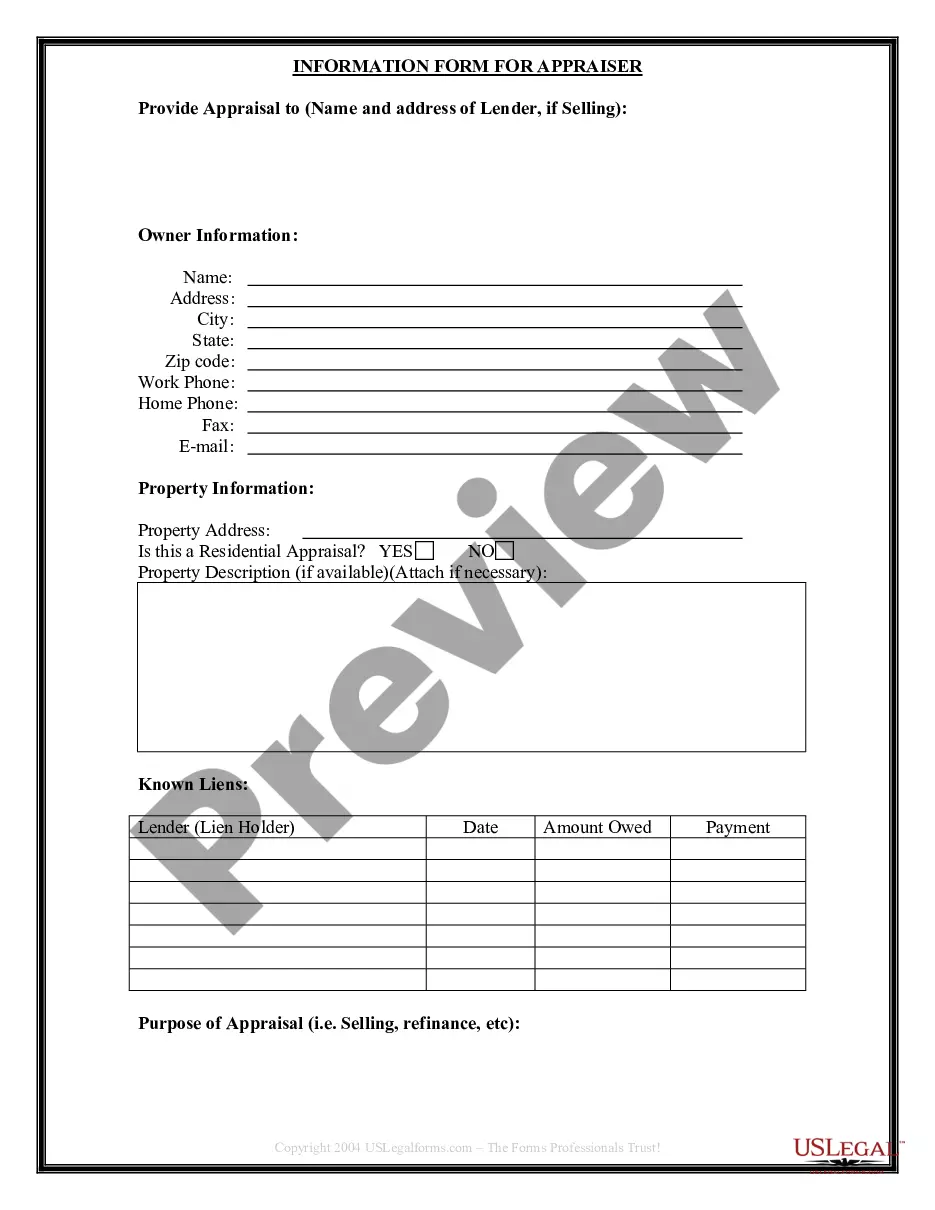

Syracuse New York Seller's Information for Appraiser provides crucial details and documentation to assist buyers and appraisers in evaluating a property's value accurately. This information is essential during real estate transactions, enabling potential buyers to make informed decisions. Let's delve into the various types of Seller's Information that appraisers in Syracuse, New York, typically provide to buyers: 1. Property Description: This section includes an in-depth overview of the property, such as its size, architectural style, number of bedrooms and bathrooms, and overall condition. It may also highlight any unique features or recent renovations that add value. 2. Property History: Here, appraisers need access to the property's historical information, including the date it was built, previous ownership details, and any relevant records about past repairs, upgrades, or damages. This data helps determine its market and historical value. 3. Property Survey: The Seller's Information may feature a copy of the most recent survey conducted on the property. This survey outlines the exact boundaries, easements, encroachments, and other relevant details, allowing appraisers to accurately gauge the parcel's size and value. 4. Title Deed and Ownership Information: Appraisers require access to the property's title deed and related ownership documentation to verify legal ownership, review any encumbrances, liens, or outstanding mortgages, and evaluate the property's marketability and overall value. 5. Home Inspection Reports: Sellers often include recent home inspection reports that detail the property's current condition, including any structural issues, electrical or plumbing problems, or required repairs. These reports aid appraisers in assessing the property's value and identifying potential areas of concern. 6. Tax Assessment and Property Tax Information: Appraisers analyze the property's current tax assessment value and review the tax payment history. This information helps determine the property's fair market value and potential tax liabilities for the buyer. 7. Recent Comparable Sales: Sellers may provide a list of recent comparable sales in the area, also known as "comps." These records assist appraisers in establishing an accurate market value by analyzing similar properties that have recently sold in the local real estate market. 8. Financial Disclosures: Depending on local regulations and seller transparency, financial disclosures may be expected. These documents highlight any outstanding debts, issues affecting the property's value, pending litigation, or bankruptcy filings that could potentially impact the buyer's decision. It is crucial for sellers to provide comprehensive and accurate information to ensure a smooth appraisal process. Appraisers heavily rely on these details to determine the fair market value of the property and provide an unbiased evaluation for prospective buyers in Syracuse, New York.

Syracuse New York Seller's Information for Appraiser provided to Buyer

Description

How to fill out Syracuse New York Seller's Information For Appraiser Provided To Buyer?

Benefit from the US Legal Forms and obtain immediate access to any form template you want. Our beneficial platform with thousands of documents makes it easy to find and get almost any document sample you will need. You are able to download, fill, and certify the Syracuse New York Seller's Information for Appraiser provided to Buyer in a matter of minutes instead of surfing the Net for many hours searching for a proper template.

Using our library is a great way to raise the safety of your form submissions. Our professional attorneys on a regular basis review all the documents to make certain that the templates are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Syracuse New York Seller's Information for Appraiser provided to Buyer? If you have a subscription, just log in to the account. The Download option will be enabled on all the documents you look at. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Find the template you require. Ensure that it is the form you were hoping to find: examine its title and description, and use the Preview feature if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Export the file. Pick the format to get the Syracuse New York Seller's Information for Appraiser provided to Buyer and revise and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy template libraries on the internet. We are always ready to help you in any legal procedure, even if it is just downloading the Syracuse New York Seller's Information for Appraiser provided to Buyer.

Feel free to benefit from our platform and make your document experience as straightforward as possible!