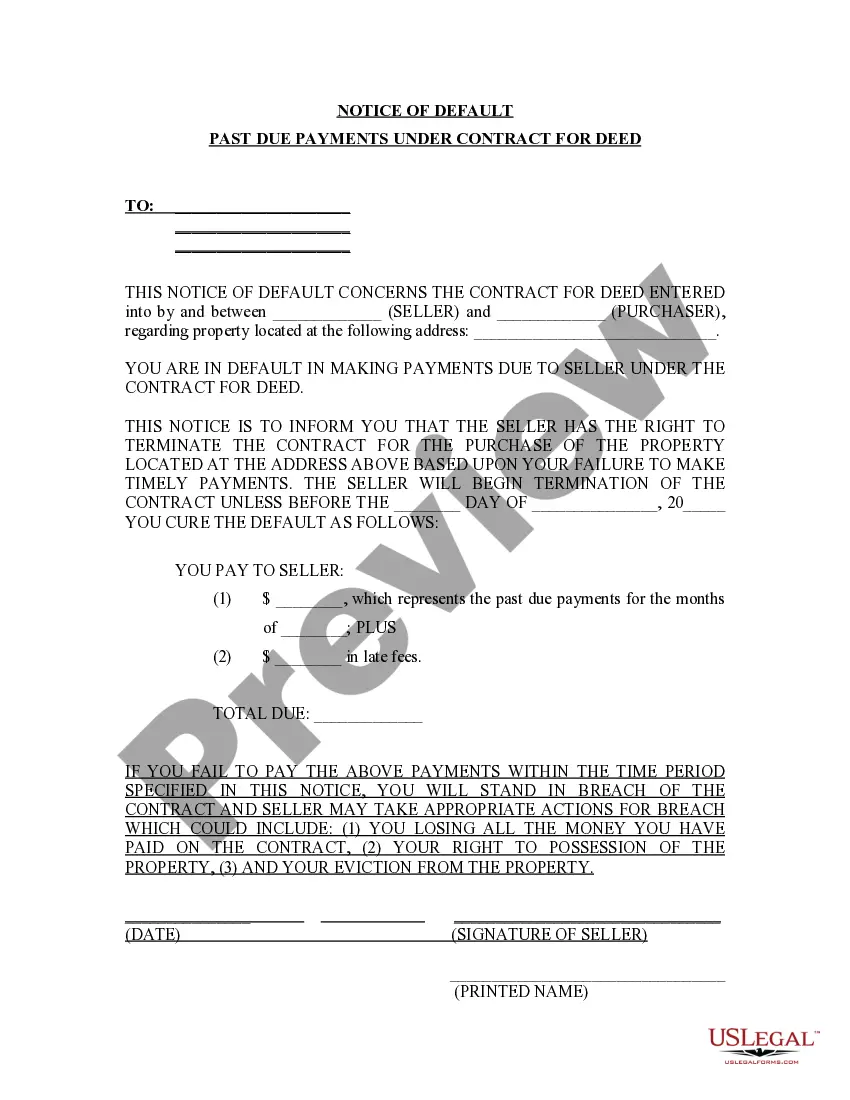

Queens New York Notice of Default for Past Due Payments in Connection with Contract for Deed In Queens, New York, a Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that alerts the buyer and seller about a breach of the terms of the contract. This notice is typically served when the buyer fails to make timely payments as agreed upon in the contract. Keywords: Queens, New York, Notice of Default, Past Due Payments, Contract for Deed, Breach, Buyer, Seller, Timely Payments. Types of Queens New York Notice of Default for Past Due Payments in Connection with Contract for Deed: 1. Preliminary Notice of Default: This type of notice is usually the first step in the process when the buyer misses or fails to make payments on time. It serves as a warning, giving the buyer an opportunity to rectify the payment default before further legal actions are taken. 2. Final Notice of Default: If the buyer fails to address the payment default after receiving the preliminary notice, a final notice of default is issued. This notice states the specific terms and conditions of the contract that have been violated, the amount of outstanding payments, and provides a final opportunity for the buyer to cure the default within a specified time frame. 3. Notice of Intent to Foreclose: If the buyer fails to rectify the default within the time given in the final notice of default, the seller may issue a Notice of Intent to Foreclose. This notice informs the buyer that legal actions, including the foreclosure of the property, will be initiated if the outstanding payments are not brought current within a specified period. 4. Notice of Acceleration: A Notice of Acceleration is served when the seller decides to accelerate the entire remaining balance due under the contract, instead of only enforcing the past due payments. This notice requires the buyer to pay the remaining balance in full within a specific time frame or face foreclosure proceedings. 5. Notice of Termination: If the buyer fails to cure the default or make satisfactory payment arrangements within the time periods stated in the previous notices, the seller may serve a Notice of Termination. This notice terminates the Contract for Deed, forfeiting all rights of the buyer to the property and allowing the seller to take further legal actions to recover the property. In conclusion, the various types of Queens New York Notice of Default for Past Due Payments in connection with a Contract for Deed include the Preliminary Notice of Default, Final Notice of Default, Notice of Intent to Foreclose, Notice of Acceleration, and Notice of Termination. These notices play a crucial role in notifying the parties involved about the default, providing opportunities for resolution, and informing the buyer about potential legal consequences if the default is not addressed.

Queens New York Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Queens New York Notice Of Default For Past Due Payments In Connection With Contract For Deed?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, as a rule, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to a lawyer. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Queens New York Notice of Default for Past Due Payments in connection with Contract for Deed or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Queens New York Notice of Default for Past Due Payments in connection with Contract for Deed adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Queens New York Notice of Default for Past Due Payments in connection with Contract for Deed would work for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!