Statement is a document that provides a detailed overview of the financial transactions and expenses involved in a contract for deed agreement in Queens, New York. It serves as a formal record of the seller's financial activities related to the property and ensures transparency and accountability. Keywords: Queens New York, contract for deed, seller, annual accounting statement, financial transactions, expenses, property, transparency, accountability. Types of Queens New York Contract for Deed Seller's Annual Accounting Statement: 1. Basic Annual Accounting Statement: This type of statement provides a comprehensive summary of the seller's income and expenses associated with the contract for deed arrangement. It includes details of the property's rental or mortgage payments, property taxes, insurance expenses, repairs and maintenance costs, and any other relevant financial transactions. 2. Detailed Income Statement: This variation of the annual accounting statement emphasizes the seller's income sources derived from the contract for deed property. It outlines the rental income generated, interest on the contract payments, late fees received, and any other revenue associated with the agreement. This statement helps in understanding the profitability of the contract for deed arrangement. 3. Expense Breakdown Statement: The expense breakdown statement focuses primarily on the seller's expenditure related to the property. It provides an itemized list of various expenses, such as property taxes, insurance premiums, repairs and maintenance, utilities, advertising costs, property management fees, and any other relevant expenses. This statement assists both the seller and the buyer in evaluating the financial implications of the contract for deed agreement. 4. Property Improvement Statement: In some cases, the seller may make significant improvements or renovations to the property during the contract for deed term. A property improvement statement highlights these enhancements and outlines the associated costs incurred by the seller. It helps in assessing the overall value of the property and can be used as a reference during negotiations or future transactions. 5. Tax Deduction Statement: This type of annual accounting statement specifically focuses on documenting the seller's tax deductions related to the contract for deed property. It outlines eligible expenses that can be claimed as deductions, such as mortgage interest, property taxes, insurance premiums, repairs, and capital improvements. This statement serves as a valuable record for tax purposes and can be used to optimize tax planning and reporting. Note: The specific type of Queens New York Contract for Deed Seller's Annual Accounting Statement may vary based on the contractual terms, individual preferences, and legal requirements.

Queens New York Contract for Deed Seller's Annual Accounting Statement

Description

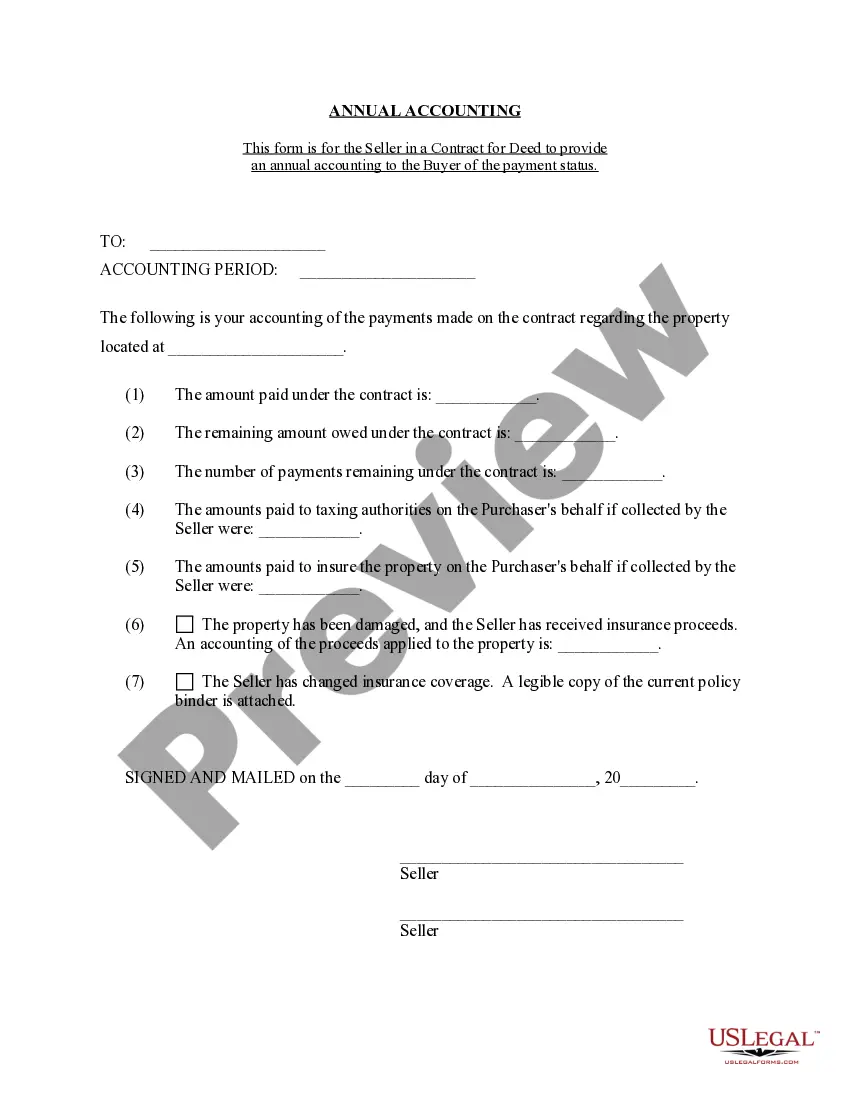

How to fill out Queens New York Contract For Deed Seller's Annual Accounting Statement?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Queens New York Contract for Deed Seller's Annual Accounting Statement becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Queens New York Contract for Deed Seller's Annual Accounting Statement takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Queens New York Contract for Deed Seller's Annual Accounting Statement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!