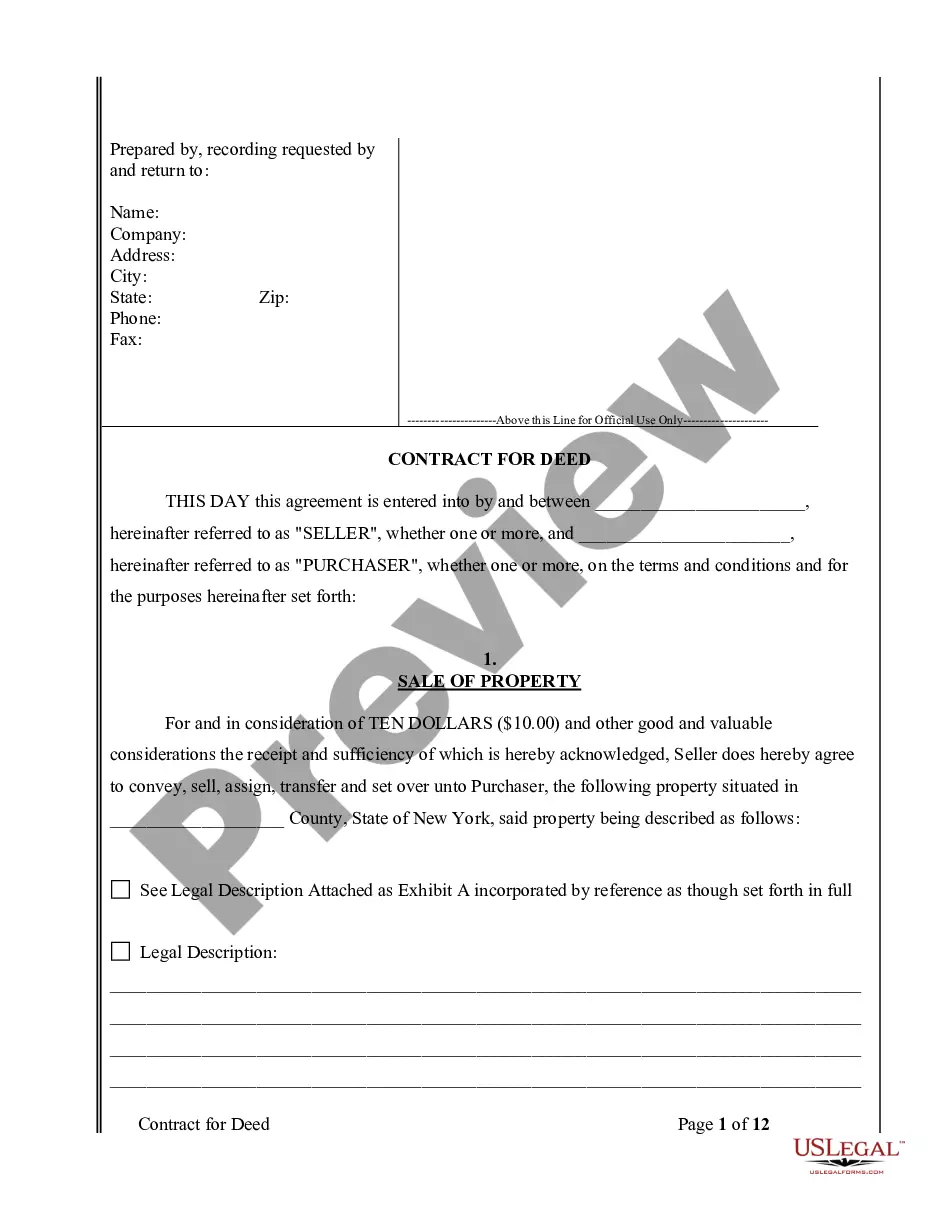

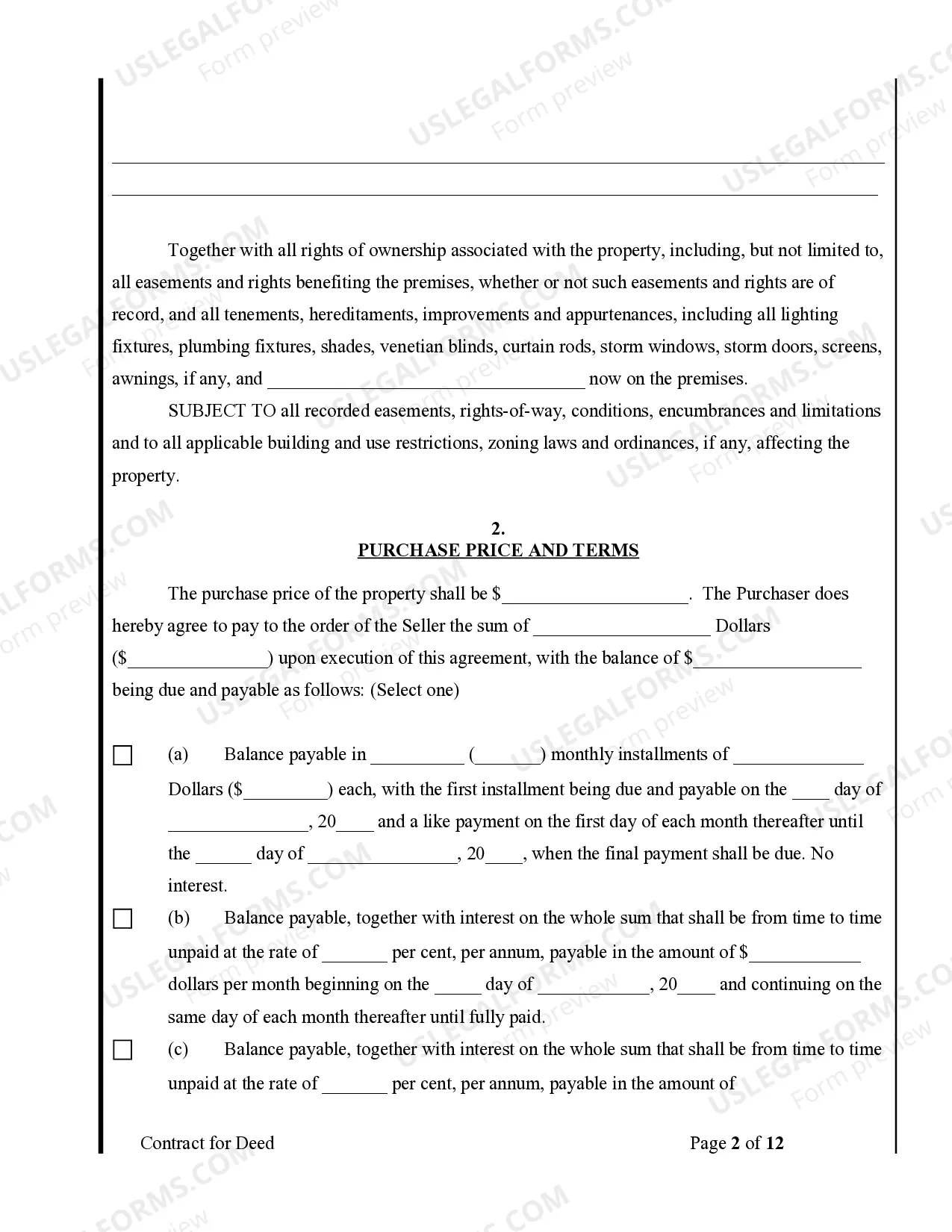

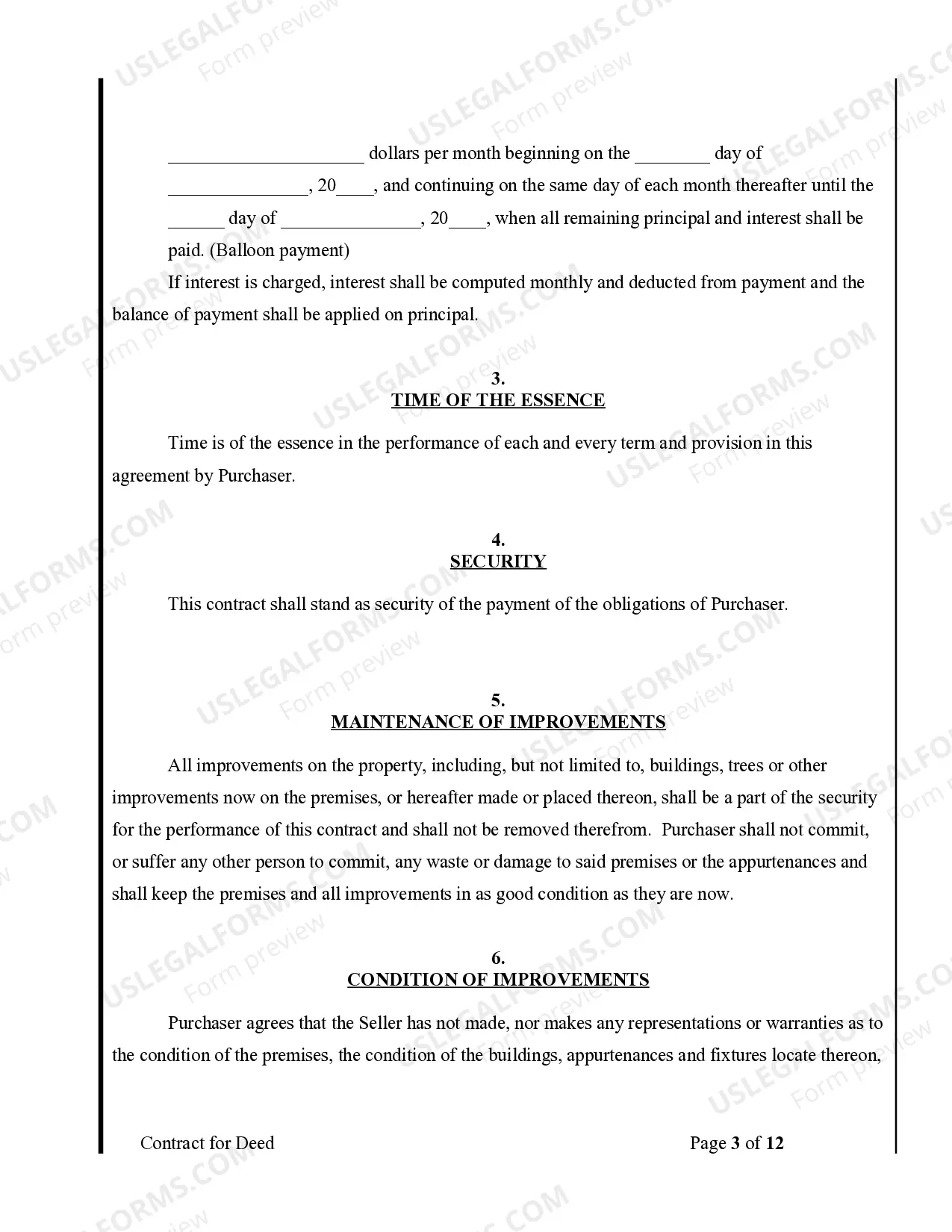

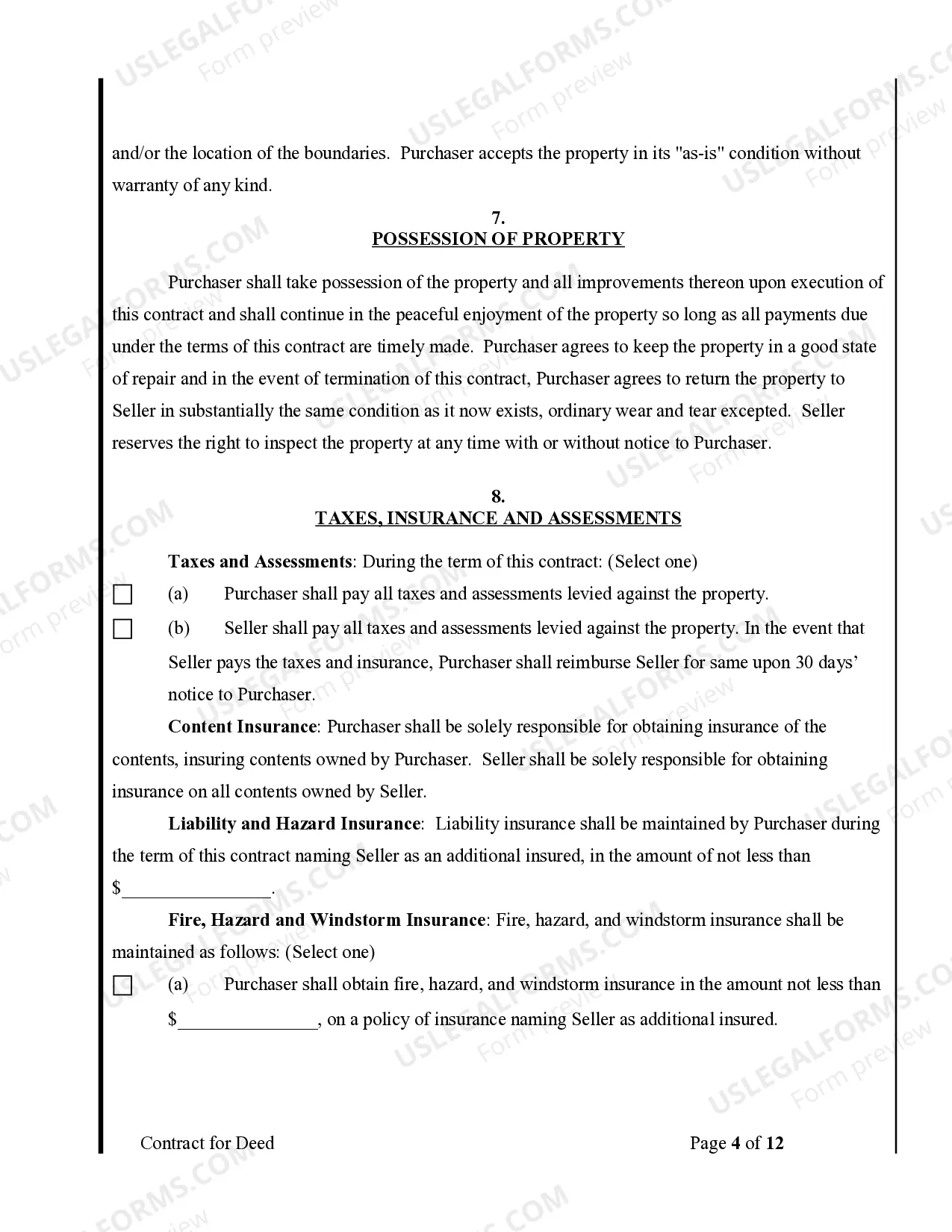

The Bronx New York Agreement or Contract for Deed for Sale and Purchase of Real Estate, also known as a Land or Executory Contract, is a legally binding agreement between a buyer and a seller for the sale and purchase of property in the Bronx, New York. This agreement outlines the terms and conditions by which the buyer will acquire the property over a specified period of time. The Bronx New York Agreement or Contract for Deed for Sale and Purchase of Real Estate is a common method of facilitating real estate transactions, especially for individuals who may not qualify for traditional financing or prefer alternative options. This agreement allows the buyer to make regular payments directly to the seller, while the seller retains legal ownership of the property until the agreed-upon purchase price is fully paid. Some key components typically included in this agreement are: 1. Purchase Price: The total price at which the buyer agrees to purchase the property. This price may be paid in installments, along with any interest or other associated fees. 2. Payment Terms: The agreement will clearly outline the payment schedule, including the frequency, amount, and due dates of the payments. The terms may also specify any penalties for late payments. 3. Property Description: A detailed description of the property being sold, including its physical address, boundaries, and any additional structures or amenities. 4. Property Condition: The agreement may include provisions regarding the condition of the property, such as any repairs or renovations needed, and the responsibilities of each party in maintaining the property. 5. Default and Termination: This section will outline the consequences and procedures if either party fails to fulfill their obligations under the agreement. It may include provisions for foreclosure or termination of the contract. There may be different types or variations of this agreement depending on specific circumstances or preferences. These could include agreements with varying payment structures, such as balloon payments or adjustable interest rates. Additionally, some agreements may include provisions for early payoff or transfer of ownership rights before the full purchase price is paid. It is important for both buyers and sellers to carefully review and understand the terms of the Bronx New York Agreement or Contract for Deed for Sale and Purchase of Real Estate. Seeking legal advice from a qualified attorney is highly recommended ensuring all parties are fully protected and aware of their rights and obligations throughout the transaction process.

- US Legal Forms

- Localized Forms

- New York

- Bronx

-

New York Agreement or Contract for Deed for Sale and Purchase of Real...

Bronx Deed

Description

Related forms

View Buyer's Request for Accounting from Seller under Contract for Deed

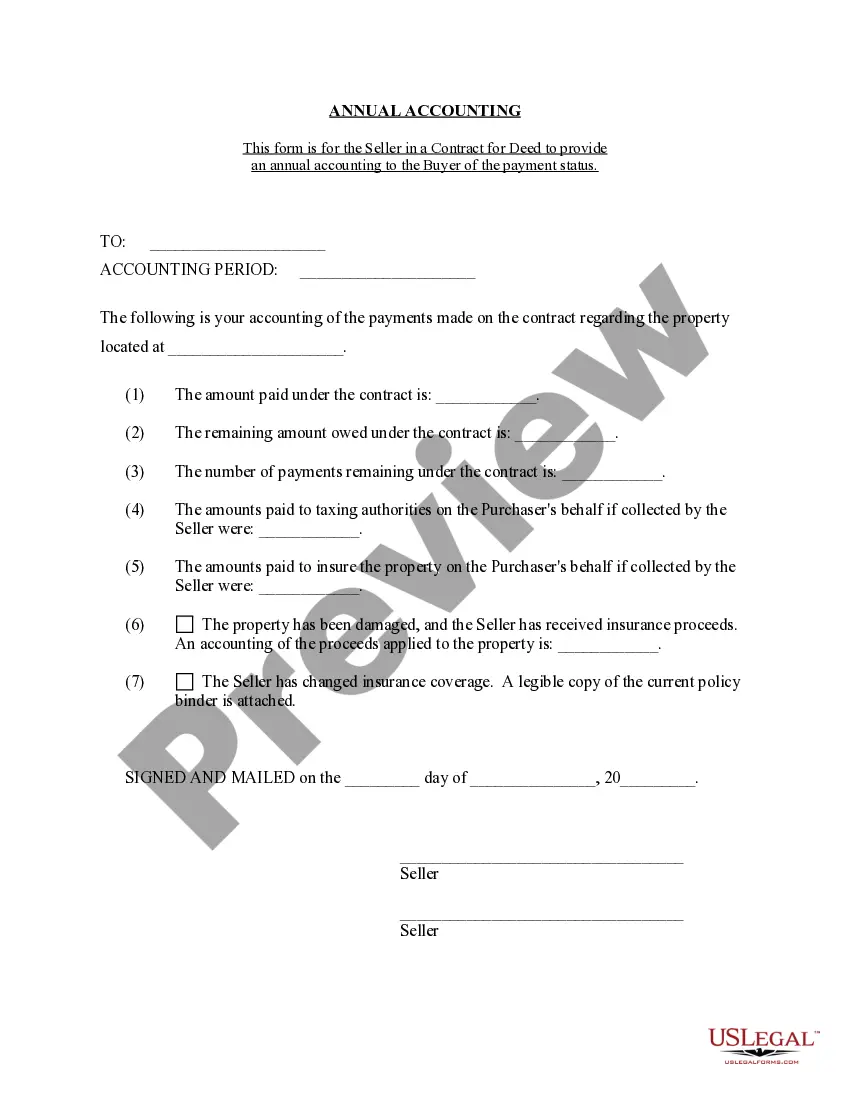

View Contract for Deed Seller's Annual Accounting Statement

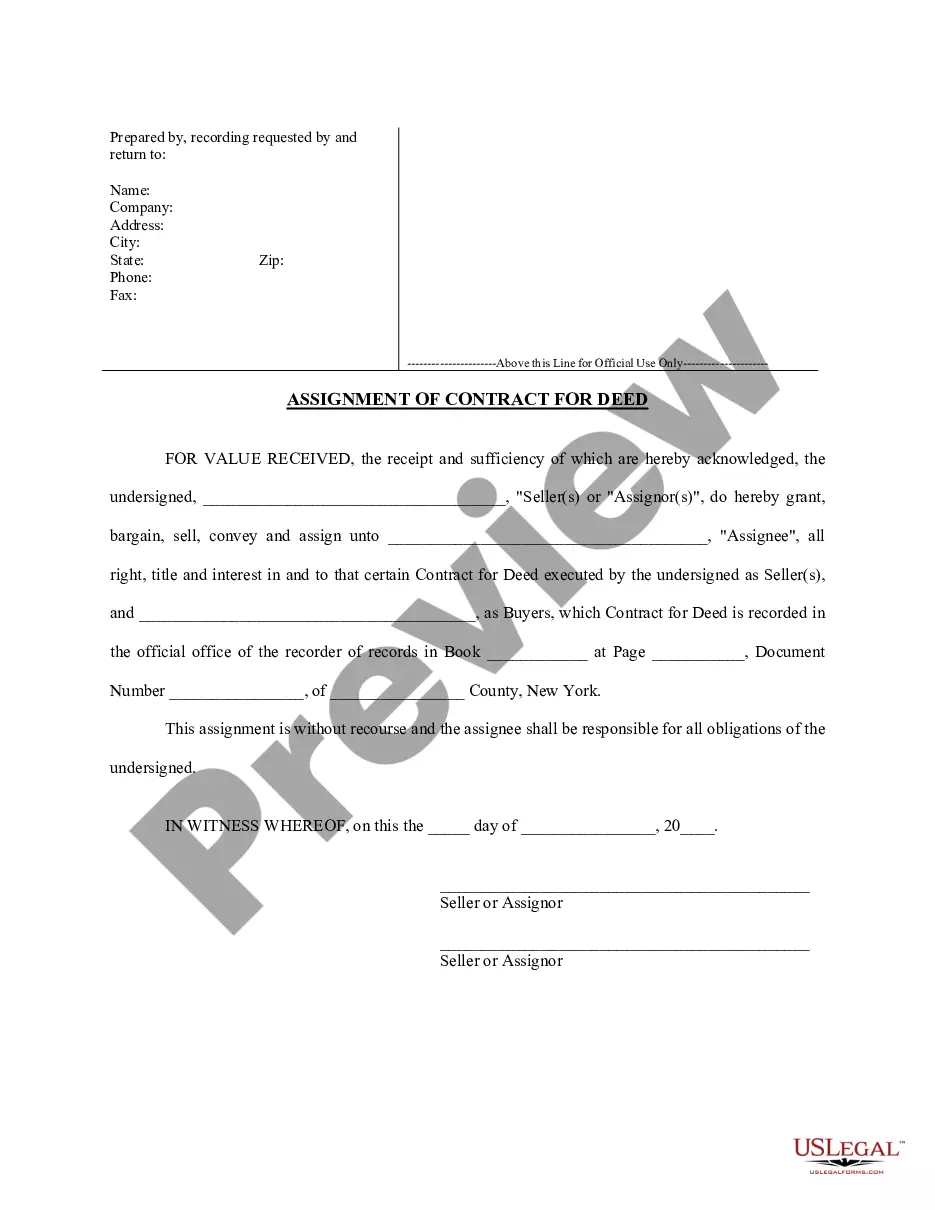

View Assignment of Contract for Deed by Seller

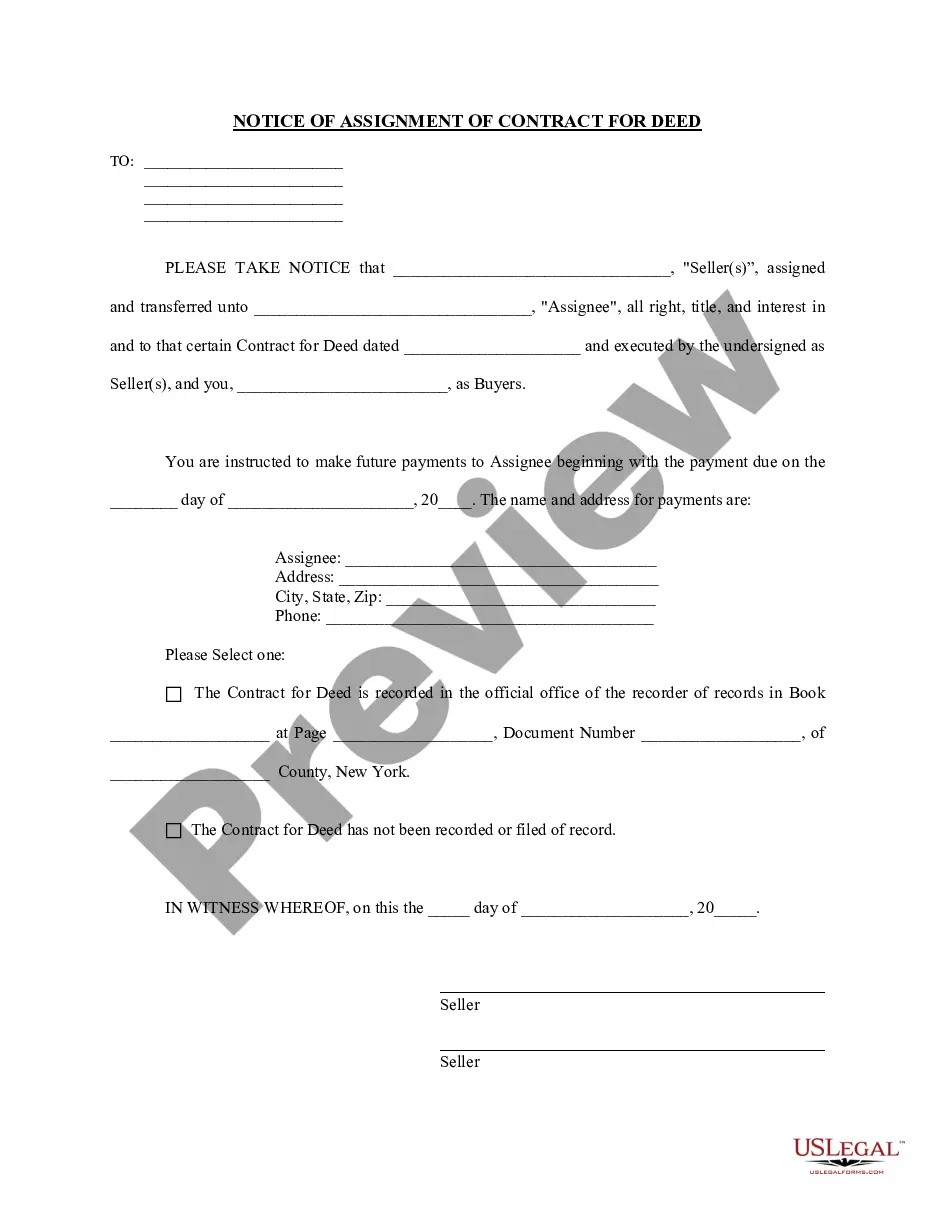

View Notice of Assignment of Contract for Deed

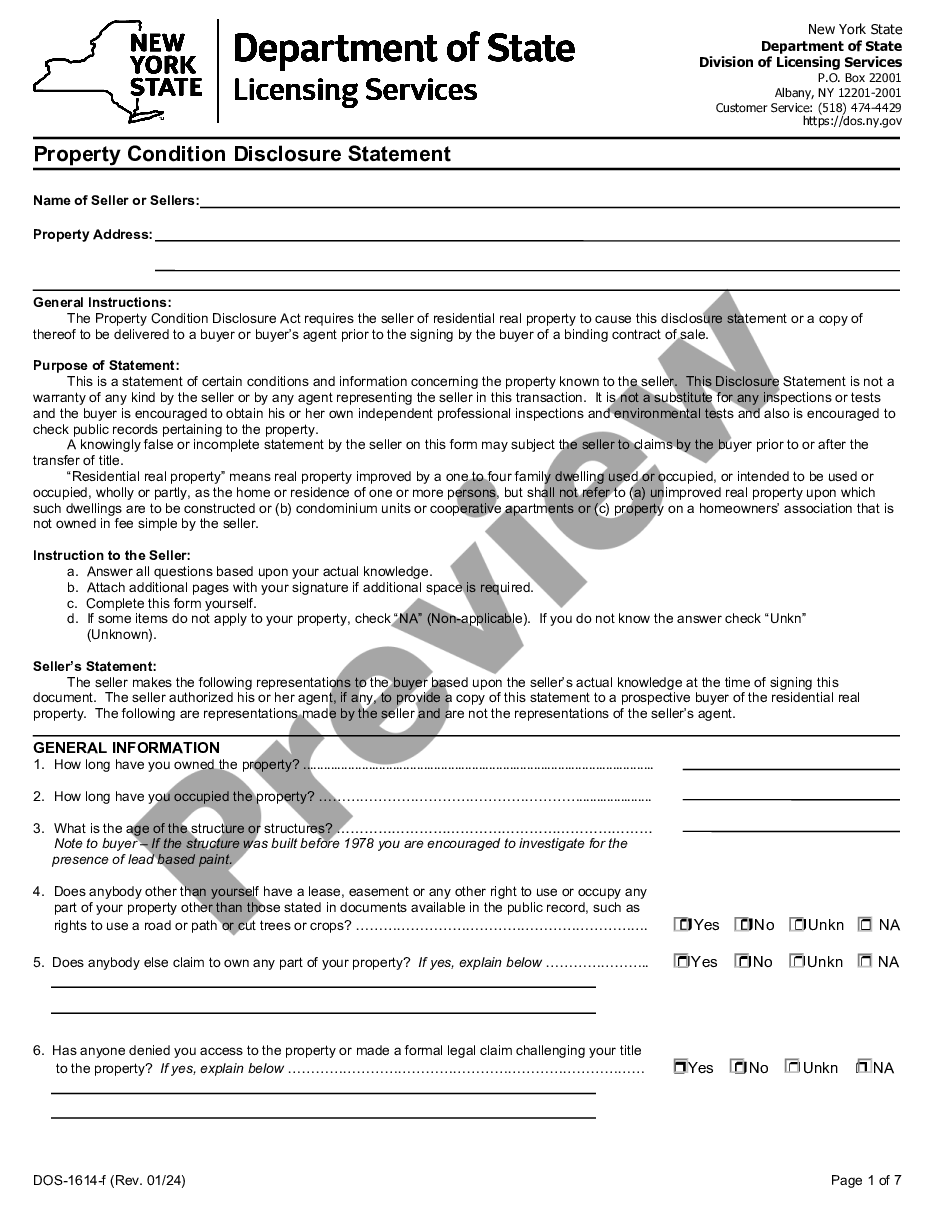

View Residential Real Estate Sales Disclosure Statement

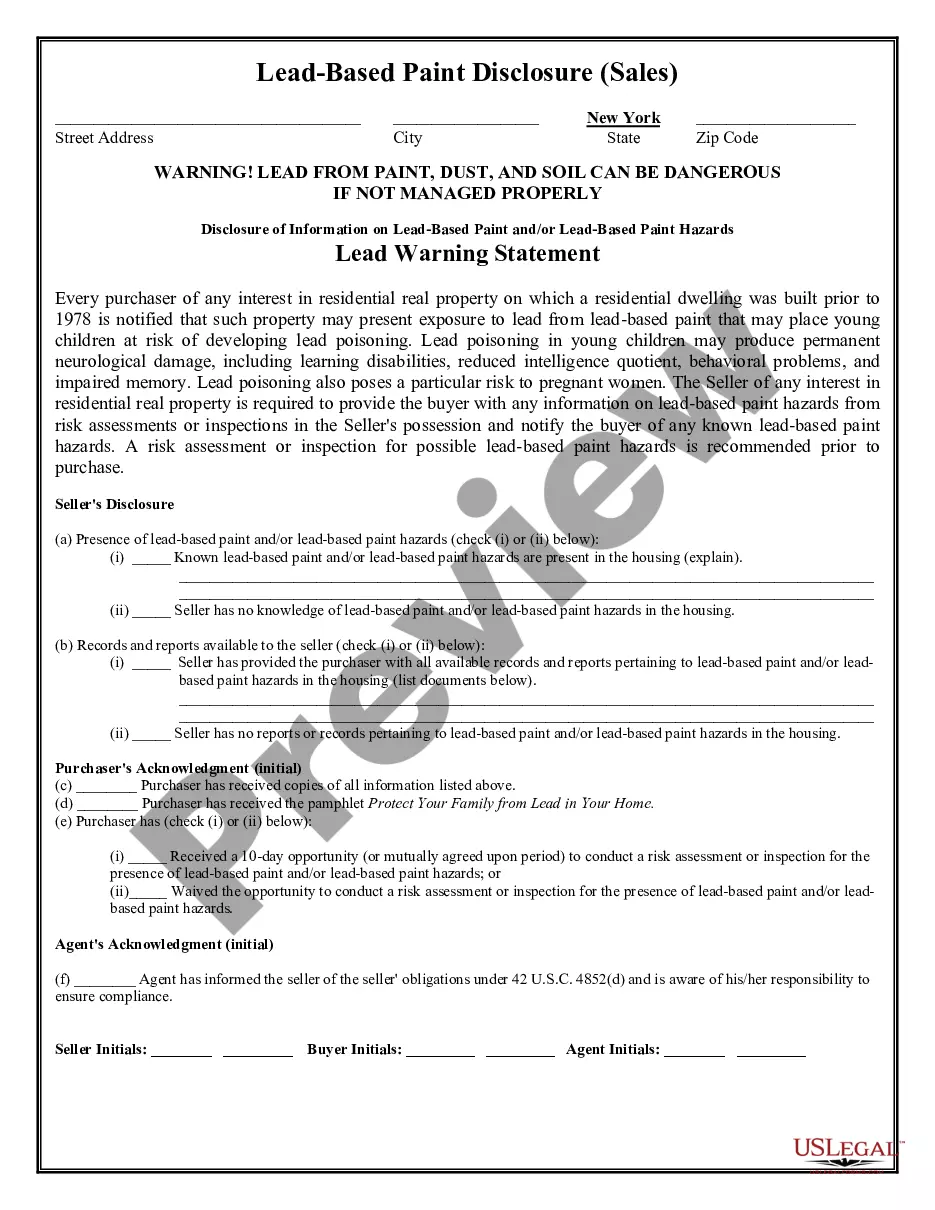

View Lead Based Paint Disclosure for Sales Transaction

View Aurora Jury Instruction - Sale Or Receipt Of A Stolen Motor Vehicle

View Atlanta Jury Instruction - Sale Or Receipt Of A Stolen Motor Vehicle

View Arlington Jury Instruction - Sale Or Receipt Of A Stolen Motor Vehicle

View Anchorage Jury Instruction - Sale Or Receipt Of A Stolen Motor Vehicle

View Anaheim Jury Instruction - Sale Or Receipt Of A Stolen Motor Vehicle

View Albuquerque Jury Instruction - Sale Or Receipt Of A Stolen Motor Vehicle

Related legal definitions

Viewed forms

How to fill out Bronx New York Agreement Or Contract For Deed For Sale And Purchase Of Real Estate A/k/a Land Or Executory Contract?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Bronx New York Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Bronx New York Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Bronx New York Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form Rating

Form popularity

FAQ

Land Contract/Installment Contract The agreement sets the purchase price and monthly payments. The buyer makes payments to the seller. After all of the payments have been made by the buyer, legal title transfers and the seller must deliver good legal title of the property to the buyer by way of a deed.

Section 4 (3) of Sale of Goods Act, 1930 directly explains this context with the words as ?Where under a contract of sale the property in the goods is transferred from the seller to the buyer, the contract is called a sale, but where the transfer of the property in the goods is to take place at a future time or subject

A purchase agreement is the most common type of real estate agreement. This contract specifies the details regarding the sale of property.

In contrast with a contract or agreement, there is no requirement for consideration to pass for a deed to be legally binding. Consideration is not required for a deed to be enforceable because of the idea that a deed is the most solemn indication to the community that the parties to a deed intend to be bound.

In a Contract to Sell the seller retains ownership over the property until the buyer fully pays the purchase price. Once the purchase price is fully paid the seller delivers the property to the buyer and transfers ownership over the same to the buyer by executing a Deed of Sale.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts. They each have different uses and stipulations.

The Five Elements of a Contract Offer. Acceptance. Consideration. Capacity. Lawful Purpose.

CTS signed in the Philippines must be NOTARIZED. However, if you signed your CTS abroad, you need to have it CONSULARIZED or APOSTILLED. If you are based overseas, you are also required to submit an AUTHENTICATED Special Power of Attorney (SPA).

Required Elements of a Real Estate Contract To establish legality, a real estate contract must include a legal purpose, legally competent parties, agreement by offer and acceptance, consideration, and consent.

On the basis of validity or enforceability, we have five different types of contracts as given below. Valid Contracts.Void Contract Or Agreement.Voidable Contract.Illegal Contract.Unenforceable Contracts.

Bronx New York Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract Related Searches

-

contract for deed florida

-

land contract form florida

-

what is a deed

-

house under contract meaning

-

agreement for deed florida form

-

florida contract for deed form free

-

contract for deed alabama

-

land contract form florida

-

what is a deed

-

house under contract meaning

Interesting Questions

The Bronx Agreement or Contract for Deed is a legal document outlining the terms and conditions of the sale and purchase of real estate or land. It is also known as an executory contract398475.

The contract allows the buyer to make regular payments to the seller instead of obtaining traditional financing from a bank. The buyer does not receive the deed until the full payment is made.

The contract offers flexibility for buyers who may have difficulty obtaining a mortgage. It provides an opportunity to purchase property without a large upfront payment or strict credit requirements.

The buyer is responsible for making regular payments, maintaining the property, and paying property taxes and insurance. They also need to follow all terms and conditions outlined in the contract.

The seller must transfer the property's title to the buyer once the full payment is made. They are also responsible for any necessary repairs until the transfer of title occurs.

If the buyer defaults on payments, the seller usually has the right to terminate the contract and repossess the property. The buyer may lose any equity they have built up, and the seller keeps the down payment and any payments made.

More info

Most brokerages work with one or two of the local real estate agencies, and most are contract law licensed by the VOLS. A contract between the broker and buyer will usually be drawn up. If the property is for sale, listing fees usually cost anywhere from 50 to 125, and then a few months down the road they become more competitive. In real estate transactions, listing fees include the expenses usually associated with marketing the property. They also include a commission fee between 25 and 125. If you think you're seeing more real estate brokers, you're right. In 2004, two-thirds of new brokers surveyed were going out of business. As a broker who represents a number of clients, you'll see more names being dropped like flies, with agents making the switch to the new brokers or selling to the new brokers. You'll often see new broker×buyer relationships develop. They're typically a result of selling to the more established brokers.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

New York

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

CHAPTER 50 OF THE CONSOLIDATED LAWS - REAL PROPERTY LAW

ARTICLE 8 CONVEYANCES AND MORTGAGES

§ 240 Real Prop. Definitions and use of terms.

<blockquote>1. The term "heirs," or other words of inheritance, are not requisite to create or convey an estate in fee.

2. The term "conveyance," as used in this article, includes every instrument, in writing, except a will, by which any estate or interest in real property is created, transferred, assigned or surrendered.

3. Every instrument creating, transferring, assigning or surrendering an estate or interest in real property must be construed according to the intent of the parties, so far as such intent can be gathered from the whole instrument, and is consistent with the rules of law.

4. The terms "estate" and "interest in real property" include every such estate and interest, freehold or chattel, legal or equitable, present or future, vested or contingent.</blockquote>

§ 240-b Real Prop. Certain conveyances authorized; effect thereof.

<blockquote>1. Any person or persons owning real property or an interest in real property which he or they have power to convey, may effectively convey such property or interest by a conveyance naming himself or themselves and another person or persons, or one or more of themselves and another person or other persons, as grantees, and the conveyance has the same effect as to whether it creates an estate in severalty, a joint tenancy, or a tenancy by the entirety, or tenancy in common, as if it were a conveyance from a stranger who owned the property or interest to the persons named as grantees in the conveyance.

2. Any two or more persons owning real property or an interest in real property which they have power to convey, may effectively convey such property or interest by a conveyance naming one, or more than one, or all such persons, as grantees, and the conveyance has the same effect, as to whether it creates an estate in severalty, or a joint tenancy, or a tenancy by the entirety, or tenancy in common, as if it were a conveyance from a stranger who owned the property or interest to the persons named as grantees in the conveyance.

3. As used in this section, "person" may be a married person and "persons" may be persons married to each other.</blockquote>

§ 240-c Real Prop. Joint tenancy severance.

<blockquote>1. In addition to any other means by which a joint tenancy with right of survivorship may be severed, a joint tenant may unilaterally sever a joint tenancy in real property without consent of any non-severing joint tenant or tenants by:

<blockquote>(a) Execution and delivery of a deed that conveys legal title to the severing joint tenant's interest to a third person, whether or not pursuant to an agreement requiring the third person to reconvey legal title to the severing joint tenant; or

(b) Execution of a written instrument that evidences the intent to sever the joint tenancy, including a deed that names the severing tenant as the direct grantee of the severing tenant's interest.</blockquote>

2. No severance of a joint tenancy pursuant to subdivision one of this section shall terminate the right of survivorship of any non-severing joint tenant or tenants as to the severing tenant's interest unless the deed or written instrument effecting the severance is recorded, prior to the death of the severing tenant, in the county where the real property is located.

3. Nothing in this section shall limit the manner or effect of:

<blockquote>(a) A severance of a joint tenancy pursuant to a written instrument executed by all joint tenants, or pursuant to a written agreement of all joint tenants.

(b) A severance of a joint tenancy effected by a deed from a joint tenant to another joint tenant.

(c) A severance ordered by a court of competent jurisdiction.</blockquote>

</blockquote>

§ 241 Real Prop. Ancient conveyances abolished.

The conveyance of real property by feoffment, with livery of seizin, or by fines, or common recoveries, is abolished.

§ 242 Real Prop. Disclosure prior to the sale of real property.

[EDITORS' NOTE: TE TEXT OF THIS SECTION IS EFFECTIVE UNTIL JANUARY 1, 2007, SEE BELOW SECTION FOR TEXT EFFECTIVE JANUARY 1, 2007.]

<blockquote>

<blockquote>1. (a) Any person, firm, company, partnership or corporation offering to sell real property to which no utility electric service is provided shall provide written notice to the prospective purchaser or to the prospective purchaser's agent, clearly indicating this fact. Such notice shall be provided prior to accepting a purchase offer.

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this section is entitled to recover any actual damages incurred from the person offering to sell said real property.

(c) The provisions of this subdivision shall not apply in instances where the real property being sold lies within the applicable free footage allowance or service lateral specified by the public service commission in rule, regulation or public utility tariff.</blockquote>

2. Disclosure prior to the sale of real property to which utility surcharge payments attach.

<blockquote>(a) Any person, firm, company, partnership or corporation offering to sell real property against which an electric, gas or water utility surcharge is assessed for the purpose of defraying the costs associated with an electric, gas or water line extension, or for the purpose of defraying the costs associated with related facilities, shall provide written notice to the prospective purchaser or the prospective purchaser's agent, stating as follows: "This property is subject to an electric , gas and/or water utility surcharge". In addition, such notice shall also state, the type and purpose of the surcharge, the amount of the surcharge and whether such surcharge is payable on a monthly, yearly or other basis. Such notice shall be provided by the seller prior to accepting a purchase offer.

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this subdivision is entitled to recover any actual damages incurred from the person offering to sell or selling said real property.

(As amended by Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004.)

Amendment Notes:

Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004, amended paragraph (a) of subdivision 2.</blockquote>

</blockquote>

§ 242 Disclosure prior to the sale of real property.

[EDITORS' NOTE: THE TEXT OF THIS SECTION IS EFFECTIVE JANUARY 1, 2007, SEE ABOVE SECTION FOR TEXT EFFECTIVE UNTIL JANUARY 1, 2007.]

<blockquote>

<blockquote>1. (a) Any person, firm, company, partnership or corporation offering to sell real property to which no utility electric service is provided shall provide written notice to the prospective purchaser or to the prospective purchaser's agent, clearly indicating this fact. Such notice shall be provided prior to accepting a purchase offer.

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this section is entitled to recover any actual damages incurred from the person offering to sell said real property.

(c) The provisions of this subdivision shall not apply in instances where the real property being sold lies within the applicable free footage allowance or service lateral specified by the public service commission in rule, regulation or public utility tariff.</blockquote>

2. Disclosure prior to the sale of real property to which utility surcharge payments attach.<br />

<br />

(a) Any person, firm, company, partnership or corporation offering to sell real property against which an electric, gas or water utility surcharge is assessed for the purpose of defraying the costs associated with an electric, gas or water line extension, or for the purpose of defraying the costs associated with related facilities, shall provide written notice to the prospective purchaser or the prospective purchaser’s agent, stating as follows: “This property is subject to an electric , gas and/or water utility surcharge”. In addition, such notice shall also state, the type and purpose of the surcharge, the amount of the surcharge and whether such surcharge is payable on a monthly, yearly or other basis. Such notice shall be provided by the seller prior to accepting a purchase offer.<br />

<br />

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this subdivision is entitled to recover any actual damages incurred from the person offering to sell or selling said real property.<br />

(As amended by Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004.)<br />

Amendment Notes:<br />

Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004, amended paragraph (a) of subdivision 2.<br />

<br />

§ 242 Disclosure prior to the sale of real property.<br />

[EDITORS’ NOTE: THE TEXT OF THIS SECTION IS EFFECTIVE JANUARY 1, 2007, SEE ABOVE SECTION FOR TEXT EFFECTIVE UNTIL JANUARY 1, 2007.]<br />

<br />

1. (a) Any person, firm, company, partnership or corporation offering to sell real property to which no utility electric service is provided shall provide written notice to the prospective purchaser or to the prospective purchaser’s agent, clearly indicating this fact. Such notice shall be provided prior to accepting a purchase offer.<br />

<br />

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this section is entitled to recover any actual damages incurred from the person offering to sell said real property.<br />

<br />

(c) The provisions of this subdivision shall not apply in instances where the real property being sold lies within the applicable free footage allowance or service lateral specified by the public service commission in rule, regulation or public utility tariff.<br />

<br />

2. Disclosure prior to the sale of real property to which utility surcharge payments attach.<br />

<br />

(a) Any person, firm, company, partnership or corporation offering to sell real property against which an electric, gas or water utility surcharge is assessed for the purpose of defraying the costs associated with an electric, gas or water line extension, or for the purpose of defraying the costs associated with related facilities, shall provide written notice to the prospective purchaser or the prospective purchaser’s agent, stating as follows: “This property is subject to an electric , gas and/or water utility surcharge”. In addition, such notice shall also state, the type and purpose of the surcharge, the amount of the surcharge and whether such surcharge is payable on a monthly, yearly or other basis. Such notice shall be provided by the seller prior to accepting a purchase offer.<br />

<br />

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this subdivision is entitled to recover any actual damages incurred from the person offering to sell or selling said real property.<br />

<br />

3. Any person, firm, company, partnership or corporation offering to sell real property on which uncapped natural gas wells are situated, and of which such person, firm, company, partnership or corporation has actual knowledge, shall inform any purchaser of the existence of these wells prior to entering into a contract for the sale/purchase of such property.<br />

(As amended by Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004; Laws 2006, ch. 163, Sec. 1, eff. Jan. 1, 2007.)<br />

Amendment Notes:<br />

Laws 2006, ch. 163, Sec. 1, eff. Jan. 1, 2007, amended this section by adding a new subdivision 3.<br />

Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004, amended paragraph (a) of subdivision 2.<br />

<br />

§ 243 Real Prop. Grant of fee or freehold.<br />

<br />

A grant in fee or of a freehold estate, must be subscribed by the person from whom the estate or interest conveyed is intended to pass, or by his lawful agent thereunto authorized in writing. If not duly acknowledged before its delivery, according to the provisions of this chapter, its execution and delivery must be attested by at least one witness, or, if not so attested, it does not take effect as against a subsequent purchaser or incumbrancer until so acknowledged.<br />

<br />

§ 244 Real Prop. When grant takes effect.<br />

<br />

A grant takes effect, so as to vest the estate or interest intended to be conveyed, only from its delivery; and all the rules of law, now in force, in respect to the delivery of deeds, apply to grants hereafter executed.<br />

<br />

§ 245 Real Prop. Estate which passes by grant or devise.<br />

<br />

A grant or devise of real property passes all the estate or interest of the grantor or testator unless the intent to pass a less estate or interest appears by the express terms of such grant or devise or by necessary implication therefrom. A greater estate or interest does not pass by any grant or conveyance, than the grantor possessed or could lawfully convey, at the time of the delivery of the deeds; except that every grant is conclusive against the grantor and his heirs claiming from him by descent, and as against a subsequent purchaser or incumbrancer from such grantor, or from such heirs claiming as such, other than a subsequent purchaser or incumbrancer in good faith and for a valuable consideration, who acquires a superior title by a conveyance that has been first duly recorded.<br />

<br />

§ 246 Real Prop. Certain deeds declared grants.<br />

<br />

Deeds of bargain and sale, and of lease and release, may continue to be used; and are to be deemed grants, subject to all the provisions of law in relation thereto.<br />

<br />

§ 247 Real Prop. Conveyance by tenant for life or years of greater estate than possessed.<br />

<br />

A conveyance made by a tenant for life or years, of a greater estate than he possesses, or can lawfully convey, does not work a forfeiture of his estate, but passes to the grantee all the title, estate or interest which such tenant can lawfully convey.<br />

<br />

§ 248 Real Prop. Effect of conveyance where property is leased.<br />

<br />

An attornment to a grantee is not requisite to the validity of a conveyance of real property occupied by a tenant, or of the rents or profits thereof, or any other interest therein. But the payment of rent to a grantor, by his tenant, before notice of the conveyance, binds the grantee; and the tenant is not liable to such grantee, before such notice, for the breach of any condition of the lease.<br />

<br />

NEW YORK CONSOLIDATED LAWS<br />

CHAPTER 50 OF THE CONSOLIDATED LAWS — REAL PROPERTY LAW<br />

ARTICLE 14 PROPERTY CONDITION DISCLOSURE IN THE SALE OF RESIDENTIAL REAL PROPERTY<br />

<br />

§ 461 Real Prop. Definitions.<br />

<br />

As used in this article, the following terms shall have the following meanings:<br />

<br />

1. “Agent” means a person who is licensed as a real estate broker or a real estate salesperson pursuant to section four hundred forty-a of this chapter and is acting in a fiduciary capacity.<br />

<br />

2. “Binding contract of sale” means a real estate purchase contract or offer that would, upon signing by the seller and subject to satisfaction of any contingencies, require the buyer to accept a transfer of title.<br />

<br />

3. “Knowledge” means only actual knowledge of a defect or condition on the part of the seller of residential real property.<br />

<br />

4. “Real estate purchase contract” means any of the following:<br />

<br />

(a) a contract which provides for the purchase and sale or exchange of residential real property;<br />

<br />

(b) a lease with an option to purchase residential real property;<br />

<br />

(c) a lease-with-obligation-to-purchase agreement for residential real property; or<br />

<br />

(d) an installment land sale contract for residential real property.<br />

<br />

5. “Residential real property” means real property improved by a one to four family dwelling used or occupied, or intended to be used or occupied, wholly or partly, as the home or residence of one or more persons, but shall not refer to (a) unimproved real property upon which such dwellings are to be constructed, or (b) condominium units or cooperative apartments, or (c) property in a homeowners’ association that is not owned in fee simple by the seller.<br />

<br />

6. “Transfer of title” means delivery of a properly executed instrument conveying title to residential real property and shall include delivery of a real estate purchase contract that is a lease or installment land sale contract.<br />

(Added by Laws 2001, ch. 456, § 2, eff. Mar. 1 2002.)<br />

<br />

§ 462 Real Prop. Property condition disclosure statement<br />

<br />

1. Except as is provided in section four hundred sixty-three of this article, every seller of residential real property pursuant to a real estate purchase contract shall complete and sign a property condition disclosure statement as prescribed by subdivision two of this section and cause it, or a copy thereof, to be delivered to a buyer or buyer’s agent prior to the signing by the buyer of a binding contract of sale. A copy of the property condition disclosure statement containing the signatures of both seller and buyer shall be attached to the real estate purchase contract. Nothing contained in this article or this disclosure statement is intended to prevent the parties to a contract of sale from entering into agreements of any kind or nature with respect to the physical condition of the property to be sold, including, but not limited to, agreements for the sale of real property “as is”.<br />

<br />

2. The following shall be the disclosure form:PROPERTY CONDITION DISCLOSURE STATEMENT<br />

<br />

NAME OF SELLER OR SELLERS:<br />

<br />

PROPERTY ADDRESS:<br />

<br />

THE PROPERTY CONDITION DISCLOSURE ACT REQUIRES THE SELLER OF RESIDENTIAL REAL PROPERTY TO CAUSE THIS DISCLOSURE STATEMENT OR A COPY THEREOF TO BE DELIVERED TO A BUYER OR BUYER’S AGENT PRIOR TO THE SIGNING BY THE BUYER OF A BINDING CONTRACT OF SALE.<br />

<br />

PURPOSE OF STATEMENT: THIS IS A STATEMENT OF CERTAIN CONDITIONS AND INFORMATION CONCERNING THE PROPERTY KNOWN TO THE SELLER. THIS DISCLOSURE STATEMENT IS NOT A WARRANTY OF ANY KIND BY THE SELLER OR BY ANY AGENT REPRESENTING THE SELLER IN THIS TRANSACTION. IT IS NOT A SUBSTITUTE FOR ANY INSPECTIONS OR TESTS AND THE BUYER IS ENCOURAGED TO OBTAIN HIS OR HER OWN INDEPENDENT PROFESSIONAL INSPECTIONS AND ENVIRONMENTAL TESTS AND ALSO IS ENCOURAGED TO CHECK PUBLIC RECORDS PERTAINING TO THE PROPERTY. A KNOWINGLY FALSE OR INCOMPLETE STATEMENT BY THE SELLER ON THIS FORM MAY SUBJECT THE SELLER TO CLAIMS BY THE BUYER PRIOR TO OR AFTER THE TRANSFER OF TITLE. IN THE EVENT A SELLER FAILS TO PERFORM THE DUTY PRESCRIBED IN THIS ARTICLE TO DELIVER A DISCLOSURE STATEMENT PRIOR TO THE SIGNING BY THE BUYER OF A BINDING CONTRACT OF SALE, THE BUYER SHALL RECEIVE UPON THE TRANSFER OF TITLE A CREDIT OF FIVE HUNDRED DOLLARS AGAINST THE AGREED UPON PURCHASE PRICE OF THE RESIDENTIAL REAL PROPERTY.<br />

<br />

“RESIDENTIAL REAL PROPERTY” MEANS REAL PROPERTY IMPROVED BY A ONE TO FOUR FAMILY DWELLING USED OR OCCUPIED, OR INTENDED TO BE USED OR OCCUPIED, WHOLLY OR PARTLY, AS THE HOME OR RESIDENCE OF ONE OR MORE PERSONS, BUT SHALL NOT REFER TO (A) UNIMPROVED REAL PROPERTY UPON WHICH SUCH DWELLINGS ARE TO BE CONSTRUCTED OR (B) CONDOMINIUM UNITS OR COOPERATIVE APARTMENTS OR (C) PROPERTY ON A HOMEOWNERS’ ASSOCIATION THAT IS NOT OWNED IN FEE SIMPLE BY THE SELLER.<br />

<br />

INSTRUCTIONS TO THE SELLER:<br />

<br />

(a) ANSWER ALL QUESTIONS BASED UPON YOUR ACTUAL KNOWLEDGE.<br />

<br />

(b) ATTACH ADDITIONAL PAGES WITH YOUR SIGNATURE IF ADDITIONAL SPACE IS REQUIRED.<br />

<br />

(c) COMPLETE THIS FORM YOURSELF.<br />

<br />

(d) IF SOME ITEMS DO NOT APPLY TO YOUR PROPERTY, CHECK “NA” (NON-APPLICABLE). IF YOU DO NOT KNOW THE ANSWER CHECK “UNKN” (UNKNOWN).<br />

<br />

SELLER’S STATEMENT: THE SELLER MAKES THE FOLLOWING REPRESENTATIONS TO THE BUYER BASED UPON THE SELLER’S ACTUAL KNOWLEDGE AT THE TIME OF SIGNING THIS DOCUMENT. THE SELLER AUTHORIZES HIS OR HER AGENT, IF ANY, TO PROVIDE A COPY OF THIS STATEMENT TO A PROSPECTIVE BUYER OF THE RESIDENTIAL REAL PROPERTY. THE FOLLOWING ARE REPRESENTATIONS MADE BY THE SELLER AND ARE NOT THE REPRESENTATIONS OF THE SELLER’S AGENT.GENERAL INFORMATION<br />

<br />

1. HOW LONG HAVE YOU OWNED THE PROPERTY?<br />

<br />

2. HOW LONG HAVE YOU OCCUPIED THE PROPERTY?<br />

<br />

3. WHAT IS THE AGE OF THE STRUCTURE OR STRUCTURES? NOTE TO BUYER — IF THE STRUCTURE WAS BUILT BEFORE 1978 YOU ARE ENCOURAGED TO INVESTIGATE FOR THE PRESENCE OF LEAD BASED PAINT.<br />

<br />

4. DOES ANYBODY OTHER THAN YOURSELF HAVE A LEASE, EASEMENT OR ANY OTHER RIGHT TO USE OR OCCUPY ANY PART OF YOUR PROPERTY OTHER THAN THOSE STATED IN DOCUMENTS AVAILABLE IN THE PUBLIC RECORD, SUCH AS RIGHTS TO USE A ROAD OR PATH OR CUT TREES OR CROPS.<br />

<br />

YES NO UNKN NA<br />

<br />

5. DOES ANYBODY ELSE CLAIM TO OWN ANY PART OF YOUR PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

6. HAS ANYONE DENIED YOU ACCESS TO THE PROPERTY OR MADE A FORMAL LEGAL CLAIM CHALLENGING YOUR TITLE TO THE PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

7. ARE THERE ANY FEATURES OF THE PROPERTY SHARED IN COMMON WITH ADJOINING LAND OWNERS OR A HOMEOWNERS ASSOCIATION, SUCH AS WALLS, FENCES OR DRIVEWAYS?<br />

<br />

YES NO UNKN NA (IF YES DESCRIBE BELOW)<br />

<br />

8. ARE THERE ANY ELECTRIC OR GAS UTILITY SURCHARGES FOR LINE EXTENSIONS, SPECIAL ASSESSMENTS OR HOMEOWNER OR OTHER ASSOCIATION FEES THAT APPLY TO THE PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

9. ARE THERE CERTIFICATES OF OCCUPANCY RELATED TO THE PROPERTY?<br />

<br />

YES NO UNKN NA (IF NO, EXPLAIN BELOW)<br />

<br />

ENVIRONMENTAL NOTE TO SELLER — IN THIS SECTION, YOU WILL BE ASKED QUESTIONS REGARDING PETROLEUM PRODUCTS AND HAZARDOUS OR TOXIC SUBSTANCES THAT YOU KNOW TO HAVE BEEN SPILLED, LEAKED OR OTHERWISE BEEN RELEASED ON THE PROPERTY OR FROM THE PROPERTY ONTO ANY OTHER PROPERTY. PETROLEUM PRODUCTS MAY INCLUDE, BUT ARE NOT LIMITED TO, GASOLINE, DIESEL FUEL, HOME HEATING FUEL, AND LUBRICANTS. HAZARDOUS OR TOXIC SUBSTANCES ARE PRODUCTS THAT COULD POSE SHORT- OR LONG-TERM DANGER TO PERSONAL HEALTH OR THE ENVIRONMENT IF THEY ARE NOT PROPERLY DISPOSED OF, APPLIED OR STORED. THESE INCLUDE, BUT ARE NOT LIMITED TO, FERTILIZERS, PESTICIDES AND INSECTICIDES, PAINT INCLUDING PAINT THINNER, VARNISH REMOVER AND WOOD PRESERVATIVES, TREATED WOOD, CONSTRUCTION MATERIALS SUCH AS ASPHALT AND ROOFING MATERIALS, ANTIFREEZE AND OTHER AUTOMOTIVE PRODUCTS, BATTERIES, CLEANING SOLVENTS INCLUDING SEPTIC TANK CLEANERS, HOUSEHOLD CLEANERS AND POOL CHEMICALS AND PRODUCTS CONTAINING MERCURY AND LEAD.<br />

<br />

NOTE TO BUYER — IF CONTAMINATION OF THIS PROPERTY FROM PETROLEUM PRODUCTS AND/OR HAZARDOUS OR TOXIC SUBSTANCES IS A CONCERN TO YOU, YOU ARE URGED TO CONSIDER SOIL AND GROUNDWATER TESTING OF THIS PROPERTY.<br />

<br />

10. IS ANY OR ALL OF THE PROPERTY LOCATED IN A DESIGNATED FLOODPLAIN?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

11. IS ANY OR ALL OF THE PROPERTY LOCATED IN A DESIGNATED WETLAND?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

12. IS THE PROPERTY LOCATED IN AN AGRICULTURAL DISTRICT?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

13. WAS THE PROPERTY EVER THE SITE OF A LANDFILL?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

14. ARE THERE OR HAVE THERE EVER BEEN FUEL STORAGE TANKS ABOVE OR BELOW THE GROUND ON THE PROPERTY?<br />

<br />

YES NO UNKN NA IF YES, ARE THEY CURRENTLY IN USE?<br />

<br />

YES NO UNKN NA LOCATION(S) ARE THEY LEAKING OR HAVE THEY EVER LEAKED?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

15. IS THERE ASBESTOS IN THE STRUCTURE?<br />

<br />

YES NO UNKN NA (IF YES, STATE LOCATION OR LOCATIONS BELOW)<br />

<br />

16. IS LEAD PLUMBING PRESENT?<br />

<br />

YES NO UNKN NA (IF YES, STATE LOCATION OR LOCATIONS BELOW)<br />

<br />

17. HAS A RADON TEST BEEN DONE?<br />

<br />

YES NO UNKN NA (IF YES, ATTACH A COPY OF THE REPORT)<br />

<br />

18. HAS MOTOR FUEL, MOTOR OIL, HOME HEATING FUEL, LUBRICATING OIL OR ANY OTHER PETROLEUM PRODUCT, METHANE GAS, OR ANY HAZARDOUS OR TOXIC SUBSTANCE SPILLED, LEAKED OR OTHERWISE BEEN RELEASED ON THE PROPERTY OR FROM THE PROPERTY ONTO ANY OTHER PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, DESCRIBE BELOW)<br />

<br />

19. HAS THE PROPERTY BEEN TESTED FOR THE PRESENCE OF MOTOR FUEL, MOTOR OIL, HOME HEATING FUEL, LUBRICATING OIL, OR ANY OTHER PETROLEUM PRODUCT, METHANE GAS, OR ANY HAZARDOUS OR TOXIC SUBSTANCE?<br />

<br />

YES NO UNKN NA (IF YES, ATTACH REPORT(S))STRUCTURAL<br />

<br />

20. IS THERE ANY ROT OR WATER DAMAGE TO THE STRUCTURE OR STRUCTURES?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

21. IS THERE ANY FIRE OR SMOKE DAMAGE TO THE STRUCTURE OR STRUCTURES?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

22. IS THERE ANY TERMITE, INSECT, RODENT OR PEST INFESTATION OR DAMAGE?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

23. HAS THE PROPERTY BEEN TESTED FOR TERMITE, INSECT, RODENT OR PEST INFESTATION OR DAMAGE?<br />

<br />

YES NO UNKN NA (IF YES, PLEASE ATTACH REPORT(S))<br />

<br />

24. WHAT IS THE TYPE OF ROOF/ROOF COVERING (SLATE, ASPHALT, OTHER.)? ANY KNOWN MATERIAL DEFECTS? HOW OLD IS THE ROOF? IS THERE A TRANSFERABLE WARRANTEE ON THE ROOF IN EFFECT NOW?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

25. ARE THERE ANY KNOWN MATERIAL DEFECTS IN ANY OF THE FOLLOWING STRUCTURAL SYSTEMS: FOOTINGS, BEAMS, GIRDERS, LINTELS, COLUMNS OR PARTITIONS.<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)MECHANICAL SYSTEMS & SERVICES<br />

<br />

26. WHAT IS THE WATER SOURCE (CIRCLE ALL THAT APPLY — WELL, PRIVATE, MUNICIPAL, OTHER)? IF MUNICIPAL, IS IT METERED?<br />

<br />

YES NO UNKN NA<br />

<br />

27. HAS THE WATER QUALITY AND/OR FLOW RATE BEEN TESTED?<br />

<br />

YES NO UNKN NA (IF YES, DESCRIBE BELOW)<br />

<br />

28. WHAT IS THE TYPE OF SEWAGE SYSTEM (CIRCLE ALL THAT APPLY — PUBLIC SEWER, PRIVATE SEWER, SEPTIC OR CESSPOOL)? IF SEPTIC OR CESSPOOL, AGE? ________ DATE LAST PUMPED? ________ FREQUENCY OF PUMPING? ________ ANY KNOWN MATERIAL DEFECTS?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

29. WHO IS YOUR ELECTRIC SERVICE PROVIDER? ________ WHAT IS THE AMPERAGE? ________ DOES IT HAVE CIRCUIT BREAKERS OR FUSES? ________ PRIVATE OR PUBLIC POLES? ________ ANY KNOWN MATERIAL DEFECTS?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

30. ARE THERE ANY FLOODING, DRAINAGE OR GRADING PROBLEMS THAT RESULTED IN STANDING WATER ON ANY PORTION OF THE PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, STATE LOCATIONS AND EXPLAIN BELOW)<br />

<br />

31. DOES THE BASEMENT HAVE SEEPAGE THAT RESULTS IN STANDING WATER?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

ARE THERE ANY KNOWN MATERIAL DEFECTS IN ANY OF THE FOLLOWING (IF YES, EXPLAIN BELOW. USE ADDITIONAL SHEETS IF NECESSARY.):<br />

<br />

32. PLUMBING SYSTEM? YES NO UNKN NA<br />

<br />

33. SECURITY SYSTEM? YES NO UNKN NA<br />

<br />

34. CARBON MONOXIDE DETECTOR? YES NO UNKN NA<br />

<br />

35. SMOKE DETECTOR? YES NO UNKN NA<br />

<br />

36. FIRE SPRINKLER SYSTEM? YES NO UNKN NA<br />

<br />

37. SUMP PUMP? YES NO UNKN NA<br />

<br />

38. FOUNDATION/SLAB? YES NO UNKN NA<br />

<br />

39. INTERIOR WALLS/CEILINGS? YES NO UNKN NA<br />

<br />

40. EXTERIOR WALLS OR SIDING? YES NO UNKN NA<br />

<br />

41. FLOORS? YES NO UNKN NA<br />

<br />

42. CHIMNEY/FIREPLACE OR STOVE? YES NO UNKN NA<br />

<br />

43. PATIO/DECK? YES NO UNKN NA<br />

<br />

44. DRIVEWAY? YES NO UNKN NA<br />

<br />

45. AIR CONDITIONER? YES NO UNKN NA<br />

<br />

46. HEATING SYSTEM? YES NO UNKN NA<br />

<br />

47. HOT WATER HEATER? YES NO UNKN NA<br />

<br />

48. THE PROPERTY IS LOCATED IN THE FOLLOWING SCHOOL DISTRICT UNKN NOTE: BUYER IS ENCOURAGED TO CHECK PUBLIC RECORDS CONCERNING THE PROPERTY (E.G. TAX RECORDS AND WETLAND AND FLOOD PLAIN MAPS)<br />

<br />

THE SELLER SHOULD USE THIS AREA TO FURTHER EXPLAIN ANY ITEM ABOVE. IF NECESSARY, ATTACH ADDITIONAL PAGES AND INDICATE HERE THE NUMBER OF ADDITIONAL PAGES ATTACHED.<br />

<br />

_______________________________________________________<br />

<br />

_______________________________________________________<br />

<br />

_______________________________________________________<br />

<br />

_______________________________________________________<br />

<br />

SELLER’S CERTIFICATION: SELLER CERTIFIES THAT THE INFORMATION IN THIS PROPERTY CONDITION DISCLOSURE STATEMENT IS TRUE AND COMPLETE TO THE SELLER’S ACTUAL KNOWLEDGE AS OF THE DATE SIGNED BY THE SELLER. IF A SELLER OF RESIDENTIAL REAL PROPERTY ACQUIRES KNOWLEDGE WHICH RENDERS MATERIALLY INACCURATE A PROPERTY CONDITION DISCLOSURE STATEMENT PROVIDED PREVIOUSLY, THE SELLER SHALL DELIVER A REVISED PROPERTY CONDITION DISCLOSURE STATEMENT TO THE BUYER AS SOON AS PRACTICABLE. IN NO EVENT, HOWEVER, SHALL A SELLER BE REQUIRED TO PROVIDE A REVISED PROPERTY CONDITION DISCLOSURE STATEMENT AFTER THE TRANSFER OF TITLE FROM THE SELLER TO THE BUYER OR OCCUPANCY BY THE BUYER, WHICHEVER IS EARLIER.<br />

<br />

SELLER__________ DATE___________<br />

<br />

SELLER__________ DATE___________<br />

<br />

BUYER’S ACKNOWLEDGMENT: BUYER ACKNOWLEDGES RECEIPT OF A COPY OF THIS STATEMENT AND BUYER UNDERSTANDS THAT THIS INFORMATION IS A STATEMENT OF CERTAIN CONDITIONS AND INFORMATION CONCERNING THE PROPERTY KNOWN TO THE SELLER. IT IS NOT A WARRANTY OF ANY KIND BY THE SELLER OR SELLER’S AGENT AND IS NOT A SUBSTITUTE FOR ANY HOME, PEST, RADON OR OTHER INSPECTIONS OR TESTING OF THE PROPERTY OR INSPECTION OF THE PUBLIC RECORDS.<br />

<br />

BUYER__________ DATE__________<br />

<br />

BUYER__________ DATE _________<br />

<br />

3. Nothing in this article shall require a seller to undertake or provide for any investigation or inspection of his or her residential real property or to check any public records.<br />

(Added by Laws 2001, ch. 456, § 2, eff. Mar. 1 2002.)<br />

<br />

§ 463 Real Prop. Exemptions.<br />

<br />

A property condition disclosure statement shall not be required in connection with any of the following transfers of residential real property:<br />

<br />

1. A transfer pursuant to a court order, including, but not limited to, a transfer order by a probate court during the administration of a decedent’s estate, a transfer pursuant to a writ of execution, a transfer by a trustee in bankruptcy or debtor-in-possession, a transfer as a result of the exercise of the power of eminent domain, and a transfer that results from a decree for specific performance of a contract or other agreement between two or more persons;<br />

<br />

2. A transfer to mortgagee or an affiliate or agent thereof by a mortgagor by deed in lieu of foreclosure or in satisfaction of the mortgage debt;<br />

<br />

3. A transfer to a beneficiary of a deed of trust;<br />

<br />

4. A transfer pursuant to a foreclosure sale that follows a default in the satisfaction of an obligation that is secured by a mortgage;<br />

<br />

5. A transfer by a sale under a power of sale that follows a default in the satisfaction of an obligation that is secured by a mortgage;<br />

<br />

6. A transfer by a mortgagee, or a beneficiary under a mortgage, or an affiliate or agent thereof, who has acquired the residential real property at a sale under a mortgage or who has acquired the residential real property by a deed in lieu of foreclosure;<br />

<br />

7. A transfer by a fiduciary in the course of the administration of a descendent’s estate, a guardianship, a conservatorship, or a trust;<br />

<br />

8. A transfer from one co-owner to one or more other co-owners;<br />

<br />

9. A transfer made to the transferor’s spouse or to one or more persons in the lineal consanguinity of one or more of the transferors;<br />

<br />

10. A transfer between spouses or former spouses as a result of a decree of divorce, dissolution of marriage, annulment, or legal separation or as a result of property settlement, agreement incidental to a decree of divorce, dissolution of marriage, annulment or legal separation;<br />

<br />

11. A transfer to or from the state, a political subdivision of the state, or another governmental entity;<br />

<br />

12. A transfer that involves newly constructed residential real property that previously had not been inhabited;<br />

<br />

13. A transfer by a sheriff; or<br />

<br />

14. A transfer pursuant to a partition action.<br />

(Added by Laws 2001, ch. 456, § 2, eff. Mar. 1 2002.)<br />

<br />

§ 464 Real Prop. Revision.<br />

<br />

If a seller of residential real property acquires knowledge which renders materially inaccurate a property condition disclosure statement provided previously, the seller shall deliver a revised property condition disclosure statement to the buyer as soon as practicable. In no event, however, shall a seller be required to provide a revised property condition disclosure statement after the transfer of title from the seller to the buyer or occupancy by the buyer, whichever is earlier.<br />

(Added by Laws 2001, ch. 456, § 2, eff. Mar. 1 2002.)<br />

<br />

§ 465 Real Prop. Remedy.<br />

<br />

1. In the event a seller fails to perform the duty prescribed in this article to deliver a disclosure statement prior to the signing by the buyer of a binding contract of sale, the buyer shall receive upon the transfer of title a credit of five hundred dollars against the agreed upon purchase price of the residential real property.<br />

<br />

2. Any seller who provides a property condition disclosure statement or provides or fails to provide a revised property condition disclosure statement shall be liable only for a willful failure to perform the requirements of this article. For such a willful failure, the seller shall be liable for the actual damages suffered by the buyer in addition to any other existing equitable or statutory remedy.<br />

(Added by Laws 2001, ch. 456, § 2, eff. Mar. 1 2002.)<br />

<br />

§ 466 Real Prop. Duty of an agent<br />

<br />

An agent representing a seller of residential real property as a listing broker shall have the duty to timely inform each seller represented by that agent of the seller’s obligations under this article. An agent representing a buyer of residential real property, or, if the buyer is not represented by an agent, the agent representing a seller of residential real property and dealing with a prospective buyer, shall have the duty to timely (in any event, before the buyer signs a binding contract of sale) inform such buyer of the buyer’s rights and obligations under this article. If an agent performs the duties and obligations imposed upon him or her pursuant to this section, the agent shall have no further duties under this article and shall not be liable to any party for a violation of this article.<br />

(Added by Laws 2001, ch. 456, § 2, eff. Mar. 1 2002.)<br />

<br />

§ 467 Real Prop. Liability.<br />

<br />

Nothing contained in this article shall be construed as limiting any existing legal cause of action or remedy at law, in statute or in equity.<br />

(Added by Laws 2001, ch. 456, § 2, eff. Mar. 1 2002.)<br />

<br />

NEW YORK CASE LAW<br />

<br />

The key to the resolution of the rights of the parties lies in whether the vendee under a land sale contract has acquired an interest in the property of such a nature that it must be extinguished before the vendor may resume possession. Such an interest exists when the vendee acquires equitable title and the vendor merely holds the legal title in trust for the vendee, subject to the vendor’s equitable lien for the payment of the purchase price in accordance with the terms of the contract. The vendor may not enforce his rights by the simple expedient of an action in ejectment but must instead proceed to foreclose the vendee’s equitable title or bring an action at law for the purchase price. Bean v. Walker, 95 A.D.2d 70 (1983)<br />

<br />

While legal title does not vest in the vendee until the contract terms are satisfied, he does acquire a vested equitable title at the time the contract is consummated. When the parties enter into the contract all incidents of ownership accrue to the vendee who assumes the risk of loss and is the recipient of all appreciation of value. The status of the parties becomes like that of mortgagor-mortgagee. Viewed otherwise would be to elevate form over substance. Id.<br />

<br />

Where sale of real property is evidenced by contract only and the purchase price has not been paid and is not to be paid until some future date in accordance with the terms of the agreement, the parties occupy substantially the position of mortgagor and mortgagee at common law. In New York a mortgage merely creates a lien rather than conveying title. Id.

CHAPTER 50 OF THE CONSOLIDATED LAWS - REAL PROPERTY LAW

ARTICLE 8 CONVEYANCES AND MORTGAGES

§ 240 Real Prop. Definitions and use of terms.

<blockquote>1. The term "heirs," or other words of inheritance, are not requisite to create or convey an estate in fee.

2. The term "conveyance," as used in this article, includes every instrument, in writing, except a will, by which any estate or interest in real property is created, transferred, assigned or surrendered.

3. Every instrument creating, transferring, assigning or surrendering an estate or interest in real property must be construed according to the intent of the parties, so far as such intent can be gathered from the whole instrument, and is consistent with the rules of law.

4. The terms "estate" and "interest in real property" include every such estate and interest, freehold or chattel, legal or equitable, present or future, vested or contingent.</blockquote>

§ 240-b Real Prop. Certain conveyances authorized; effect thereof.

<blockquote>1. Any person or persons owning real property or an interest in real property which he or they have power to convey, may effectively convey such property or interest by a conveyance naming himself or themselves and another person or persons, or one or more of themselves and another person or other persons, as grantees, and the conveyance has the same effect as to whether it creates an estate in severalty, a joint tenancy, or a tenancy by the entirety, or tenancy in common, as if it were a conveyance from a stranger who owned the property or interest to the persons named as grantees in the conveyance.

2. Any two or more persons owning real property or an interest in real property which they have power to convey, may effectively convey such property or interest by a conveyance naming one, or more than one, or all such persons, as grantees, and the conveyance has the same effect, as to whether it creates an estate in severalty, or a joint tenancy, or a tenancy by the entirety, or tenancy in common, as if it were a conveyance from a stranger who owned the property or interest to the persons named as grantees in the conveyance.

3. As used in this section, "person" may be a married person and "persons" may be persons married to each other.</blockquote>

§ 240-c Real Prop. Joint tenancy severance.

<blockquote>1. In addition to any other means by which a joint tenancy with right of survivorship may be severed, a joint tenant may unilaterally sever a joint tenancy in real property without consent of any non-severing joint tenant or tenants by:

<blockquote>(a) Execution and delivery of a deed that conveys legal title to the severing joint tenant's interest to a third person, whether or not pursuant to an agreement requiring the third person to reconvey legal title to the severing joint tenant; or

(b) Execution of a written instrument that evidences the intent to sever the joint tenancy, including a deed that names the severing tenant as the direct grantee of the severing tenant's interest.</blockquote>

2. No severance of a joint tenancy pursuant to subdivision one of this section shall terminate the right of survivorship of any non-severing joint tenant or tenants as to the severing tenant's interest unless the deed or written instrument effecting the severance is recorded, prior to the death of the severing tenant, in the county where the real property is located.

3. Nothing in this section shall limit the manner or effect of:

<blockquote>(a) A severance of a joint tenancy pursuant to a written instrument executed by all joint tenants, or pursuant to a written agreement of all joint tenants.

(b) A severance of a joint tenancy effected by a deed from a joint tenant to another joint tenant.

(c) A severance ordered by a court of competent jurisdiction.</blockquote>

</blockquote>

§ 241 Real Prop. Ancient conveyances abolished.

The conveyance of real property by feoffment, with livery of seizin, or by fines, or common recoveries, is abolished.

§ 242 Real Prop. Disclosure prior to the sale of real property.

[EDITORS' NOTE: TE TEXT OF THIS SECTION IS EFFECTIVE UNTIL JANUARY 1, 2007, SEE BELOW SECTION FOR TEXT EFFECTIVE JANUARY 1, 2007.]

<blockquote>

<blockquote>1. (a) Any person, firm, company, partnership or corporation offering to sell real property to which no utility electric service is provided shall provide written notice to the prospective purchaser or to the prospective purchaser's agent, clearly indicating this fact. Such notice shall be provided prior to accepting a purchase offer.

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this section is entitled to recover any actual damages incurred from the person offering to sell said real property.

(c) The provisions of this subdivision shall not apply in instances where the real property being sold lies within the applicable free footage allowance or service lateral specified by the public service commission in rule, regulation or public utility tariff.</blockquote>

2. Disclosure prior to the sale of real property to which utility surcharge payments attach.

<blockquote>(a) Any person, firm, company, partnership or corporation offering to sell real property against which an electric, gas or water utility surcharge is assessed for the purpose of defraying the costs associated with an electric, gas or water line extension, or for the purpose of defraying the costs associated with related facilities, shall provide written notice to the prospective purchaser or the prospective purchaser's agent, stating as follows: "This property is subject to an electric , gas and/or water utility surcharge". In addition, such notice shall also state, the type and purpose of the surcharge, the amount of the surcharge and whether such surcharge is payable on a monthly, yearly or other basis. Such notice shall be provided by the seller prior to accepting a purchase offer.

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this subdivision is entitled to recover any actual damages incurred from the person offering to sell or selling said real property.

(As amended by Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004.)

Amendment Notes:

Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004, amended paragraph (a) of subdivision 2.</blockquote>

</blockquote>

§ 242 Disclosure prior to the sale of real property.

[EDITORS' NOTE: THE TEXT OF THIS SECTION IS EFFECTIVE JANUARY 1, 2007, SEE ABOVE SECTION FOR TEXT EFFECTIVE UNTIL JANUARY 1, 2007.]

<blockquote>

<blockquote>1. (a) Any person, firm, company, partnership or corporation offering to sell real property to which no utility electric service is provided shall provide written notice to the prospective purchaser or to the prospective purchaser's agent, clearly indicating this fact. Such notice shall be provided prior to accepting a purchase offer.

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this section is entitled to recover any actual damages incurred from the person offering to sell said real property.

(c) The provisions of this subdivision shall not apply in instances where the real property being sold lies within the applicable free footage allowance or service lateral specified by the public service commission in rule, regulation or public utility tariff.</blockquote>

2. Disclosure prior to the sale of real property to which utility surcharge payments attach.<br />

<br />

(a) Any person, firm, company, partnership or corporation offering to sell real property against which an electric, gas or water utility surcharge is assessed for the purpose of defraying the costs associated with an electric, gas or water line extension, or for the purpose of defraying the costs associated with related facilities, shall provide written notice to the prospective purchaser or the prospective purchaser’s agent, stating as follows: “This property is subject to an electric , gas and/or water utility surcharge”. In addition, such notice shall also state, the type and purpose of the surcharge, the amount of the surcharge and whether such surcharge is payable on a monthly, yearly or other basis. Such notice shall be provided by the seller prior to accepting a purchase offer.<br />

<br />

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this subdivision is entitled to recover any actual damages incurred from the person offering to sell or selling said real property.<br />

(As amended by Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004.)<br />

Amendment Notes:<br />

Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004, amended paragraph (a) of subdivision 2.<br />

<br />

§ 242 Disclosure prior to the sale of real property.<br />

[EDITORS’ NOTE: THE TEXT OF THIS SECTION IS EFFECTIVE JANUARY 1, 2007, SEE ABOVE SECTION FOR TEXT EFFECTIVE UNTIL JANUARY 1, 2007.]<br />

<br />

1. (a) Any person, firm, company, partnership or corporation offering to sell real property to which no utility electric service is provided shall provide written notice to the prospective purchaser or to the prospective purchaser’s agent, clearly indicating this fact. Such notice shall be provided prior to accepting a purchase offer.<br />

<br />

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this section is entitled to recover any actual damages incurred from the person offering to sell said real property.<br />

<br />

(c) The provisions of this subdivision shall not apply in instances where the real property being sold lies within the applicable free footage allowance or service lateral specified by the public service commission in rule, regulation or public utility tariff.<br />

<br />

2. Disclosure prior to the sale of real property to which utility surcharge payments attach.<br />

<br />

(a) Any person, firm, company, partnership or corporation offering to sell real property against which an electric, gas or water utility surcharge is assessed for the purpose of defraying the costs associated with an electric, gas or water line extension, or for the purpose of defraying the costs associated with related facilities, shall provide written notice to the prospective purchaser or the prospective purchaser’s agent, stating as follows: “This property is subject to an electric , gas and/or water utility surcharge”. In addition, such notice shall also state, the type and purpose of the surcharge, the amount of the surcharge and whether such surcharge is payable on a monthly, yearly or other basis. Such notice shall be provided by the seller prior to accepting a purchase offer.<br />

<br />

(b) Any prospective or actual purchaser who has suffered a loss due to a violation of this subdivision is entitled to recover any actual damages incurred from the person offering to sell or selling said real property.<br />

<br />

3. Any person, firm, company, partnership or corporation offering to sell real property on which uncapped natural gas wells are situated, and of which such person, firm, company, partnership or corporation has actual knowledge, shall inform any purchaser of the existence of these wells prior to entering into a contract for the sale/purchase of such property.<br />

(As amended by Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004; Laws 2006, ch. 163, Sec. 1, eff. Jan. 1, 2007.)<br />

Amendment Notes:<br />

Laws 2006, ch. 163, Sec. 1, eff. Jan. 1, 2007, amended this section by adding a new subdivision 3.<br />

Laws 2004, ch. 61, Sec. 1, eff. Oct. 31, 2004, amended paragraph (a) of subdivision 2.<br />

<br />

§ 243 Real Prop. Grant of fee or freehold.<br />

<br />

A grant in fee or of a freehold estate, must be subscribed by the person from whom the estate or interest conveyed is intended to pass, or by his lawful agent thereunto authorized in writing. If not duly acknowledged before its delivery, according to the provisions of this chapter, its execution and delivery must be attested by at least one witness, or, if not so attested, it does not take effect as against a subsequent purchaser or incumbrancer until so acknowledged.<br />

<br />

§ 244 Real Prop. When grant takes effect.<br />

<br />

A grant takes effect, so as to vest the estate or interest intended to be conveyed, only from its delivery; and all the rules of law, now in force, in respect to the delivery of deeds, apply to grants hereafter executed.<br />

<br />

§ 245 Real Prop. Estate which passes by grant or devise.<br />

<br />

A grant or devise of real property passes all the estate or interest of the grantor or testator unless the intent to pass a less estate or interest appears by the express terms of such grant or devise or by necessary implication therefrom. A greater estate or interest does not pass by any grant or conveyance, than the grantor possessed or could lawfully convey, at the time of the delivery of the deeds; except that every grant is conclusive against the grantor and his heirs claiming from him by descent, and as against a subsequent purchaser or incumbrancer from such grantor, or from such heirs claiming as such, other than a subsequent purchaser or incumbrancer in good faith and for a valuable consideration, who acquires a superior title by a conveyance that has been first duly recorded.<br />

<br />

§ 246 Real Prop. Certain deeds declared grants.<br />

<br />

Deeds of bargain and sale, and of lease and release, may continue to be used; and are to be deemed grants, subject to all the provisions of law in relation thereto.<br />

<br />

§ 247 Real Prop. Conveyance by tenant for life or years of greater estate than possessed.<br />

<br />

A conveyance made by a tenant for life or years, of a greater estate than he possesses, or can lawfully convey, does not work a forfeiture of his estate, but passes to the grantee all the title, estate or interest which such tenant can lawfully convey.<br />

<br />

§ 248 Real Prop. Effect of conveyance where property is leased.<br />

<br />

An attornment to a grantee is not requisite to the validity of a conveyance of real property occupied by a tenant, or of the rents or profits thereof, or any other interest therein. But the payment of rent to a grantor, by his tenant, before notice of the conveyance, binds the grantee; and the tenant is not liable to such grantee, before such notice, for the breach of any condition of the lease.<br />

<br />

NEW YORK CONSOLIDATED LAWS<br />

CHAPTER 50 OF THE CONSOLIDATED LAWS — REAL PROPERTY LAW<br />

ARTICLE 14 PROPERTY CONDITION DISCLOSURE IN THE SALE OF RESIDENTIAL REAL PROPERTY<br />

<br />

§ 461 Real Prop. Definitions.<br />

<br />

As used in this article, the following terms shall have the following meanings:<br />

<br />

1. “Agent” means a person who is licensed as a real estate broker or a real estate salesperson pursuant to section four hundred forty-a of this chapter and is acting in a fiduciary capacity.<br />

<br />

2. “Binding contract of sale” means a real estate purchase contract or offer that would, upon signing by the seller and subject to satisfaction of any contingencies, require the buyer to accept a transfer of title.<br />

<br />

3. “Knowledge” means only actual knowledge of a defect or condition on the part of the seller of residential real property.<br />

<br />

4. “Real estate purchase contract” means any of the following:<br />

<br />

(a) a contract which provides for the purchase and sale or exchange of residential real property;<br />

<br />

(b) a lease with an option to purchase residential real property;<br />

<br />

(c) a lease-with-obligation-to-purchase agreement for residential real property; or<br />

<br />

(d) an installment land sale contract for residential real property.<br />

<br />

5. “Residential real property” means real property improved by a one to four family dwelling used or occupied, or intended to be used or occupied, wholly or partly, as the home or residence of one or more persons, but shall not refer to (a) unimproved real property upon which such dwellings are to be constructed, or (b) condominium units or cooperative apartments, or (c) property in a homeowners’ association that is not owned in fee simple by the seller.<br />

<br />

6. “Transfer of title” means delivery of a properly executed instrument conveying title to residential real property and shall include delivery of a real estate purchase contract that is a lease or installment land sale contract.<br />

(Added by Laws 2001, ch. 456, § 2, eff. Mar. 1 2002.)<br />

<br />

§ 462 Real Prop. Property condition disclosure statement<br />

<br />

1. Except as is provided in section four hundred sixty-three of this article, every seller of residential real property pursuant to a real estate purchase contract shall complete and sign a property condition disclosure statement as prescribed by subdivision two of this section and cause it, or a copy thereof, to be delivered to a buyer or buyer’s agent prior to the signing by the buyer of a binding contract of sale. A copy of the property condition disclosure statement containing the signatures of both seller and buyer shall be attached to the real estate purchase contract. Nothing contained in this article or this disclosure statement is intended to prevent the parties to a contract of sale from entering into agreements of any kind or nature with respect to the physical condition of the property to be sold, including, but not limited to, agreements for the sale of real property “as is”.<br />

<br />

2. The following shall be the disclosure form:PROPERTY CONDITION DISCLOSURE STATEMENT<br />

<br />

NAME OF SELLER OR SELLERS:<br />

<br />

PROPERTY ADDRESS:<br />

<br />

THE PROPERTY CONDITION DISCLOSURE ACT REQUIRES THE SELLER OF RESIDENTIAL REAL PROPERTY TO CAUSE THIS DISCLOSURE STATEMENT OR A COPY THEREOF TO BE DELIVERED TO A BUYER OR BUYER’S AGENT PRIOR TO THE SIGNING BY THE BUYER OF A BINDING CONTRACT OF SALE.<br />

<br />

PURPOSE OF STATEMENT: THIS IS A STATEMENT OF CERTAIN CONDITIONS AND INFORMATION CONCERNING THE PROPERTY KNOWN TO THE SELLER. THIS DISCLOSURE STATEMENT IS NOT A WARRANTY OF ANY KIND BY THE SELLER OR BY ANY AGENT REPRESENTING THE SELLER IN THIS TRANSACTION. IT IS NOT A SUBSTITUTE FOR ANY INSPECTIONS OR TESTS AND THE BUYER IS ENCOURAGED TO OBTAIN HIS OR HER OWN INDEPENDENT PROFESSIONAL INSPECTIONS AND ENVIRONMENTAL TESTS AND ALSO IS ENCOURAGED TO CHECK PUBLIC RECORDS PERTAINING TO THE PROPERTY. A KNOWINGLY FALSE OR INCOMPLETE STATEMENT BY THE SELLER ON THIS FORM MAY SUBJECT THE SELLER TO CLAIMS BY THE BUYER PRIOR TO OR AFTER THE TRANSFER OF TITLE. IN THE EVENT A SELLER FAILS TO PERFORM THE DUTY PRESCRIBED IN THIS ARTICLE TO DELIVER A DISCLOSURE STATEMENT PRIOR TO THE SIGNING BY THE BUYER OF A BINDING CONTRACT OF SALE, THE BUYER SHALL RECEIVE UPON THE TRANSFER OF TITLE A CREDIT OF FIVE HUNDRED DOLLARS AGAINST THE AGREED UPON PURCHASE PRICE OF THE RESIDENTIAL REAL PROPERTY.<br />

<br />

“RESIDENTIAL REAL PROPERTY” MEANS REAL PROPERTY IMPROVED BY A ONE TO FOUR FAMILY DWELLING USED OR OCCUPIED, OR INTENDED TO BE USED OR OCCUPIED, WHOLLY OR PARTLY, AS THE HOME OR RESIDENCE OF ONE OR MORE PERSONS, BUT SHALL NOT REFER TO (A) UNIMPROVED REAL PROPERTY UPON WHICH SUCH DWELLINGS ARE TO BE CONSTRUCTED OR (B) CONDOMINIUM UNITS OR COOPERATIVE APARTMENTS OR (C) PROPERTY ON A HOMEOWNERS’ ASSOCIATION THAT IS NOT OWNED IN FEE SIMPLE BY THE SELLER.<br />

<br />

INSTRUCTIONS TO THE SELLER:<br />

<br />

(a) ANSWER ALL QUESTIONS BASED UPON YOUR ACTUAL KNOWLEDGE.<br />

<br />

(b) ATTACH ADDITIONAL PAGES WITH YOUR SIGNATURE IF ADDITIONAL SPACE IS REQUIRED.<br />

<br />

(c) COMPLETE THIS FORM YOURSELF.<br />

<br />

(d) IF SOME ITEMS DO NOT APPLY TO YOUR PROPERTY, CHECK “NA” (NON-APPLICABLE). IF YOU DO NOT KNOW THE ANSWER CHECK “UNKN” (UNKNOWN).<br />

<br />

SELLER’S STATEMENT: THE SELLER MAKES THE FOLLOWING REPRESENTATIONS TO THE BUYER BASED UPON THE SELLER’S ACTUAL KNOWLEDGE AT THE TIME OF SIGNING THIS DOCUMENT. THE SELLER AUTHORIZES HIS OR HER AGENT, IF ANY, TO PROVIDE A COPY OF THIS STATEMENT TO A PROSPECTIVE BUYER OF THE RESIDENTIAL REAL PROPERTY. THE FOLLOWING ARE REPRESENTATIONS MADE BY THE SELLER AND ARE NOT THE REPRESENTATIONS OF THE SELLER’S AGENT.GENERAL INFORMATION<br />

<br />

1. HOW LONG HAVE YOU OWNED THE PROPERTY?<br />

<br />

2. HOW LONG HAVE YOU OCCUPIED THE PROPERTY?<br />

<br />

3. WHAT IS THE AGE OF THE STRUCTURE OR STRUCTURES? NOTE TO BUYER — IF THE STRUCTURE WAS BUILT BEFORE 1978 YOU ARE ENCOURAGED TO INVESTIGATE FOR THE PRESENCE OF LEAD BASED PAINT.<br />

<br />

4. DOES ANYBODY OTHER THAN YOURSELF HAVE A LEASE, EASEMENT OR ANY OTHER RIGHT TO USE OR OCCUPY ANY PART OF YOUR PROPERTY OTHER THAN THOSE STATED IN DOCUMENTS AVAILABLE IN THE PUBLIC RECORD, SUCH AS RIGHTS TO USE A ROAD OR PATH OR CUT TREES OR CROPS.<br />

<br />

YES NO UNKN NA<br />

<br />

5. DOES ANYBODY ELSE CLAIM TO OWN ANY PART OF YOUR PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

6. HAS ANYONE DENIED YOU ACCESS TO THE PROPERTY OR MADE A FORMAL LEGAL CLAIM CHALLENGING YOUR TITLE TO THE PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

7. ARE THERE ANY FEATURES OF THE PROPERTY SHARED IN COMMON WITH ADJOINING LAND OWNERS OR A HOMEOWNERS ASSOCIATION, SUCH AS WALLS, FENCES OR DRIVEWAYS?<br />

<br />

YES NO UNKN NA (IF YES DESCRIBE BELOW)<br />

<br />

8. ARE THERE ANY ELECTRIC OR GAS UTILITY SURCHARGES FOR LINE EXTENSIONS, SPECIAL ASSESSMENTS OR HOMEOWNER OR OTHER ASSOCIATION FEES THAT APPLY TO THE PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

9. ARE THERE CERTIFICATES OF OCCUPANCY RELATED TO THE PROPERTY?<br />

<br />

YES NO UNKN NA (IF NO, EXPLAIN BELOW)<br />

<br />

ENVIRONMENTAL NOTE TO SELLER — IN THIS SECTION, YOU WILL BE ASKED QUESTIONS REGARDING PETROLEUM PRODUCTS AND HAZARDOUS OR TOXIC SUBSTANCES THAT YOU KNOW TO HAVE BEEN SPILLED, LEAKED OR OTHERWISE BEEN RELEASED ON THE PROPERTY OR FROM THE PROPERTY ONTO ANY OTHER PROPERTY. PETROLEUM PRODUCTS MAY INCLUDE, BUT ARE NOT LIMITED TO, GASOLINE, DIESEL FUEL, HOME HEATING FUEL, AND LUBRICANTS. HAZARDOUS OR TOXIC SUBSTANCES ARE PRODUCTS THAT COULD POSE SHORT- OR LONG-TERM DANGER TO PERSONAL HEALTH OR THE ENVIRONMENT IF THEY ARE NOT PROPERLY DISPOSED OF, APPLIED OR STORED. THESE INCLUDE, BUT ARE NOT LIMITED TO, FERTILIZERS, PESTICIDES AND INSECTICIDES, PAINT INCLUDING PAINT THINNER, VARNISH REMOVER AND WOOD PRESERVATIVES, TREATED WOOD, CONSTRUCTION MATERIALS SUCH AS ASPHALT AND ROOFING MATERIALS, ANTIFREEZE AND OTHER AUTOMOTIVE PRODUCTS, BATTERIES, CLEANING SOLVENTS INCLUDING SEPTIC TANK CLEANERS, HOUSEHOLD CLEANERS AND POOL CHEMICALS AND PRODUCTS CONTAINING MERCURY AND LEAD.<br />

<br />

NOTE TO BUYER — IF CONTAMINATION OF THIS PROPERTY FROM PETROLEUM PRODUCTS AND/OR HAZARDOUS OR TOXIC SUBSTANCES IS A CONCERN TO YOU, YOU ARE URGED TO CONSIDER SOIL AND GROUNDWATER TESTING OF THIS PROPERTY.<br />

<br />

10. IS ANY OR ALL OF THE PROPERTY LOCATED IN A DESIGNATED FLOODPLAIN?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

11. IS ANY OR ALL OF THE PROPERTY LOCATED IN A DESIGNATED WETLAND?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

12. IS THE PROPERTY LOCATED IN AN AGRICULTURAL DISTRICT?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

13. WAS THE PROPERTY EVER THE SITE OF A LANDFILL?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

14. ARE THERE OR HAVE THERE EVER BEEN FUEL STORAGE TANKS ABOVE OR BELOW THE GROUND ON THE PROPERTY?<br />

<br />

YES NO UNKN NA IF YES, ARE THEY CURRENTLY IN USE?<br />

<br />

YES NO UNKN NA LOCATION(S) ARE THEY LEAKING OR HAVE THEY EVER LEAKED?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

15. IS THERE ASBESTOS IN THE STRUCTURE?<br />

<br />

YES NO UNKN NA (IF YES, STATE LOCATION OR LOCATIONS BELOW)<br />

<br />

16. IS LEAD PLUMBING PRESENT?<br />

<br />

YES NO UNKN NA (IF YES, STATE LOCATION OR LOCATIONS BELOW)<br />

<br />

17. HAS A RADON TEST BEEN DONE?<br />

<br />

YES NO UNKN NA (IF YES, ATTACH A COPY OF THE REPORT)<br />

<br />

18. HAS MOTOR FUEL, MOTOR OIL, HOME HEATING FUEL, LUBRICATING OIL OR ANY OTHER PETROLEUM PRODUCT, METHANE GAS, OR ANY HAZARDOUS OR TOXIC SUBSTANCE SPILLED, LEAKED OR OTHERWISE BEEN RELEASED ON THE PROPERTY OR FROM THE PROPERTY ONTO ANY OTHER PROPERTY?<br />

<br />

YES NO UNKN NA (IF YES, DESCRIBE BELOW)<br />

<br />

19. HAS THE PROPERTY BEEN TESTED FOR THE PRESENCE OF MOTOR FUEL, MOTOR OIL, HOME HEATING FUEL, LUBRICATING OIL, OR ANY OTHER PETROLEUM PRODUCT, METHANE GAS, OR ANY HAZARDOUS OR TOXIC SUBSTANCE?<br />

<br />

YES NO UNKN NA (IF YES, ATTACH REPORT(S))STRUCTURAL<br />

<br />

20. IS THERE ANY ROT OR WATER DAMAGE TO THE STRUCTURE OR STRUCTURES?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

21. IS THERE ANY FIRE OR SMOKE DAMAGE TO THE STRUCTURE OR STRUCTURES?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

22. IS THERE ANY TERMITE, INSECT, RODENT OR PEST INFESTATION OR DAMAGE?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

23. HAS THE PROPERTY BEEN TESTED FOR TERMITE, INSECT, RODENT OR PEST INFESTATION OR DAMAGE?<br />

<br />

YES NO UNKN NA (IF YES, PLEASE ATTACH REPORT(S))<br />

<br />

24. WHAT IS THE TYPE OF ROOF/ROOF COVERING (SLATE, ASPHALT, OTHER.)? ANY KNOWN MATERIAL DEFECTS? HOW OLD IS THE ROOF? IS THERE A TRANSFERABLE WARRANTEE ON THE ROOF IN EFFECT NOW?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />

25. ARE THERE ANY KNOWN MATERIAL DEFECTS IN ANY OF THE FOLLOWING STRUCTURAL SYSTEMS: FOOTINGS, BEAMS, GIRDERS, LINTELS, COLUMNS OR PARTITIONS.<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)MECHANICAL SYSTEMS & SERVICES<br />

<br />

26. WHAT IS THE WATER SOURCE (CIRCLE ALL THAT APPLY — WELL, PRIVATE, MUNICIPAL, OTHER)? IF MUNICIPAL, IS IT METERED?<br />

<br />

YES NO UNKN NA<br />

<br />

27. HAS THE WATER QUALITY AND/OR FLOW RATE BEEN TESTED?<br />

<br />

YES NO UNKN NA (IF YES, DESCRIBE BELOW)<br />

<br />

28. WHAT IS THE TYPE OF SEWAGE SYSTEM (CIRCLE ALL THAT APPLY — PUBLIC SEWER, PRIVATE SEWER, SEPTIC OR CESSPOOL)? IF SEPTIC OR CESSPOOL, AGE? ________ DATE LAST PUMPED? ________ FREQUENCY OF PUMPING? ________ ANY KNOWN MATERIAL DEFECTS?<br />

<br />

YES NO UNKN NA (IF YES, EXPLAIN BELOW)<br />

<br />