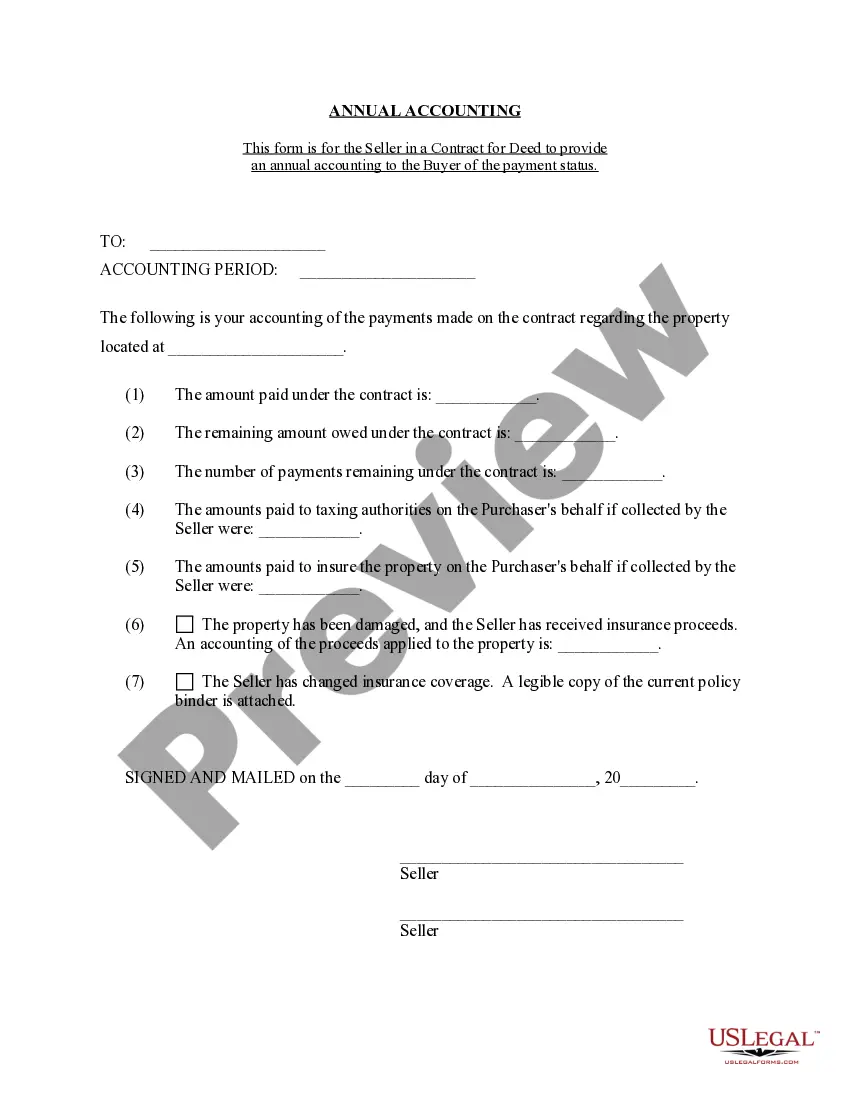

The Rochester New York Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and records of a property seller who has finalized a contract for deed in Rochester, New York. This statement serves as a comprehensive record of all financial activities related to the contract, ensuring transparency and accountability between the seller and buyer. The Rochester New York Contract for Deed Seller's Annual Accounting Statement typically includes various essential details, such as the total purchase price, down payment amount, terms of the contract, and the principal balance on the property. Additionally, it will encompass the amount of interest charged, the total repayment amount received from the buyer, and any incurred fees or charges throughout the year. Moreover, this statement outlines the specific transaction dates, including the beginning and ending accounting periods, enabling the seller to accurately present all financial activities that have occurred during this time. It provides a clear breakdown of the monthly payments received from the buyer, highlighting the proportion allocated towards the principal balance reduction and the interest payment. Furthermore, the Rochester New York Contract for Deed Seller's Annual Accounting Statement distinguishes between various types of charges applied to the contract. These might include taxes, insurance premiums, maintenance fees, or any other expenses agreed upon in the contract. Each cost will be documented separately, ensuring clarity and comprehension for both parties. In regard to different types of Rochester New York Contract for Deed Seller's Annual Accounting Statement, they mainly vary based on the specific terms and conditions agreed upon between the seller and buyer. For instance, there might be statements that focus solely on rental properties, lease-to-own agreements, or specific payment structures tailored to individual circumstances. In conclusion, the Rochester New York Contract for Deed Seller's Annual Accounting Statement is a comprehensive document that provides a transparent record of financial transactions and activities related to a contract for deed. By utilizing this statement, both seller and buyer can ensure accuracy, accountability, and clarity regarding the property's financial aspects.

Rochester New York Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Rochester New York Contract For Deed Seller's Annual Accounting Statement?

If you are looking for a valid form template, it’s difficult to choose a better platform than the US Legal Forms website – probably the most comprehensive libraries on the web. Here you can find a huge number of templates for organization and personal purposes by types and regions, or keywords. With our high-quality search feature, finding the newest Rochester New York Contract for Deed Seller's Annual Accounting Statement is as elementary as 1-2-3. Additionally, the relevance of each and every record is confirmed by a group of professional lawyers that on a regular basis check the templates on our platform and revise them according to the newest state and county demands.

If you already know about our platform and have a registered account, all you need to receive the Rochester New York Contract for Deed Seller's Annual Accounting Statement is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the form you want. Read its explanation and utilize the Preview option to explore its content. If it doesn’t meet your needs, use the Search field at the top of the screen to get the appropriate document.

- Affirm your choice. Click the Buy now option. After that, select your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the template. Select the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the received Rochester New York Contract for Deed Seller's Annual Accounting Statement.

Each template you save in your user profile does not have an expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to get an additional copy for modifying or printing, you can come back and export it once more at any moment.

Take advantage of the US Legal Forms professional library to get access to the Rochester New York Contract for Deed Seller's Annual Accounting Statement you were looking for and a huge number of other professional and state-specific templates in a single place!