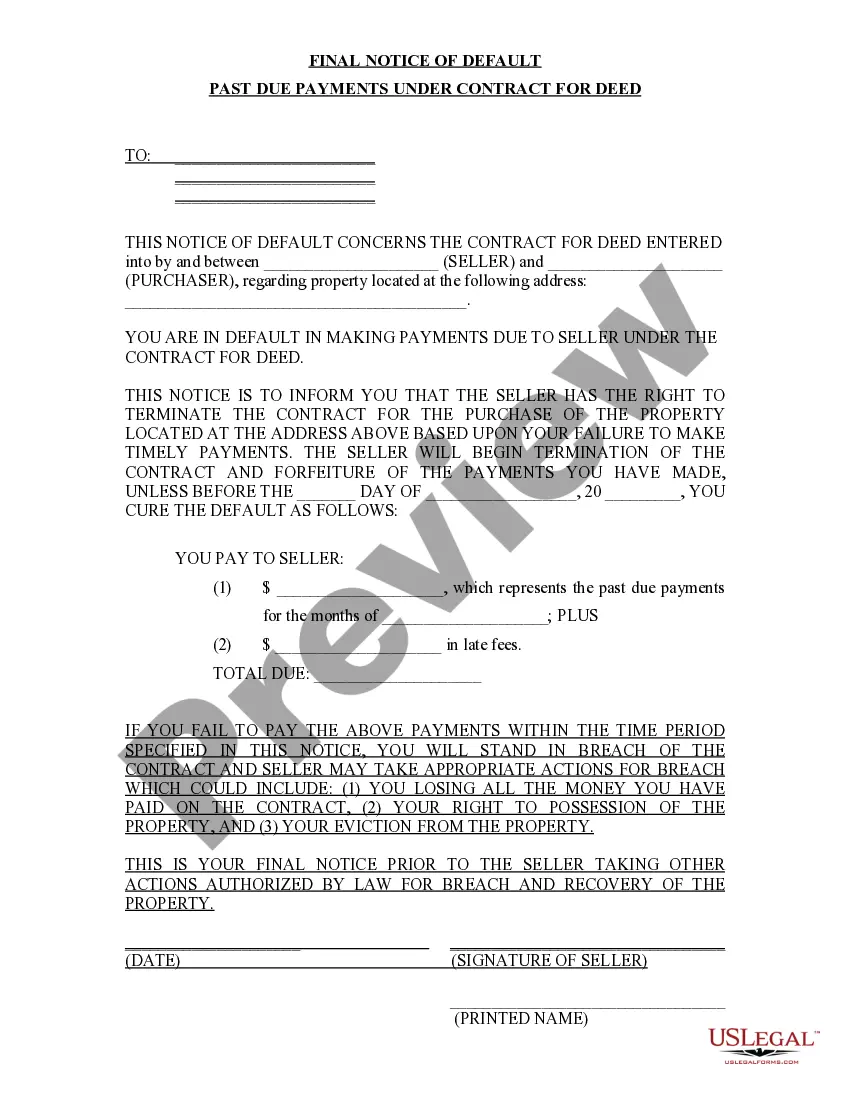

Title: Syracuse New York Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: A Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a crucial legal document issued by a property owner or lender in Syracuse, New York. This notice serves as a warning to the buyer or lessee that they have fallen behind on their payment obligations under the Contract for Deed. Understanding the implications of this notice and its potential consequences is vital for both parties involved. In Syracuse, New York, there are typically two types of Final Notices of Default for Past Due Payments related to Contract for Deed — Judicial and Non-judicial. 1. Judicial Notice of Default: A Judicial Notice of Default is often utilized in Syracuse, New York when the defaulting party has failed to remit payments as specified in the Contract for Deed. This notice initiates a legal process that involves court intervention to resolve the defaulted payments. The buyer or lessee is provided with a specific timeframe to rectify their outstanding payments before facing potential legal action and foreclosure. Keywords: Syracuse New York, Final Notice of Default, Past Due Payments, Contract for Deed, Judicial Notice, Defaulted Payments, Legal Process, Court Intervention, Rectify, Legal Action, Foreclosure. 2. Non-judicial Notice of Default: In Syracuse, New York, a Non-judicial Notice of Default is an alternative to the judicial procedure. It gives the seller or lender the authority to proceed with the foreclosure process without the need for court involvement. This type of notice is typically issued when the Contract for Deed includes a Power of Sale clause, enabling the seller or lender to sell the property to recover the unpaid balance. The buyer or lessee also receives a specific period to bring the payments up to date before facing foreclosure proceedings. Keywords: Syracuse New York, Final Notice of Default, Past Due Payments, Contract for Deed, Non-judicial Notice, Foreclosure Process, Court Involvement, Power of Sale Clause, Unpaid Balance, Bring Payments Up to Date, Foreclosure Proceedings. Conclusion: Understanding the different types of Final Notices of Default for Past Due Payments in connection with a Contract for Deed in Syracuse, New York, is essential for both parties involved. Whether it's a Judicial or Non-judicial Notice of Default, timely action must be taken by the buyer or lessee to rectify the past due payments and avoid further legal consequences, such as court intervention or foreclosure proceedings. Seeking legal advice and working towards an equitable solution is strongly advised in such situations.

Syracuse New York Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Syracuse New York Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone without any legal background to draft this sort of papers from scratch, mainly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our platform offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you require the Syracuse New York Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Syracuse New York Final Notice of Default for Past Due Payments in connection with Contract for Deed quickly using our reliable platform. If you are presently an existing customer, you can proceed to log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Syracuse New York Final Notice of Default for Past Due Payments in connection with Contract for Deed:

- Be sure the form you have chosen is specific to your area because the rules of one state or county do not work for another state or county.

- Review the document and read a brief outline (if available) of cases the paper can be used for.

- If the one you picked doesn’t suit your needs, you can start again and look for the suitable form.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Syracuse New York Final Notice of Default for Past Due Payments in connection with Contract for Deed once the payment is done.

You’re good to go! Now you can proceed to print the document or fill it out online. Should you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.