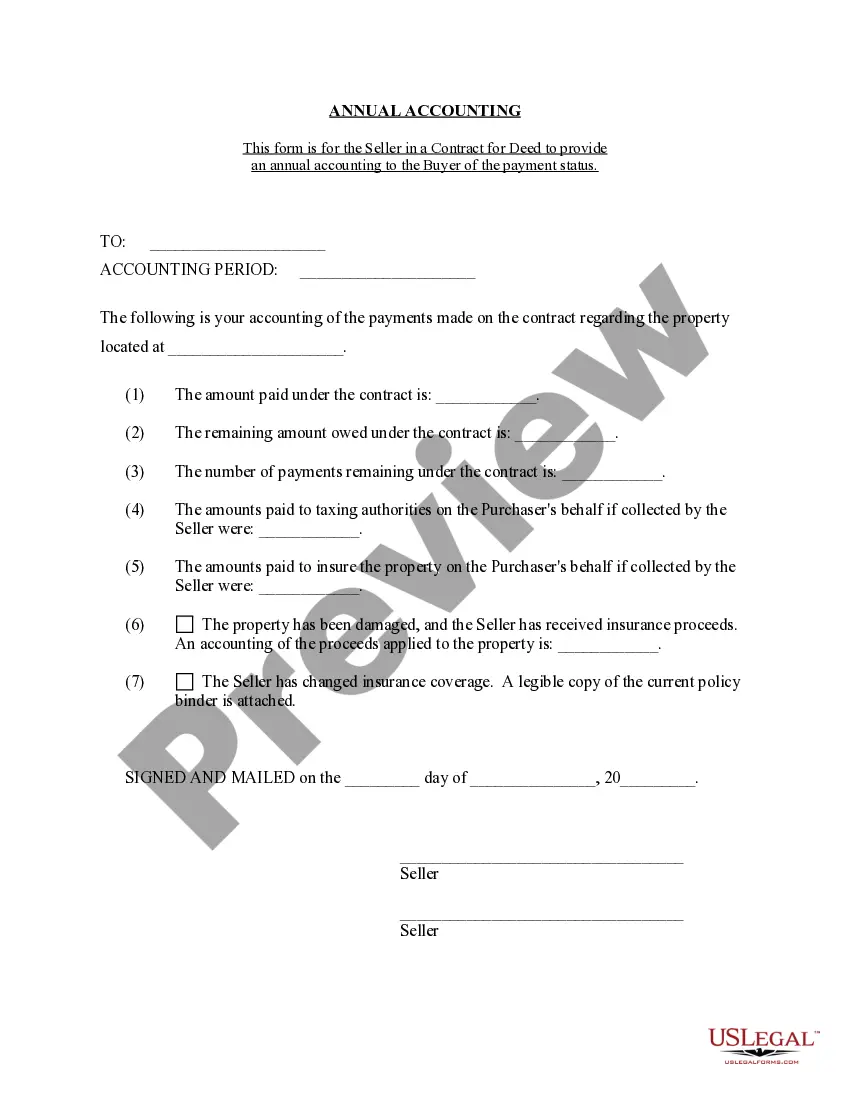

Syracuse New York Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive summary of financial transactions and activities between a contract-for-deed seller and buyer in Syracuse, New York. This statement serves as an annual record of the financial performance of the contract for deed agreement and allows both parties to assess the progress and obligations associated with the contract. Key elements included in the Syracuse New York Contract for Deed Seller's Annual Accounting Statement are: 1. Financial Summary: The statement begins with a financial summary, presenting the total amount received from the buyer over the year and any outstanding payments yet to be received. 2. Payment Breakdown: It further breaks down the payments received, highlighting principal payments, interest, penalties (if applicable), and any other relevant charges or fees associated with the contract for deed. 3. Tax and Insurance Payments: The statement also includes a section outlining the property tax and insurance payments made by the seller on behalf of the buyer. This ensures transparency and clarifies the allocation of expenses. 4. Escrow Account Details: If an escrow account has been established, the statement provides an overview of any funds held in escrow and any disbursements made from the account during the stated period. 5. Maintenance and Repairs: In some instances, the contract for deed may specify the seller's responsibility for certain maintenance or repair costs. The accounting statement may include a section that outlines these expenditures and their impact on the overall financial status. 6. Outstanding Balances or Arrears: If there are any outstanding balances or delayed payments from the buyer, the statement highlights these, along with any late fees or penalties incurred. Overall, the Syracuse New York Contract for Deed Seller's Annual Accounting Statement ensures transparency and fosters a healthy buyer-seller relationship by providing a thorough overview of financial transactions. These statements facilitate clear communication, allowing both parties to address any concerns or discrepancies promptly. Types of Syracuse New York Contract for Deed Seller's Annual Accounting Statements may include: 1. Basic Annual Accounting Statement: This type of statement covers the essential financial elements, including payment breakdown, tax and insurance payments, and outstanding balances or arrears. 2. Comprehensive Annual Accounting Statement: In addition to the components covered in the basic statement, this document includes a detailed breakdown of escrow account activity, maintenance and repair expenses, and any other financial aspects outlined in the contract for deed agreement. Effective record-keeping and comprehensive accounting statements are vital for maintaining a harmonious relationship between contract-for-deed sellers and buyers in Syracuse, New York. These statements provide a clear snapshot of the financial position and obligations of both parties, ensuring transparency and accountability throughout the duration of the contract.

Syracuse New York Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Syracuse New York Contract For Deed Seller's Annual Accounting Statement?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone with no legal education to create this sort of papers cfrom the ground up, mainly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our service offers a huge collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to save time using our DYI forms.

Whether you want the Syracuse New York Contract for Deed Seller's Annual Accounting Statement or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Syracuse New York Contract for Deed Seller's Annual Accounting Statement quickly using our trustworthy service. In case you are already a subscriber, you can go ahead and log in to your account to get the needed form.

However, if you are unfamiliar with our platform, make sure to follow these steps prior to downloading the Syracuse New York Contract for Deed Seller's Annual Accounting Statement:

- Be sure the form you have chosen is specific to your location since the rules of one state or county do not work for another state or county.

- Review the document and read a brief description (if available) of cases the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start again and look for the needed form.

- Click Buy now and choose the subscription option that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Choose the payment method and proceed to download the Syracuse New York Contract for Deed Seller's Annual Accounting Statement as soon as the payment is through.

You’re good to go! Now you can go ahead and print out the document or fill it out online. In case you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.