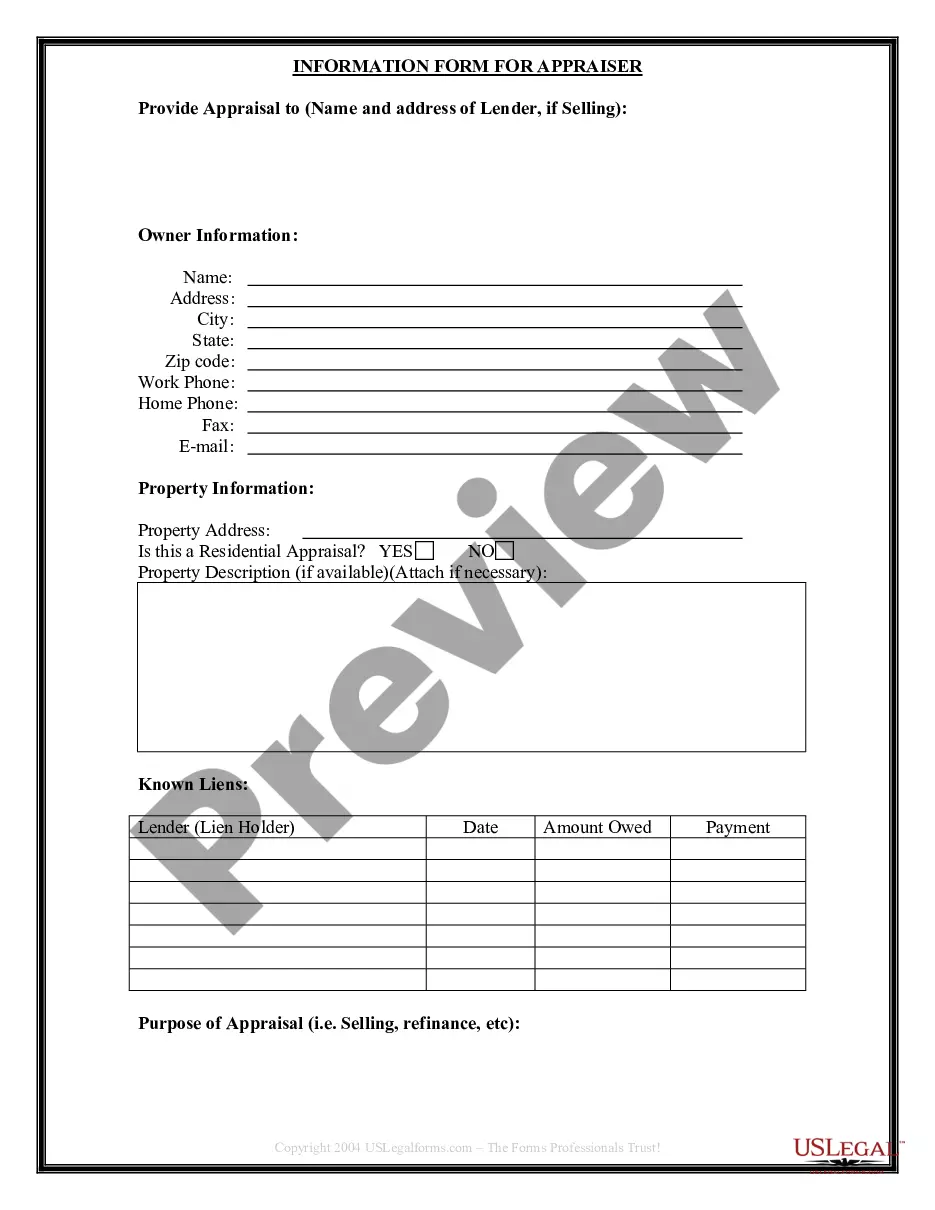

Kings New York Seller's Information for Appraiser provided to Buyer is a comprehensive set of documents and data designed to inform the appraiser about the property being sold. It includes various details and specifications about the property that can influence its value. The collected information assists the appraiser in conducting a thorough evaluation and providing an accurate appraisal report to the potential buyer. Some common types of Kings New York Seller's Information for Appraiser provided to Buyer may include: 1. Property Information: This section consists of basic details about the property, such as the address, lot size, property type (residential, commercial, etc.), number of bedrooms and bathrooms, square footage, and any additional features (pool, garage, etc.). The appraiser needs this information to determine the property's physical attributes. 2. Property History: This section focuses on the history of the property, including any previous sales, changes in ownership, and the length of time the current owner has possessed the property. It may also include details about any upgrades, renovations, or repairs done to the property, which could influence its value. 3. Listing Price and Market Comparisons: The appraiser needs information on the listing price and any recent sales of comparable properties in the area. This allows for a comparative market analysis to determine the property's value based on current market trends. 4. Pending or Contingent Sales: This section provides insights into any pending or contingent sales related to the property. This information helps the appraiser understand the current market demand and the property's potential sales value. 5. Property Disclosures: Sellers are required to disclose any known issues or defects that could affect the property's value. This section may include information about structural damage, leaks, pest infestations, or any other significant issues impacting the property's condition. 6. Homeowners Association (HOA) Details: If the property is part of an HOA, the seller's information for the appraiser will include details about the association, its fees, rules, and restrictions. This is important as it can affect the property's value and marketability. 7. Additional Documentation: Depending on the property type and specific requirements, additional documentation may be included, such as survey reports, inspection reports, title documents, and any relevant permits or certificates. In summary, Kings New York Seller's Information for Appraiser provided to Buyer is a crucial resource offering comprehensive insights into the property being appraised. It encompasses various aspects, such as property details, history, market comparable, disclosures, HOA information, and any additional supporting documentation. Such information allows the appraiser to form an accurate valuation opinion, helping the buyer make informed decisions regarding the property purchase.

Kings New York Seller's Information for Appraiser provided to Buyer is a comprehensive set of documents and data designed to inform the appraiser about the property being sold. It includes various details and specifications about the property that can influence its value. The collected information assists the appraiser in conducting a thorough evaluation and providing an accurate appraisal report to the potential buyer. Some common types of Kings New York Seller's Information for Appraiser provided to Buyer may include: 1. Property Information: This section consists of basic details about the property, such as the address, lot size, property type (residential, commercial, etc.), number of bedrooms and bathrooms, square footage, and any additional features (pool, garage, etc.). The appraiser needs this information to determine the property's physical attributes. 2. Property History: This section focuses on the history of the property, including any previous sales, changes in ownership, and the length of time the current owner has possessed the property. It may also include details about any upgrades, renovations, or repairs done to the property, which could influence its value. 3. Listing Price and Market Comparisons: The appraiser needs information on the listing price and any recent sales of comparable properties in the area. This allows for a comparative market analysis to determine the property's value based on current market trends. 4. Pending or Contingent Sales: This section provides insights into any pending or contingent sales related to the property. This information helps the appraiser understand the current market demand and the property's potential sales value. 5. Property Disclosures: Sellers are required to disclose any known issues or defects that could affect the property's value. This section may include information about structural damage, leaks, pest infestations, or any other significant issues impacting the property's condition. 6. Homeowners Association (HOA) Details: If the property is part of an HOA, the seller's information for the appraiser will include details about the association, its fees, rules, and restrictions. This is important as it can affect the property's value and marketability. 7. Additional Documentation: Depending on the property type and specific requirements, additional documentation may be included, such as survey reports, inspection reports, title documents, and any relevant permits or certificates. In summary, Kings New York Seller's Information for Appraiser provided to Buyer is a crucial resource offering comprehensive insights into the property being appraised. It encompasses various aspects, such as property details, history, market comparable, disclosures, HOA information, and any additional supporting documentation. Such information allows the appraiser to form an accurate valuation opinion, helping the buyer make informed decisions regarding the property purchase.