Keywords: Rochester New York, final notice of default, past due payments, connection with Contract for Deed. Title: Understanding the Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed Introduction: In Rochester, New York, individuals who enter into a Contract for Deed to purchase a property may sometimes find themselves in a situation where they are unable to make timely payments. In such cases, a Final Notice of Default for Past Due Payments is issued to notify the buyer regarding their delinquency, initiating a specific process that differs based on the circumstances. This article aims to provide a detailed description of this notice, its purpose, different types, and the necessary actions a recipient must take to resolve the default situation. 1. Purpose of the Final Notice of Default: The Final Notice of Default for Past Due Payments serves as an official document, providing written notice to the buyer that they have breached their contractual obligations by failing to make payments as agreed in the Contract for Deed. This notice is typically issued by the seller or a designated representative, outlining the specific amount owed and the consequences of continued non-payment. 2. Types of Final Notice of Default: a) Simple Final Notice: This type of notice states the outstanding amount due and informs the buyer of the consequences if they fail to take corrective action within a specified timeframe. The notice may also include information about any applicable late fees, penalties, or interest that will accrue until the delinquency is resolved. b) Intent to Accelerate: In some cases, the seller may issue an Intent to Accelerate notice alongside the Final Notice of Default. This notice informs the buyer that if they fail to cure the default within a certain period, the seller has the right to accelerate the repayment of the entire remaining balance on the Contract for Deed. c) Foreclosure Notice: If the buyer fails to cure their payment default within the specified timeframe mentioned in the Final Notice of Default, the seller may decide to initiate foreclosure proceedings. A Foreclosure Notice will be issued, providing the buyer with information on the foreclosure process and their rights. 3. Actions to be Taken: a) Immediate communication: Upon receiving a Final Notice of Default, it is crucial for the buyer to contact the seller or their representative promptly. Open communication can potentially lead to finding a solution, such as negotiating new payment terms or exploring other options to resolve the default. b) Cure the Default: The buyer needs to take appropriate steps to cure the default by making the outstanding payment amount in full, including any applicable late fees, penalties, or interest. Resolving the delinquency within the specified timeframe can help prevent further consequences. c) Seek legal advice: If the buyer is unable to resolve the default despite their best efforts, seeking legal advice from a reliable attorney experienced in real estate and contract law is strongly recommended. Legal guidance can help the buyer understand their rights and explore potential remedies or options to avoid more severe consequences. Conclusion: Receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed can be a stressful situation for Rochester, New York residents. Understanding the purpose of this notice, different types, and the necessary actions to be taken are essential for buyers to protect their rights and find a resolution. Timely communication, curing the default, and seeking professional advice when needed can help buyers navigate the challenging process effectively.

Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed

State:

New York

City:

Rochester

Control #:

NY-00470-9

Format:

Word;

Rich Text

Instant download

Description

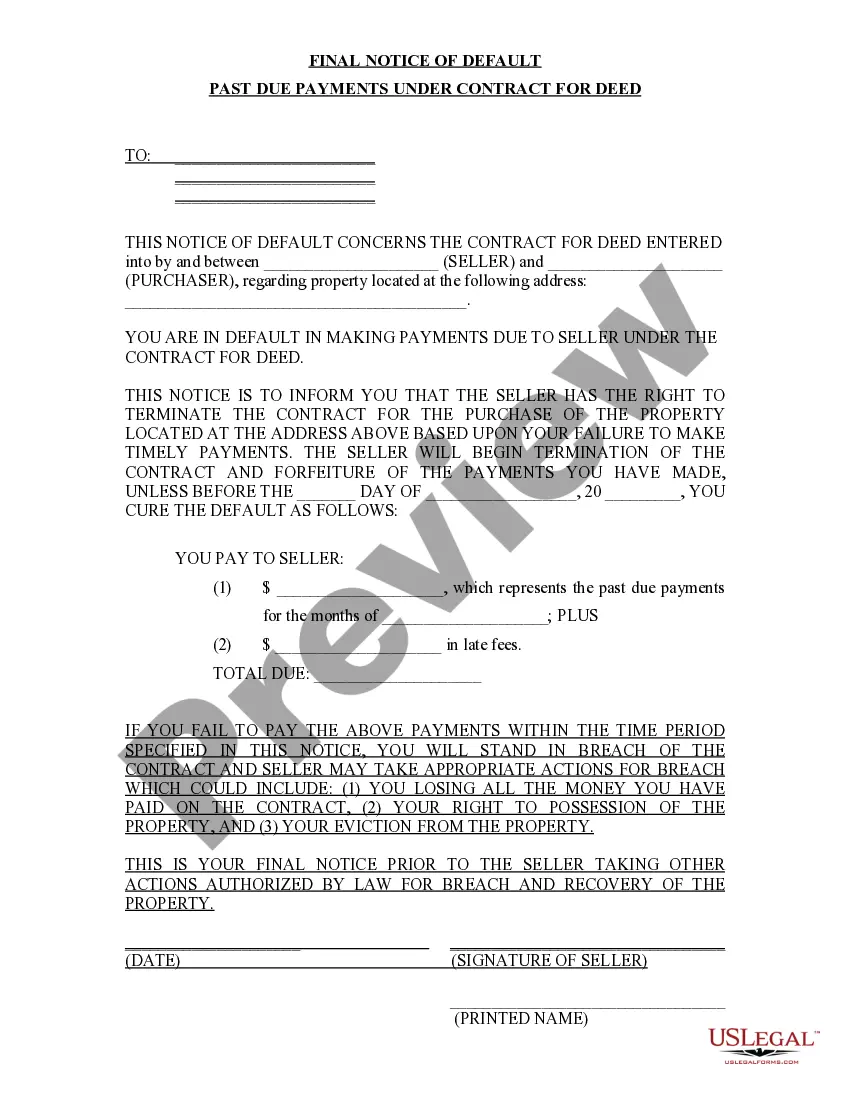

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Keywords: Rochester New York, final notice of default, past due payments, connection with Contract for Deed. Title: Understanding the Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed Introduction: In Rochester, New York, individuals who enter into a Contract for Deed to purchase a property may sometimes find themselves in a situation where they are unable to make timely payments. In such cases, a Final Notice of Default for Past Due Payments is issued to notify the buyer regarding their delinquency, initiating a specific process that differs based on the circumstances. This article aims to provide a detailed description of this notice, its purpose, different types, and the necessary actions a recipient must take to resolve the default situation. 1. Purpose of the Final Notice of Default: The Final Notice of Default for Past Due Payments serves as an official document, providing written notice to the buyer that they have breached their contractual obligations by failing to make payments as agreed in the Contract for Deed. This notice is typically issued by the seller or a designated representative, outlining the specific amount owed and the consequences of continued non-payment. 2. Types of Final Notice of Default: a) Simple Final Notice: This type of notice states the outstanding amount due and informs the buyer of the consequences if they fail to take corrective action within a specified timeframe. The notice may also include information about any applicable late fees, penalties, or interest that will accrue until the delinquency is resolved. b) Intent to Accelerate: In some cases, the seller may issue an Intent to Accelerate notice alongside the Final Notice of Default. This notice informs the buyer that if they fail to cure the default within a certain period, the seller has the right to accelerate the repayment of the entire remaining balance on the Contract for Deed. c) Foreclosure Notice: If the buyer fails to cure their payment default within the specified timeframe mentioned in the Final Notice of Default, the seller may decide to initiate foreclosure proceedings. A Foreclosure Notice will be issued, providing the buyer with information on the foreclosure process and their rights. 3. Actions to be Taken: a) Immediate communication: Upon receiving a Final Notice of Default, it is crucial for the buyer to contact the seller or their representative promptly. Open communication can potentially lead to finding a solution, such as negotiating new payment terms or exploring other options to resolve the default. b) Cure the Default: The buyer needs to take appropriate steps to cure the default by making the outstanding payment amount in full, including any applicable late fees, penalties, or interest. Resolving the delinquency within the specified timeframe can help prevent further consequences. c) Seek legal advice: If the buyer is unable to resolve the default despite their best efforts, seeking legal advice from a reliable attorney experienced in real estate and contract law is strongly recommended. Legal guidance can help the buyer understand their rights and explore potential remedies or options to avoid more severe consequences. Conclusion: Receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed can be a stressful situation for Rochester, New York residents. Understanding the purpose of this notice, different types, and the necessary actions to be taken are essential for buyers to protect their rights and find a resolution. Timely communication, curing the default, and seeking professional advice when needed can help buyers navigate the challenging process effectively.

How to fill out Rochester New York Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you’ve already utilized our service before, log in to your account and save the Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!